Tragedy in the Sky: NYC Helicopter Tour Grounded After Deadly Hudson River Crash

Companies

2025-04-14 01:49:56

In the wake of a tragic helicopter crash on the Hudson River last week, the Federal Aviation Administration (FAA) has confirmed that New York Helicopter Tours will permanently cease all operations. The decision comes as a direct response to the recent fatal incident that shocked the city and raised serious questions about the company's safety protocols. The sudden shutdown underscores the critical importance of aviation safety and the stringent oversight maintained by federal regulators. While details of the crash investigation are still emerging, the FAA's swift action signals a commitment to protecting public safety and holding transportation providers to the highest standards. Passengers and aviation enthusiasts are left to reflect on the potential risks associated with scenic tours, and the paramount need for rigorous safety measures in aerial transportation. The closure of New York Helicopter Tours serves as a stark reminder of the delicate balance between adventure and safety in the skies above New York City. MORE...

Fatal Hudson River Crash Grounds NYC Helicopter Tour Operator, FAA Pulls Plug

Companies

2025-04-14 01:46:38

In a tragic incident, the Escobar family was among those lost in the devastating crash. Agustin Escobar, 49, and his wife Mercè Camprubí Montal, 39, perished alongside their three young children: Victor, just 4 years old, Mercedes, 8, and Agustin, 10. At the helm of the ill-fated flight was Seankese Johnson, a 36-year-old U.S. Navy veteran who had recently achieved his commercial pilot's license in 2023, marking a promising career cut tragically short. The family's untimely loss serves as a poignant reminder of the fragility of life and the profound impact of such unexpected tragedies. Each victim represented not just a statistic, but a life full of potential, dreams, and connections. MORE...

Local Food Supplier Slashes Prices: Tariff Tensions Spark Strategic Move

Companies

2025-04-14 01:13:15

In a bold move to support consumers amid rising trade tensions, a Kansas City home food service company is taking a proactive stance by slashing prices across its entire product line. The company aims to cushion the impact of recent tariffs, offering relief to customers feeling the pinch of increased trade costs. By strategically reducing food prices, this innovative local business demonstrates its commitment to customer affordability and economic resilience. Their decision reflects a customer-first approach, ensuring that families can continue to enjoy high-quality meal services without breaking the bank. This price reduction strategy not only helps consumers but also sends a powerful message about corporate responsibility during challenging economic times. The company's leadership shows that businesses can be both competitive and compassionate, even in the face of complex international trade dynamics. MORE...

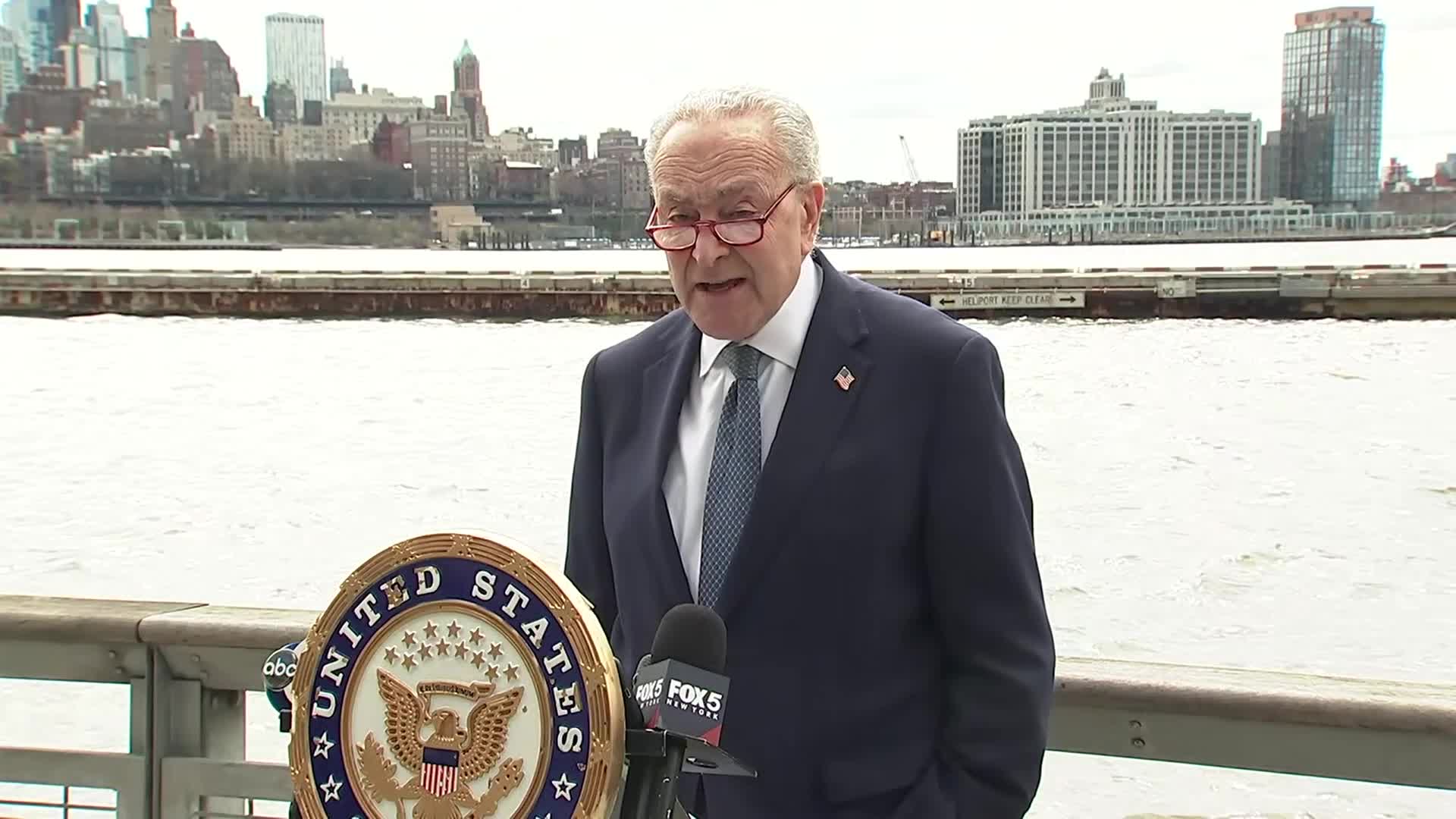

Chopper Safety Showdown: Schumer Demands Grounding After Deadly Flight

Companies

2025-04-14 00:30:12

In the wake of a devastating helicopter crash that claimed six lives, Senate Minority Leader Chuck Schumer is demanding immediate and decisive action from the Federal Aviation Administration (FAA). Schumer is calling for the swift revocation of New York Helicopter Charter Inc.'s operating license and a comprehensive expansion of safety inspections across tour helicopter operators nationwide. The tragic incident has prompted Schumer to push for stricter oversight and enhanced safety protocols in the aerial tourism industry. By advocating for the immediate suspension of the charter company's license and a thorough review of other tour operators, the senator aims to prevent similar accidents and protect public safety. Schumer's urgent plea underscores the critical need for rigorous safety standards and proactive measures to ensure the well-being of passengers who rely on helicopter tour services. His call to action serves as a stark reminder of the importance of maintaining the highest levels of safety in aerial transportation. MORE...

Bracing for Impact: UK Firms Tighten Belts as Trump Tariff Storm Looms, Deloitte Reveals

Companies

2025-04-13 23:06:59

In a strategic response to potential economic uncertainties, Britain's largest corporations have adopted their most cautious approach since the early days of the COVID-19 pandemic. As tensions mounted ahead of U.S. President Donald Trump's anticipated tariff announcements on April 2, companies across the United Kingdom pivoted towards a defensive financial strategy. The latest survey reveals a comprehensive corporate playbook focused on three critical areas: maximizing cash flow, aggressively trimming operational expenses, and strategically reducing borrowing. This proactive stance underscores the business community's preparedness to navigate potential economic headwinds and market volatility. By prioritizing financial resilience and operational efficiency, these companies are positioning themselves to withstand potential economic challenges and maintain their competitive edge in an increasingly unpredictable global marketplace. MORE...

Disney Magic or Investor Mirage? Billionaires' Secret Playground Revealed

Companies

2025-04-13 21:50:06

Disney: A Top Pick Among Billionaire-Backed Kid-Friendly Stocks

In our recent exploration of investment opportunities that capture the imagination of young audiences, we delved into the top 10 kid-friendly stocks recommended by billionaire investors. Today, we're taking a closer look at The Walt Disney Company (NYSE:DIS) and its standing in this exciting investment landscape.

As financial markets continue to navigate through recent volatility, Disney emerges as a compelling choice for investors seeking stocks with enduring appeal to children and families. The entertainment giant has long been synonymous with childhood wonder, innovative storytelling, and cross-generational entertainment.

With its diverse portfolio spanning theme parks, streaming services, beloved franchises, and cutting-edge media content, Disney represents more than just a stock—it's a global entertainment powerhouse that continues to captivate audiences of all ages.

Investors and parents alike recognize the unique value proposition Disney brings to the table: a brand that consistently reinvents itself while maintaining its core magic and appeal to younger generations.

MORE...Retail Royalty: Why Jim Cramer Crowns TJX Companies as the Ultimate Shopping Sector Champion

Companies

2025-04-13 21:45:14

Jim Cramer's Stock Spotlight: Diving Deep into TJX Companies

In the ever-evolving world of stock market analysis, Jim Cramer continues to provide investors with valuable insights. Our latest exploration focuses on TJX Companies, Inc. (NYSE:TJX) and its position among the stocks recently highlighted by the renowned Mad Money host.

During a recent broadcast, Cramer made waves with his commentary on market dynamics, particularly addressing the significant 145% duty on China that has caught the attention of investors and market watchers alike. The discussion surrounding TJX Companies offers a fascinating glimpse into the current market landscape.

As we delve deeper into the analysis, we'll examine how TJX Companies stands out among the dozen stocks Cramer recently discussed, providing investors with a comprehensive overview of its potential and market positioning.

Stay tuned for an in-depth look at this intriguing stock and Cramer's expert perspective on its future prospects.

MORE...Limb Lost, Coverage Denied: The Hidden Battle of Prosthetic Patients

Companies

2025-04-13 21:35:37

The landscape of limb loss in America is rapidly changing, with an astounding 2 million individuals already navigating life with prosthetic limbs. Even more striking, federal projections suggest this number could surge to nearly 4 million by 2050, highlighting a growing healthcare challenge. A recent investigation by KFF Health News has uncovered a critical barrier facing these resilient individuals: the complex and often frustrating journey of obtaining insurance coverage for prosthetic devices. The financial burden of replacement limbs can be overwhelming, creating significant obstacles for those seeking to restore mobility and independence. In an exclusive interview, KFF Health News contributing writer Michelle Andrews delves into the intricate world of prosthetic insurance, revealing the systemic challenges that amputees face when attempting to secure essential medical equipment. Her reporting sheds light on the personal struggles behind the statistics, bringing human stories to the forefront of this important healthcare issue. As the number of Americans living with limb loss continues to climb, understanding and addressing these insurance barriers becomes increasingly crucial. The path to mobility and quality of life for amputees depends not just on medical technology, but on creating more accessible and compassionate healthcare systems. MORE...

Tariff Tango: Businesses Slap 'Trump Tax' on Customer Bills

Companies

2025-04-13 20:58:08

President Trump's economic standing has taken a significant hit following his controversial decision to impose sweeping tariffs across multiple nations. The blanket trade restrictions, announced earlier this month, have sparked widespread concern and led to a noticeable decline in public approval of his economic policies. Economists and business leaders are increasingly critical of the broad-based approach, suggesting that the tariffs could potentially harm domestic industries and disrupt international trade relationships. As public sentiment shifts, the president faces growing challenges in maintaining his reputation as a business-friendly leader who can effectively manage the nation's economic interests. MORE...

Beyond Buzzwords: The CEO's Guide to Transforming Corporate Values from Decoration to Dollars

Companies

2025-04-13 20:54:49

The Corporate Values Dilemma: Why Your Inspirational Posters Are Falling Short In boardrooms and office lobbies across the corporate landscape, carefully crafted value statements gleam from polished frames—yet they're doing little more than collecting dust. These grandiose declarations of purpose, meticulously designed to inspire and align teams, are increasingly revealing a critical performance gap. Modern organizations invest significant time and resources in developing these philosophical manifestos, believing they will transform workplace culture and drive exceptional results. However, the stark reality is that most of these value statements remain mere decorative artifacts, disconnected from actual organizational behavior and performance. The problem isn't in the words themselves, which are often eloquent and well-intentioned. The disconnect lies in the implementation. Companies create these statements with genuine enthusiasm, but fail to embed them into daily operations, performance metrics, and leadership practices. They become beautiful wallpaper instead of actionable blueprints for excellence. To bridge this gap, organizations must move beyond superficial proclamations. Values must be actively translated into concrete behaviors, rewarded through performance systems, and consistently modeled by leadership. Only then can these statements transform from passive declarations to powerful drivers of organizational success. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331