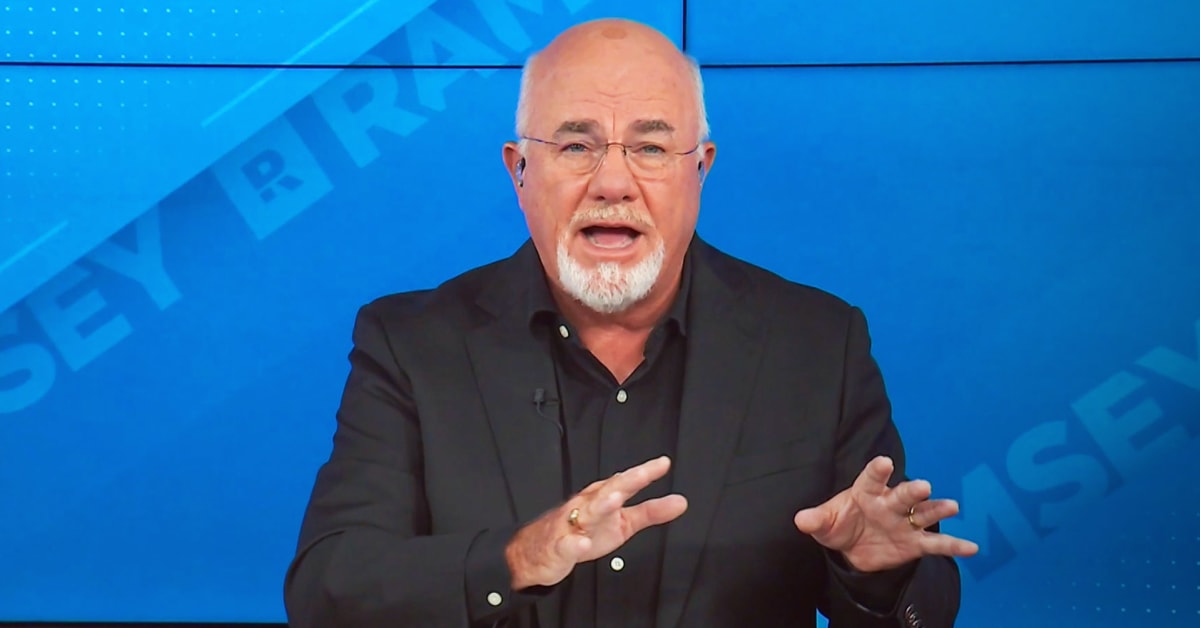

Homebuying Pitfall: Dave Ramsey Reveals the Critical Error Draining Your Wallet

Finance

2025-05-03 15:17:00Content

Navigating the Home Buying Journey: A Financial Perspective

Purchasing a home is far more than just finding your dream living space—it's a complex financial decision with long-lasting implications. As a best-selling personal finance expert, I've witnessed countless individuals underestimate the profound economic impact of homeownership.

When you decide to buy a home, you're not simply acquiring property; you're making a significant investment that can dramatically shape your financial future. From mortgage rates and property taxes to maintenance costs and potential appreciation, each aspect carries substantial weight in your overall financial landscape.

Smart homebuyers understand that this decision extends beyond the initial purchase price. They consider factors like location, market trends, potential equity growth, and the total cost of ownership. It's not just about monthly mortgage payments, but about creating a strategic financial asset that can potentially build wealth over time.

Moreover, the financial ramifications of home ownership ripple through multiple aspects of your personal economic ecosystem. Your credit score, long-term savings potential, tax deductions, and investment portfolio can all be influenced by this pivotal decision.

Before taking the plunge, carefully evaluate your financial readiness, understand the market dynamics, and develop a comprehensive strategy that aligns with your personal and financial goals.

Navigating the Financial Maze: Unraveling the True Cost of Homeownership

In the complex landscape of personal finance, few decisions carry as much weight and potential transformation as purchasing a home. Beyond the picturesque facade and dreams of stability, lies a intricate financial journey that demands careful navigation, strategic planning, and a profound understanding of long-term economic implications.Unlock the Hidden Financial Secrets of Real Estate Investment

The Economic Anatomy of Home Purchasing

Homeownership represents far more than a mere transaction—it's a multifaceted financial ecosystem with interconnected variables that can dramatically alter one's economic trajectory. Potential buyers must recognize that a home isn't just a physical structure, but a complex financial instrument with nuanced implications spanning decades. The initial purchase price represents merely the tip of the proverbial iceberg. Sophisticated investors understand that true cost encompasses a labyrinth of expenses: property taxes, maintenance, insurance, potential renovation costs, and opportunity costs associated with capital allocation. Each of these elements intertwines to create a comprehensive financial narrative that extends well beyond the initial down payment.Psychological and Financial Risk Assessment

Emotional decision-making often clouds rational financial judgment when contemplating home acquisition. Individuals must transcend romantic notions of homeownership and approach the decision through a clinical, analytical lens. Risk assessment involves meticulously evaluating personal financial health, job stability, local real estate market dynamics, and potential long-term appreciation potential. Strategic financial planning demands a holistic view that considers not just current economic circumstances, but potential future scenarios. This includes stress-testing potential mortgage scenarios, understanding interest rate fluctuations, and maintaining robust emergency reserves to mitigate unexpected financial challenges.Investment Strategy and Wealth Accumulation

Contrary to popular belief, home purchasing isn't universally beneficial. The investment potential varies dramatically based on geographic location, market conditions, and individual financial circumstances. Sophisticated investors recognize that real estate represents one potential wealth-building strategy among many, not an automatic path to financial prosperity. Diversification remains paramount. While home equity can serve as a valuable asset, over-concentrating wealth in a single real estate asset introduces significant risk. Intelligent investors maintain a balanced portfolio that includes various investment vehicles, ensuring resilience against market volatility.Technological and Market Disruption Considerations

Emerging technological trends and shifting demographic patterns are fundamentally reshaping traditional real estate paradigms. Remote work, sustainable living preferences, and evolving urban landscapes introduce unprecedented complexity to home purchasing decisions. Potential buyers must remain adaptable, understanding that today's ideal property might not align with tomorrow's lifestyle and economic requirements. Flexibility, continuous market research, and a willingness to reassess investment strategies become critical components of successful real estate navigation.Financial Optimization and Strategic Planning

Maximizing home purchasing potential requires a multidimensional approach. This involves comprehensive financial modeling, understanding tax implications, exploring mortgage optimization strategies, and developing a nuanced comprehension of local and national real estate trends. Prospective homeowners should invest significant time in education, consulting financial professionals, and developing a robust, personalized strategy that aligns with individual economic goals and risk tolerance.RELATED NEWS

Finance

Crisis-Proof Strategy: Lagarde Signals ECB's Financial Firepower Stands Ready

2025-04-11 10:35:23

Finance

Financial Leadership Shake-Up: Darja Bolshakova Steers Arco Vara's Financial Future

2025-05-05 06:00:00