Navigating Career Shifts: Your 401(k) Survival Guide in 4 Bold Moves

Finance

2025-04-14 17:23:01Content

Navigating Career Transitions: Protecting Your Retirement Savings

Changing jobs can be an exciting professional milestone, but it also comes with potential financial pitfalls that could derail your retirement planning. In a recent discussion with Yahoo Finance Senior Columnist Kerry Hannon, key strategies emerged for safeguarding your financial future during career transitions.

Hannon highlights four critical considerations for professionals switching jobs:

1. Retirement Account Management

Carefully tracking and managing your retirement accounts is crucial during job changes. Don't let your hard-earned savings get lost in the shuffle of career transitions.

2. Avoiding Early Withdrawals

Resist the temptation to cash out retirement funds when switching jobs. Early withdrawals can trigger significant tax penalties and erode your long-term financial security.

3. Rollover Strategies

Understand your options for rolling over 401(k) accounts, whether into a new employer's plan or an individual retirement account (IRA) to maintain tax-advantaged growth.

4. Continuous Financial Planning

Maintain a proactive approach to your retirement savings, even during periods of professional uncertainty.

For more expert insights and comprehensive market analysis, explore additional resources on financial planning and career transitions.

Navigating Career Transitions: A Comprehensive Guide to Protecting Your Retirement Savings

In the dynamic landscape of modern employment, professionals frequently encounter career shifts that can significantly impact their long-term financial planning. Understanding the intricate nuances of managing retirement accounts during job transitions is crucial for maintaining financial stability and securing future economic well-being.Safeguard Your Financial Future: Strategic Moves During Career Transformations

Understanding the Complex Terrain of Retirement Account Management

Changing jobs represents a critical moment in one's professional journey that extends far beyond mere career progression. The financial implications of such transitions can be profound, particularly when it comes to retirement savings. Many professionals inadvertently compromise their long-term financial health by making hasty decisions during employment shifts. Retirement accounts are not simply static repositories of money, but dynamic financial instruments that require careful navigation. Each job change presents unique challenges and opportunities for strategic financial management. Professionals must approach these transitions with a comprehensive understanding of their existing retirement portfolios and potential preservation strategies.Critical Strategies for Retirement Account Preservation

The most vulnerable moment for retirement savings occurs during job transitions. Employees often face complex decisions regarding their existing retirement accounts, with potential pitfalls that can dramatically reduce their long-term financial potential. Rolling over 401(k) accounts requires meticulous planning and understanding of various financial mechanisms. Direct rollovers represent the most secure method of transferring retirement funds between employers. By executing a direct transfer, individuals can avoid potential tax penalties and maintain the tax-advantaged status of their retirement savings. This approach minimizes administrative complications and ensures continuous investment growth without unnecessary interruptions.Avoiding Costly Withdrawal Mistakes

Early withdrawals from retirement accounts can trigger substantial financial consequences. The Internal Revenue Service imposes significant penalties for premature distributions, typically charging a 10% additional tax on withdrawals made before reaching the age of 59½. These penalties compound the immediate financial loss with long-term investment opportunity costs. Financial experts consistently recommend exploring alternative funding sources during career transitions. Maintaining the integrity of retirement accounts preserves compound growth potential and ensures continued financial momentum. Temporary financial challenges should be addressed through emergency funds, personal loans, or other less destructive financial strategies.Comprehensive Account Consolidation Techniques

Modern professionals often accumulate multiple retirement accounts throughout their careers. Consolidating these accounts can streamline financial management, reduce administrative complexity, and potentially optimize investment strategies. Careful evaluation of existing accounts allows individuals to create more cohesive and efficient retirement portfolios. Professional financial advisors can provide invaluable guidance during this consolidation process. They can help identify potential tax implications, recommend optimal investment allocations, and develop personalized strategies that align with individual career trajectories and retirement objectives.Technological Tools and Resources for Retirement Planning

Emerging financial technologies have revolutionized retirement account management during career transitions. Sophisticated digital platforms now offer comprehensive tracking, analysis, and optimization tools that empower professionals to make informed decisions about their retirement savings. These technological solutions provide real-time insights, predictive modeling, and personalized recommendations that can significantly enhance financial decision-making. By leveraging these advanced tools, individuals can maintain greater control and visibility over their retirement planning, even during complex career transitions.Psychological Dimensions of Financial Transitions

Beyond technical considerations, job changes invoke significant psychological challenges related to financial security. The emotional stress of career transitions can lead to impulsive financial decisions that may have long-lasting repercussions. Developing emotional resilience and maintaining a strategic perspective is crucial during these periods of professional transformation. Mindful approach to financial management requires balancing analytical decision-making with emotional intelligence. Professionals must cultivate a holistic understanding of their career and financial journeys, recognizing that each transition represents an opportunity for strategic growth and refinement.RELATED NEWS

Finance

Financial Fraud Shocker: School Official's £86,000 Embezzlement Lands Her Behind Bars

2025-03-27 16:05:21

Finance

Global Markets Reel: Trump Tariffs Spark Widespread Sell-Off Across Major Indexes

2025-04-03 11:34:57

Finance

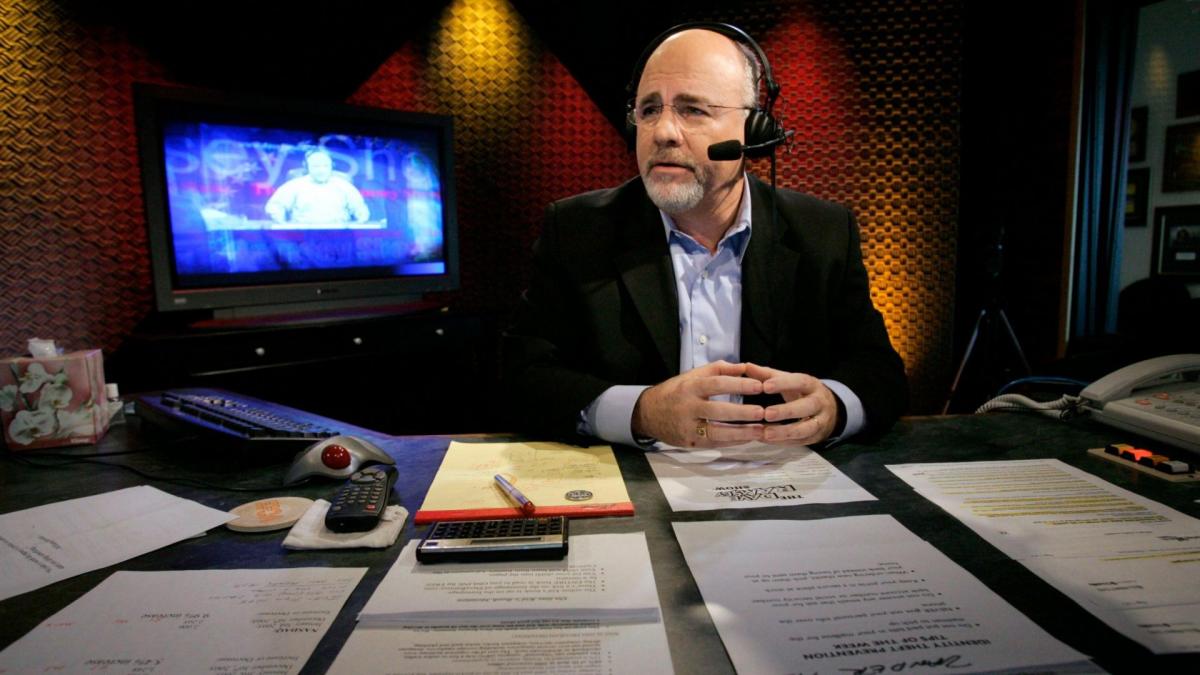

Money Makeover: Dave Ramsey's Game-Changing Financial Strategies for 2025

2025-02-19 15:00:14