Tariff Tsunami: Dave Ramsey Warns of Economic Ripple Effects from Trump's Trade Tactics

Companies

2025-04-11 11:04:31

As the global trade landscape continues to evolve under potential tariff proposals, renowned financial experts Dave Ramsey and Ken Coleman from Ramsey Solutions are offering critical insights into the potential economic implications. While the full implementation of trade policies remains uncertain, these financial thought leaders are proactively analyzing the potential impacts on American businesses and consumers. The ongoing discussions surrounding international trade strategies have sparked intense debate among economic analysts, with Ramsey and Coleman providing nuanced perspectives on how potential tariff changes could reshape economic dynamics. Their expertise offers a valuable lens through which to understand the complex interplay of global trade, economic policy, and individual financial planning. By breaking down the potential scenarios and offering practical guidance, these experts aim to help individuals and businesses navigate the uncertain terrain of international trade regulations. Their collaborative approach combines deep economic understanding with actionable advice, empowering people to make informed financial decisions in an increasingly interconnected global marketplace. MORE...

Green Horizons: IM Cannabis Unveils Strategic Moves in Evolving Market Landscape

Companies

2025-04-11 11:00:00

IM Cannabis Corp. (CSE: IMCC) (NASDAQ: IMCC), a pioneering force in the medical cannabis industry, is making waves with its strategic operations across Israel and Germany. Today, the company is excited to share key corporate updates that highlight its continued growth and innovation in the rapidly evolving cannabis market. As a leading medical cannabis provider, IM Cannabis continues to position itself at the forefront of international cannabis research, production, and distribution. The company's robust presence in two key European markets demonstrates its commitment to expanding access to high-quality medical cannabis solutions. With a proven track record of excellence, IM Cannabis remains dedicated to advancing medical cannabis treatments and meeting the diverse needs of patients across its operational regions. The latest corporate updates underscore the company's ongoing strategic initiatives and commitment to driving innovation in the global medical cannabis landscape. Investors and industry observers can look forward to further developments as IM Cannabis continues to strengthen its market position and explore new opportunities in the medical cannabis sector. MORE...

Silicon Valley's New Playbook: Why AI Is Rewriting the Rules of Business

Companies

2025-04-11 11:00:00

AI-Native Companies: Transforming Business Beyond Automation

In the rapidly evolving digital landscape, forward-thinking organizations are doing far more than simply automating processes. AI-native companies are fundamentally reimagining and restructuring their entire business ecosystem through intelligent technology.

These innovative enterprises understand that true digital transformation goes well beyond surface-level task automation. Instead, they are strategically embedding artificial intelligence into the core of their operational DNA, fundamentally reshaping how decisions are made, strategies are developed, and talent is cultivated.

Strategic Integration of AI

Successful AI-native companies recognize that artificial intelligence is not just a technological tool, but a strategic imperative. They are proactively:

- Integrating AI into strategic planning processes

- Empowering data-driven decision-making

- Continuously evolving their workforce capabilities

Workforce Transformation

These organizations are not replacing human talent, but augmenting and elevating it. By creating a symbiotic relationship between human creativity and machine intelligence, they are unlocking unprecedented levels of innovation and efficiency.

The future belongs to companies that view AI not as a peripheral technology, but as a fundamental driver of organizational evolution and competitive advantage.

MORE...Corporate Royalty: Georgia's Business Titans Top the 'Most Envied' Leadership Chart

Companies

2025-04-11 10:50:44

In a recent survey highlighting corporate leadership, Georgia-based companies have emerged as powerhouses of executive talent. Coca-Cola leads the pack among eight prominent Georgia companies recognized for their exceptional leadership and corporate success. The poll, which evaluated top executives across various industries, showcased the remarkable influence of Georgia's business leaders. These companies have not only demonstrated remarkable performance but have also set new standards in corporate excellence and innovation. Coca-Cola, a global beverage giant headquartered in Atlanta, continues to stand out as a prime example of strategic leadership and brand management. The company's executives have been particularly praised for their ability to navigate complex market challenges and maintain the brand's iconic status. The survey results underscore Georgia's significant role in shaping national business leadership, highlighting the state's robust corporate ecosystem and the exceptional talent driving these organizations forward. While specific details of the poll were not disclosed, the recognition serves as a testament to the strategic vision and leadership prowess of these Georgia-based companies and their top executives. MORE...

Tech Titans Beware: EU's Bold Move to Levy Silicon Valley's Digital Empire

Companies

2025-04-11 10:27:22

In a bold move signaling potential escalation of transatlantic tech tensions, European Commission President Ursula von der Leyen has hinted at imposing targeted tariffs on major US technology companies like Meta and Google. Speaking candidly to the Financial Times, von der Leyen suggested that the EU is preparing strategic contingencies if ongoing diplomatic negotiations fail to resolve the complex trade dispute initially triggered during the Trump administration. Currently, both the United States and European Union have strategically paused planned import tax increases, creating a diplomatic window for constructive dialogue. However, Brussels is carefully crafting backup plans, demonstrating a willingness to take decisive action if negotiations do not progress satisfactorily. The potential tariffs represent a significant development in the ongoing technological and economic standoff between the two global economic powerhouses. By considering such measures, the European Commission signals its commitment to protecting European economic interests and ensuring a level playing field in the increasingly competitive global tech landscape. As negotiations continue, businesses, policymakers, and tech giants are closely watching the potential implications of these proposed tariffs, which could dramatically reshape international technology trade relations. MORE...

AI Résumés: The Surprising Hiring Hack Recruiters Can't Ignore

Companies

2025-04-11 10:00:00

In today's rapidly evolving job market, companies that dismiss AI-generated résumés are inadvertently overlooking a goldmine of innovative talent. These cutting-edge candidates represent the future workforce, bringing sophisticated technological skills and forward-thinking perspectives that are critical to organizational growth and competitiveness. Modern professionals leveraging AI tools to craft their résumés demonstrate technological savvy, adaptability, and an understanding of emerging workplace trends. By automatically filtering out these applications, organizations risk missing exceptional candidates who are not just technologically proficient, but also strategic thinkers capable of driving digital transformation. The résumés generated through AI platforms often showcase a candidate's ability to harness advanced technologies, highlighting their potential to contribute meaningfully in an increasingly digital workplace. Forward-thinking companies recognize that embracing these applications is not just about accepting a document, but about recognizing the innovative potential of candidates who are already thinking several steps ahead. Talent acquisition strategies must evolve to appreciate the nuanced skills represented in AI-enhanced résumés. Those organizations that remain open-minded and technologically progressive will ultimately attract the most dynamic and adaptable professionals, securing a significant competitive advantage in the talent marketplace. MORE...

Trust Titans: Illinois Firms Top Credibility Rankings in Surprising Survey

Companies

2025-04-11 09:05:57

Trust Matters: Illinois Shines in National Trustworthiness Rankings In a remarkable showcase of corporate integrity, a prestigious national survey has recognized 700 companies across the United States for their exceptional trustworthiness. Among these standout organizations, Illinois proudly claims 35 spots, highlighting the state's commitment to ethical business practices. These companies represent a diverse range of industries, from technology and manufacturing to service and retail sectors. Their inclusion in this elite list is a testament to their unwavering dedication to transparency, customer satisfaction, and ethical standards. The recognition goes beyond mere numbers—it reflects a deeper commitment to building genuine relationships with customers, employees, and communities. Each of these 35 Illinois-based companies has demonstrated that trust is not just a buzzword, but a fundamental business principle. While the full list offers a comprehensive view of these outstanding organizations, it serves as a powerful reminder that integrity and reliability remain crucial in today's competitive business landscape. For businesses and consumers alike, these rankings provide valuable insights into companies that consistently go above and beyond in maintaining trust. Want to know which Illinois companies made the cut? Stay tuned for the complete list that celebrates corporate excellence and ethical leadership. MORE...

Firearm Industry Trembles: Trump's Tariff Gambit Sparks Panic in Gun Manufacturing Circles

Companies

2025-04-11 09:03:39

While American gun manufacturers have long held a commanding position in the global firearms market, the recent tariffs imposed by the Trump administration are poised to send ripples through the industry's robust ecosystem. Despite the sector's domestic strength, these new trade policies could potentially disrupt the delicate balance of manufacturing costs, supply chains, and international competitiveness. The gun industry, traditionally a bastion of American manufacturing prowess, now faces unprecedented economic challenges. Trump's tariffs threaten to increase production expenses, potentially forcing manufacturers to reevaluate their strategic approaches and pricing models. Even companies with deep roots in domestic production may find themselves navigating complex economic terrain as global trade dynamics shift. Key players in the firearms sector will need to carefully assess the potential impacts, weighing the immediate cost increases against long-term market strategies. While American manufacturers have historically demonstrated remarkable resilience, these tariffs represent a significant test of their adaptability and economic fortitude. MORE...

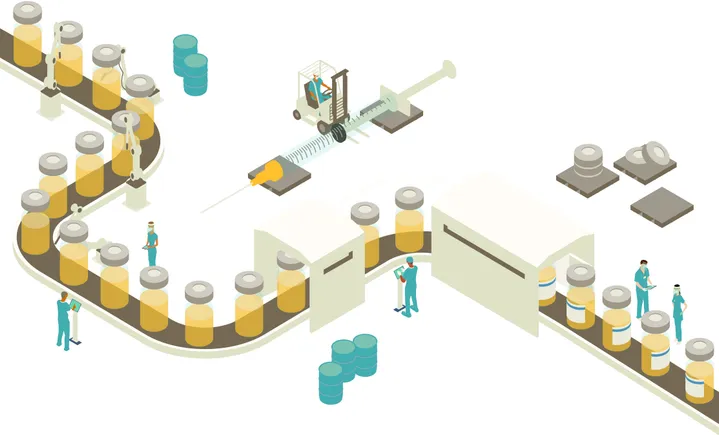

Inside Pharma's Manufacturing Revolution: The Strategic Shifts Reshaping Global Production

Companies

2025-04-11 07:13:22

As global trade tensions escalate, the ongoing tariff war is sparking a significant shift in manufacturing strategies. Pharmaceutical giants are leading the charge, increasingly bringing production back to domestic shores in a trend known as reshoring. The complex geopolitical landscape has exposed vulnerabilities in global supply chains, compelling major pharmaceutical companies to reconsider their international manufacturing footprints. By localizing production, these firms aim to reduce risks, enhance supply chain resilience, and mitigate potential disruptions caused by ongoing trade conflicts. This strategic pivot not only addresses immediate economic challenges but also represents a broader movement towards creating more robust and self-sufficient domestic manufacturing ecosystems. As companies reassess their global production networks, reshoring is emerging as a critical strategy for maintaining competitive advantage and ensuring long-term operational stability. MORE...

Tech Giants Clash: Global Manufacturers Challenge India's E-Waste Regulation Roadmap

Companies

2025-04-11 07:04:15

India's Growing E-Waste Challenge: A Battle Between Environmental Responsibility and Economic Constraints As India grapples with an ever-increasing mountain of electronic waste, the nation finds itself at a critical crossroads. The rapid technological advancement and widespread adoption of electronic devices have created an unprecedented environmental challenge that demands immediate attention. The scale of the problem is staggering. Millions of smartphones, computers, and electronic gadgets are discarded annually, creating a toxic waste stream that threatens both environmental sustainability and public health. While the Indian government is pushing for comprehensive e-waste management strategies, global electronics manufacturers are pushing back, citing prohibitive costs. These multinational companies argue that implementing rigorous recycling and responsible disposal programs would significantly increase production expenses. Their resistance highlights the complex tension between environmental protection and economic considerations. India's proposed regulations aim to mandate comprehensive recycling protocols and establish stricter guidelines for electronic waste management. However, the implementation faces substantial hurdles, with industry players expressing concerns about the financial implications of such sweeping changes. The stakes are high. Without effective intervention, India risks becoming a global dumping ground for electronic waste, with potentially devastating environmental and health consequences. The challenge now is to find a balanced approach that protects both economic interests and ecological sustainability. As the world watches, India's approach to this critical issue could set a precedent for developing nations struggling with similar electronic waste challenges. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331