Color Crisis: RFK Jr. and FDA Demand Food Industry Ditch Synthetic Dyes

Companies

2025-04-22 22:19:52

In a groundbreaking move towards healthier food options, major food manufacturers are facing a critical deadline to revolutionize their product coloration. By the end of 2026, companies will be required to bid farewell to artificial dyes and embrace natural, vibrant alternatives that promise both visual appeal and improved nutritional profiles. This transformative mandate is set to reshape the food industry's approach to color additives. Manufacturers will need to get creative, exploring innovative natural sources like beetroot, turmeric, spirulina, and other plant-based ingredients to achieve the eye-catching hues consumers have come to expect. The shift isn't just about compliance—it's about responding to growing consumer demand for cleaner, more transparent food products. Health-conscious shoppers have long expressed concerns about synthetic food dyes, linking them to potential health risks and seeking more natural options. Food giants will need to invest significant resources in research and development, testing new coloration methods that maintain the visual appeal of their products while meeting strict safety and quality standards. This challenge presents an exciting opportunity for culinary innovation and a healthier future for food production. As the countdown to 2026 begins, consumers can look forward to a more natural, vibrant food landscape where color comes from nature's own palette. MORE...

Solana Deal Sparks Investor Frenzy: Tiny Tech Firm Rockets 325% in Jaw-Dropping Market Surge

Companies

2025-04-22 21:06:33

Crypto's Corporate Conquest: When Public Companies Bet on Digital Gold In the high-stakes world of corporate finance, a fascinating trend is emerging: public companies are increasingly treating cryptocurrencies as a strategic asset, transforming their balance sheets into digital treasure chests. But beneath the glittering surface of this crypto transformation lie significant risks that could potentially destabilize corporate financial strategies. As more companies pivot towards digital currencies, they're not just making a financial bet—they're gambling with shareholder trust and corporate stability. The allure of cryptocurrency's potential returns is powerful, but the volatility and regulatory uncertainty create a minefield of potential pitfalls. These corporate crypto adventures represent more than simple investment diversification. They signal a profound shift in how traditional businesses perceive and interact with digital assets. However, the path is fraught with challenges: extreme price fluctuations, regulatory crackdowns, and the inherent unpredictability of a nascent financial ecosystem. Investors and corporate leaders must approach this trend with a critical eye, understanding that while cryptocurrency might promise revolutionary returns, it also carries unprecedented risks that could quickly erode corporate value. MORE...

Nuclear Pivot: Sam Altman Exits Oklo's Leadership, Paving Way for AI-Powered Energy Innovation

Companies

2025-04-22 20:00:14

Oklo is revolutionizing nuclear energy with its innovative Aurora microreactors, featuring cutting-edge designs that promise to transform the power generation landscape. These compact and sophisticated reactors offer remarkable flexibility, with power output ranging from a nimble 15 megawatts to an impressive 100 megawatts or more. By reimagining nuclear technology through smaller, more streamlined configurations, Oklo is positioning itself at the forefront of sustainable and efficient energy solutions. The Aurora microreactors represent a bold leap forward in nuclear power generation, combining advanced engineering with a commitment to simplicity and scalability. Their versatile design allows for deployment in diverse settings, from remote communities to industrial complexes, potentially providing clean, reliable electricity where traditional power infrastructure is challenging to establish. MORE...

Travel Titans' Power Play: Inside the Lobbying Millions Shaping U.S. Tourism

Companies

2025-04-22 19:45:26

In a notable shift reflecting the travel sector's growing political influence, major players in the tourism and hospitality industries have significantly ramped up their federal lobbying efforts during the early months of 2025. Leading travel companies, tourism boards, and industry associations are investing heavily in strategic advocacy to shape policy discussions and protect their economic interests at the national level. The increased lobbying expenditures signal a proactive approach by the travel industry to navigate complex regulatory landscapes, address pandemic-related challenges, and secure favorable legislative conditions. Key stakeholders are focusing on issues such as travel regulations, economic recovery initiatives, and policies that could impact tourism infrastructure and international travel. This surge in federal-level engagement demonstrates the industry's commitment to maintaining its economic resilience and strategic positioning in an evolving global marketplace. By amplifying their voice in Washington, these organizations aim to ensure their perspectives are heard and considered in critical policy-making processes that directly affect their business operations and future growth. MORE...

Trailer Equipment Market Shakes Up: Midwest Companies Joins Forces with Patriot Sales & Rental

Companies

2025-04-22 19:10:58

Midwest Companies Expands Portfolio with Strategic Acquisition of Patriot Sales & Rental In a significant move that underscores its commitment to growth and diversification, Midwest Companies has announced the acquisition of Patriot Sales & Rental, a prominent business located in Hampshire. This latest addition to the family-owned sustainable waste management and construction services enterprise represents another strategic step in the company's expansion strategy. The acquisition of Patriot Sales & Rental further strengthens Midwest Companies' already robust portfolio of subsidiaries, demonstrating the organization's continued dedication to providing comprehensive and innovative solutions in the waste management and construction services sectors. By integrating Patriot Sales & Rental's expertise and local market knowledge, Midwest Companies continues to position itself as a leader in sustainable business practices and regional service delivery. This strategic expansion reflects the company's ongoing commitment to growth, operational excellence, and delivering high-quality services to its diverse client base across multiple markets. MORE...

Carbliss Rockets to Success: Local Plymouth Beverage Brand Shatters Industry Growth Records

Companies

2025-04-22 19:00:06

Plymouth's Spirited Success: Local Cocktail Company Rises to Prominence A dynamic Plymouth-based cocktail company is making waves in the beverage industry, recently earning recognition as one of the most rapidly expanding enterprises in its sector. This innovative brand has captured the attention of industry experts and cocktail enthusiasts alike with its remarkable growth trajectory and unique approach to craft mixology. The company's meteoric rise is a testament to its creative vision, commitment to quality, and ability to tap into the evolving preferences of modern drink connoisseurs. By blending traditional cocktail craftsmanship with contemporary flavor profiles, they have successfully carved out a distinctive niche in a competitive market. Their strategic approach and passionate dedication have not only propelled them to the forefront of the local business scene but have also positioned them as a promising player in the broader beverage industry. The recognition as a fast-growing company serves as a powerful endorsement of their innovative spirit and entrepreneurial excellence. As the cocktail company continues to expand its reach and refine its offerings, industry observers are watching with keen interest, anticipating the next exciting chapter in their remarkable journey of growth and success. MORE...

Silicon Valley Showdown: Chinese Tech Giants Brave Trade Tensions to Crack US Market

Companies

2025-04-22 19:00:00

Despite Growing Tensions: Chinese Firms Remain Committed to US Capital Markets In a testament to the enduring allure of global financial opportunities, several Chinese companies continue to pursue listings on US stock exchanges, even amid escalating geopolitical tensions and regulatory challenges. The persistent interest highlights the strategic importance of accessing one of the world's most sophisticated and liquid capital markets. Despite increased scrutiny from US regulators and potential delisting risks, Chinese firms recognize the significant advantages of tapping into American investor networks and raising international capital. Recent developments suggest that while some companies have been deterred, a resilient group remains determined to navigate the complex landscape. These businesses are carefully weighing the potential benefits against the potential political and regulatory obstacles, demonstrating a calculated approach to international financial expansion. Key motivations include accessing broader investment pools, enhancing global corporate visibility, and securing funding for ambitious growth strategies. The willingness of these companies to persist underscores their confidence in long-term global economic integration and their ability to adapt to challenging regulatory environments. As the global financial ecosystem continues to evolve, the story of Chinese companies seeking US listings represents a nuanced narrative of economic ambition, strategic resilience, and cross-border financial diplomacy. MORE...

Power Grid vs. Data Centers: The Electricity Hunger Games

Companies

2025-04-22 18:42:19

A Tidal Wave of Global Energy Demand: The Power Sector's Unprecedented Challenge The world is experiencing an extraordinary surge in energy consumption that's reshaping the global landscape faster than ever before. Energy providers are now navigating through unprecedented waters, struggling to meet the mounting demand while balancing technological innovation, environmental concerns, and economic pressures. This massive wave of energy requirements is driven by multiple powerful currents: rapid industrialization in developing nations, the explosive growth of digital technologies, increasing electrification, and the rising global population. From bustling metropolises in Asia to emerging economies in Africa, the hunger for reliable and sustainable power has never been more intense. Utility companies and energy strategists are being forced to reimagine their entire approach. Traditional power generation models are being challenged, with renewable energy sources and smart grid technologies emerging as critical solutions. The race is on to develop more efficient, cleaner, and more adaptable energy infrastructure that can withstand this tsunami of demand. The stakes are incredibly high. Those who can innovate and respond quickly will thrive, while those who remain static risk being swept away by the overwhelming tide of technological and economic transformation. The global energy landscape is no longer just about generating power—it's about creating intelligent, responsive systems that can meet the world's insatiable appetite for electricity. MORE...

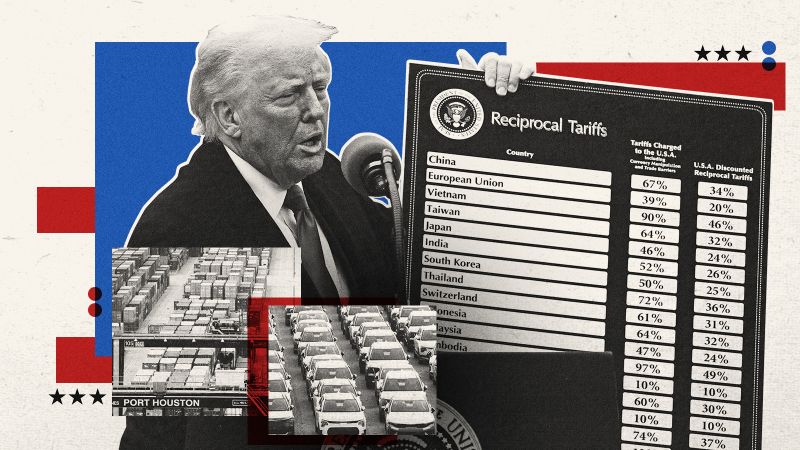

Trade War Tactics: Inside Corporate America's Tariff Survival Strategy

Companies

2025-04-22 18:41:09

Kimberly-Clark is bracing for significant financial challenges as trade tensions escalate, anticipating an additional $300 million in costs that could flatten the company's earnings for the year. In a candid statement following the latest quarterly results, CEO Michael Hsu highlighted the mounting pressure on the company's global supply chain. "The current economic landscape is presenting unexpected hurdles," Hsu explained, emphasizing that the company's cost structure has been dramatically impacted by the ongoing trade uncertainties. Approximately 20% of Kimberly-Clark's U.S. operational expenses are now directly exposed to tariff-related increases, creating a complex financial environment for the consumer goods giant. The company's proactive communication signals a strategic approach to navigating the challenging economic terrain, demonstrating transparency about the potential financial implications of current global trade dynamics. Investors and stakeholders are closely watching how Kimberly-Clark will adapt to these emerging economic pressures. MORE...

Acquisition Guru Reveals: The Insider's Playbook to Selling Your Company Like a Pro

Companies

2025-04-22 17:50:44

Navigating the Path to a Successful Business Exit: Insights from Tilray's CEO Entrepreneurs dreaming of a strategic business exit can learn valuable lessons from Irwin Simon, the visionary CEO of Tilray Brands, a prominent publicly-traded consumer packaged goods (CPG) company. With decades of experience building and selling businesses, Simon offers critical advice for small business owners looking to maximize their company's value and attract potential buyers. Key Strategies for a Successful Business Exit: 1. Build a Compelling Value Proposition Simon emphasizes the importance of creating a unique and differentiated business model. Potential acquirers are attracted to companies that offer innovative solutions and demonstrate clear market potential. 2. Focus on Financial Performance Maintain robust financial records and consistently show strong growth. Investors and potential buyers are drawn to businesses with solid revenue streams and promising profit margins. 3. Cultivate Strategic Relationships Develop meaningful connections within your industry. Networking can open doors to potential strategic partnerships and acquisition opportunities. 4. Remain Adaptable and Forward-Thinking Stay ahead of market trends and be willing to pivot your business strategy. Companies that show agility and innovation are more attractive to potential buyers. 5. Prepare Comprehensive Documentation Ensure your financial statements, operational processes, and growth strategies are meticulously documented and transparent. By implementing these strategies, small business owners can significantly enhance their chances of a successful and lucrative business exit, transforming years of hard work into a rewarding financial opportunity. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331