Money Smarts: Raising a Generation of Savvy Young Investors

Finance

2025-02-17 12:09:50Content

Empowering Kids: The Essential Guide to Financial Literacy

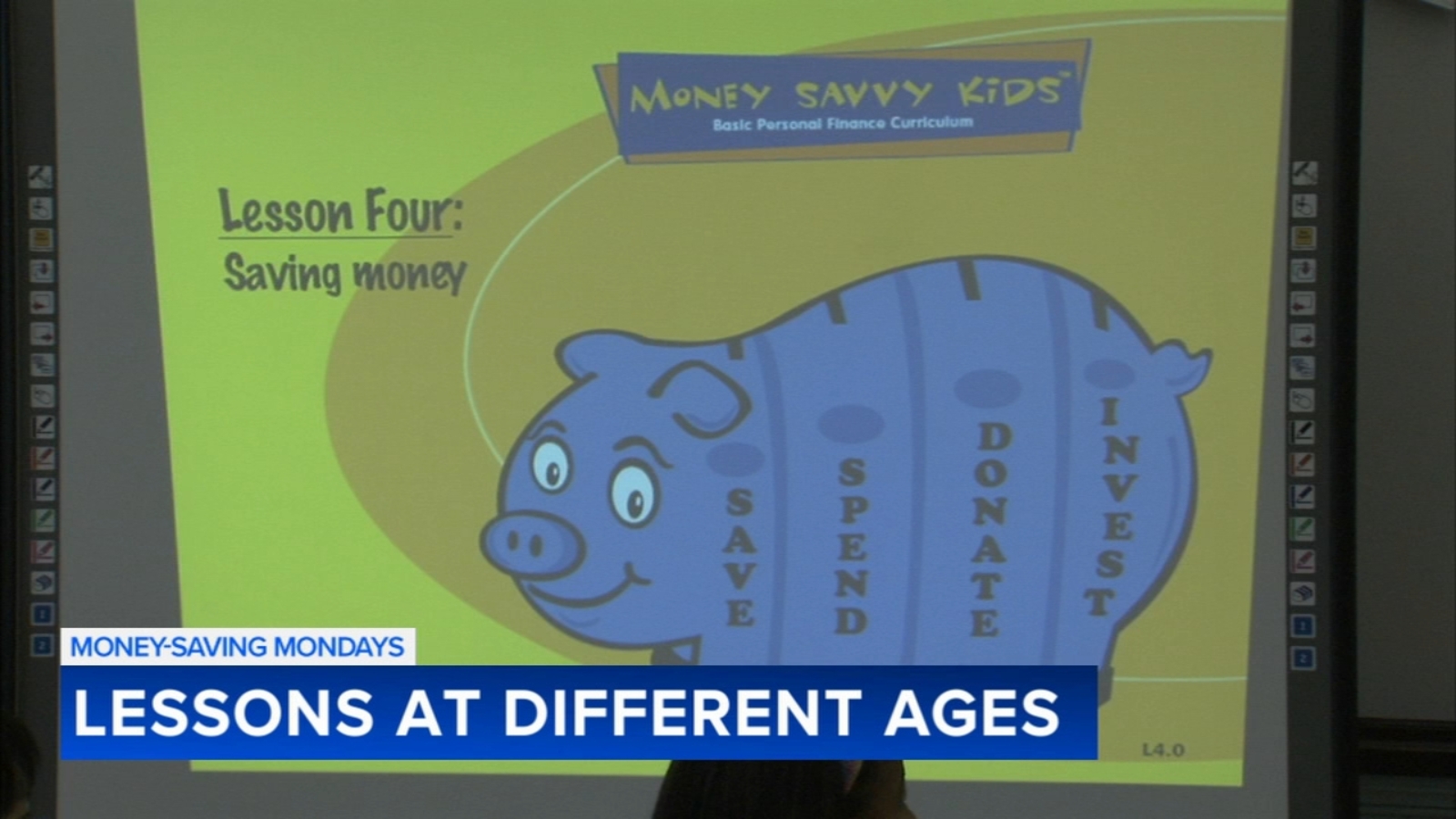

This Monday morning, we're diving deep into a crucial topic that every parent should prioritize: teaching children about money management. Joining us is Ross Mac, a renowned financial expert and successful entrepreneur who has made it his mission to transform how we approach financial education for young minds.

In today's complex economic landscape, financial literacy is no longer just a skill—it's a critical life tool. Children who understand the value of money, learn smart saving strategies, and develop responsible spending habits are better equipped to navigate their financial futures.

Ross Mac brings a wealth of experience and passion to this important conversation. Through his innovative approach, he breaks down complex financial concepts into digestible, engaging lessons that resonate with children and parents alike.

"Financial education shouldn't be intimidating," Mac explains. "It's about creating a positive, empowering relationship with money from an early age."

Whether you're a parent looking to start your child's financial journey or an educator seeking practical strategies, this discussion promises to provide invaluable insights into raising financially savvy kids.

Empowering Young Minds: The Critical Path to Financial Mastery in Childhood

In an era of complex economic landscapes, understanding financial literacy has become more than just a skill—it's a fundamental survival strategy for the next generation. As traditional educational systems continue to overlook the crucial aspects of money management, parents and educators are increasingly recognizing the paramount importance of introducing financial concepts to children at an early age.Unlock Your Child's Financial Potential: A Revolutionary Approach to Money Wisdom

The Psychological Foundation of Financial Intelligence

Modern developmental psychology reveals that children's money attitudes are fundamentally shaped during their earliest years. Neuroscientific research demonstrates that financial behaviors are not innate but learned, making childhood the most critical period for establishing robust monetary understanding. By introducing age-appropriate financial concepts, parents can rewire children's neural pathways, creating lifelong patterns of responsible financial decision-making. Experts suggest that children as young as four can comprehend basic economic principles. Through strategic interactions and carefully designed learning experiences, parents can transform abstract financial concepts into tangible, understandable lessons. This approach goes beyond traditional allowance systems, focusing instead on creating comprehensive financial narratives that resonate with young minds.Transformative Strategies for Financial Education

Implementing financial literacy requires a multifaceted approach that transcends conventional teaching methods. Interactive technologies, gamified learning platforms, and real-world simulation experiences have emerged as powerful tools in financial education. These innovative approaches engage children through immersive experiences that make complex monetary concepts accessible and exciting. Successful financial education programs integrate practical skills like budgeting, saving, and understanding value with broader conceptual frameworks. By presenting money as a tool for achieving personal goals rather than an abstract concept, educators can motivate children to develop intrinsic financial motivation. Role-playing scenarios, digital financial simulation games, and collaborative learning environments provide dynamic platforms for monetary skill development.Technology's Role in Modern Financial Learning

Digital platforms have revolutionized financial education, offering unprecedented opportunities for interactive and personalized learning. Mobile applications designed specifically for children provide safe, controlled environments where young learners can experiment with financial decision-making without real-world consequences. Advanced algorithmic platforms now offer personalized financial learning paths, adapting content based on individual child's comprehension levels and learning styles. These technological innovations represent a paradigm shift in financial education, transforming traditional passive learning into dynamic, engagement-driven experiences.Emotional Intelligence and Financial Decision Making

Financial literacy extends far beyond numerical calculations—it's fundamentally about understanding emotional relationships with money. Psychological research indicates that early emotional intelligence training significantly correlates with more sophisticated financial behaviors in adulthood. By teaching children to recognize emotional triggers related to spending and saving, parents can help them develop healthier long-term financial perspectives. Techniques like mindful spending, delayed gratification training, and emotional awareness exercises become critical components of comprehensive financial education strategies.Cultural and Generational Perspectives on Money

Financial literacy is not a one-size-fits-all concept but a nuanced discipline deeply influenced by cultural and generational contexts. Contemporary approaches recognize the importance of tailoring financial education to reflect diverse socioeconomic backgrounds and emerging economic realities. Intergenerational knowledge transfer plays a crucial role in shaping financial understanding. By creating open dialogues about money management, families can bridge knowledge gaps and create supportive learning environments that transcend traditional educational boundaries.RELATED NEWS

High-Stakes Showdown: Car Finance Lawsuit Lands at Supreme Court's Doorstep