Wall Street Wobbles: Why Your Wallet Shouldn't Worry Right Now

Finance

2025-04-07 06:21:27Content

Global Market Turbulence: Why Investors Should Stay Calm

In the wake of recent seismic shifts in international trade, financial markets have been experiencing significant volatility. While the headlines might seem alarming and the market graphs look intimidating, there's no need to hit the panic button just yet.

The current economic landscape is undoubtedly complex. Trade tensions, geopolitical uncertainties, and rapidly changing global dynamics are creating ripples of uncertainty across investment platforms. However, seasoned investors understand that market fluctuations are a natural part of the economic ecosystem.

Instead of making hasty, emotion-driven decisions, experts recommend maintaining a balanced and strategic approach. Diversification remains key - spreading investments across different sectors and asset classes can help mitigate risks during turbulent times. Long-term investment strategies have historically proven more resilient than knee-jerk reactions to short-term market movements.

Remember, market corrections are not just inevitable but can also present unique opportunities for savvy investors. By staying informed, maintaining a cool head, and focusing on fundamental economic principles, you can navigate these challenging waters with confidence.

The message is clear: Don't panic. Stay informed, stay strategic, and keep your investment perspective broad and long-term.

Global Trade Tremors: Navigating Financial Market Volatility with Confidence

In an era of unprecedented economic uncertainty, financial markets are experiencing seismic shifts that challenge traditional understanding of global economic dynamics. The intricate web of international trade, once considered stable, now trembles under the weight of geopolitical tensions, technological disruptions, and rapidly evolving economic paradigms.Transforming Market Chaos into Strategic Opportunity

The Anatomy of Market Disruption

Financial markets are not merely statistical abstractions but living, breathing ecosystems that reflect complex human interactions and global economic currents. Recent upheavals have exposed vulnerabilities in traditional trade networks, revealing how interconnected yet fragile our global economic infrastructure truly is. Investors and economic strategists must recognize that volatility is not a signal of impending doom but an invitation to adaptive thinking. The current market landscape demands a nuanced approach that transcends knee-jerk reactions. Sophisticated investors understand that turbulence creates unique opportunities for those prepared to analyze deeper patterns and emerging trends. By maintaining a strategic perspective, market participants can transform potential challenges into competitive advantages.Psychological Resilience in Financial Decision-Making

Emotional intelligence plays a critical role in navigating market uncertainties. Panic-driven decisions often lead to substantial financial losses, whereas calculated, research-backed strategies can mitigate risks and unlock potential growth opportunities. Understanding market psychology becomes as crucial as understanding financial metrics. Successful navigation requires a multifaceted approach that combines rigorous data analysis, emotional equilibrium, and forward-thinking strategic planning. Investors must cultivate a mindset that views market fluctuations as dynamic landscapes of potential rather than threatening terrains of potential loss.Technological Innovation and Market Adaptation

Emerging technologies are rapidly reshaping global trade dynamics, introducing unprecedented levels of complexity and opportunity. Artificial intelligence, blockchain technologies, and advanced predictive analytics are transforming how markets operate, communicate, and respond to global economic signals. These technological innovations provide sophisticated tools for understanding and anticipating market movements. By leveraging cutting-edge technological frameworks, investors and economic strategists can develop more nuanced, predictive approaches to market engagement.Geopolitical Dimensions of Market Volatility

Global trade is increasingly influenced by complex geopolitical interactions that extend far beyond traditional economic models. Diplomatic tensions, regional conflicts, and shifting international alliances create intricate ripple effects across financial markets. Understanding these geopolitical nuances requires a holistic approach that integrates economic analysis with geopolitical intelligence. Successful market navigation demands a comprehensive worldview that recognizes the multidimensional nature of contemporary global economic systems.Strategic Risk Management Frameworks

Developing robust risk management strategies becomes paramount in an environment characterized by constant flux. This involves creating flexible, adaptive frameworks that can quickly respond to emerging market signals while maintaining core investment principles. Diversification remains a fundamental strategy, but modern approaches require more sophisticated, dynamic implementation. Investors must continuously reassess and recalibrate their portfolios, embracing both traditional and emerging investment vehicles.Future-Oriented Economic Perspectives

The current market landscape is not a temporary aberration but a fundamental transformation of global economic paradigms. Forward-thinking economic actors must develop capabilities that transcend reactive approaches, instead cultivating proactive, anticipatory strategies. This requires continuous learning, technological adaptation, and a willingness to challenge established economic narratives. The most successful market participants will be those who can synthesize complex information, remain emotionally balanced, and maintain strategic flexibility.RELATED NEWS

Finance

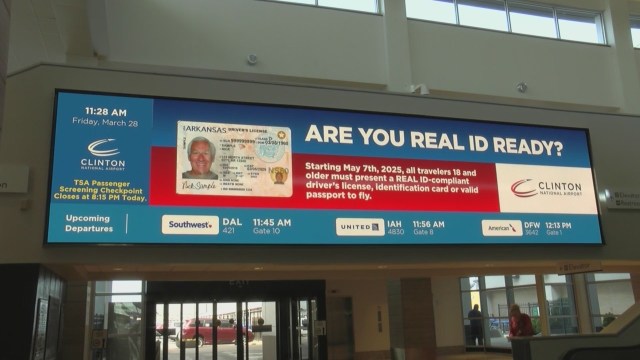

Time's Running Out: Arkansas Residents Face Critical REAL ID Cutoff in May

2025-03-28 23:56:46

Finance

Green Revolution: How India's Financial Powerhouses Are Reshaping Climate Investment

2025-03-07 07:32:36