Wall Street's Pulse: Jobs Report Could Make or Break Stock Market's Fragile Momentum

Finance

2025-03-07 10:59:01Content

Wall Street Braces for Potential Market Surge on Jobs Report

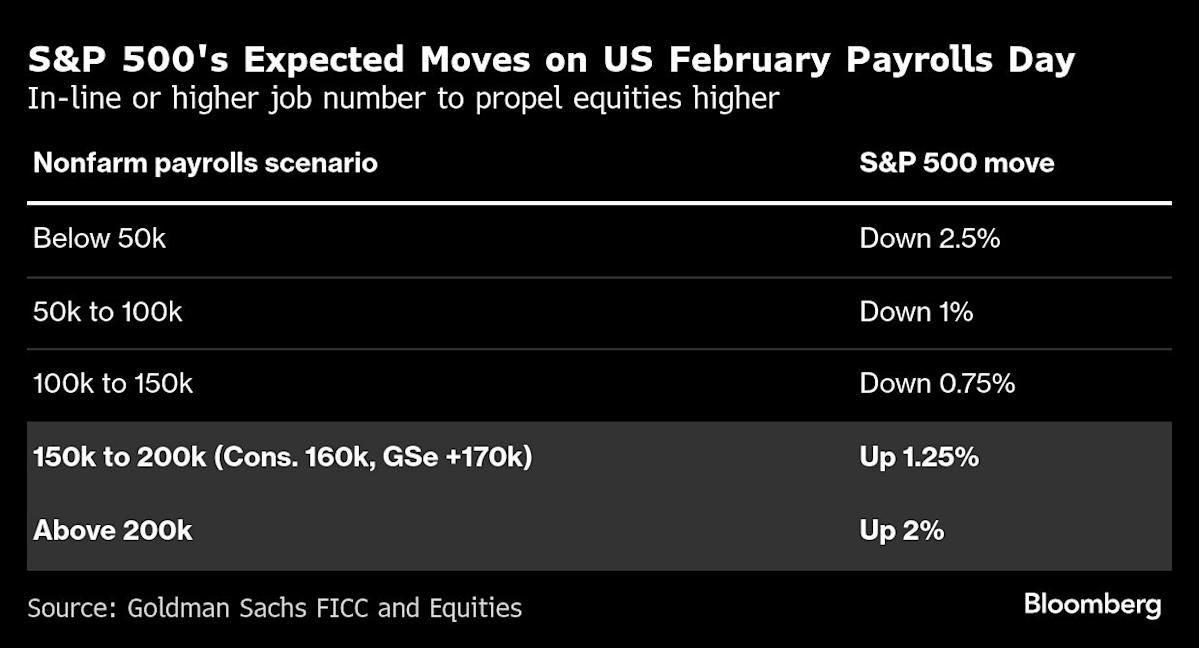

In a surprising twist, Goldman Sachs suggests that the current market pessimism might actually set the stage for a significant stock market rally. The investment giant's trading desk predicts that even a marginally positive US jobs report could trigger an unexpected surge in the S&P 500.

The current investor sentiment has been overwhelmingly negative, creating a unique market dynamic where even modest good news could spark substantial market movement. This suggests that expectations have been set so low that any hint of economic resilience could prompt a swift and dramatic market response.

Investors and market analysts are now closely watching the upcoming jobs data, anticipating that even a slight deviation from pessimistic forecasts could lead to a notable uptick in stock prices. The potential rally underscores the current market's sensitivity to economic indicators and the complex interplay between investor psychology and financial performance.

As traders and investors prepare for the report, the Goldman Sachs insight offers a glimmer of hope in an otherwise cautious market landscape, highlighting the potential for unexpected positive momentum.

Market Tremors: How Investor Sentiment Could Trigger the Next Stock Rally

In the volatile landscape of financial markets, investor sentiment stands as a critical barometer measuring potential economic shifts and market movements. The delicate interplay between economic indicators, investor psychology, and market performance creates a complex ecosystem where even minor signals can precipitate significant transformations.Decoding the Hidden Signals of Market Momentum

The Psychological Underpinnings of Market Dynamics

Financial markets are not merely mathematical constructs but intricate systems deeply influenced by human emotion and perception. When investor confidence wanes, even marginally positive economic indicators can spark unexpected rallies. Goldman Sachs' trading desk suggests that the current market environment is primed for dramatic shifts, where seemingly modest improvements could trigger substantial investment movements. The psychological landscape of investment is fraught with nuanced interpretations. Investors constantly navigate between risk aversion and opportunity seeking, creating a dynamic environment where sentiment can change rapidly. The potential for a stock market rally hinges not just on objective economic data, but on the collective psychological state of market participants.Employment Reports: A Catalyst for Market Transformation

Employment statistics represent more than mere numerical data; they are powerful narratives about economic health and potential. A jobs report that marginally exceeds expectations can serve as a pivotal moment, potentially reversing negative sentiment and injecting renewed optimism into financial markets. The intricate relationship between employment metrics and market performance reveals complex interconnections. Investors meticulously analyze these reports, searching for subtle indicators of economic resilience or potential challenges. Each data point becomes a potential signal, capable of influencing investment strategies across diverse portfolios.Goldman Sachs' Perspective: Reading Between the Lines

Goldman Sachs' trading desk offers a nuanced perspective on current market conditions. Their analysis suggests that the current investor sentiment, characterized by widespread pessimism, creates a unique environment where even modest positive signals can generate significant market movements. This perspective underscores the importance of understanding market psychology beyond traditional economic metrics. The potential for a rally emerges not from absolute performance, but from the gap between expectations and actual results. When investors are positioned defensively, even slight improvements can trigger substantial repositioning of investment strategies.Strategic Implications for Investors

For sophisticated investors, understanding these market dynamics requires a multifaceted approach. The ability to interpret economic indicators through the lens of investor sentiment becomes crucial. Recognizing that markets are driven by perception as much as by fundamental economic data allows for more nuanced investment strategies. Successful navigation of such market conditions demands flexibility, deep analytical skills, and an understanding of the psychological factors driving investment decisions. The potential for a rally exists not in guaranteed outcomes, but in the probabilistic landscape of market movements.Global Economic Context and Market Sentiment

The current market environment reflects broader global economic uncertainties. Geopolitical tensions, technological disruptions, and ongoing economic transformations create a complex backdrop against which investor sentiment evolves. Each economic report becomes a potential inflection point, capable of reshaping market expectations. Understanding these dynamics requires a holistic approach that integrates economic analysis, psychological insights, and strategic foresight. The potential for market rallies emerges from the intricate interplay of these multifaceted factors.RELATED NEWS

Finance

Jio Finance Gears Up for Landmark Rupee Bond Launch, Eyeing $118M Market Debut

2025-05-06 08:37:03

Finance

Financial Maverick Kirk Badii Set to Headline Exclusive Maui Summit for Top-Tier Advisors

2025-02-26 16:11:00

Finance

Dividend Delight: Bank of the James Rewards Shareholders with Steady $0.10 Payout

2025-05-04 14:34:59