Financial Frontier: How North Carolina Continues to Set the Gold Standard in Economic Preparedness

Finance

2025-03-14 17:00:00Content

Securing Our Financial Future: Why Retirement Education Matters

In an era of increasing financial complexity, our state legislature has a critical opportunity to empower citizens with essential financial knowledge. By expanding current financial education mandates to include comprehensive retirement investing strategies, we can equip residents with the tools they need to build long-term financial security.

Currently, many individuals enter adulthood without understanding fundamental investment principles, retirement account options, or the power of compound interest. A targeted update to our state's educational requirements could bridge this crucial knowledge gap, helping citizens make informed decisions about their financial futures.

Introducing robust retirement investment education in schools and professional training programs would provide practical insights into:

• Different types of retirement accounts

• Basic investment strategies

• Risk management

• Long-term financial planning

• The importance of early and consistent investing

By proactively addressing financial literacy, we can help create a more financially resilient community, reduce potential future economic burdens, and empower individuals to take control of their retirement planning. The time for comprehensive financial education is now.

Revolutionizing Financial Literacy: The Critical Need for Comprehensive Retirement Investment Education

In an era of increasing financial complexity and economic uncertainty, the landscape of personal finance demands a transformative approach to education. The traditional methods of financial learning have fallen short, leaving countless individuals unprepared for the critical challenge of securing their financial future through strategic retirement investments.Empowering Individuals Through Knowledge: Your Financial Destiny Starts Here

The Retirement Investment Landscape: Understanding the Fundamental Challenges

Modern financial planning represents a labyrinthine journey that requires sophisticated understanding and strategic insight. Most individuals find themselves navigating a complex ecosystem of investment options without adequate preparation. The current educational framework fails to equip citizens with the nuanced skills necessary to make informed financial decisions. Retirement planning is not merely about saving money, but about understanding sophisticated investment mechanisms, risk management, and long-term financial strategy. The intricate world of stocks, bonds, mutual funds, and retirement accounts demands comprehensive knowledge that goes beyond basic arithmetic.Legislative Intervention: Reimagining Financial Education Mandates

State legislatures possess a unique opportunity to transform financial literacy through targeted educational mandates. By implementing robust, comprehensive financial education programs, governments can empower citizens to take control of their economic futures. The proposed legislative amendment would require educational institutions to integrate sophisticated investment education into core curriculum. This approach goes beyond traditional financial literacy, focusing on practical skills such as portfolio diversification, understanding market dynamics, and long-term wealth accumulation strategies.Economic Implications of Enhanced Financial Knowledge

Comprehensive investment education carries profound economic implications. When individuals understand complex financial mechanisms, they make more informed decisions, potentially reducing economic vulnerability and increasing personal financial resilience. Research consistently demonstrates that financially educated populations exhibit greater economic stability, reduced dependency on social support systems, and enhanced personal economic outcomes. By investing in financial education, states can create a more economically robust and self-sufficient citizenry.Technological Integration and Modern Learning Approaches

The future of financial education lies in leveraging cutting-edge technological platforms. Interactive digital learning modules, simulation-based training, and personalized financial coaching can revolutionize how individuals approach retirement planning. Advanced educational technologies can provide real-time market insights, predictive financial modeling, and personalized investment strategy development. These tools transform abstract financial concepts into tangible, actionable knowledge.Psychological Dimensions of Financial Learning

Financial education is not merely about numbers but understanding human behavior and psychological barriers to effective investment. Cognitive biases, emotional decision-making, and risk perception play crucial roles in financial strategy. By incorporating psychological insights into financial education, individuals can develop more rational, strategic approaches to retirement planning. Understanding one's own financial psychology becomes as important as understanding market mechanics.Global Perspectives and Competitive Advantage

Nations that prioritize comprehensive financial education create significant competitive advantages. By developing a financially literate population, states can foster innovation, entrepreneurship, and economic resilience. The global economic landscape demands adaptable, financially sophisticated citizens who can navigate complex investment environments. Legislative initiatives that support robust financial education contribute directly to long-term economic development.RELATED NEWS

Finance

Money Mastery: Financial Guru Reveals Secrets to Crushing Your Cash Goals

2025-04-25 18:15:14

Finance

Privacy Shield: Georgia Lawmakers Seek to Protect Public Officials' Personal Details

2025-02-25 10:00:00

Finance

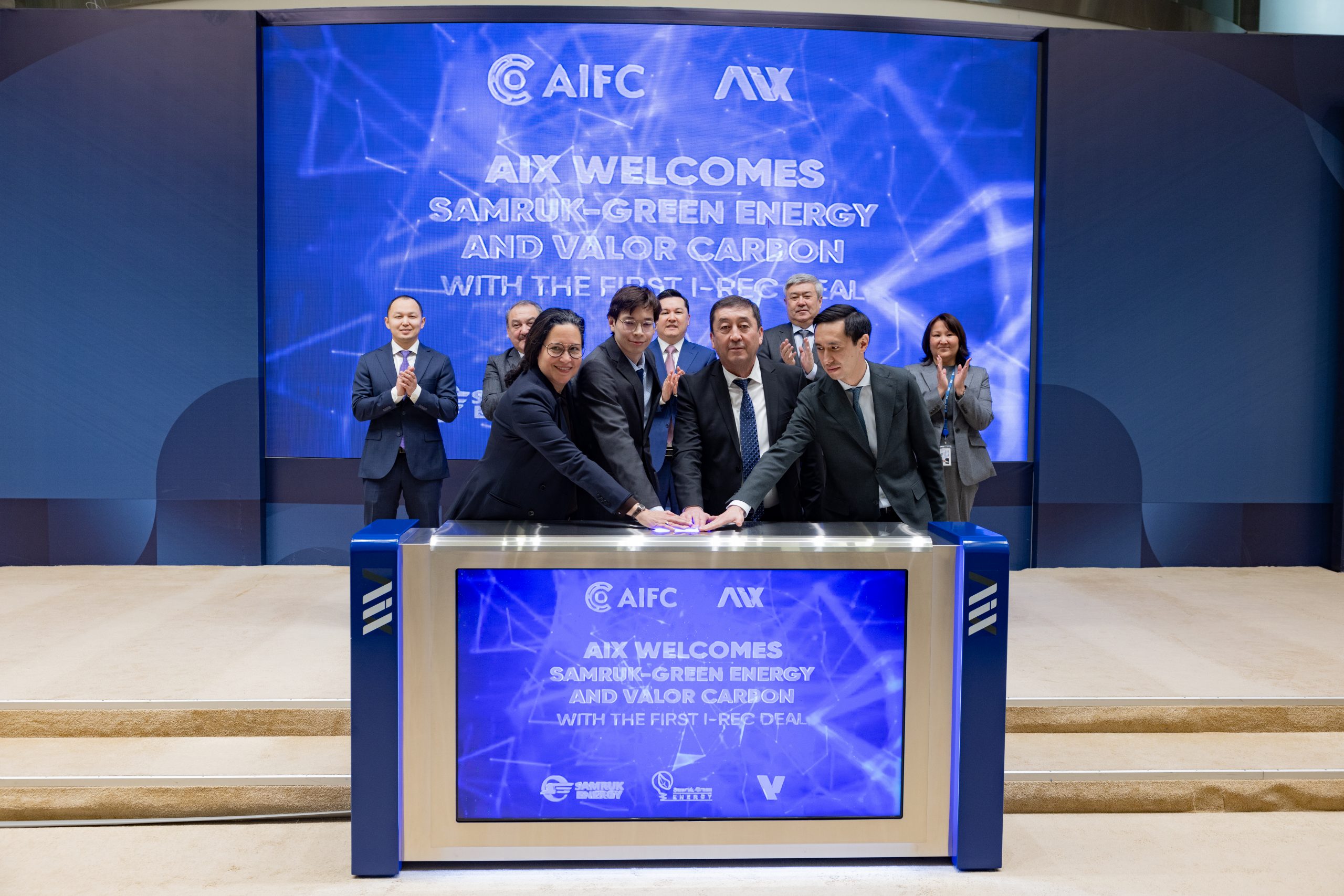

Green Energy Revolution: AIX Launches Renewable Certificates Trading Platform

2025-03-06 07:00:21