Senate Bombshell: How Musk's Dogecoin Maneuvers May Have Shielded Firms from $2B Legal Minefield

Companies

2025-04-28 17:39:22

In an extraordinary display of technological and political power, Elon Musk has dramatically reshaped the landscape of Washington during Donald Trump's era, wielding an influence that transcends traditional boundaries of business and governance. His unprecedented reach has transformed political dynamics, blending Silicon Valley innovation with political strategy in ways never before seen. Musk's strategic interventions have gone far beyond typical corporate lobbying, creating ripple effects that touch multiple sectors of government policy. From space exploration and electric vehicle initiatives to social media regulation and national security discussions, his impact has been both profound and wide-ranging. The billionaire entrepreneur has masterfully navigated complex political terrain, leveraging his technological expertise and media prominence to drive conversations and influence decision-making at the highest levels of government. His ability to challenge established norms and push technological boundaries has made him a uniquely powerful figure in modern political discourse. By strategically positioning his companies and personal brand at the intersection of innovation and policy, Musk has created a new model of corporate-political engagement that defies traditional categorizations. His approach represents a bold reimagining of how technology leaders can interact with and potentially reshape governmental structures. As Washington continues to grapple with the implications of his influence, one thing remains clear: Elon Musk has fundamentally altered the relationship between technological innovation and political power, setting a precedent that will likely be studied for years to come. MORE...

Lead Shield Crumbles: New York's Bold Move to Strip Insurance Giants of Toxic Exemptions

Companies

2025-04-28 17:22:00

In a bold move to protect tenants and hold landlords accountable, two New York state legislators are pushing forward groundbreaking legislation aimed at preventing insurance companies from sidestepping lead poisoning claims. The proposed bill would close a critical legal loophole that has long shielded property owners from financial responsibility for potential health hazards. By eliminating insurance policy exemptions related to lead poisoning, the lawmakers hope to create a powerful incentive for landlords to proactively address and prevent lead contamination in rental properties. This legislative effort could significantly improve housing safety standards and protect vulnerable populations, especially children, who are most at risk from lead exposure. The proposed measure represents a significant step toward ensuring that property owners take meaningful action to maintain safe living environments and that insurance providers cannot easily escape their responsibilities when dangerous health conditions exist in rental properties. MORE...

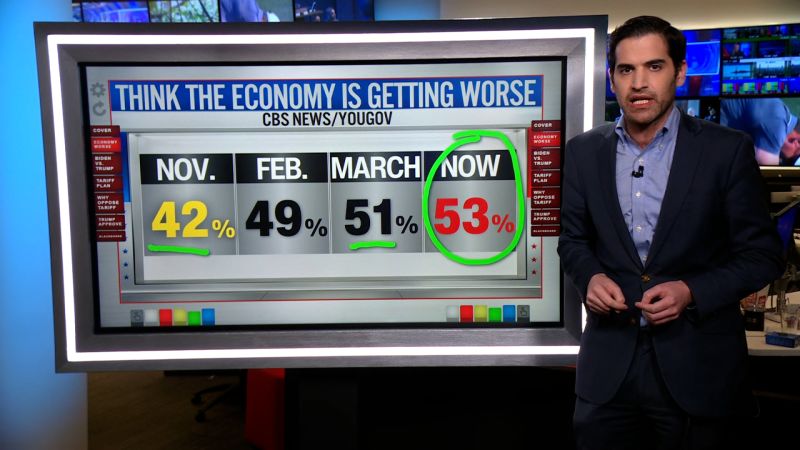

100 Days of Uncertainty: Trump's Presidency Leaves Business Leaders Divided

Companies

2025-04-28 17:13:54

As President Donald Trump's first 100 days in office approach, WPTV is committed to providing comprehensive insights into the critical economic shifts and policy changes that could impact everyday Americans. Our team has been diligently investigating the potential consequences of recent trade policies, with a particular focus on understanding how emerging tariffs might affect local communities and national economic landscapes. Through in-depth research and expert consultations, we aim to break down the complex world of international trade and tariffs, offering clear, accessible information that helps viewers understand the real-world implications of these significant policy decisions. Our goal is to demystify the economic strategies unfolding in Washington and explain how they could potentially touch the lives of ordinary citizens. Stay tuned as we continue to explore the economic dynamics of the Trump administration's early days, providing you with the most current and relevant information to help you navigate these transformative times. MORE...

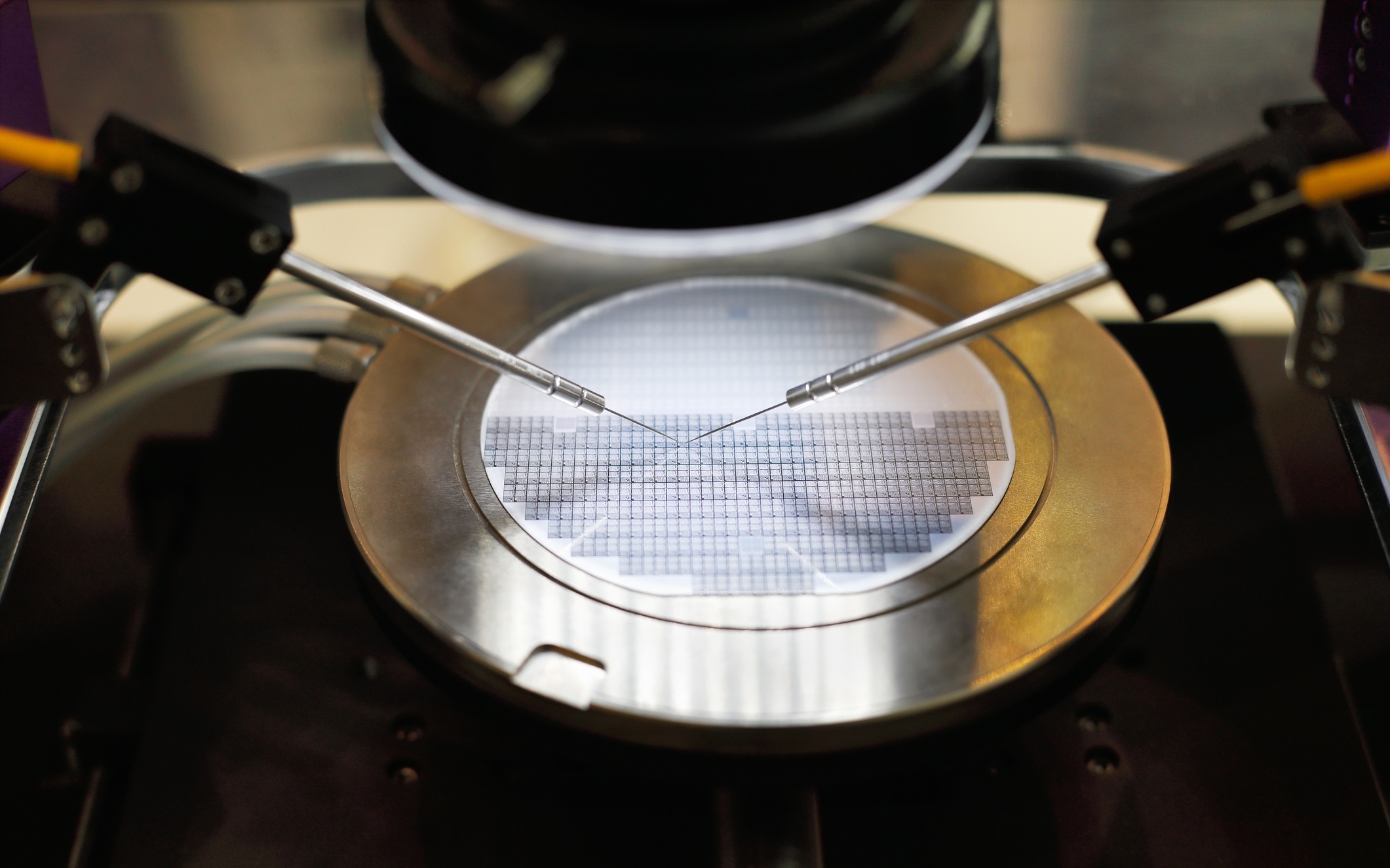

Brain Data Bazaar: Tech Firms' Controversial Sell-Off Sparks Senate Alarm

Companies

2025-04-28 17:00:00

In a bold move that signals growing congressional scrutiny, a group of U.S. senators has directly challenged Elon Musk's brain-computer interface company, Neuralink, over serious safety concerns surrounding its experimental medical technology. The bipartisan letter, penned by senators from both sides of the political aisle, takes direct aim at Neuralink's controversial research practices and potential risks associated with its neural implant technology. By explicitly naming the company, the senators are sending a clear message that they are closely monitoring the firm's scientific and ethical standards. At the heart of their concerns are critical questions about the safety protocols, potential human subject risks, and the comprehensive evaluation of Neuralink's groundbreaking but potentially dangerous neural interface technology. The senators are demanding transparency and rigorous oversight to ensure that the company's ambitious technological pursuits do not compromise patient safety. This unprecedented congressional intervention highlights the increasing regulatory attention being paid to cutting-edge neurotechnology companies. As Neuralink continues to push the boundaries of brain-computer interfaces, lawmakers are stepping in to ensure that scientific innovation does not come at the expense of human well-being. The letter represents a significant moment of governmental scrutiny for Musk's neurotechnology venture, signaling that even revolutionary medical technologies must be held to the highest standards of safety and ethical research. MORE...

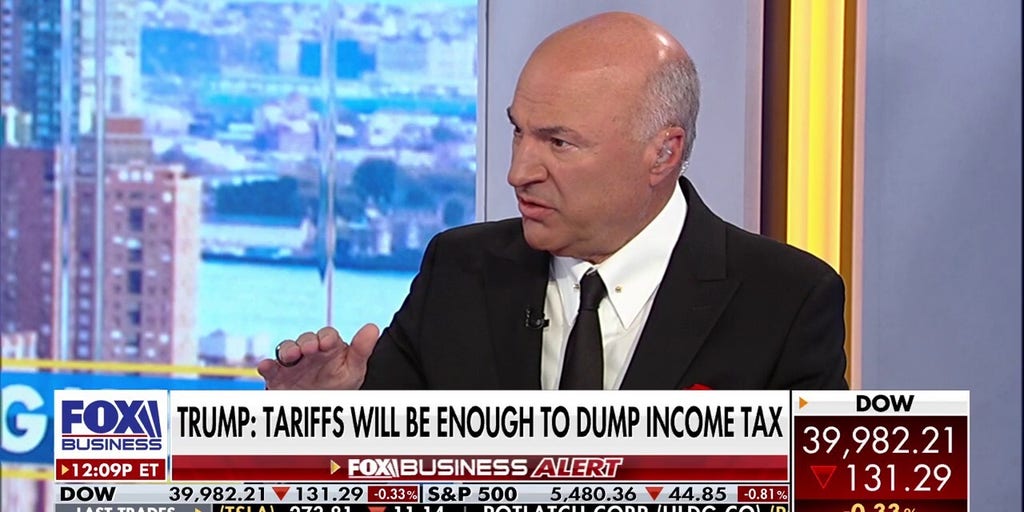

Wall Street Shakeup: O'Leary Warns of Potential Mass Exodus of Chinese Stocks from US Markets

Companies

2025-04-28 16:59:02

On a recent episode of 'The Big Money Show', O'Leary Ventures Chairman Kevin O'Leary offered a compelling analysis of the initial impact of President Donald Trump's tariff strategies. Drawing from his extensive financial expertise, O'Leary delved into the early economic implications and potential long-term consequences of the trade policy, providing viewers with insights into how these tariffs might reshape international commerce and domestic economic dynamics. MORE...

Shareholder Power Unleashed: How Proxy Advisors Are Transforming Corporate Governance

Companies

2025-04-28 16:36:58

Defending Proxy Advisory Firms: A Critical Role in Shareholder Oversight

WASHINGTON, D.C. — Benjamin Schiffrin, Director of Securities Policy at Better Markets, has stepped forward to defend the vital role of proxy advisory firms in corporate governance. As Congress prepares to hold a hearing that Schiffrin believes may unfairly target these essential institutions, he emphasizes their critical importance to shareholders.

In response to the upcoming congressional hearing, Schiffrin released a statement highlighting the significance of proxy advisory firms in enabling shareholders to effectively monitor and oversee the companies they own. These firms provide independent research and recommendations that empower investors to make informed decisions about corporate governance and strategic matters.

The new Fact Sheet from Better Markets underscores how proxy advisory firms serve as an important mechanism for transparency and accountability in the corporate landscape. By offering unbiased analysis, these firms help shareholders exercise their rights and protect their investments.

Schiffrin's statement suggests that any attempt to undermine proxy advisory firms could potentially weaken shareholder protections and corporate oversight mechanisms.

MORE...Leaked Documents Reveal: Gulf Oil Spills Far Worse Than Reported

Companies

2025-04-28 16:30:02

The dawn broke softly over Isla Aguada, casting a golden shimmer across the tranquil waters of southeastern Mexico. Elías Naal Hernández, a seasoned local fisherman, prepared his well-worn fishing net with practiced hands, ready to navigate the delicate boundary between the Gulf of Mexico and the expansive Laguna de Términos—the largest coastal lagoon in the country. As the morning mist began to lift, Elías set out on his daily quest, unaware that this particular April morning in 2024 would soon become anything but ordinary. The rhythmic lapping of waves against his small boat and the distant calls of seabirds were his only companions as he cast his net into the promising waters, hoping for a catch that would sustain his family and community. Little did he know that this seemingly routine expedition would soon unfold into an extraordinary encounter that would challenge everything he thought he knew about the marine world around him. MORE...

Boardroom Battle Plan: Outsmarting Activist Investors Before They Strike

Companies

2025-04-28 16:10:45

Forbes CEO Insights: Navigating Turbulent Business Landscapes

In an era of unprecedented economic challenges, business leaders are drawing critical lessons from years of supply chain disruptions, emerging with strategic resilience and adaptability.

Supply Chain Transformation

Companies have learned to build more robust and flexible supply networks, moving beyond traditional linear models to create dynamic, responsive systems that can quickly adapt to global uncertainties.

Tariff Preparedness

With geopolitical tensions reshaping international trade, businesses are proactively developing comprehensive strategies to mitigate potential tariff impacts. Executives are diversifying sourcing, reassessing global manufacturing footprints, and implementing agile financial planning.

Corporate Social Engagement Shifts

The corporate landscape is experiencing nuanced changes in social advocacy, with many companies recalibrating their approach to Pride Month and diversity initiatives. This reflects a broader trend of strategic, thoughtful corporate social responsibility.

As businesses continue to navigate these complex challenges, adaptability, strategic foresight, and innovative thinking remain key to sustainable success.

MORE...Cybersecurity Titans: Fenix24 and Battalion Companies Sweep Global InfoSec Awards

Companies

2025-04-28 16:00:00

In a groundbreaking announcement today, Fenix24, a pioneering cyber disaster recovery powerhouse, alongside its strategic partners Grypho5 and Conversant Group, is set to revolutionize the cybersecurity landscape with an innovative approach to digital resilience. The collaborative effort brings together three industry-leading organizations, each renowned for their expertise in protecting and recovering critical digital infrastructure. By combining their cutting-edge technologies and strategic insights, the team aims to provide businesses with unprecedented levels of cyber protection and rapid recovery capabilities. Leveraging their collective strengths, Fenix24 and its affiliated companies are poised to deliver comprehensive solutions that address the increasingly complex and evolving cybersecurity challenges faced by modern enterprises. Their integrated approach promises to set new standards in digital risk management and disaster recovery strategies. This strategic alliance represents a significant milestone in the cybersecurity industry, demonstrating a commitment to proactive defense and rapid response in an era of escalating digital threats. MORE...

Chemical Titans Converge: 147 Companies Scale Uttar Pradesh's Industrial Summit

Companies

2025-04-28 15:51:05

Union Pacific Honors Chemical Industry Leaders with Prestigious Safety Recognition In a remarkable celebration of safety excellence, Union Pacific (UP) recently recognized 147 outstanding chemical shippers for their exceptional commitment to transportation safety. The 2024 Pinnacle Award highlights the critical role these companies play in maintaining the highest standards of safety and responsible shipping practices. The annual awards program underscores Union Pacific's dedication to promoting safety across the chemical transportation industry. By acknowledging these top-performing shippers, the company reinforces its commitment to protecting communities, employees, and the environment through rigorous safety protocols and collaborative partnerships. Recipients of the Pinnacle Award demonstrate extraordinary attention to detail, adherence to safety guidelines, and a proactive approach to minimizing transportation risks. Their outstanding performance reflects the critical importance of safety in chemical logistics and transportation. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331