Local Business Titans Take Center Stage: Unveiling the Innovators Next Door

Companies

2025-03-21 10:37:01

Local businesses in St. Cloud are set to gain unprecedented visibility thanks to an innovative initiative by the St. Cloud Area Chamber of Commerce. The organization is offering an exciting opportunity for companies to amplify their market presence and connect with potential customers and partners. Through this strategic program, local businesses will have a unique platform to showcase their products, services, and brand identity. The Chamber's proactive approach aims to support the economic growth of the St. Cloud business community by providing enhanced exposure and networking opportunities. By participating in this initiative, companies can leverage the Chamber's extensive network and resources to expand their reach, build meaningful connections, and ultimately drive business growth. This collaborative effort underscores the Chamber's commitment to fostering a thriving and interconnected local business ecosystem. Local entrepreneurs and business owners are encouraged to take advantage of this valuable opportunity to elevate their company's profile and tap into new market potential. MORE...

Sustainable Skies Struggle: Why Only a Third of Air Cargo Firms Are Betting on Green Fuel

Companies

2025-03-21 10:29:11

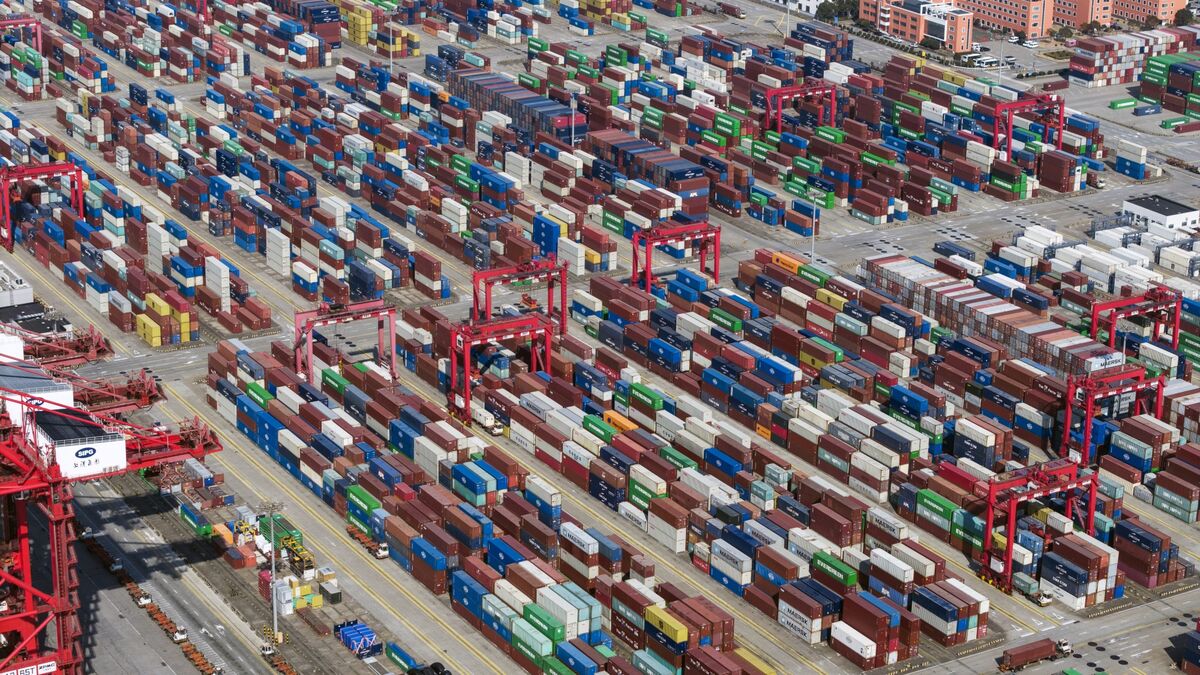

In a groundbreaking exploration of sustainability in the air cargo industry, TIACA's latest Air Cargo Sustainability Insights Report reveals a compelling snapshot of progress, challenges, and emerging trends. Drawing insights from 274 industry leaders, the fifth edition of this comprehensive study offers a nuanced look at how air cargo professionals are navigating the complex landscape of environmental responsibility. The report goes beyond mere statistics, providing a deep dive into the strategic approaches and innovative solutions being implemented across the global air cargo sector. From cutting-edge carbon reduction initiatives to transformative operational practices, the findings highlight both the industry's commitment and the ongoing challenges in achieving meaningful sustainability. Key highlights include a growing recognition of environmental impact, with leaders demonstrating increased awareness and proactive measures to address ecological concerns. The survey captures a moment of critical transformation, showcasing how air cargo companies are balancing economic imperatives with environmental stewardship. While significant progress has been made, the report also candidly acknowledges the road ahead. It serves as both a celebration of current achievements and a call to action for continued innovation and commitment to sustainable practices in the air cargo industry. As the global logistics landscape continues to evolve, this insights report stands as a crucial benchmark, providing stakeholders with a comprehensive understanding of sustainability efforts and potential future directions in air cargo transportation. MORE...

Wall Street Breathes Sigh of Relief: Bausch Health Stages Comeback After Brutal Year

Companies

2025-03-21 10:28:50

Unveiling the Investment Landscape: Institutional Insights into Bausch Health Companies The investment world has cast a revealing spotlight on Bausch Health Companies, with substantial institutional holdings signaling a profound level of confidence and strategic interest. Major financial players have demonstrated significant engagement with the company, suggesting a nuanced understanding of its potential and market positioning. Institutional investors, known for their sophisticated analysis and calculated investment strategies, have accumulated considerable stakes in Bausch Health Companies. This concentrated ownership implies more than mere financial investment—it reflects a deeper belief in the company's strategic direction, growth prospects, and underlying value proposition. The substantial institutional presence indicates a robust vote of confidence from professional investors who meticulously evaluate market opportunities. Their significant holdings suggest a comprehensive assessment of Bausch Health Companies' fundamentals, competitive advantages, and potential for future expansion. By maintaining substantial positions, these institutional investors are not just passive shareholders but active participants in the company's financial narrative. Their involvement hints at a strategic alignment with Bausch Health Companies' long-term vision and potential for value creation in the dynamic healthcare and pharmaceutical landscape. MORE...

Gambling Meets Glamour: Bruce Smith's Touchdown in Virginia's Casino Landscape

Companies

2025-03-21 10:27:22

Petersburg, Virginia Welcomes Groundbreaking of Transformative LIVE! CASINO & HOTEL VIRGINIA In a momentous celebration today, Bruce Smith Enterprise and The Cordish Companies officially launched construction on the highly anticipated LIVE! CASINO & HOTEL VIRGINIA, marking a significant milestone for the city of Petersburg. This groundbreaking project promises to be a game-changer for the region, with far-reaching economic implications. The ambitious development is set to generate billions of dollars in economic benefits, create thousands of new jobs, and establish a new benchmark for gaming, hospitality, and entertainment in Virginia. As part of a comprehensive $1.4 billion master plan, the project will be developed in strategic phases, ultimately transforming Petersburg into a world-class mixed-use resort destination. This landmark initiative represents more than just a casino and hotel—it's a catalyst for regional growth, innovation, and economic revitalization. The partnership between Bruce Smith Enterprise and The Cordish Companies demonstrates a bold commitment to Petersburg's future, promising to attract visitors, investors, and opportunities to the area. MORE...

Sky-High Success: Private Jet Firms Soar While Commercial Travel Stumbles

Companies

2025-03-21 08:55:04

In the dynamic landscape of luxury markets, the premium segment continues to demonstrate remarkable resilience. Despite broader economic uncertainties, high-end consumers appear to be maintaining their purchasing power and appetite for quality products and experiences. This segment's ability to weather market fluctuations stems from its unique characteristics: discerning clientele, brand loyalty, and less price-sensitive purchasing behaviors. While other market sectors may experience more significant volatility, the premium end remains a beacon of stability. Luxury brands and high-end service providers can expect a relatively steady demand in the short term, as affluent consumers continue to prioritize exceptional quality, exclusivity, and distinctive offerings. This resilience is not just about price point, but about the perceived value and emotional connection that premium products and services provide. Investors, market analysts, and business strategists would be wise to pay close attention to this segment, recognizing its potential for sustained performance even in challenging economic environments. The premium market's strength lies not just in its current position, but in its adaptability and ongoing appeal to sophisticated consumers who seek more than just commodities—they seek experiences, status, and unparalleled quality. MORE...

Sphere of Influence: Dead & Company's Electrifying Vegas Comeback Unveiled

Companies

2025-03-21 08:36:47

5 Electrifying Highlights from Dead & Company's 2025 Sphere Residency Opener

The legendary Dead & Company have triumphantly returned to Las Vegas's iconic Sphere, and the opening night was nothing short of spectacular. Fans were treated to an unforgettable musical journey that showcased the band's enduring magic and innovative spirit. Here are the five most memorable moments that made the night truly extraordinary:

- Immersive Visual Spectacle: The Sphere's cutting-edge technology transformed the concert into a mind-bending sensory experience, with mind-blowing visuals that perfectly complemented the band's legendary improvisational style.

- Unexpected Song Selections: The band surprised fans with deep cuts and rare performances that demonstrated their musical versatility and deep connection to the Grateful Dead's rich musical legacy.

- John Mayer's Stellar Guitar Work: Mayer continued to prove why he's become an integral part of the band, delivering jaw-dropping solos that honored the group's original sound while adding his unique musical perspective.

- Emotional Crowd Connection: The energy in the Sphere was electric, with long-time fans and new generations of Dead heads united in a powerful musical celebration.

- Technical Brilliance: The band's tight musical interplay and seamless transitions between songs highlighted their continued musical excellence and improvisational prowess.

As the residency continues, fans can expect more magical nights that push the boundaries of live musical performance at the extraordinary Sphere venue.

MORE...Trapped in the Cloud: The Silent SaaS Threat Companies Can't Ignore

Companies

2025-03-21 06:30:23

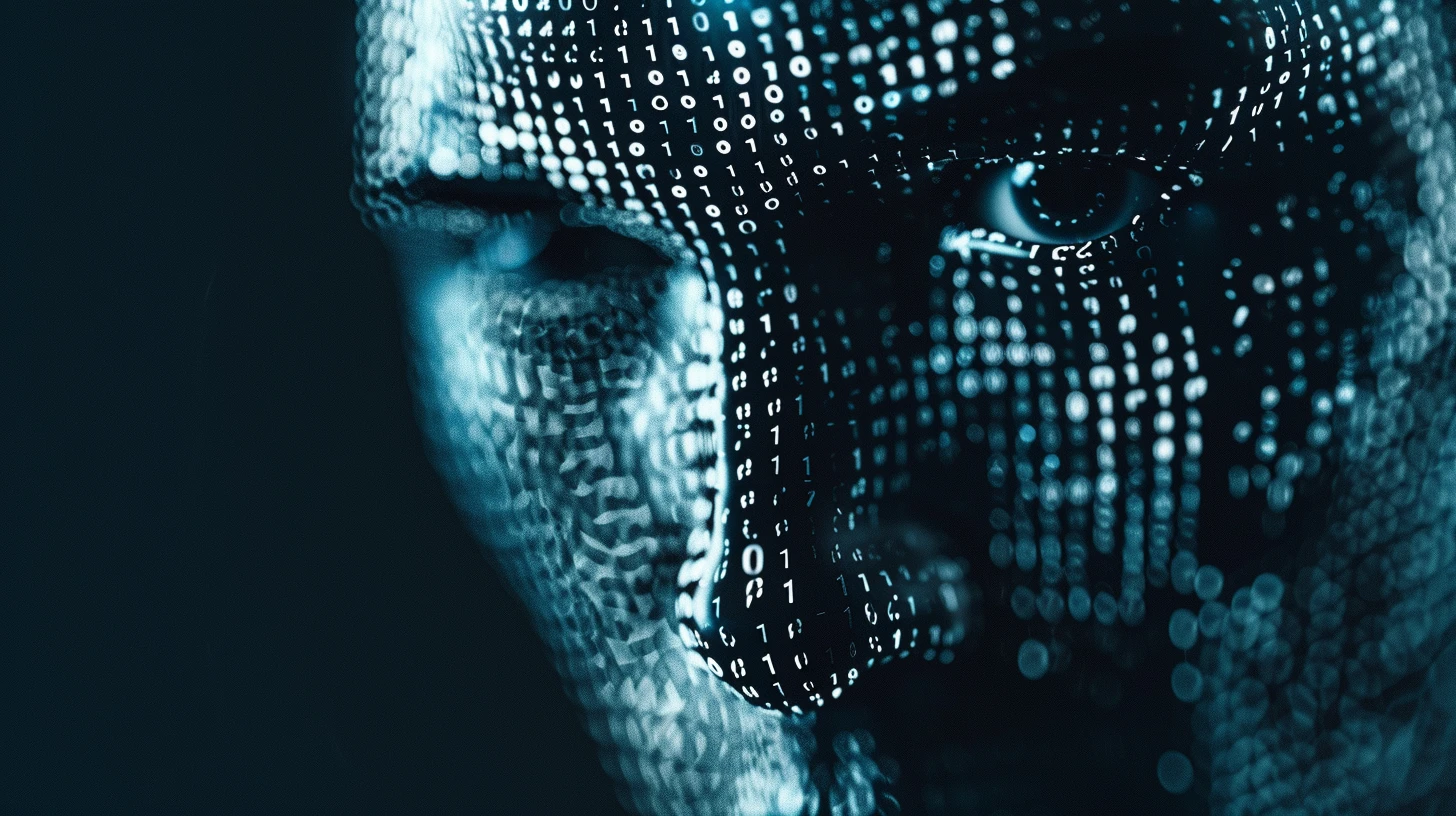

In today's rapidly evolving digital landscape, businesses are increasingly vulnerable when they outsource critical identity services to Software-as-a-Service (SaaS) providers located outside their primary operational region. This strategy, once seen as a cost-effective solution, now represents a potentially dangerous gamble with significant strategic and compliance risks. The global geopolitical climate is increasingly unpredictable, with sudden policy shifts and regulatory changes capable of disrupting international technology partnerships overnight. Companies that rely on external identity management platforms from distant regions may find themselves suddenly cut off, facing potential data sovereignty challenges, unexpected service interruptions, and complex legal complications. Smart organizations are recognizing the need to prioritize local or regionally aligned identity service providers who understand the nuanced regulatory environment and can offer more stable, predictable service continuity. By maintaining closer control over identity management infrastructure, businesses can mitigate risks, ensure compliance, and protect their most sensitive digital assets. The stakes are simply too high to leave identity services to chance. In an era of heightened cybersecurity threats and complex international regulations, strategic localization of critical technological services isn't just a preference—it's becoming a fundamental business imperative. MORE...

Insider Stakes Soar: 3 British Companies Poised for Explosive Growth

Companies

2025-03-21 06:05:33

In the current volatile market landscape, the United Kingdom's stock indices—FTSE 100 and FTSE 250—are experiencing significant headwinds, driven by disappointing trade data emerging from China. This development has cast a shadow over global economic recovery expectations, prompting investors to seek more strategic investment opportunities. Amidst these challenging market conditions, savvy investors are turning their attention to growth companies characterized by substantial insider ownership. This approach offers a compelling investment strategy, as high insider ownership often signals deep confidence in a company's long-term potential. When company leaders and key executives maintain significant stakes in their own businesses, it typically suggests they believe strongly in the organization's future trajectory and growth prospects. By focusing on such companies, investors can potentially identify more resilient and promising investment opportunities, even in uncertain economic environments. The alignment of insider interests with broader shareholder goals can provide an additional layer of reassurance during turbulent market periods. MORE...

EU Funding Bonanza: Israeli Innovation Bags €1.1 Billion in Groundbreaking Grants

Companies

2025-03-21 05:30:20

The scientific and technological partnership between the European Union and Israel stands as a beacon of collaborative innovation, representing one of the most dynamic and productive international research relationships in the contemporary global landscape. This robust cooperation continues to yield groundbreaking advancements across multiple disciplines, demonstrating the immense potential of cross-border scientific exchange. The synergy between European and Israeli researchers has consistently generated remarkable breakthroughs, leveraging the complementary strengths of both regions. Israel's renowned culture of technological entrepreneurship and cutting-edge research capabilities blend seamlessly with the European Union's comprehensive research infrastructure and diverse scientific expertise. From pioneering medical technologies to sustainable energy solutions and advanced digital innovations, this strategic partnership exemplifies how international collaboration can drive scientific progress and address complex global challenges. The ongoing commitment to shared research goals underscores the mutual benefits of this extraordinary technological alliance. MORE...

Western Business Exodus: Zero Companies Seek Russian Market Return, Official Reveals

Companies

2025-03-21 05:14:30

In a significant diplomatic effort, the Trump administration is actively pursuing a potential cease-fire agreement with Russia, simultaneously opening the door for Western businesses to potentially re-engage with the Russian market. The ongoing negotiations signal a complex diplomatic dance aimed at easing tensions and creating pathways for economic reconnection. Diplomatic sources suggest that the proposed cease-fire deal represents more than just a strategic political maneuver; it could mark a pivotal moment for international relations and economic collaboration. The potential agreement hints at a nuanced approach to rebuilding diplomatic bridges and exploring opportunities for Western companies to re-establish their presence in Russia. The discussions underscore the delicate balance between geopolitical considerations and economic interests, with both sides carefully weighing the potential benefits and risks of renewed engagement. As negotiations continue, business leaders and policymakers are watching closely, anticipating the potential for a significant shift in international economic dynamics. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331