Navigating on the Fly: How Modern Businesses Are Revolutionizing Delivery Logistics

Companies

2025-02-27 15:05:05

In a groundbreaking analysis, leading industry technology experts have unveiled critical insights into the persistent challenges plaguing last-mile delivery logistics. The comprehensive study underscores the urgent need for advanced artificial intelligence solutions to revolutionize the final stage of product distribution. Researchers discovered significant inefficiencies that continue to hamper delivery performance across multiple sectors. These bottlenecks not only impact operational costs but also directly affect customer satisfaction and overall supply chain effectiveness. The technology firm's findings suggest that traditional delivery methods are increasingly inadequate in meeting the rapidly evolving demands of modern consumers. Artificial intelligence emerges as a transformative solution, offering unprecedented potential to streamline delivery processes. By leveraging sophisticated algorithms and real-time data analysis, AI-driven optimization can dramatically reduce delivery times, minimize resource waste, and enhance route planning precision. The study highlights the critical importance of embracing technological innovation in an increasingly competitive logistics landscape. Companies that proactively integrate intelligent systems stand to gain significant competitive advantages, improving both operational efficiency and customer experience. As e-commerce continues to expand and consumer expectations rise, the implementation of AI-powered delivery optimization is no longer a luxury but a strategic necessity for businesses seeking to thrive in the digital age. MORE...

Mobile Boom: Latin American Platform Drives Global Companies' Transactions Skyward

Companies

2025-02-27 15:05:00

Colombia's Digital Payment Revolution: Nequi Leads the Charge The digital payments landscape in Colombia is experiencing an unprecedented surge, with Nequi emerging as the country's trailblazing mobile transactions platform. At the heart of this financial transformation, Nequi is reshaping how Colombians manage and transfer money in an increasingly digital world. Driving this digital payment evolution is EBANX, a key player that is helping to accelerate the adoption of innovative financial technologies across the region. The platform's rapid growth reflects a broader trend of technological innovation and financial inclusion in Colombia. Nequi has distinguished itself by offering seamless, user-friendly mobile payment solutions that cater to the diverse needs of Colombian consumers. From peer-to-peer transfers to convenient digital transactions, the platform is breaking down traditional banking barriers and empowering users with instant, secure financial services. As digital payments continue to gain momentum, Nequi stands at the forefront of a financial revolution that is transforming how Colombians interact with money, making transactions faster, more accessible, and more convenient than ever before. MORE...

Digital Battleground: How Your Personal Data Became the New Global Currency

Companies

2025-02-27 14:59:55

In the high-stakes digital battleground, a critical conflict is unfolding that could fundamentally reshape our understanding of data privacy. As governments and tech giants wage war over encryption access, everyday users find themselves caught in the crossfire, with personal privacy hanging precariously in the balance. The current landscape is fraught with tension. Powerful entities are demanding backdoor access to encrypted communications, arguing that such access is crucial for national security and crime prevention. However, privacy advocates warn that these demands could create unprecedented vulnerabilities for millions of digital citizens. Encryption has long been the shield protecting our most sensitive digital interactions - from personal messages to financial transactions. But now, this protective barrier is under intense scrutiny. Tech companies are being pressured to create "exceptional access" mechanisms that would theoretically allow authorized entities to decrypt communications. The irony is stark: in the name of protecting people, we might be dismantling the very privacy protections that keep individuals safe from potential misuse and unauthorized surveillance. Each compromise in encryption standards could potentially expose millions to unprecedented digital risks. As this complex debate continues, ordinary users are left wondering: Who truly controls our digital privacy? And at what point does security become indistinguishable from intrusion? The battle for data privacy is far from over, and the stakes have never been higher. MORE...

Retail Revolt: South Carolina Leads National Spending Freeze in Unprecedented Economic Protest

Companies

2025-02-27 14:58:05

Black Friday Boycott: What Consumers Need to Know

As tensions rise and social movements gain momentum, a widespread boycott is set to make waves this Black Friday. Activists are calling on supporters to take a stand by withholding their spending from select companies, transforming traditional holiday shopping into a powerful statement of solidarity.

The boycott aims to send a clear message to businesses, challenging them to address specific social, political, or ethical concerns. Supporters are encouraged to pause their purchasing power and consider the broader impact of their consumer choices.

Key Takeaways:

- Boycott targets specific companies across various industries

- Participants are asked to avoid spending money on Black Friday

- The movement seeks to draw attention to important social issues

While the full list of targeted companies continues to circulate, consumers are advised to stay informed and research the specific details of the boycott. Social media platforms and activist networks are primary sources for up-to-date information.

Whether you choose to participate or not, this boycott highlights the growing power of conscious consumerism in today's interconnected world.

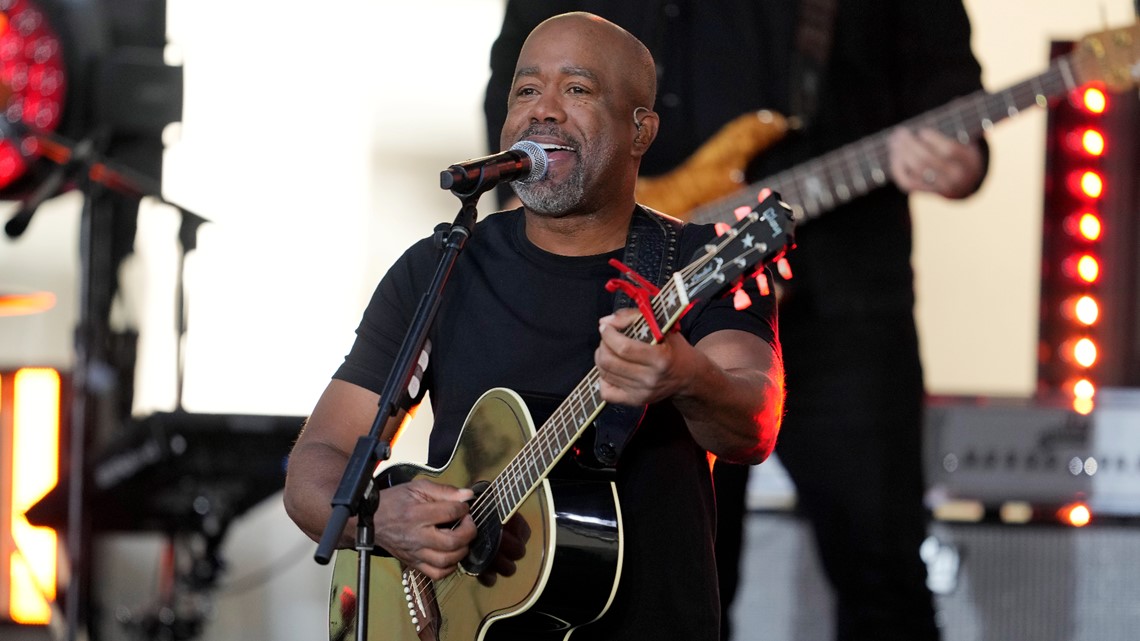

MORE...Country Star Darius Rucker Honored with Prestigious Golf Ambassador Award in Akron Ceremony

Companies

2025-02-27 14:30:00

Country music star Darius Rucker is set to receive a prestigious honor at a special ceremony on Thursday, June 19. The event, which will take place at the renowned Firestone Country Club in Akron, promises to be a memorable celebration recognizing Rucker's outstanding achievements in the music industry. MORE...

Pharma's Hidden Gem: Why Bausch Health Could Be Your Next Smart Investment Move

Companies

2025-02-27 14:18:45

Exploring Promising Pharma Stocks: A Deep Dive into Bausch Health Companies

In the ever-evolving landscape of pharmaceutical investments, our team has meticulously curated a comprehensive list of the top 12 low-priced pharma stocks that show exceptional potential for investors. Today, we're turning our spotlight on Bausch Health Companies Inc. (NYSE:BHC) to examine its standing among other competitive pharmaceutical stocks.

The pharmaceutical sector is currently experiencing a fascinating transformation, driven by groundbreaking developments in various therapeutic areas. One particularly exciting trend is the surging demand for weight-loss medications and innovative GLP-1 treatments, which are reshaping the healthcare investment ecosystem.

Bausch Health Companies presents an intriguing case study in this dynamic market. With its diverse portfolio and strategic positioning, the company offers investors a unique opportunity to tap into emerging healthcare trends while potentially mitigating investment risks.

As we continue to analyze the most promising pharmaceutical stocks, Bausch Health remains a compelling candidate for investors seeking growth and value in this rapidly changing industry.

MORE...Diversity Dilemma: Inside Paramount's Controversial DEI Rollback and the Corporate Exodus

Companies

2025-02-27 13:53:42

In a surprising shift mirroring former President Donald Trump's stance, major corporations are dramatically scaling back their diversity, equity, and inclusion (DEI) initiatives. Retail giants Walmart and Lowe's, along with tech powerhouse Meta, have announced significant reductions in their diversity programs, signaling a potential broader trend in corporate America. These companies are following a growing movement that challenges traditional DEI approaches, with some business leaders arguing that such programs have become overly politicized or ineffective. The pullback comes amid increasing scrutiny of corporate diversity efforts and a changing landscape of workplace inclusion strategies. While the exact motivations vary by organization, the trend suggests a recalibration of how companies approach workforce diversity and representation. Executives are reportedly reassessing their DEI investments, weighing the programs' impact against potential business and legal considerations. As this corporate landscape continues to evolve, many are watching closely to see how these changes might reshape workplace culture and opportunities for underrepresented groups in the coming years. MORE...

Nevada's Corporate Champions: Forbes Crowns 4 Local Employers as Top Workplace Innovators

Companies

2025-02-27 13:18:23

Nevada's Business Excellence: Four Local Companies Shine on Forbes' Best Employers List for 2025 In a remarkable showcase of workplace innovation and employee satisfaction, four Nevada-based companies have secured prestigious positions on Forbes' highly anticipated Best Employers list for 2025. These organizations have distinguished themselves by creating exceptional work environments that prioritize employee well-being, professional growth, and corporate culture. The recognition highlights Nevada's emerging reputation as a hub for progressive and employee-centric businesses. By earning a spot on this competitive national ranking, these companies demonstrate their commitment to fostering supportive, dynamic workplaces that attract and retain top talent. While the specific details of each company's ranking remain to be revealed, their inclusion on the Forbes list signals significant achievements in workplace management, employee engagement, and corporate leadership. This accomplishment not only reflects positively on the individual organizations but also underscores Nevada's growing business landscape. Professionals and job seekers across the state can look to these employers as benchmarks of excellence, offering insights into what makes a truly outstanding workplace in today's competitive job market. MORE...

Breaking: PayPal Shakes Up Leadership with Innovative Executive Merger

Companies

2025-02-27 12:32:27

Jamie Miller Elevates Leadership Role in Cutting-Edge Fintech Landscape In a strategic move that signals continued growth and innovation, Jamie Miller has stepped into an expanded leadership position within the dynamic fintech organization. The appointment underscores the company's commitment to driving transformative change in the financial technology sector. Miller, known for her exceptional strategic vision and deep industry expertise, will now oversee critical operational domains that promise to propel the company's competitive edge. Her new responsibilities encompass a broader range of strategic initiatives, leveraging her proven track record of driving organizational success and technological advancement. This leadership transition reflects the company's forward-thinking approach, positioning Miller at the forefront of developing innovative financial solutions that address emerging market challenges. Her expanded role is expected to accelerate the organization's strategic objectives and reinforce its position as a leader in the rapidly evolving fintech ecosystem. Colleagues and industry observers alike are optimistic about the potential impact of Miller's enhanced leadership, anticipating breakthrough strategies and continued innovation in the financial technology landscape. MORE...

Beyond Silicon Valley: How Century-Old Companies Outmaneuver Modern Startups

Companies

2025-02-27 12:00:15

Timeless Titans: Businesses That Have Stood the Test of Centuries

In the fast-paced world of entrepreneurship, building a lasting business might seem like a monumental challenge. Yet, some extraordinary companies have not just survived but thrived for hundreds of years, demonstrating remarkable resilience and adaptability.

While most entrepreneurs measure their success in years or even decades, a select group of legendary organizations have roots that stretch back centuries. These enduring enterprises have weathered economic storms, technological revolutions, and massive societal changes, emerging not just intact, but often as global leaders in their respective industries.

These remarkable businesses serve as inspiring examples of strategic vision, continuous innovation, and the ability to reinvent themselves while maintaining their core values and identity. Their longevity is a testament to the power of sustainable business practices and the importance of staying relevant in an ever-changing world.

Join us as we explore some of these extraordinary companies that have transformed the concept of business longevity from a distant dream to an achievable reality.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331