Money Matters: The Financial Secrets Every Couple Needs to Uncover

Finance

2025-03-02 08:00:20Content

Money Matters: Why Financial Transparency Can Make or Break Your Relationship

Love might conquer all, but financial harmony is the secret sauce that keeps relationships strong and resilient. Surprisingly, many couples navigate their romantic journey without truly understanding each other's financial landscape—a risky strategy that can lead to tension, misunderstandings, and unexpected conflicts.

Financial intimacy goes far beyond simply sharing a bank account. It's about creating a transparent, supportive environment where both partners feel comfortable discussing income, debt, spending habits, and long-term financial goals. When couples remain in the dark about each other's financial realities, they're setting themselves up for potential relationship stress.

The key to financial unity is open, honest communication. This means having regular, judgment-free conversations about money, setting shared financial objectives, and developing a mutual understanding of each other's financial values and concerns.

By proactively addressing financial matters together, couples can build trust, reduce potential conflicts, and create a solid foundation for their shared future. Remember, in love and finances, transparency is not just recommended—it's essential.

Financial Harmony: Navigating the Uncharted Waters of Spousal Money Matters

In the intricate dance of marriage, financial transparency often becomes a delicate choreography that many couples struggle to master. The silent financial conversations that remain unspoken can create invisible barriers, potentially undermining the very foundation of marital trust and mutual understanding.Unlock the Secret to Financial Intimacy and Relationship Resilience

The Hidden Landscape of Marital Financial Disconnection

Financial intimacy represents far more than simply sharing bank accounts or discussing monthly expenses. It's a profound journey of vulnerability, trust, and mutual understanding that many couples inadvertently overlook. Research consistently reveals that numerous married partners remain surprisingly uninformed about their spouse's comprehensive financial landscape, creating potential vulnerabilities that could dramatically impact their long-term economic stability. Couples often navigate their financial relationships through unspoken assumptions and inherited communication patterns. These deeply ingrained behaviors can lead to significant misunderstandings, where partners might believe they understand each other's financial perspectives, when in reality, substantial knowledge gaps persist.Decoding the Complex Dynamics of Financial Communication

Effective financial communication requires more than mere transactional discussions about income and expenditures. It demands a holistic approach that encompasses emotional intelligence, vulnerability, and genuine curiosity about each other's financial histories, aspirations, and underlying money scripts. Many couples inadvertently develop financial silos, where individual monetary experiences and perspectives remain compartmentalized. This fragmentation can lead to misaligned financial goals, unaddressed anxieties, and potential conflicts that simmer beneath the surface of seemingly harmonious relationships.Strategies for Cultivating Financial Transparency

Creating a robust financial dialogue requires intentional, structured approaches. Couples must develop safe conversational spaces where both partners feel empowered to share their financial narratives without fear of judgment or criticism. This involves establishing regular financial check-ins, practicing active listening, and approaching discussions with genuine empathy and openness. Transparency isn't about perfection but about mutual understanding. Partners should be encouraged to share not just numerical data, but the emotional contexts surrounding their financial experiences, fears, and dreams. This deeper level of communication transforms financial discussions from potentially contentious interactions into opportunities for mutual growth and connection.Navigating Potential Financial Blind Spots

Identifying and addressing financial blind spots requires a combination of vulnerability, curiosity, and strategic questioning. Couples must be willing to explore potentially uncomfortable territories, including past financial mistakes, inherited money beliefs, and individual risk tolerances. Professional financial counseling can provide neutral ground for these critical conversations, offering structured frameworks and expert guidance. These interventions can help couples develop more nuanced, collaborative approaches to managing their collective financial journey.The Psychological Dimensions of Financial Intimacy

Beyond practical considerations, financial communication is fundamentally a psychological endeavor. Each partner brings a unique set of money narratives shaped by family history, personal experiences, and individual psychological patterns. Understanding these underlying narratives becomes crucial in developing genuine financial alignment. Emotional intelligence plays a pivotal role in transforming potentially challenging financial conversations into opportunities for deeper mutual understanding and relationship strengthening. By approaching financial discussions with empathy, curiosity, and genuine respect, couples can convert potential sources of tension into powerful moments of connection.RELATED NEWS

Money Talks: Wisconsin Supreme Court Race Hits Unprecedented Funding Frenzy

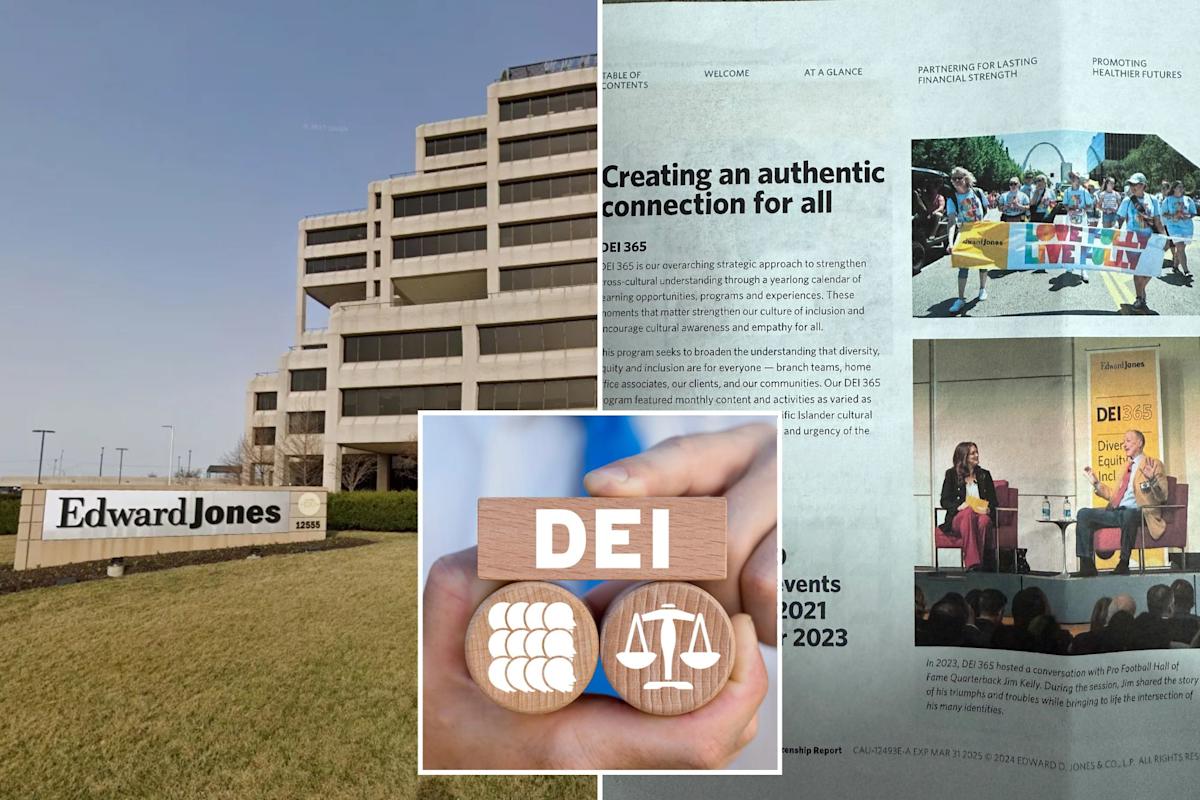

Inside Edward Jones: Whistleblower Exposes Hidden DEI Strategy Amid Corporate Silence