Investor Spotlight: How Friedrich Vorwerk Group SE is Capturing Market Attention with Unique Ownership Structure

Companies

2025-05-02 05:11:23

Unveiling the Ownership Dynamics of Friedrich Vorwerk Group

The Friedrich Vorwerk Group presents a fascinating case of public company involvement, where significant ownership stakes reveal intriguing insights into the company's corporate structure. Public entities have established a notable presence in the group's ownership landscape, demonstrating a substantial level of influence and strategic interest.

By holding considerable control, these public companies have positioned themselves at the heart of the group's governance and strategic decision-making processes. This ownership model suggests a complex interplay between public investment and corporate management, highlighting the group's unique approach to ownership and control.

The substantial public company involvement indicates more than just financial investment—it represents a deeper commitment to the group's long-term vision and operational strategy. Investors and stakeholders can gain valuable insights into the company's governance framework through this distinctive ownership arrangement.

Understanding these ownership dynamics provides a clearer picture of how public entities are shaping the future of the Friedrich Vorwerk Group, blending public interest with corporate innovation and strategic growth.

MORE...Beauty Giant's Struggle: Estée Lauder's Uphill Battle for Market Momentum

Companies

2025-05-02 04:30:00

In a recent financial update, the company revealed a mixed performance landscape. While demonstrating impressive progress in cost-cutting measures, the organization has simultaneously adjusted its sales forecast, now projecting a more significant decline than initially expected. The strategic cost reduction efforts highlight management's commitment to operational efficiency, even as market challenges pose increasing pressure on revenue streams. Investors and analysts will be closely monitoring how these dual dynamics of expense management and sales contraction will ultimately impact the company's overall financial health in the coming fiscal year. MORE...

Climate Showdown: Hawaii Challenges Big Oil's Deceptive Tactics in Landmark Lawsuit

Companies

2025-05-02 03:15:28

In a dramatic legal showdown, the Trump administration has launched a federal lawsuit against Hawaii, seeking to prevent the state from pursuing legal action against major oil companies for their alleged role in climate change damages. The unprecedented legal battle highlights the growing tension between environmental advocacy and fossil fuel industries. Hawaii's lawsuit aims to hold Big Oil accountable for the environmental and economic consequences of climate change, while the federal government is attempting to block the state's legal efforts. By challenging Hawaii's right to seek damages, the Trump administration appears to be protecting the interests of oil corporations and potentially limiting states' abilities to address climate-related challenges through legal channels. This legal maneuver underscores the complex and contentious nature of climate change litigation in the United States. The lawsuit represents a significant moment in the ongoing debate about corporate responsibility, environmental protection, and the legal strategies states can employ to combat climate change impacts. MORE...

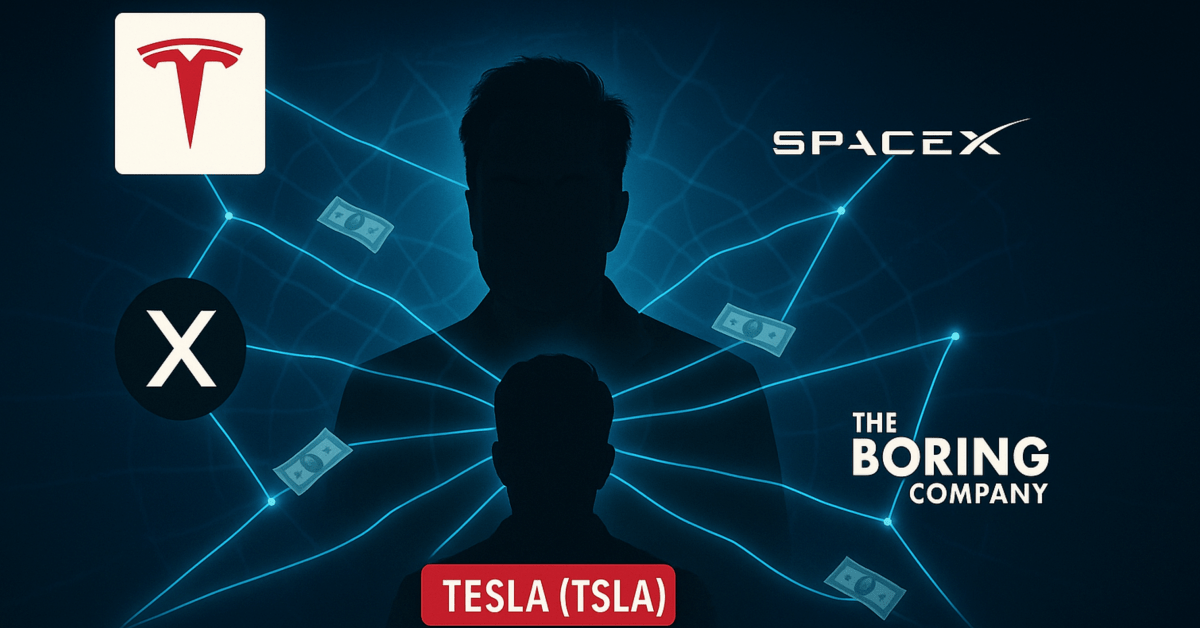

Musk's Corporate Web: Tesla Unveils Intricate Financial Connections

Companies

2025-05-02 00:12:48

In a revealing financial disclosure, Tesla has pulled back the curtain on a complex web of interconnected transactions involving CEO Elon Musk, his various corporate entities, and the company's board members. The intricate financial landscape highlights the deeply intertwined relationships that exist within Musk's business empire. The latest documentation exposes a nuanced network of financial interactions that demonstrate the intricate connections between Tesla and Musk's other business ventures. These transactions shed light on the sophisticated financial strategies employed by the electric vehicle and clean energy company and its high-profile leader. Board members and corporate executives are shown to be integral parts of this financial ecosystem, with multiple touchpoints that reveal the complex nature of corporate relationships within Musk's business portfolio. The transparency of these disclosures provides investors and stakeholders with a deeper understanding of the company's internal financial dynamics. While such interconnected transactions are not uncommon in corporate environments, Tesla's detailed revelation offers an unprecedented glimpse into the financial choreography that underpins Musk's business operations. The disclosure underscores the importance of corporate transparency and the intricate relationships that drive modern corporate structures. Investors and market analysts will likely scrutinize these details, seeking to understand the potential implications of these multifaceted financial connections on Tesla's overall corporate governance and strategic direction. MORE...

Trillion-Dollar Damage Unveiled: How 5 Corporate Giants Broke the Climate Silence

Companies

2025-05-02 00:00:00

A groundbreaking study has revealed the staggering economic toll of heat-trapping pollution, with major fossil fuel giants like ExxonMobil at the forefront of environmental damage. The research exposes a shocking $28 trillion in global economic losses directly attributed to extreme heat events, highlighting the devastating financial consequences of unchecked carbon emissions. The study paints a stark picture of how dirty fuel companies have not only contributed to climate change but have also imposed massive economic burdens on communities worldwide. These astronomical damages underscore the urgent need for comprehensive climate action and a decisive shift towards sustainable energy solutions. As extreme heat events become increasingly frequent and intense, the economic impact continues to mount, serving as a critical wake-up call for policymakers, businesses, and individuals alike to address the mounting environmental and financial challenges posed by climate change. MORE...

Reviving the American Dream: The Manufacturing Renaissance Starts Now

Companies

2025-05-01 23:20:00

Revitalizing American Manufacturing: A Path to Economic Strength and Workforce Empowerment In an era of global economic uncertainty, the resurgence of manufacturing in the United States represents a powerful strategy for national economic renewal. By bringing production back home, American companies can unlock a wealth of opportunities that extend far beyond factory floors. The benefits of domestic manufacturing are multifaceted and profound. When businesses choose to manufacture within U.S. borders, they create high-quality jobs, stimulate local economies, and reduce dependency on international supply chains. This approach not only strengthens corporate resilience but also provides meaningful employment for millions of skilled workers across the country. Moreover, investing in domestic manufacturing drives innovation, technological advancement, and economic competitiveness. By developing cutting-edge production capabilities, American companies can lead global markets, attract top talent, and build a more robust and adaptable economic ecosystem. The ripple effects of a strong manufacturing sector are transformative. Local communities gain economic stability, workers develop specialized skills, and the nation's overall economic infrastructure becomes more dynamic and self-sufficient. From advanced technology to traditional industries, American manufacturing represents a critical pathway to sustainable economic growth and national prosperity. As businesses and policymakers increasingly recognize these advantages, the renaissance of American manufacturing stands poised to redefine the country's economic landscape, creating a more resilient, innovative, and prosperous future for generations to come. MORE...

Heating Up Controversy: Massachusetts Gas Providers Accused of Billing Customers Beyond Fair Rates

Companies

2025-05-01 22:30:00

In a groundbreaking move to provide relief for consumers, Massachusetts energy regulators have unveiled an innovative strategy aimed at dramatically reducing natural gas bills. This proactive approach signals a significant commitment to addressing the financial burden faced by residents struggling with rising energy costs. The new initiative represents a comprehensive effort to explore and implement cost-saving measures that could potentially bring substantial financial relief to households across the state. By targeting the root causes of high gas prices, regulators are demonstrating their dedication to supporting local communities and easing the economic strain on families. While specific details of the plan are still emerging, early indications suggest a multi-pronged approach that could include infrastructure improvements, negotiated pricing strategies, and innovative conservation techniques. The discovery is part of a broader commitment to making energy more affordable and accessible for Massachusetts residents. Experts believe this approach could serve as a model for other states grappling with similar energy affordability challenges. As energy costs continue to be a significant concern for many households, this proactive stance by Massachusetts regulators offers a glimmer of hope for consumers seeking more manageable utility expenses. MORE...

Trade War Tremors: Apple Braces for $900M Tariff Blow, Stocks Take a Hit

Companies

2025-05-01 22:18:48

Apple Defies Market Expectations with Stellar Q2 Performance In a remarkable display of resilience, Apple has once again proven its market dominance by delivering a standout second-quarter earnings report that surpassed Wall Street's predictions. The tech giant's impressive performance was primarily driven by robust iPhone sales, which demonstrated the company's continued strength in the competitive smartphone market. Investors and analysts were pleasantly surprised by Apple's ability to navigate challenging economic conditions, with the company's iPhone segment showing particular vigor. The strong sales figures suggest that consumer demand for Apple's flagship product remains remarkably solid, even in the face of global economic uncertainties. This stellar performance not only highlights Apple's enduring brand appeal but also underscores the company's strategic prowess in maintaining consumer interest and loyalty. The better-than-anticipated results serve as a testament to Apple's innovative approach and its ability to consistently deliver products that resonate with global consumers. As the tech world continues to watch Apple's every move, this Q2 earnings report stands as a powerful reminder of the company's remarkable resilience and market leadership. Investors and tech enthusiasts alike are now eagerly anticipating what Apple will unveil next in its ongoing quest for technological innovation. MORE...

Beyond Software: How Tech Giants Are Revolutionizing the Workplace

Companies

2025-05-01 21:48:00

Beyond Features: Understanding Customer Needs Through Purpose

In today's competitive marketplace, successful businesses are shifting their perspective from simply showcasing product specifications to deeply understanding customer motivations. The key lies not in describing what a product is, but in comprehending why customers are seeking it in the first place.

When companies truly grasp the underlying job that customers want accomplished, they unlock powerful insights that drive innovation and customer satisfaction. Instead of getting lost in technical details and feature lists, businesses should ask: "What problem are customers trying to solve? What outcome are they hoping to achieve?"

This customer-centric approach transforms product development from a feature-driven process to a purpose-driven strategy. By focusing on the fundamental needs and desired results, organizations can create solutions that resonate more deeply with their target audience, leading to more meaningful and impactful offerings.

Ultimately, customers don't buy products; they hire solutions to make progress in their lives. The most successful companies are those that understand and address this fundamental human desire for meaningful progress.

MORE...Fluoride Fallout: Paxton Launches Probe into Toothpaste Giants' Health Risks

Companies

2025-05-01 21:46:31

Texas Attorney General Ken Paxton has launched a comprehensive investigation into toothpaste manufacturers over potential concerns regarding fluoride exposure, signaling a proactive approach to consumer health and safety. The investigation, which comes amid growing public interest in dental product ingredients, aims to scrutinize the levels of fluoride in various toothpaste brands and assess potential health risks associated with their formulations. Paxton's office is examining whether manufacturers are adhering to established safety standards and providing transparent information to consumers. Local health experts and consumer advocacy groups have welcomed the investigation, noting that understanding the long-term implications of fluoride exposure is crucial for public well-being. The probe seeks to ensure that toothpaste products on the market meet rigorous safety criteria and do not pose unintended health risks to consumers. As the investigation unfolds, residents of Dallas-Fort Worth and across Texas are encouraged to stay informed about potential developments and any subsequent recommendations from the Attorney General's office. FOX 4 News will continue to provide updates on this ongoing investigation, keeping the community informed about potential findings and their implications for consumer health. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331