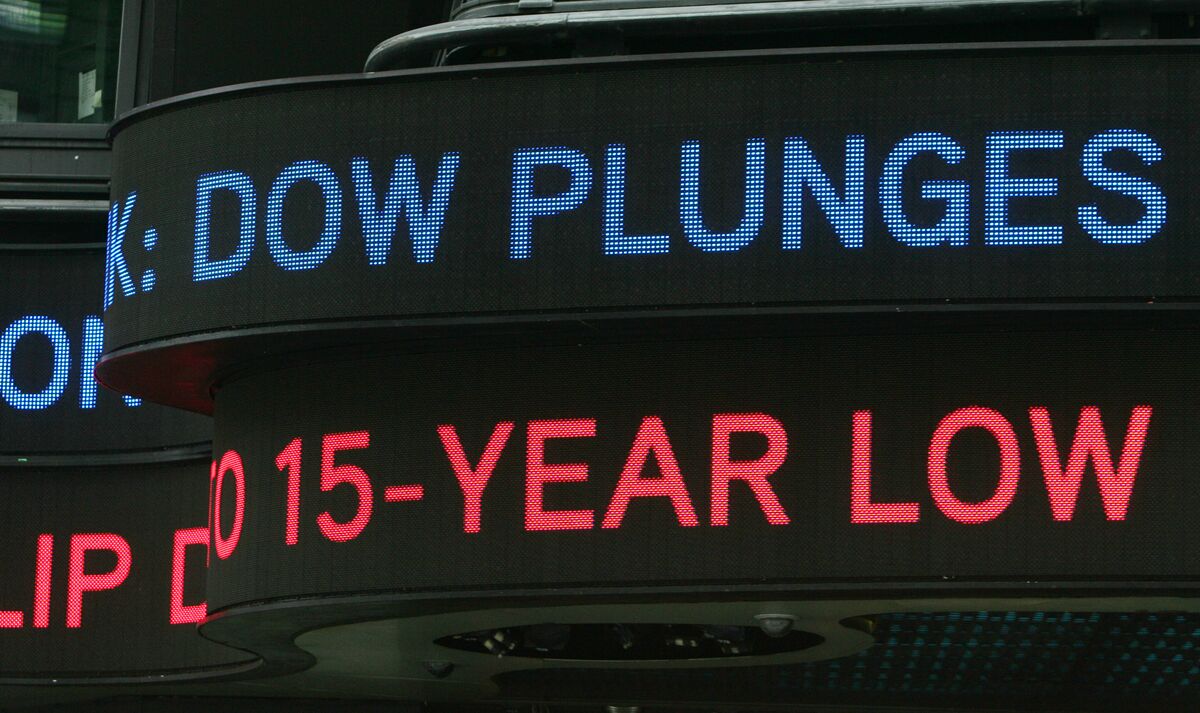

Market Mayhem: Dow Plummets as Trade Tensions Reignite Wall Street Selloff

Finance

2025-04-10 20:04:12Content

Wall Street Braces for Escalating US-China Trade Tensions as Trump Ramps Up Economic Pressure

The financial markets are closely monitoring the dramatic intensification of trade hostilities between the United States and China, as former President Donald Trump signals a potentially aggressive economic strategy. In a bold move that has sent ripples through global financial circles, Trump is positioning himself to dramatically reshape the economic landscape of international trade.

Investors and market analysts are carefully assessing the potential implications of Trump's increasingly confrontational approach toward China. His recent statements suggest a willingness to impose substantial tariffs and implement more restrictive trade policies that could significantly disrupt existing economic relationships.

The potential economic fallout is causing considerable uncertainty on Wall Street, with traders and investment firms scrambling to understand the potential consequences of this escalating trade battle. Key sectors such as technology, manufacturing, and agriculture are particularly vulnerable to potential retaliatory measures and trade restrictions.

As tensions continue to mount, the financial world remains on high alert, recognizing that the strategic economic moves between the United States and China could have far-reaching consequences for global markets, international trade dynamics, and geopolitical relationships.

Financial Tremors: How Trump's Trade Offensive Reshapes Global Economic Dynamics

In the high-stakes arena of international commerce, the United States finds itself at a critical juncture, where strategic economic maneuvers could fundamentally alter the global trade landscape. The escalating tensions between Washington and Beijing represent more than a mere diplomatic disagreement—they signal a profound transformation in international economic relationships that could reverberate through markets, industries, and geopolitical power structures.Navigating Unprecedented Economic Turbulence: A Deep Dive into US-China Trade Confrontation

The Geopolitical Chess Match of Trade Negotiations

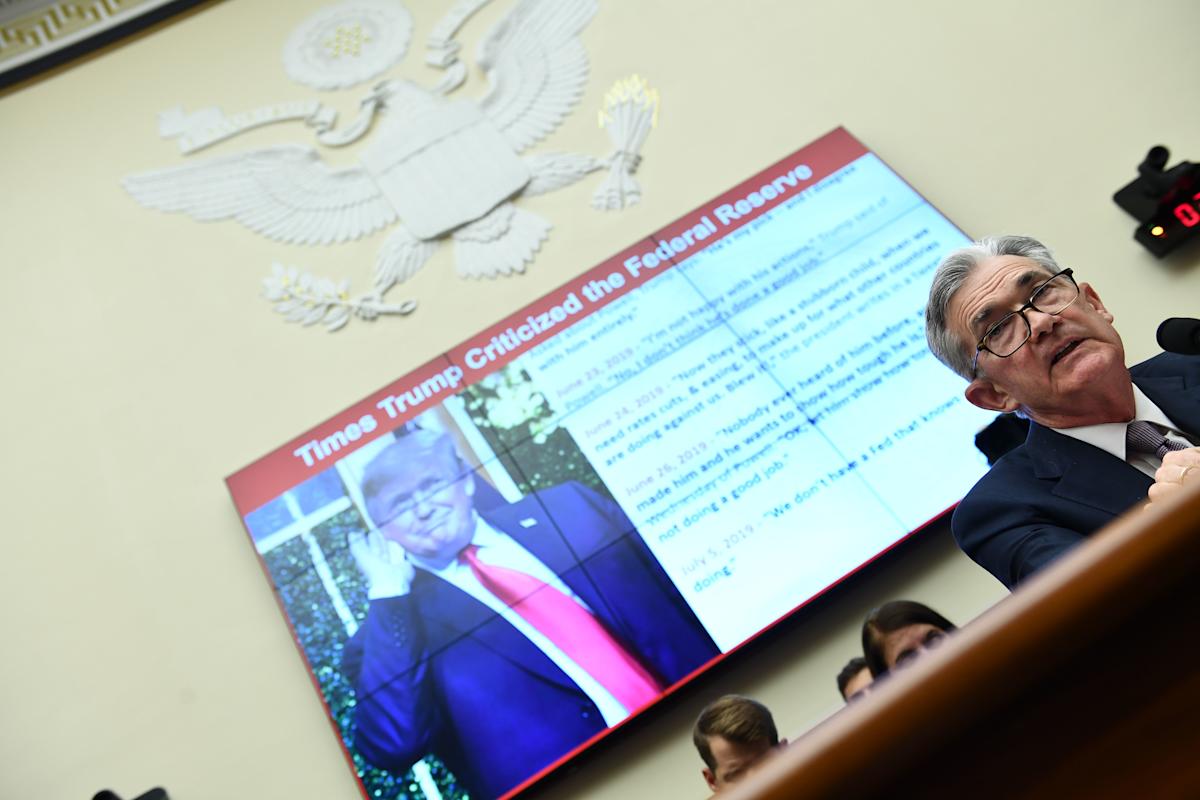

The current trade landscape between the United States and China represents a complex, multifaceted strategic engagement that transcends traditional economic negotiations. Each policy decision, tariff implementation, and diplomatic statement carries profound implications for global economic stability. The intricate dance between these economic superpowers involves sophisticated negotiation tactics, where economic leverage becomes a nuanced instrument of international diplomacy. Analysts observe that the escalating trade tensions are not merely about economic transactions, but reflect deeper geopolitical ambitions. The strategic positioning of both nations suggests a comprehensive approach that extends beyond immediate financial considerations, encompassing technological supremacy, market access, and long-term global influence.Market Reactions and Investor Sentiment

Wall Street's response to the unfolding trade dynamics reveals a complex tapestry of uncertainty and strategic repositioning. Institutional investors and market analysts are meticulously parsing every diplomatic signal, understanding that each nuanced development could trigger significant market volatility. The financial ecosystem demonstrates remarkable adaptability, with sophisticated investors developing intricate hedging strategies to mitigate potential risks. Investment portfolios are being recalibrated to account for potential trade disruptions, reflecting a proactive approach to managing geopolitical uncertainties.Technological and Economic Sovereignty Implications

Beyond traditional trade metrics, the current confrontation represents a profound struggle for technological and economic sovereignty. The battleground has expanded from tariffs and trade barriers to include critical domains such as technological innovation, intellectual property protection, and strategic industrial capabilities. Emerging technologies like artificial intelligence, semiconductor manufacturing, and advanced telecommunications infrastructure have become pivotal elements in this complex economic narrative. Each policy decision carries implications that extend far beyond immediate economic metrics, potentially reshaping global technological hierarchies.Long-Term Strategic Consequences

The ongoing trade tensions between the United States and China are not transient economic skirmishes but potentially transformative geopolitical events. Economists and policy experts suggest that the current trajectory could fundamentally restructure global economic relationships, challenging established international trade paradigms. The potential long-term consequences include potential decoupling of economic ecosystems, reconfiguration of global supply chains, and emergence of new economic alliances. These developments suggest a profound reimagining of international economic interactions, where traditional multilateral frameworks are being systematically reevaluated.Global Economic Ecosystem Adaptation

As the trade confrontation evolves, the global economic ecosystem demonstrates remarkable resilience and adaptability. Multinational corporations, financial institutions, and governments are developing sophisticated strategies to navigate the increasingly complex international trade environment. The emerging landscape suggests a shift towards more regionalized economic strategies, with businesses and nations seeking to diversify their economic dependencies and develop more robust, flexible economic frameworks. This adaptive approach represents a significant departure from previous globalization models.RELATED NEWS

Finance

Urban Money Maestro: Rick Cole's Radical Blueprint for City Financial Transformation

2025-03-31 16:00:00