Reservation Warfare: Illinois Moves to Block Restaurant Booking Middlemen

Companies

2025-03-14 01:20:28

In a bold move to protect local dining establishments, Illinois legislators are stepping up to challenge the controversial practice of online reservation sales by third-party service companies. The proposed legislation aims to curb what many restaurant owners see as an unfair and potentially harmful business model that monetizes table bookings. The bill seeks to prevent companies from purchasing and reselling restaurant reservations, a practice that has increasingly frustrated local restaurateurs. These third-party platforms often charge hefty fees and create additional barriers between diners and restaurants, potentially disrupting the traditional dining reservation process. Supporters of the legislation argue that these reservation sales can create artificial scarcity, drive up costs for consumers, and undermine the direct relationship between restaurants and their patrons. By introducing this bill, Illinois lawmakers hope to restore more control to local dining establishments and ensure a more transparent reservation system. While the details of the proposed legislation are still being finalized, restaurant owners and industry advocates are watching closely, seeing this as a potential turning point in how dining reservations are managed in the digital age. MORE...

Pharma's Digital Lifeline: How Track-and-Trace Tech Will Revolutionize Supply Chains in 2025

Companies

2025-03-14 00:00:00

6 Compelling Reasons Pharmaceutical Companies Must Embrace Track-and-Trace Technology in 2025

In the rapidly evolving landscape of pharmaceutical and life sciences logistics, track-and-trace technology is no longer a luxury—it's a critical necessity. As we approach 2025, companies in this sector must recognize the transformative potential of advanced tracking systems. Here are six compelling reasons why implementing cutting-edge track-and-trace solutions should be a top priority:

- Enhanced Supply Chain Transparency

Modern track-and-trace technologies provide unprecedented visibility into every stage of the pharmaceutical supply chain, enabling real-time monitoring and instant insights into product movement and status.

- Regulatory Compliance

Increasingly stringent global regulations demand robust tracking mechanisms. By proactively adopting advanced track-and-trace systems, companies can ensure seamless compliance and avoid potential legal complications.

- Counterfeit Prevention

With sophisticated tracking technologies, pharmaceutical companies can significantly reduce the risk of counterfeit medications entering the market, protecting both patient safety and brand reputation.

- Improved Inventory Management

Real-time tracking enables more precise inventory control, reducing waste, optimizing stock levels, and ultimately lowering operational costs.

- Quality Assurance

Advanced tracking systems allow for continuous monitoring of environmental conditions during transportation, ensuring medication integrity and efficacy.

- Data-Driven Decision Making

Track-and-trace technologies generate valuable data insights that can drive strategic improvements in logistics, supply chain management, and overall operational efficiency.

As the pharmaceutical industry continues to evolve, embracing innovative track-and-trace technologies will be crucial for companies seeking to maintain competitive advantage, ensure regulatory compliance, and deliver superior patient care.

MORE...Silicon Giant's Massive Payout: Trump's Billion-Dollar 'Protection' Windfall Sparks Controversy

Companies

2025-03-13 22:00:53

In a dramatic White House ceremony that caught many by surprise, President Donald Trump celebrated a groundbreaking technological investment that promises to reshape American semiconductor manufacturing. The spotlight was on Taiwan Semiconductor Manufacturing Company (TSMC), a global tech giant that Trump hailed as the "world's most powerful company," announcing a staggering $100 billion commitment to expand its manufacturing presence in the United States. The unexpected event underscored the strategic importance of semiconductor production in an increasingly competitive global technology landscape. TSMC's massive investment signals a significant vote of confidence in American technological infrastructure and represents a major milestone in the ongoing efforts to bolster domestic chip manufacturing capabilities. President Trump, visibly pleased with the announcement, emphasized the economic and strategic implications of the deal, positioning it as a key victory for American technological sovereignty. The ceremony not only highlighted the growing collaboration between the United States and Taiwan but also demonstrated the potential for international partnerships to drive innovation and economic growth. MORE...

Navigating the Storm: Breakthrough Strategies for Business Resilience in Turbulent Times

Companies

2025-03-13 21:52:56

Navigating Growth in Uncertain Times: Strategies for Success In today's rapidly changing business landscape, uncertainty can feel like an insurmountable challenge. However, successful leaders understand that adversity often presents unique opportunities for innovation and growth. By adopting a strategic mindset and implementing key principles, organizations can not only survive but thrive during turbulent periods. The first critical lesson is embracing adaptability. Businesses that remain flexible and quick to pivot can transform potential obstacles into competitive advantages. This means continuously monitoring market trends, being open to new approaches, and developing agile strategies that can quickly respond to changing conditions. Another crucial strategy is investing in your most valuable asset: your people. During uncertain times, employee development, engagement, and support become paramount. By providing training, fostering a culture of continuous learning, and maintaining transparent communication, companies can build resilience and maintain team morale. Financial prudence is equally important. This doesn't mean cutting costs indiscriminately, but rather making strategic investments that drive long-term value. Carefully analyze your resources, prioritize essential initiatives, and maintain a lean yet effective operational approach. Innovation should never take a backseat during challenging periods. Some of the most groundbreaking solutions emerge when organizations are pushed out of their comfort zones. Encourage creative thinking, support experimental projects, and create an environment where calculated risks are welcomed. Lastly, maintain a forward-looking perspective. While it's essential to address immediate challenges, successful leaders simultaneously plan for future opportunities. This balanced approach ensures that short-term survival doesn't come at the expense of long-term growth potential. By implementing these strategies, businesses can transform uncertainty from a threat into a catalyst for innovation, resilience, and sustainable growth. MORE...

Brick Battle: Toy Makers Wage War on Lego's Building Block Empire

Companies

2025-03-13 21:46:51

In the world of construction toys, Lego has long reigned supreme as the undisputed king. However, the toy landscape is shifting, with two ambitious newcomers challenging the iconic brand's market dominance. These emerging brick manufacturers are strategically positioning themselves to chip away at Lego's seemingly impenetrable market share. While Lego has built an empire on creativity and innovation, these emerging competitors are bringing fresh perspectives and unique approaches to the construction toy category. They're not just mimicking Lego's success, but are developing distinctive product lines that appeal to both traditional toy enthusiasts and a new generation of builders. The battle for toy shelf space is heating up, and consumers can expect to see more diverse and exciting options in the construction toy market. As these new brands emerge, they're pushing Lego to continue innovating and maintaining its competitive edge in an increasingly dynamic industry. MORE...

Talent War Secrets: How Top Companies Win the Battle for Exceptional Employees

Companies

2025-03-13 21:17:58

The labor landscape in Arkansas has become a hot-button issue, mirroring a challenge faced by states across the nation. As businesses and industries grapple with persistent workforce shortages, the state finds itself at the epicenter of a complex employment puzzle that demands innovative solutions and strategic thinking. From small local businesses to large corporations, employers are feeling the pinch of a tight labor market. The struggle to attract, recruit, and retain talented workers has become increasingly pronounced, highlighting the need for creative approaches to workforce development and engagement. While the labor shortage is not unique to Arkansas, the state's economic leaders and policymakers are working diligently to understand the underlying factors and develop targeted strategies to address this critical challenge. From workforce training programs to incentive initiatives, Arkansas is exploring multiple avenues to bridge the gap between available jobs and qualified workers. The current labor market dynamics underscore the importance of adaptability, skill development, and collaborative efforts between businesses, educational institutions, and government agencies to create a robust and resilient workforce for the future. MORE...

Game Industry Standoff: SAG-AFTRA's Wage Battle Hits Stalemate

Companies

2025-03-13 20:38:38

In a landmark move that could reshape the entertainment industry, SAG-AFTRA—the powerful union representing 160,000 entertainment professionals including actors, voiceover artists, and media specialists—has taken a bold stance that promises to send ripples through Hollywood's core. The union, which has long been a critical voice for media talent, is preparing to issue a groundbreaking directive that could significantly impact how performers and content creators are compensated and protected in an increasingly digital landscape. With the entertainment world rapidly evolving due to technological advancements and streaming platforms, SAG-AFTRA's upcoming announcement is poised to be a pivotal moment for industry workers. At the heart of this development is a commitment to ensuring fair treatment, equitable compensation, and robust protections for its diverse membership. By addressing emerging challenges in the media ecosystem, the union continues to demonstrate its role as a crucial advocate for those who bring stories to life on screens big and small. Stay tuned for more details on this potentially transformative decision that could redefine the relationship between entertainment professionals and the industry that employs them. MORE...

Notorious 'Worst Landlord' Case Closes: City Secures Massive $11.5M Settlement

Companies

2025-03-13 19:44:33

In an escalating legal showdown, the city is intensifying its pursuit of justice against two prominent landowners who have accumulated substantial outstanding fines. The municipal authorities are preparing to launch aggressive legal actions to recover millions in unpaid penalties, signaling a tough stance against property owners who have repeatedly ignored financial obligations. These legal battles represent a critical effort by city officials to enforce accountability and ensure that property regulations are taken seriously. By targeting these landowners with comprehensive legal strategies, the city aims to send a clear message about the consequences of financial non-compliance and protect municipal revenue streams. MORE...

Silicon Valley's Survival Playbook: Tech Giants Recalibrate in the AI Revolution

Companies

2025-03-13 19:37:00

Indian IT giants demonstrated remarkable financial strength in the past year, generating an impressive $20 billion in free cash flows. In a significant move that underscores their commitment to shareholder value, these companies returned over 75% of their cash reserves directly to investors through dividends and share buybacks. Industry experts are now calling for a strategic reset in the sector, emphasizing the need for innovative approaches to sustain growth and competitiveness. The substantial cash return highlights the robust financial health of Indian technology firms, but also signals a potential turning point for the industry. The massive cash distribution reflects the sector's resilience amid global economic uncertainties, showcasing the continued demand for Indian IT services and the companies' efficient operational strategies. However, the expert recommendations suggest that simply returning cash may not be sufficient for long-term success in an increasingly dynamic global technology landscape. As the industry stands at a critical juncture, IT firms are being urged to invest in emerging technologies, develop new service offerings, and explore innovative business models to maintain their competitive edge in the global market. MORE...

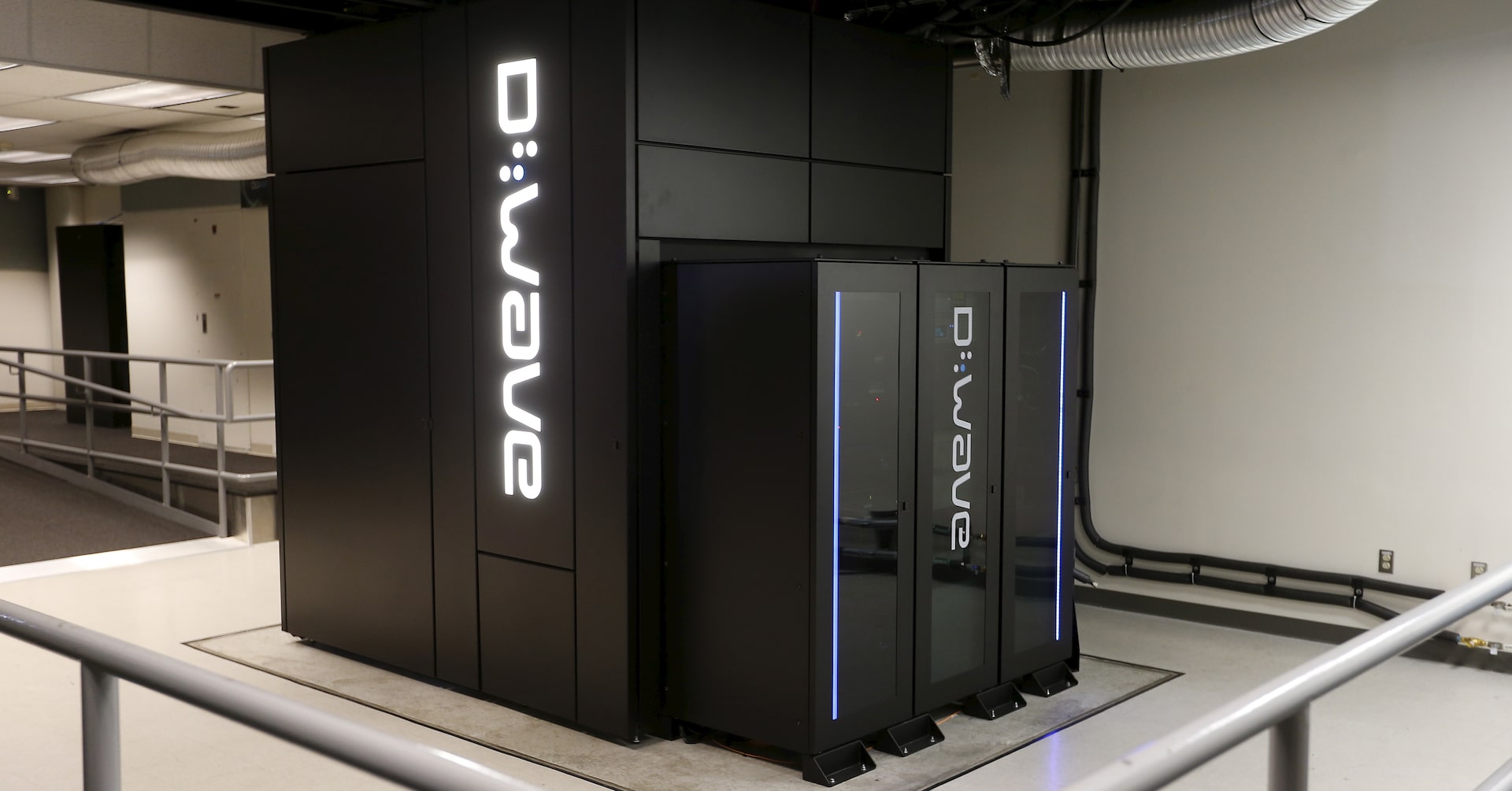

Quantum Leap: D-Wave's Bullish Outlook Sends Tech Stocks Soaring

Companies

2025-03-13 18:23:03

Quantum Computing Stocks Surge on Promising Revenue Forecast Investors witnessed an exciting surge in quantum computing stocks on Thursday, as the sector defied broader market trends. The rally was sparked by D-Wave Quantum's unexpected positive revenue projection, which injected renewed optimism into the emerging technology market. While traditional market indices struggled, quantum computing companies experienced a notable uptick in share prices. This unexpected performance highlighted the growing investor confidence in cutting-edge technological innovations, particularly in the quantum computing space. D-Wave Quantum's stronger-than-anticipated quarterly revenue forecast served as a catalyst, driving enthusiasm among investors and signaling potential growth in the quantum computing sector. The company's optimistic outlook suggests that the revolutionary technology may be closer to mainstream adoption than previously thought. The surge demonstrates the increasing market interest in quantum computing, a field that promises to transform computing capabilities across multiple industries, from finance and healthcare to artificial intelligence and cryptography. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331