Earnings Estimates Decoded: Navigating Market Chaos with Confidence

Finance

2025-04-20 13:30:37Content

When calendar year estimates come into play, what was once a forward-looking conversation about potential earnings can swiftly transform into a retrospective analysis of past financial performance. The shift from projecting future potential to examining historical results provides a dynamic perspective on a company's financial trajectory.

By anchoring discussions in specific calendar year data, stakeholders gain a more concrete understanding of an organization's financial journey. This approach allows for a nuanced examination of earnings, revealing not just numbers, but the story behind the financial metrics.

The transition from speculative forecasts to documented achievements offers a clearer, more transparent view of a company's economic health and performance. It transforms abstract predictions into tangible evidence of financial success or challenges.

Decoding Financial Timelines: When Calendar Year Estimates Blur the Lines of Earnings Perception

In the intricate world of financial analysis, the interpretation of earnings can be a complex and nuanced endeavor. Professionals and investors constantly navigate the delicate balance between forward-looking projections and retrospective financial assessments, seeking to understand the true economic narrative hidden within numerical data.Unraveling the Complexity of Financial Forecasting and Retrospective Analysis

The Dynamic Landscape of Earnings Interpretation

Financial professionals face a perpetual challenge in distinguishing between predictive and historical financial metrics. Calendar year estimates represent a critical juncture where future expectations intersect with past performance, creating a sophisticated landscape of economic interpretation. The traditional boundaries between prospective and retrospective financial analysis have become increasingly blurred, demanding a more nuanced approach to understanding corporate financial health. Sophisticated investors and analysts recognize that calendar year estimates are not merely static projections but dynamic representations of potential economic trajectories. These estimates serve as complex mathematical models that integrate multiple variables, including market trends, historical performance, macroeconomic indicators, and company-specific dynamics. The intricate nature of these calculations requires a multifaceted understanding that goes beyond simple numerical extrapolation.Navigating the Temporal Complexity of Financial Metrics

The transformation of forward-looking discussions into retrospective analyses occurs with remarkable rapidity in contemporary financial ecosystems. What once represented a speculative projection can swiftly metamorphose into a concrete historical record, challenging traditional frameworks of financial interpretation. This temporal fluidity demands unprecedented adaptability from financial professionals who must continuously recalibrate their analytical approaches. Modern financial analysis requires a holistic perspective that transcends traditional temporal boundaries. Professionals must develop sophisticated cognitive frameworks that can simultaneously process predictive and historical data, creating a more comprehensive understanding of economic performance. The ability to seamlessly transition between forward-looking projections and retrospective assessments has become a critical skill in an increasingly complex financial landscape.Strategic Implications of Earnings Perception

The convergence of predictive and historical financial metrics presents both significant challenges and unprecedented opportunities for strategic decision-making. Organizations and investors who can effectively navigate this complex terrain gain a substantial competitive advantage. By developing nuanced interpretative frameworks, they can extract deeper insights from financial data, transforming raw numerical information into strategic intelligence. Successful financial strategists understand that earnings perception is not a static concept but a dynamic, continuously evolving narrative. They recognize that calendar year estimates represent more than mere numerical projections—they are sophisticated representations of potential economic trajectories, embodying the complex interplay between historical performance and future potential.Technological Evolution in Financial Analysis

Emerging technological innovations are revolutionizing the way financial professionals interpret and utilize calendar year estimates. Advanced machine learning algorithms and artificial intelligence platforms can now process vast quantities of financial data, providing unprecedented insights into the intricate relationships between historical performance and future projections. These technological advancements enable more sophisticated predictive models that can rapidly adapt to changing economic conditions. By integrating multiple data sources and employing complex algorithmic frameworks, these systems can generate more accurate and nuanced financial interpretations, bridging the gap between retrospective analysis and forward-looking projections.RELATED NEWS

Finance

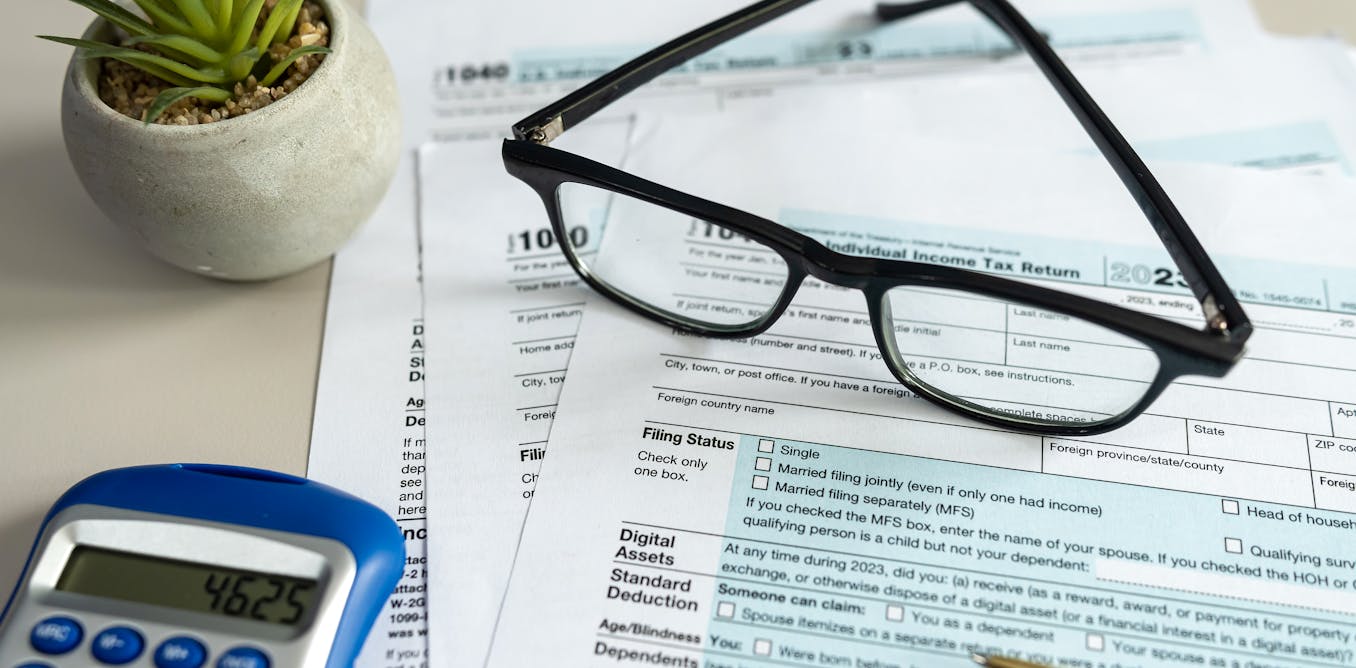

Single and Taxed: How Soaring Living Costs Are Reshaping Financial Futures

2025-04-10 12:55:14

Finance

Idorsia's Q1 Breakthrough: QUVIVIQ Soars in Europe as TRYVIO Gains Market Momentum

2025-04-30 05:00:00

Finance

Beyond Private Equity: Carlyle's COO Reveals the Next Big Wave in Finance

2025-02-21 14:06:53