Global Investment Titans Clash: KKR Leads Race for Abu Dhabi's Lucrative District Cooling Contract

Business

2025-04-18 17:35:52Content

Global investment powerhouses KKR and I Squared Capital are currently competing in a high-stakes bidding war for a strategic district cooling business owned by Abu Dhabi's Multiply Group. The asset, which is part of a sprawling $1.5 trillion business empire, is attracting significant attention from international private equity firms, according to three people familiar with the ongoing negotiations.

The Multiply Group, which operates under the umbrella of one of the United Arab Emirates' most influential political leaders, is exploring potential sale options that could draw substantial interest from top-tier global investment firms. The district cooling business represents an attractive infrastructure investment opportunity in the rapidly developing Middle Eastern market.

With KKR and I Squared Capital emerging as frontrunners, the competitive bidding process underscores the growing appetite for infrastructure and utility assets in the region. The potential transaction highlights the strategic importance of cooling infrastructure in the UAE's urban development landscape and the increasing global investment interest in sustainable utility services.

Global Investment Titans Vie for Abu Dhabi's Cooling Empire: A Strategic Acquisition Showdown

In the high-stakes world of international asset management, a fascinating battle is unfolding as premier global investment firms position themselves to acquire a strategic district cooling business with connections to one of the United Arab Emirates' most influential power brokers.Transformative Investment Opportunity Sparks Intense Global Competition

The Strategic Landscape of Middle Eastern Infrastructure Investments

The district cooling sector represents a critical infrastructure segment within the Middle Eastern economic ecosystem. Multiply Group, a subsidiary of an expansive $1.5 trillion enterprise, has become a focal point for sophisticated global investment strategists seeking to penetrate the region's lucrative market. The potential acquisition signals a complex interplay of geopolitical positioning, technological infrastructure, and strategic asset management. Renowned investment powerhouses like KKR and I Squared Capital are meticulously evaluating this opportunity, recognizing the profound potential embedded within this seemingly niche infrastructure asset. Their interest underscores the sophisticated calculus driving contemporary global investment strategies, where understanding regional dynamics becomes as crucial as financial metrics.Investment Dynamics and Technological Infrastructure

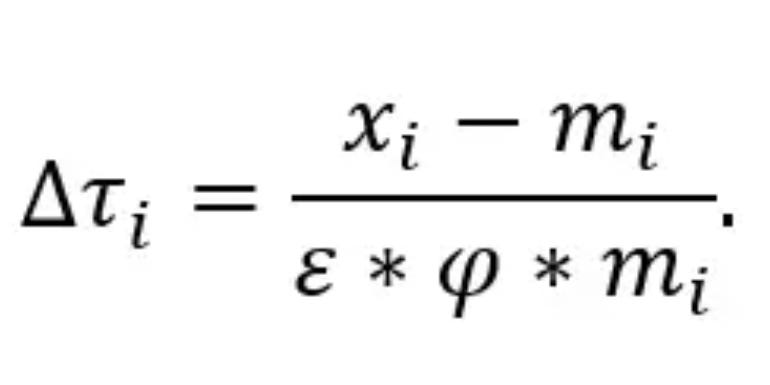

District cooling represents a sophisticated approach to urban temperature management, offering centralized cooling solutions that dramatically enhance energy efficiency. By consolidating cooling infrastructure, these systems can reduce overall energy consumption by up to 50% compared to traditional building-level cooling mechanisms. The technological sophistication of such infrastructure makes it an attractive investment target. Global asset managers like KKR understand that infrastructure investments in emerging markets offer stable, long-term returns with potentially lower volatility compared to traditional equity markets. The strategic positioning within the UAE's rapidly evolving economic landscape further enhances the asset's attractiveness.Geopolitical Context and Economic Significance

The potential acquisition transcends mere financial transaction, representing a nuanced engagement with one of the Middle East's most influential economic ecosystems. Multiply Group's connection to a prominent UAE Sheikh amplifies the strategic significance of this opportunity, suggesting potential pathways for deeper regional economic integration. Investment firms are not merely purchasing a cooling infrastructure asset; they are securing a strategic foothold in a complex and dynamic economic environment. The due diligence process involves intricate assessments of technological capabilities, regulatory frameworks, and long-term economic projections.Competitive Landscape and Strategic Positioning

The involvement of heavyweight investment entities like KKR and I Squared Capital indicates the substantial perceived value of this opportunity. These firms bring extensive global expertise, sophisticated analytical capabilities, and robust financial resources to evaluate and potentially transform the acquired infrastructure. Their competitive interest suggests that the district cooling business represents more than a simple infrastructure asset—it is a potential platform for broader technological and economic innovation within the Middle Eastern market.Future Implications and Market Transformation

This potential acquisition symbolizes the ongoing transformation of global investment strategies. As traditional investment models evolve, sophisticated asset managers are increasingly seeking opportunities that blend technological innovation, infrastructure development, and strategic regional positioning. The outcome of this competitive bidding process will likely provide significant insights into the future of infrastructure investments in emerging markets, particularly within the dynamic economic landscape of the United Arab Emirates.RELATED NEWS

Business

Philanthropy Powerhouse Melinda French Gates Claps Back at Tech Critics: 'I'm Doing the Real Work'

2025-04-25 04:07:56