Money Smarts: How One Program is Turning Kids into Financial Wizards

Finance

2025-03-30 12:00:05Content

Empowering Young Minds: The Finance Compass Journey

In a world where financial knowledge can make or break future success, The Finance Compass emerges as a beacon of hope for young people seeking to navigate the complex landscape of personal finance. This dynamic, youth-led organization is on a mission to bridge the critical gap in financial literacy, transforming how the next generation understands and manages money.

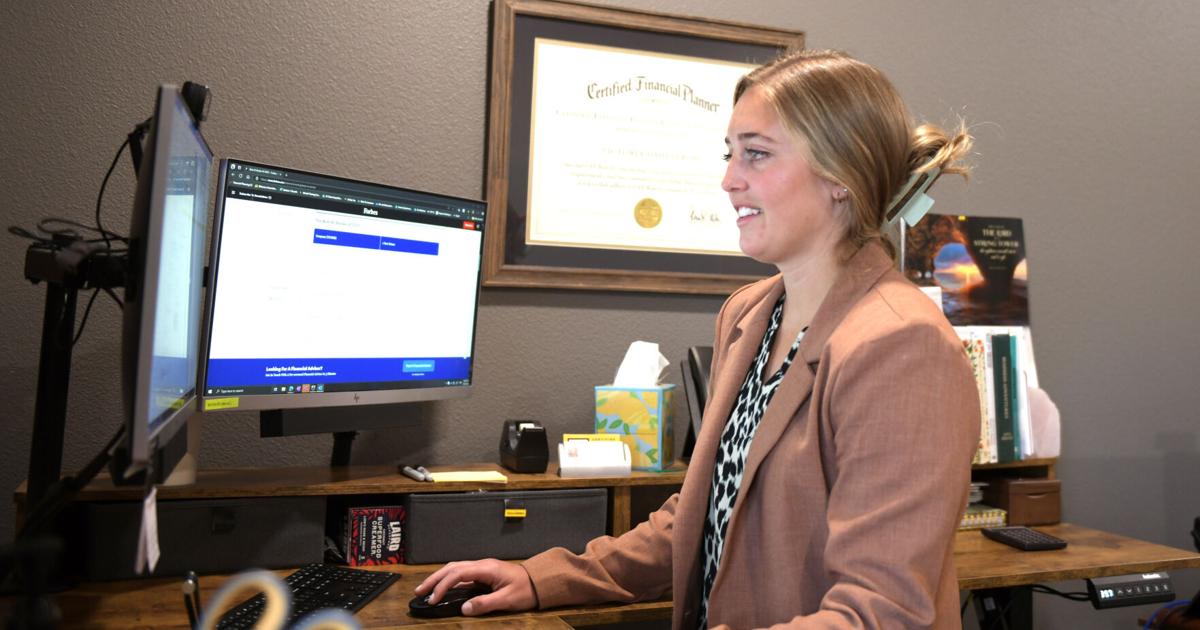

Founded by passionate young professionals who recognized the glaring absence of practical financial education, The Finance Compass goes beyond traditional learning methods. We believe that financial wisdom shouldn't be a privilege, but a fundamental skill accessible to all young people. Through innovative workshops, interactive online resources, and mentorship programs, we're equipping teenagers and young adults with the tools they need to make informed financial decisions.

Our approach is simple yet powerful: demystify financial concepts, provide real-world insights, and inspire confidence in managing personal finances. From understanding budgeting basics to exploring investment strategies, The Finance Compass is committed to creating a financially empowered generation that can turn their dreams into reality.

Join us in our mission to transform financial literacy, one young mind at a time.

Empowering Young Minds: The Revolutionary Approach to Financial Education

In an era where financial complexity continues to challenge even seasoned adults, a groundbreaking movement is emerging to transform how younger generations understand and interact with money. This innovative approach goes beyond traditional financial education, seeking to equip children and teenagers with practical, real-world financial skills that can shape their economic futures.Unlocking Financial Potential: A Game-Changing Youth Movement

The Critical Need for Financial Literacy

Modern educational systems have long overlooked a fundamental life skill: financial intelligence. Traditional curricula often leave students unprepared for real-world financial challenges, creating a generational knowledge gap that can have profound long-term consequences. Young people today face increasingly complex financial landscapes, from digital currencies to intricate investment strategies, making comprehensive financial education more crucial than ever before. The consequences of financial illiteracy are far-reaching. Without proper guidance, young individuals may struggle with basic financial concepts like budgeting, saving, investing, and understanding credit. This knowledge deficit can lead to poor financial decisions that impact their entire economic trajectory, potentially limiting opportunities and creating unnecessary financial stress.Innovative Approaches to Financial Education

Emerging youth-led organizations are revolutionizing financial learning by creating engaging, interactive, and practical educational experiences. These initiatives recognize that traditional lecture-based approaches fail to capture young learners' attention and motivation. Instead, they develop immersive programs that transform complex financial concepts into accessible, exciting learning journeys. By leveraging technology, gamification, and real-world scenarios, these educational platforms make financial literacy both enjoyable and meaningful. Interactive workshops, digital simulations, and peer-to-peer learning environments allow young people to experiment with financial concepts in safe, controlled settings. This approach not only teaches theoretical knowledge but also builds practical skills and confidence.Building Financial Resilience for Future Generations

The most profound impact of modern financial education extends far beyond immediate monetary understanding. These programs aim to cultivate a holistic financial mindset that empowers young individuals to make informed, strategic decisions throughout their lives. By introducing concepts like compound interest, risk management, and strategic planning early on, educators are helping create a generation of financially confident and competent individuals. Moreover, these initiatives recognize financial literacy as a critical tool for social mobility. By democratizing financial knowledge, they provide young people from diverse backgrounds with the skills needed to navigate economic challenges, create wealth, and build sustainable futures. This approach represents more than education—it's a pathway to economic empowerment.Technology and Financial Learning: A Symbiotic Relationship

Digital platforms have become instrumental in transforming financial education. Mobile applications, online courses, and interactive learning environments allow young people to access financial knowledge anytime, anywhere. These technologies break down traditional barriers, making sophisticated financial concepts accessible and engaging. Artificial intelligence and personalized learning algorithms are further enhancing these educational experiences. By adapting content to individual learning styles and progress, these technologies ensure that financial education is not just comprehensive but also tailored to each learner's unique needs and capabilities.The Broader Social Impact

Beyond individual benefits, comprehensive financial education has profound societal implications. As more young people develop robust financial skills, communities can expect reduced economic vulnerability, increased entrepreneurship, and more informed economic participation. This collective financial intelligence has the potential to drive broader economic innovation and stability. By investing in financial literacy today, we are essentially investing in a more economically resilient and empowered future generation. The ripple effects of this educational transformation will likely be felt across economic, social, and personal domains for years to come.RELATED NEWS

Finance

Harvard's Funding in Crosshairs: McMahon Hints at Potential Financial Crackdown

2025-05-07 00:52:20

Finance

Money Missteps: Financial Pro Reveals the Shocking Wealth Drain Most Millennials Never See Coming

2025-05-06 11:00:49