Energy Sector Surge: Hallador's Surprising Stock Rally Explained

Companies

2025-04-13 18:58:07

Navigating the Energy Market: A Closer Look at Hallador Energy Company In the dynamic world of energy stocks, Hallador Energy Company (NASDAQ:HNRG) has emerged as a notable player amid the challenging market landscape. As the energy sector continues to face unprecedented challenges, including the impact of international trade tensions, investors are keenly watching how companies like Hallador are positioning themselves. The recent market volatility, particularly triggered by trade policy shifts, has sent ripples through the energy industry. With the sector experiencing significant fluctuations—dropping over 8% in recent weeks—companies are being forced to adapt and strategize in an increasingly complex economic environment. Hallador Energy Company stands at a critical juncture, presenting an intriguing opportunity for investors seeking to understand the nuanced dynamics of today's energy market. Our comprehensive analysis aims to provide insights into the company's current standing and potential trajectory in this turbulent landscape. Stay tuned as we dive deeper into Hallador's performance and explore its position among other energy stocks in this rapidly evolving sector. MORE...

Corporate Controversy: AUB's Funding Ties Spark Campus Debate

Companies

2025-04-13 18:05:36

BEIRUT — The American University of Beirut (AUB) has sparked controversy during its Career Fair 2025, with critics arguing that the event has deviated from its primary purpose of supporting student career opportunities. From April 7–11, the university faced criticism for allegedly promoting normalization with Israeli companies, raising concerns about the fair's underlying agenda. Student activists and local commentators have expressed disappointment, suggesting that the career fair should focus exclusively on enhancing students' professional prospects rather than potentially compromising political sensitivities. The presence of companies perceived as supporting the Israeli occupation has drawn sharp criticism from various campus groups. The university's decision to include these companies has ignited a broader debate about the role of academic institutions in maintaining political neutrality while supporting student career development. As tensions continue to simmer, the AUB Career Fair 2025 has become a focal point for discussions about institutional responsibility and student advocacy. MORE...

Grounded: Schumer Moves to Ban Chopper Firm After Fatal Hudson River Tragedy

Companies

2025-04-13 17:54:11

In the wake of a devastating midair helicopter accident, New York Senator Chuck Schumer is demanding swift and decisive action. The senior lawmaker is urging federal regulators to immediately revoke the operating permits of the helicopter tour company responsible for the tragic incident that saw a sightseeing chopper dramatically disintegrate and plummet into the Hudson River. Schumer's call for accountability comes as investigators continue to probe the circumstances surrounding the catastrophic mechanical failure. By pushing for the company's permits to be suspended, the senator aims to prioritize passenger safety and prevent potential future incidents that could put more lives at risk. The dramatic crash serves as a stark reminder of the critical importance of rigorous safety standards and thorough maintenance protocols in the aerial tourism industry. Senator Schumer's intervention underscores a commitment to ensuring that companies operating in this high-stakes sector are held to the highest possible safety standards. MORE...

Rocket Companies Drops a Financial Bombshell: Shareholders Set to Receive Massive $0.80 Special Dividend

Companies

2025-04-13 17:18:35

Rocket Companies (NYSE:RKT) is charting an ambitious course in the mortgage industry with its strategic acquisition of Mr. Cooper Group Inc., signaling a bold move to expand its market footprint. The company's recent financial performance underscores this growth trajectory, with fourth-quarter earnings revealing a remarkable transformation. In a compelling financial narrative, Rocket Companies reported a substantial year-over-year revenue surge to $1,769 million, accompanied by a notable shift from previous losses to a profitable quarter. This financial turnaround demonstrates the company's resilience and strategic acumen in a dynamic market landscape. Adding to the investor excitement, Rocket Companies announced a generous special dividend of $0.80 per share, potentially attracting more market attention and rewarding shareholders. The combination of strategic acquisition, strong financial performance, and shareholder-friendly policies positions Rocket Companies as a dynamic player in the competitive mortgage sector. By leveraging the Mr. Cooper Group acquisition and maintaining a robust financial strategy, Rocket Companies is clearly signaling its commitment to growth and market leadership in the evolving mortgage industry. MORE...

Breaking: Top 9 Remote Writing Gigs That Could Transform Your Career in 2025

Companies

2025-04-13 16:00:20

Freelance Writing in 2025: 9 Top Companies Offering Remote Opportunities

The freelance writing landscape is experiencing an unprecedented surge, with industry projections indicating a staggering $107 billion market value by 2026. For aspiring and experienced writers seeking flexible, remote work, the opportunities have never been more promising.

As digital content continues to dominate the global marketplace, companies are increasingly turning to talented freelance writers to create compelling, high-quality content. Whether you're a seasoned wordsmith or just starting your writing journey, these nine companies are actively recruiting remote freelance writers in 2025.

Why Freelance Writing?

- Flexible work schedules

- Location-independent opportunities

- Diverse writing projects

- Competitive compensation

Stay tuned as we unveil the top companies offering exciting remote writing opportunities that can transform your career and provide the freedom you've always desired.

MORE...Sky-High Controversy: Schumer Demands FAA Clip Wings of Troubled Helicopter Operator

Companies

2025-04-13 14:31:35

In the wake of a tragic midair helicopter crash that claimed the lives of five Spanish tourists, a New York Democrat is shining a spotlight on the controversial "Part 91" licensing regulations that allowed New York Helicopter to operate its ill-fated aircraft. The devastating incident, which saw the helicopter dramatically split in half during flight, has sparked urgent questions about aviation safety and regulatory oversight. The lawmaker is calling for a comprehensive review of Part 91 licenses, which have long been criticized for their relatively lax safety standards compared to more stringent commercial aviation regulations. This tragic accident has become a pivotal moment for examining the potential risks associated with these less-regulated flight operations. By bringing national attention to the licensing issue, the Democrat hopes to prevent similar tragedies and ensure that passenger safety remains the paramount concern in aerial transportation. The investigation promises to delve deep into the circumstances that led to this catastrophic midair failure, potentially reshaping how smaller aviation operators are monitored and regulated in the future. MORE...

Return to Office Backfires: Talent Exodus Leaves Companies Scrambling

Companies

2025-04-13 14:30:59

The Transformative Journey of Modern Workplace Dynamics

In today's rapidly changing professional landscape, the traditional office paradigm is undergoing a profound metamorphosis. The rise of remote work and hybrid work models has not just been a temporary response to global challenges, but a fundamental reimagining of how and where work gets accomplished.

Companies across industries are navigating uncharted territories, carefully balancing employee flexibility with organizational productivity. The once-rigid boundaries between home and workplace have blurred, creating new opportunities and challenges for both employers and employees.

While some organizations enthusiastically embrace this transformation, others remain cautious, weighing the potential benefits against potential risks. The debate continues about the most effective work structures that can maximize collaboration, maintain team cohesion, and support individual employee well-being.

Key considerations include technological infrastructure, communication strategies, performance management, and creating inclusive environments that support both in-person and remote team members. The future of work is not about choosing between traditional and remote models, but about crafting flexible, adaptive approaches that meet diverse workforce needs.

As businesses continue to experiment and evolve, one thing remains clear: the workplace of tomorrow will look dramatically different from the workplace of yesterday.

MORE...Flames, Fury, and Lawsuits: LA Homeowners Battle Insurance Giants Over Fire Damage Claims

Companies

2025-04-13 11:59:54

In the aftermath of California's devastating wildfires, homeowners are facing a hidden threat that goes far beyond the visible destruction. Homes that survived the flames are now revealing a silent danger: toxic chemical contamination that could pose serious health risks. David Jones, the former California Insurance Commissioner, is shedding light on a troubling insurance dilemma facing wildfire survivors. Many homeowners who thought they were spared the worst are discovering that their seemingly intact homes are now toxic hazards, contaminated with dangerous chemicals from burned materials, plastics, and household items. The contamination is more than just surface-level damage. Toxic substances like benzene have been found seeping into building materials, potentially creating long-term health risks for residents. Yet, in a cruel twist, many insurance companies are refusing to cover the extensive cleaning and remediation required to make these homes safe. Homeowners are caught in a devastating catch-22: their properties appear intact but are potentially uninhabitable, and insurance providers are turning their backs on this complex environmental challenge. Jones argues that insurers have a moral and legal obligation to support homeowners in these extraordinary circumstances. The situation highlights the growing challenges posed by increasingly frequent and destructive wildfires, which are leaving communities not just physically scarred, but facing hidden environmental and health challenges that extend far beyond the immediate destruction. As California continues to grapple with wildfire recovery, the toxic aftermath represents a critical issue that demands immediate attention from insurers, policymakers, and environmental experts. MORE...

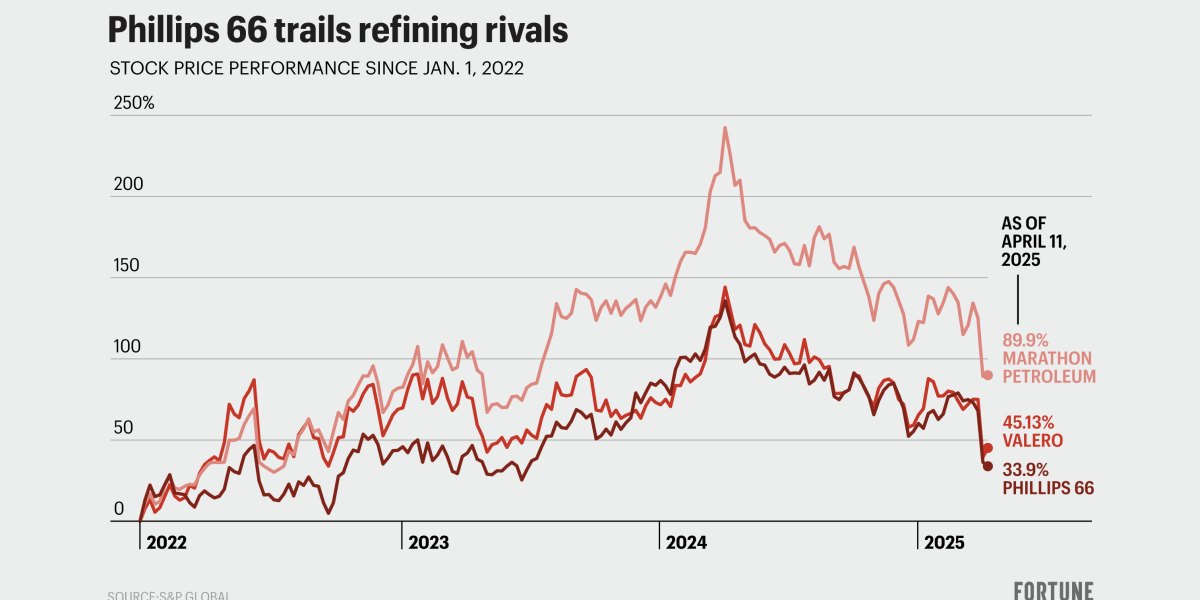

Revolt in the Boardroom: How Elliott Management Is Pushing Phillips 66 to Unlock Hidden Value

Companies

2025-04-13 11:00:00

Elliott Management, the activist investment firm known for its aggressive strategic interventions, is setting its sights on Phillips 66. The hedge fund is proposing a bold plan to dramatically reshape the energy company's leadership and corporate structure. At the heart of Elliott's strategy is a comprehensive proposal to overhaul the company's board of directors and potentially break up Phillips 66 into separate entities. The goal is clear: maximize shareholder value by unlocking the hidden potential within the company's diverse business segments. By targeting board composition and suggesting a potential strategic restructuring, Elliott aims to create more value for shareholders and push the company toward a more dynamic and efficient operational model. This approach is typical of the firm's activist investment strategy, which often involves pushing for significant corporate transformations to drive financial performance. Investors and industry observers are closely watching how Phillips 66's leadership will respond to Elliott's ambitious proposal, which could potentially trigger a significant shift in the company's strategic direction and governance. MORE...

Cyber Career Gold: The Heavyweight Companies That Make Recruiters Swoon

Companies

2025-04-13 10:37:02

Top Cybersecurity Companies That Can Supercharge Your Career

In the competitive world of cybersecurity, not all employers are created equal. Business Insider recently consulted six top recruiting experts to uncover the most prestigious companies that can instantly elevate your professional profile.

These industry-leading organizations aren't just employers—they're career launchpads that can dramatically boost your résumé and open doors to exciting opportunities in the cybersecurity landscape.

The experts unanimously agreed that certain companies stand out as gold standards in the cybersecurity industry. Having these names on your professional document can signal to potential employers that you've been trained in cutting-edge security practices and have worked with industry innovators.

While the specific rankings may vary, companies like Palo Alto Networks, CrowdStrike, Cisco, and Splunk consistently emerged as top-tier employers that cybersecurity professionals aspire to work for.

Recruiters emphasized that beyond just a prestigious name, these companies offer exceptional training, exposure to advanced technologies, and opportunities for professional growth that can accelerate your career trajectory.

For ambitious cybersecurity professionals, targeting these industry leaders could be the strategic move that transforms your career from good to extraordinary.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331