Investing Insider: Is XRF Scientific the Hidden Gem Investors Are Missing?

Companies

2025-03-31 02:22:16

Navigating the Investment Landscape: Beyond the Compelling Narrative In the dynamic world of investing, many newcomers fall into a common trap: becoming captivated by an enticing corporate story and rushing to invest without deeper analysis. While a compelling narrative can be seductive, successful investors understand that a great story alone is not a guarantee of financial success. Experienced investors know that behind every attractive company pitch lies a complex web of financial metrics, market conditions, and strategic performance. The most prudent approach involves looking beyond the surface-level storytelling and conducting thorough due diligence. Key considerations should include: • Comprehensive financial health • Sustainable business model • Competitive market positioning • Management team's track record • Long-term growth potential By moving past the initial allure of a persuasive corporate narrative and diving into substantive research, investors can make more informed decisions that align with their financial goals and risk tolerance. Remember, in the investment world, substance trumps style every time. MORE...

Oil Diplomacy Shift: Trump Cuts Western Firms' Venezuela Crude Export Lifeline

Companies

2025-03-31 01:25:56

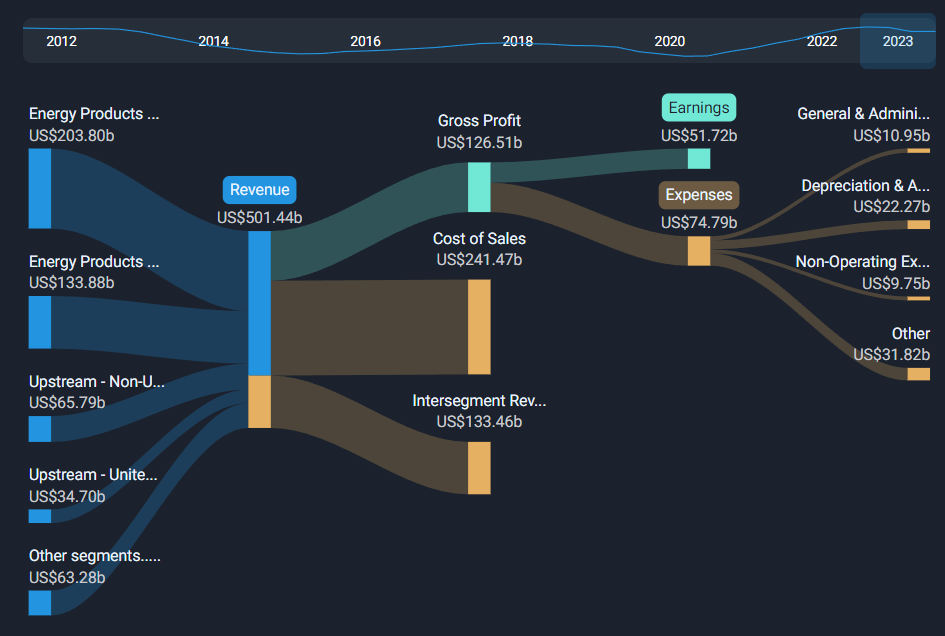

In a bold and decisive move, the Trump administration has escalated its economic campaign against Venezuelan President Nicolás Maduro, dramatically intensifying pressure on the embattled leader. With strategic precision, the White House is deploying a series of targeted financial measures designed to isolate Maduro's regime and challenge its grip on power. The administration's swift and calculated approach signals a commitment to addressing the ongoing political and humanitarian crisis in Venezuela. By ramping up economic sanctions and diplomatic isolation, the United States aims to create significant economic strain that could potentially weaken Maduro's political standing and influence. These aggressive tactics reflect the Trump administration's determination to support democratic change in Venezuela and challenge what it views as an authoritarian government that has systematically undermined the country's democratic institutions and economic stability. As the economic pressure mounts, the international community watches closely, anticipating potential shifts in Venezuela's complex political landscape and the potential for meaningful political transformation. MORE...

Retail's Hidden Gem: Why TJX Companies Is Crushing the Dividend Game

Companies

2025-03-30 23:56:51

Diving Deep into Retail Dividend Stocks: TJX Companies Under the Microscope In our recent exploration of top-performing retail dividend stocks, we're now turning our spotlight on The TJX Companies, Inc. (NYSE:TJX) to understand its unique position in a rapidly evolving retail landscape. The retail sector has undergone a dramatic transformation in the wake of the COVID-19 pandemic, with digital innovation reshaping traditional business models. Against this backdrop of change, TJX Companies emerges as a compelling case study of resilience and strategic adaptation. As brick-and-mortar retailers navigate unprecedented challenges, TJX has demonstrated remarkable agility. By understanding consumer trends and maintaining a robust dividend strategy, the company continues to attract investor attention in an increasingly competitive market. Our comprehensive analysis will unpack TJX's performance, dividend potential, and strategic positioning among the most promising retail dividend stocks in today's dynamic marketplace. Investors seeking stable returns and long-term growth will find valuable insights in this deep-dive examination. Stay tuned as we unravel the investment potential of TJX Companies and its standing in the ever-changing retail ecosystem. MORE...

Dividend Goldmine: How Lowe's Is Quietly Outperforming Retail Rivals

Companies

2025-03-30 23:55:22

Lowe's Companies: A Standout in Retail Dividend Investing

In our recent exploration of top-performing retail dividend stocks, Lowe's Companies, Inc. (NYSE:LOW) emerges as a compelling investment opportunity that demands closer examination. The retail landscape has undergone a dramatic transformation in the wake of the COVID-19 pandemic, with digital innovation reshaping traditional business models.

As home improvement and consumer spending continue to evolve, Lowe's has positioned itself as a strategic player in the retail dividend market. The company's ability to adapt to changing consumer preferences and leverage digital technologies sets it apart from many competitors in the retail sector.

Investors seeking stable dividend stocks will find Lowe's particularly intriguing. The company's robust financial performance, consistent dividend payouts, and strategic approach to market challenges make it a standout choice for those looking to build a resilient investment portfolio.

Our comprehensive analysis delves into Lowe's financial metrics, dividend history, and potential for future growth, providing investors with valuable insights into why this retail giant continues to be a top contender in the dividend stock arena.

MORE...Salary Surge: 5 Employers Boosting Paychecks in 2025's Competitive Job Market

Companies

2025-03-30 22:00:57

Navigating the Competitive Job Market: Understanding Salary Dynamics In today's dynamic professional landscape, salary increases have become a critical strategy for organizations seeking to attract and retain exceptional talent. As the job market continues to evolve, companies are increasingly recognizing the importance of competitive compensation packages in winning the war for top-tier professionals. For job seekers, understanding which employers are committed to fair and attractive compensation is more important than ever. Beyond just a paycheck, talented professionals are looking for organizations that demonstrate a genuine investment in their workforce through meaningful salary growth and comprehensive benefits. Employers who prioritize competitive compensation not only draw in high-caliber candidates but also foster a culture of loyalty and motivation. By offering strategic salary increases, companies can create an environment where employees feel valued, recognized, and inspired to contribute their best work. As the employment landscape continues to shift, both employers and job seekers must remain adaptable, informed, and strategic in their approach to compensation and career development. MORE...

Dividend Boost Alert: 10 Companies Set to Sweeten Investor Payouts This April

Companies

2025-03-30 21:52:13

April's Top Dividend Growth Stocks: Potential Payouts to Watch

Investors seeking reliable income streams and long-term growth opportunities are turning their attention to promising dividend stocks this April. Our expert analysis highlights companies poised to deliver impressive dividend increases, offering both stability and potential financial rewards.

Key Highlights for Dividend Investors

- Identify companies with consistent dividend growth histories

- Explore sectors showing strong potential for dividend expansion

- Understand the strategic value of dividend-increasing stocks

This month's forecast reveals several standout companies demonstrating robust financial health and a commitment to shareholder value. From established blue-chip corporations to emerging market leaders, our curated list provides investors with strategic insights into potential dividend growth opportunities.

What Makes These Stocks Special?

The selected stocks aren't just about current yields—they represent companies with proven track records of financial strength, consistent earnings, and a strategic approach to returning value to shareholders. By focusing on these potential dividend champions, investors can build a more resilient and income-generating portfolio.

Stay ahead of the market and discover which stocks are primed to boost their dividend payouts in the coming months. Your path to smarter investment decisions starts here.

MORE...Diplomatic Pushback: European Allies Dismiss Trump Team's DEI Critique

Companies

2025-03-30 20:49:55

Belgian Deputy Prime Minister Jan Jambon delivered a sharp rebuke to American leadership, boldly declaring that Belgium has nothing to learn from the current U.S. administration. His pointed comments reflect growing tensions and a critical stance towards American political leadership. Jambon's unequivocal statement underscores a growing sentiment of diplomatic independence among European leaders, who are increasingly willing to challenge the traditional narrative of American global influence. By dismissing any potential lessons from the U.S. leadership, he signals a strong, self-assured position that prioritizes Belgium's own political and strategic perspectives. The remarks highlight the complex and evolving dynamics of international relations, where traditional alliances are being reevaluated and national interests are taking center stage. Jambon's comments suggest a more assertive approach to diplomacy, one that is not afraid to speak candidly about perceived shortcomings in global leadership. While the statement may be controversial, it reflects a broader trend of European nations seeking to establish their own distinct voice on the world stage, independent of historical power structures and expectations. MORE...

Wall Street Jitters: Earnings Outlook Dims as Consumer Hope Plummets to Decade-Low

Companies

2025-03-30 20:31:22

Economic Warning Signs: Is a Recession on the Horizon? The latest insights from The Conference Board's expectations index are sending ripples of concern through financial circles. Currently positioned well below the critical threshold that economists traditionally associate with impending economic downturns, the index is raising red flags for financial analysts and market watchers. This key economic indicator suggests that business and consumer confidence may be wavering, potentially signaling a challenging economic landscape ahead. While not a definitive prediction, the index provides a valuable snapshot of economic sentiment and potential future market conditions. Investors and policymakers are closely monitoring these signals, understanding that such indicators can offer early warnings about potential economic shifts. The current positioning of the expectations index underscores the importance of strategic financial planning and preparedness in an increasingly uncertain economic environment. MORE...

Genetic Gold Mine: How 23andMe's DNA Trove Could Reshape Corporate Strategies

Companies

2025-03-30 19:58:00

The future of 23andMe remains shrouded in uncertainty, but one thing is crystal clear: the company's vast genetic database is an incredibly valuable asset. Experts are buzzing about the immense potential and strategic importance of this genetic treasure trove, which has caught the attention of both corporate strategists and scientific researchers. The genetic information collected by 23andMe represents a goldmine of insights, offering unprecedented opportunities for understanding human genetics, disease patterns, and personalized medicine. Corporations and research institutions are keenly interested in accessing this comprehensive genetic repository, recognizing its potential to drive groundbreaking medical research, develop targeted therapies, and unlock new understanding of human genetic diversity. As the company navigates its next chapter, the strategic value of its genetic data collection cannot be overstated. The wealth of genetic information represents not just a business asset, but a potential key to transformative scientific discoveries that could reshape our understanding of human health and genetics. MORE...

Trump's DEI Rollback: Are US Firms Pressuring French Companies to Follow Suit?

Companies

2025-03-30 19:34:00

Diplomatic Tensions: US Accused of Pressuring French Businesses

A growing controversy has emerged as French media and government officials allege that United States diplomats are actively interfering with the operations of French companies, compelling them to adhere to specific compliance standards.

The accusations suggest that American diplomatic channels are exerting significant pressure on French businesses, potentially challenging international business norms and bilateral economic relations. While details remain limited, the claims hint at a complex diplomatic and economic dispute between the two traditionally allied nations.

French officials have expressed concern over what they perceive as unwarranted intervention in their corporate affairs, raising questions about the boundaries of diplomatic influence in international business practices.

The situation underscores the delicate balance of global economic diplomacy and the ongoing tensions that can arise between major economic powers seeking to protect their strategic interests.

As the story develops, both French and American authorities are expected to provide further clarification on these serious allegations of diplomatic overreach.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331