Giants of Wall Street: How the S&P 500's Titans Have Transformed Over Four Decades

Companies

2025-04-10 14:51:31

The technological revolution has dramatically reshaped the landscape of the S&P 500, transforming tech companies from peripheral players to dominant market leaders in just two decades. Before the turn of the millennium, technology firms were barely a blip on the financial radar, occupying minimal space in the top 10 market capitalization rankings. Today, they command an unprecedented level of economic influence and market presence. Giants like Apple, Microsoft, Amazon, and Alphabet (Google's parent company) now sit comfortably at the pinnacle of the S&P 500, representing a seismic shift in corporate power. This meteoric rise reflects the digital age's transformative potential, where innovative technology has become the primary driver of economic growth and value creation. The rapid ascension of tech companies illustrates how quickly the business world can be revolutionized by breakthrough technologies, strategic innovation, and the ability to capture global markets. What was once considered a niche sector has now become the backbone of modern economic performance, signaling a new era of technological dominance in corporate America. MORE...

Federal Budget Cuts Hit Cleveland-Cliffs: Inside the Funding Fallout

Companies

2025-04-10 14:48:27

A proposed budget cut by President Donald Trump threatens to deliver a devastating blow to a key manufacturing sector, potentially striking at the heart of Vice President Mike Pence's hometown and the broader industrial landscape of the United States. The proposed program reduction could send shockwaves through local manufacturing communities, risking job losses and economic instability in regions that have long depended on these critical investments. By targeting a program that supports some of the nation's most significant industrial sectors, the administration's plan could undermine years of economic development and technological innovation. Particularly vulnerable are manufacturing hubs like those in Indiana, where local economies are intricately tied to industrial growth and federal support. The potential cuts raise serious questions about the administration's commitment to American manufacturing and the economic well-being of communities that form the backbone of the nation's industrial strength. As details of the proposed cuts emerge, local leaders, industry experts, and workers are expressing growing concern about the potential long-term consequences. The move could not only impact immediate job prospects but also potentially compromise the United States' competitive edge in global manufacturing markets. MORE...

Moderne Ventures Unveils Next-Gen Startup Cohort: 6 Trailblazers Set to Disrupt Industry Landscapes

Companies

2025-04-10 14:23:00

Moderne Ventures Launches Groundbreaking 2025 Passport Class, Signaling Bold Investment Strategy In a strategic move that's set to reshape the venture capital landscape, Moderne Ventures has unveiled its inaugural 2025 Passport Class. The firm, known for its innovative approach to strategic venture capital and growth equity investments, is positioning itself at the forefront of emerging market opportunities. This latest initiative underscores Moderne Ventures' commitment to identifying and nurturing transformative businesses across key industry sectors. By carefully selecting and supporting promising startups, the firm continues to demonstrate its expertise in driving meaningful economic growth and technological advancement. The 2025 Passport Class represents a carefully curated group of companies that show exceptional potential for disruption and scalability. Investors and industry watchers are eagerly anticipating the unique perspectives and breakthrough innovations these selected ventures will bring to the market. As Moderne Ventures continues to expand its investment portfolio, this new class signals the firm's forward-thinking approach to venture capital and its dedication to supporting the next generation of groundbreaking entrepreneurs. MORE...

Unveiling Hidden Commissions: Missouri Pushes for Transparency in Senior Care Referrals

Companies

2025-04-10 14:00:03

In a move to increase transparency and protect vulnerable seniors, Missouri lawmakers are proposing a new regulation that would require referral companies to reveal their financial connections to assisted living facilities. This groundbreaking legislation aims to shed light on potential conflicts of interest that could influence recommendations for senior care. Currently, many referral services connect seniors and their families with assisted living facilities, but the financial relationships behind these recommendations have remained largely hidden. The proposed bill would mandate that these companies disclose any financial incentives or partnerships they have with specific care facilities, giving families a clearer picture of the referral process. Consumer advocates argue that such transparency is crucial in helping families make informed decisions about senior care. By understanding potential financial motivations, seniors and their loved ones can more confidently navigate the complex landscape of assisted living options. The proposed legislation represents a significant step toward protecting Missouri's senior population, ensuring that referral recommendations are made in the best interest of the individuals seeking care, rather than being driven by hidden financial arrangements. As the bill moves through the legislative process, it promises to bring much-needed clarity and accountability to senior care referral services, potentially serving as a model for other states looking to protect their elderly residents. MORE...

Sonic Time Machines: How Guitar Tech is Resurrecting Vintage Tones in the Digital Era

Companies

2025-04-10 14:00:00

In the world of guitar technology, amp modelers have become the ultimate time machines for musicians, breathing new life into legendary guitar tones from decades past. These sophisticated digital devices are revolutionizing how guitarists capture and recreate iconic sounds that once seemed locked in vintage amplifiers. Modern amp modeling technology goes far beyond simple sound reproduction. Today's advanced processors can meticulously analyze and recreate the nuanced characteristics of classic amplifiers, from the warm tube overdrive of a 1950s Fender Bassman to the aggressive crunch of a 1980s Marshall stack. Musicians can now access an entire museum of legendary sounds with just a few digital tweaks. What makes these digital marvels so compelling is their ability to provide studio-quality tones in compact, portable packages. Guitarists no longer need to haul massive amplifiers or invest in expensive vintage equipment to achieve their dream sound. With high-resolution modeling technology, every subtle harmonic and dynamic response can be faithfully reproduced, giving musicians unprecedented creative flexibility. From bedroom musicians to professional recording artists, amp modelers are transforming how guitar sounds are created, recorded, and experienced. The future of guitar tone is here, and it sounds remarkably like the past. MORE...

Tech Titans Revealed: Google's Parent Company Dominates LinkedIn's 2025 Workplace Rankings

Companies

2025-04-10 13:48:21

LinkedIn Unveils Top Workplace Destinations: Tech and Finance Lead the Pack in 2025 In a groundbreaking revelation, LinkedIn has just released its highly anticipated annual ranking of the most desirable large companies to work for in 2025. The prestigious list showcases the crème de la crème of corporate environments, with technology and financial services sectors emerging as the clear frontrunners. This year's rankings highlight the evolving landscape of workplace culture, where innovative companies are setting new standards for employee satisfaction, professional growth, and cutting-edge work environments. Tech giants and financial powerhouses have distinguished themselves by offering compelling benefits, dynamic work cultures, and opportunities for career advancement. Professionals across industries are taking note of these top-tier employers, recognizing that the best workplaces go beyond traditional compensation packages. They offer holistic experiences that prioritize employee well-being, professional development, and meaningful work. As the job market continues to transform, LinkedIn's list serves as a crucial guide for talent seeking exceptional career opportunities and companies striving to attract and retain top-tier professionals. MORE...

Breaking: Golden Crow Consulting Emerges to Revolutionize Private Sector Strategy

Companies

2025-04-10 12:49:00

New Canaan, Connecticut - In a strategic move to empower private business owners, seasoned finance veteran Andrew Vandekerckhove has unveiled Golden Crow, a cutting-edge consultancy dedicated to helping entrepreneurs unlock their company's full potential. With an impressive two-decade track record in finance and investment leadership, Vandekerckhove brings unparalleled expertise to the business advisory landscape. Golden Crow aims to provide tailored strategic guidance that enables business owners to maximize their company's value and achieve sustainable growth. As the founder and Chief Executive, Vandekerckhove leverages his extensive professional experience to offer comprehensive consulting services designed to address the unique challenges and opportunities facing private enterprises. His approach combines deep financial insights with strategic planning to help clients transform their business vision into tangible success. Golden Crow represents a significant milestone in Vandekerckhove's career, reflecting his commitment to empowering entrepreneurs and driving business excellence through personalized, results-oriented consulting. MORE...

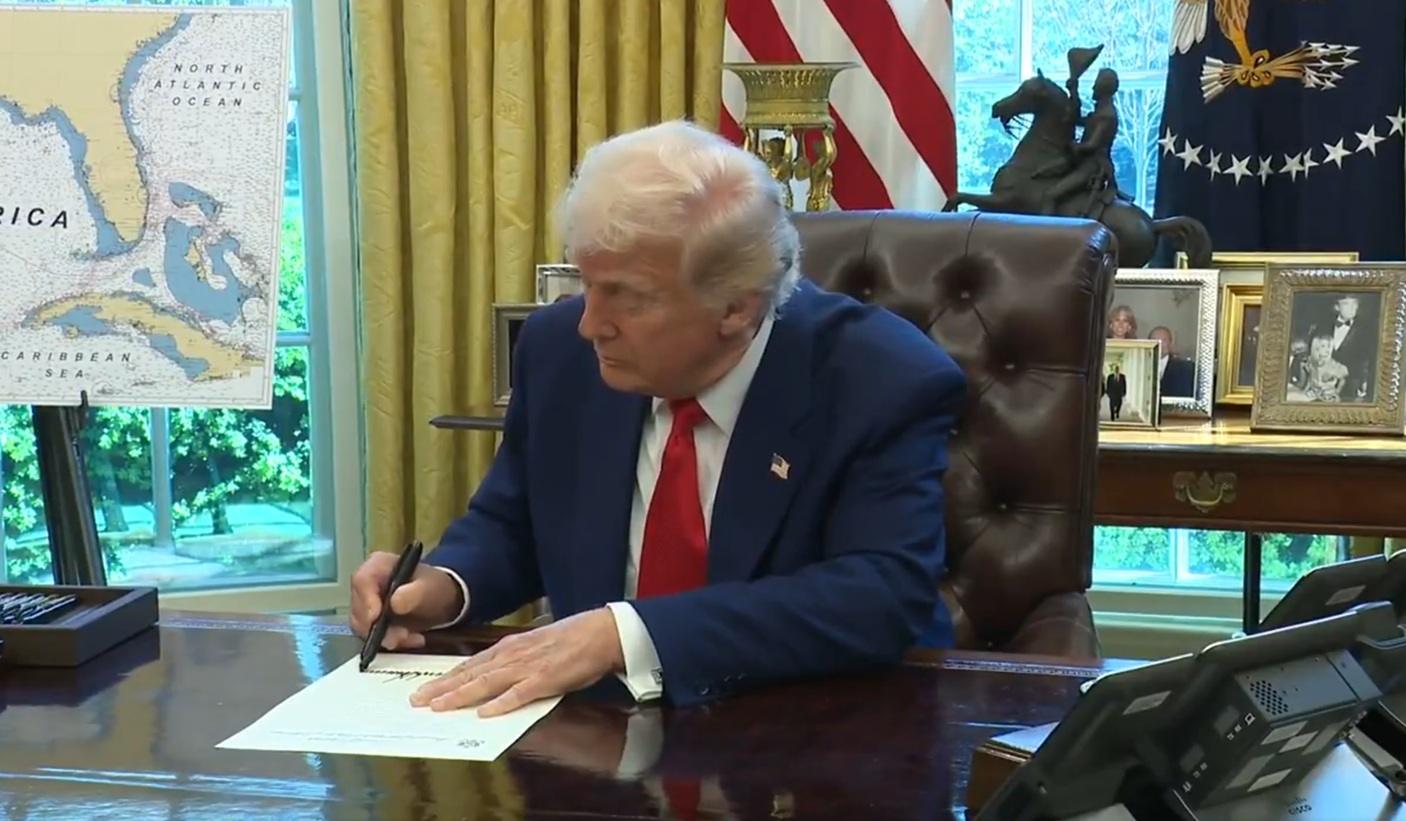

Climate Clash: Trump Blocks State Penalties on Oil Giants' Emissions

Companies

2025-04-10 12:22:49

In a bold move to support the energy sector, President Trump has signed a groundbreaking executive order designed to protect American energy companies from state-level environmental regulations. The "Protecting American Energy from State Overreach" order aims to shield energy corporations from increasingly stringent state laws that impose financial penalties for greenhouse gas emissions. This latest executive action is part of the administration's broader strategy to champion domestic energy production and push back against what they view as excessive environmental restrictions. By creating a protective barrier against state-level fines, the order seeks to preserve the economic interests of energy companies while challenging recent climate-focused regulatory approaches. The executive order represents a significant step in President Trump's ongoing mission to "unleash American energy" and roll back environmental policies implemented during the previous administration. It signals a continued commitment to supporting traditional energy industries and reducing regulatory barriers that could potentially impact their operational capabilities and financial performance. Energy industry leaders have largely welcomed the move, viewing it as a crucial intervention that protects their economic interests and prevents what they consider to be overreaching state-level environmental regulations. MORE...

The Future of Content: 7 Trailblazing Startups Reshaping the Creator Landscape in 2025

Companies

2025-04-10 12:00:00

The Creator Economy Revolution: How Companies Are Reimagining Support for Digital Innovators In the rapidly evolving digital landscape, forward-thinking companies are transforming traditional business models to empower content creators like never before. From innovative banking platforms to comprehensive brand incubators, these organizations are developing cutting-edge solutions that address the unique needs of modern digital entrepreneurs. Banking platforms are no longer just about managing finances; they're becoming strategic partners for creators. By offering specialized financial services, these institutions are providing tailored support that goes beyond conventional banking. They understand that creators need flexible financial tools that can adapt to their dynamic income streams and entrepreneurial ambitions. Meanwhile, brand incubators are emerging as powerful ecosystems that nurture talent and provide holistic support. These platforms offer more than just funding—they deliver mentorship, networking opportunities, and strategic guidance that can help creators transform their passion into sustainable businesses. The shift reflects a broader recognition of the creator economy's immense potential. As more individuals leverage digital platforms to build personal brands and monetize their skills, companies are racing to develop innovative solutions that can support this new generation of digital entrepreneurs. By reimagining traditional services and creating creator-centric approaches, these companies are not just observing the creator economy—they're actively shaping its future. MORE...

Identity Verification Showdown: Companies House Drops New Compliance Bombshell

Companies

2025-04-10 12:00:00

Unmasking Corporate Ownership: A New Era of Transparency The Economic Crime and Corporate Transparency Act 2023 marks a pivotal moment in UK corporate governance, introducing groundbreaking reforms that promise to shed light on the shadowy world of company ownership. At the heart of these transformative changes lies a robust identity verification process designed to bring unprecedented clarity and accountability to corporate structures. Gone are the days when companies could operate behind a veil of anonymity. The new legislation aims to strip away layers of complexity, ensuring that the true individuals running and controlling UK businesses are brought into the spotlight. By implementing stringent identity checks, the act seeks to create a more transparent and trustworthy business environment. This landmark reform is not just about bureaucratic paperwork; it's a powerful tool in combating corporate misconduct. By requiring precise and verifiable identification of company directors and key stakeholders, the act creates significant barriers for those attempting to abuse corporate structures for illicit purposes. The identity verification process represents a critical step towards building a more accountable and ethical business landscape in the United Kingdom. It signals a clear message: transparency is no longer optional, but a fundamental requirement for corporate legitimacy. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331