Dogecoin's Dark Side: AI Firm's Potential Monopoly on Government Secrets Revealed

Companies

2025-03-09 19:15:19

In the high-stakes world of artificial intelligence, U.S. business leaders are voicing growing concerns about China's strategic advantage. The country's tightly controlled, centralized governance model provides unprecedented access to massive government datasets, giving Chinese AI developers a potentially game-changing edge in technological innovation. Unlike the more decentralized U.S. approach, China's system allows for seamless data sharing between government agencies and technology companies. This unique ecosystem enables AI researchers and developers to tap into vast pools of information, ranging from population statistics to urban infrastructure data, at an unprecedented scale and speed. Top executives in Silicon Valley argue that this data-driven approach gives Chinese AI initiatives a significant competitive advantage. By leveraging comprehensive national datasets, Chinese companies can train their AI models more effectively, potentially accelerating technological breakthroughs in areas like machine learning, predictive analytics, and advanced algorithms. The stark contrast in data accessibility highlights the complex interplay between government policy, technological innovation, and global AI competition. As the race for AI supremacy intensifies, U.S. tech leaders are increasingly calling for more collaborative and data-friendly policies to maintain their competitive position in the global technology landscape. MORE...

Dogecoin's Dark Side: AI Firm's Potential Monopoly on Government Secrets Revealed

Companies

2025-03-09 19:15:19

In the high-stakes world of artificial intelligence, U.S. business leaders are voicing growing concerns about China's strategic advantage. The country's tightly controlled, centralized governance model provides unprecedented access to massive government datasets, giving Chinese AI developers a potentially game-changing edge in technological innovation. Unlike the more decentralized U.S. approach, China's system allows for seamless data sharing between government agencies and technology companies. This unique ecosystem enables AI researchers and developers to tap into vast pools of information, ranging from population statistics to urban infrastructure data, at an unprecedented scale and speed. Top executives in Silicon Valley argue that this data-driven approach gives Chinese AI initiatives a significant competitive advantage. By leveraging comprehensive national datasets, Chinese companies can train their AI models more effectively, potentially accelerating technological breakthroughs in areas like machine learning, predictive analytics, and advanced algorithms. The stark contrast in data accessibility highlights the complex interplay between government policy, technological innovation, and global AI competition. As the race for AI supremacy intensifies, U.S. tech leaders are increasingly calling for more collaborative and data-friendly policies to maintain their competitive position in the global technology landscape. MORE...

Breaking: Bain Capital and WPP Plot Strategic Dismantling of Global Research Giant Kantar

Companies

2025-03-09 18:12:56

In a stark reflection of the current market challenges, another company has opted to pull back from its initial public offering (IPO), signaling the persistent volatility and investor hesitation in the financial landscape. This strategic retreat underscores the growing reluctance among businesses to enter the public markets amid uncertain economic conditions. The decision to abandon the listing is not merely a singular event, but part of a broader trend emerging in the financial sector. Investors and company leadership are increasingly cautious, carefully weighing the risks and potential returns of going public. The current market environment demands a more strategic approach, with companies prioritizing financial stability and investor confidence over rapid expansion. Market analysts suggest that this trend is driven by multiple factors, including market unpredictability, valuation concerns, and a more conservative investment climate. Potential IPO candidates are now more likely to delay their public debut, waiting for more favorable market conditions that promise better valuations and stronger investor interest. This development serves as a clear indicator that the IPO market remains fragile, with companies increasingly selective about their timing and approach to public offerings. The landscape continues to evolve, challenging traditional assumptions about growth and market entry strategies. MORE...

The Return Roadblock: Why Retailers Are Making Refunds Tougher (And Why That's Actually Smart)

Companies

2025-03-09 17:00:00

In the ever-evolving world of online shopping, a clothing expert has revealed an unexpected silver lining to a practice that many consumers initially view as frustrating: paid online returns. What might seem like an additional expense could actually be a strategic move that benefits both shoppers and retailers. The influencer suggests that charging for returns isn't just a money-making tactic, but a clever approach that encourages more mindful shopping behavior. When customers know they'll incur a fee for sending items back, they tend to be more deliberate in their purchasing decisions. This means shoppers are likely to: • Carefully review size charts • Read product descriptions more thoroughly • Examine product images with greater scrutiny • Consider their actual wardrobe needs before clicking "buy" This shift in consumer behavior can lead to reduced impulse buying and more intentional fashion choices. Additionally, return fees help retailers offset the significant costs associated with processing and restocking returned items, which can ultimately contribute to more stable pricing for consumers. While the idea of paying for returns might initially seem off-putting, this perspective offers a refreshing take on a practice that could actually promote more sustainable and thoughtful shopping habits. MORE...

The Return Roadblock: Why Retailers Are Making Refunds Tougher (And Why That's Actually Smart)

Companies

2025-03-09 17:00:00

In the ever-evolving world of online shopping, a clothing expert has revealed an unexpected silver lining to a practice that many consumers initially view as frustrating: paid online returns. What might seem like an additional expense could actually be a strategic move that benefits both shoppers and retailers. The influencer suggests that charging for returns isn't just a money-making tactic, but a clever approach that encourages more mindful shopping behavior. When customers know they'll incur a fee for sending items back, they tend to be more deliberate in their purchasing decisions. This means shoppers are likely to: • Carefully review size charts • Read product descriptions more thoroughly • Examine product images with greater scrutiny • Consider their actual wardrobe needs before clicking "buy" This shift in consumer behavior can lead to reduced impulse buying and more intentional fashion choices. Additionally, return fees help retailers offset the significant costs associated with processing and restocking returned items, which can ultimately contribute to more stable pricing for consumers. While the idea of paying for returns might initially seem off-putting, this perspective offers a refreshing take on a practice that could actually promote more sustainable and thoughtful shopping habits. MORE...

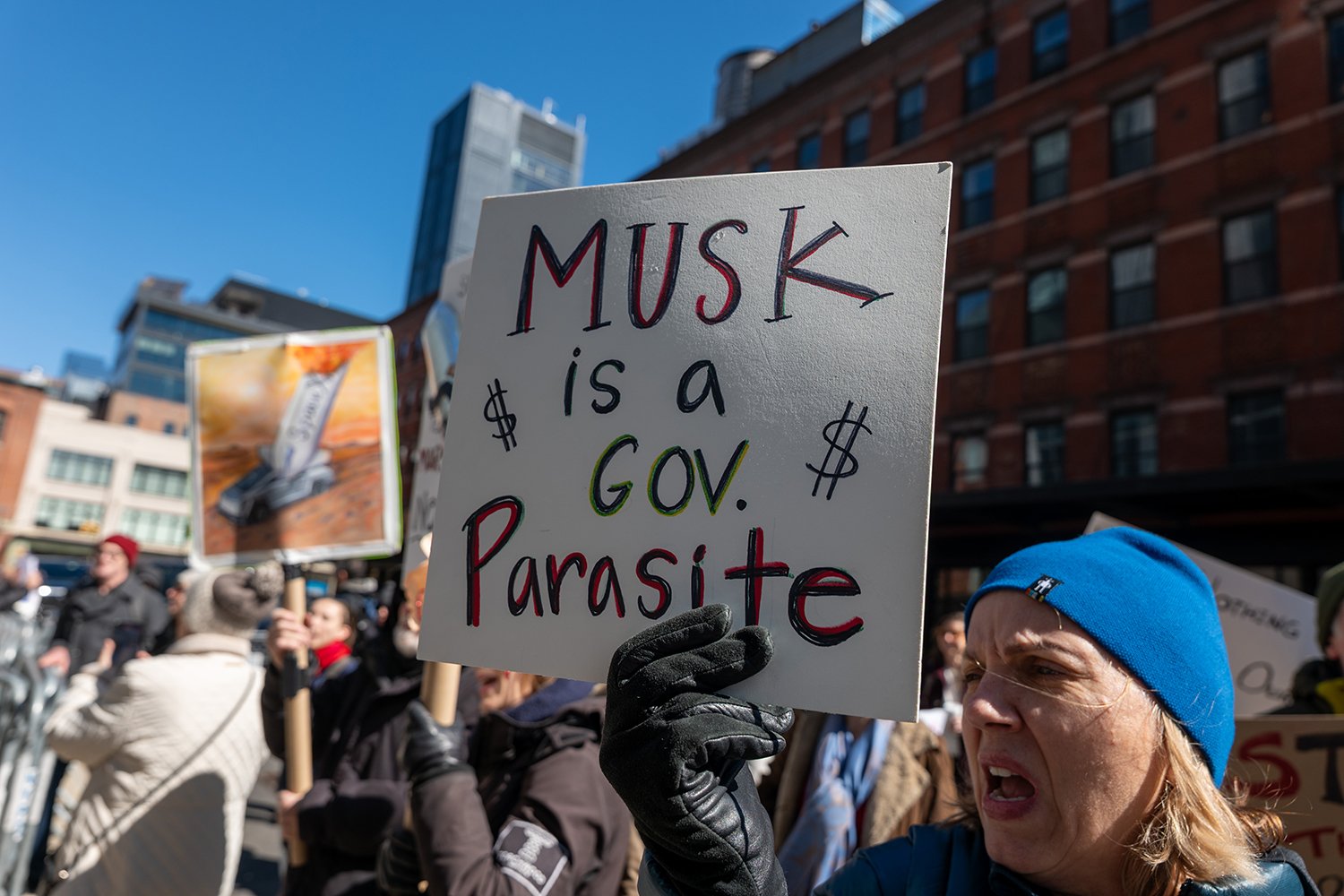

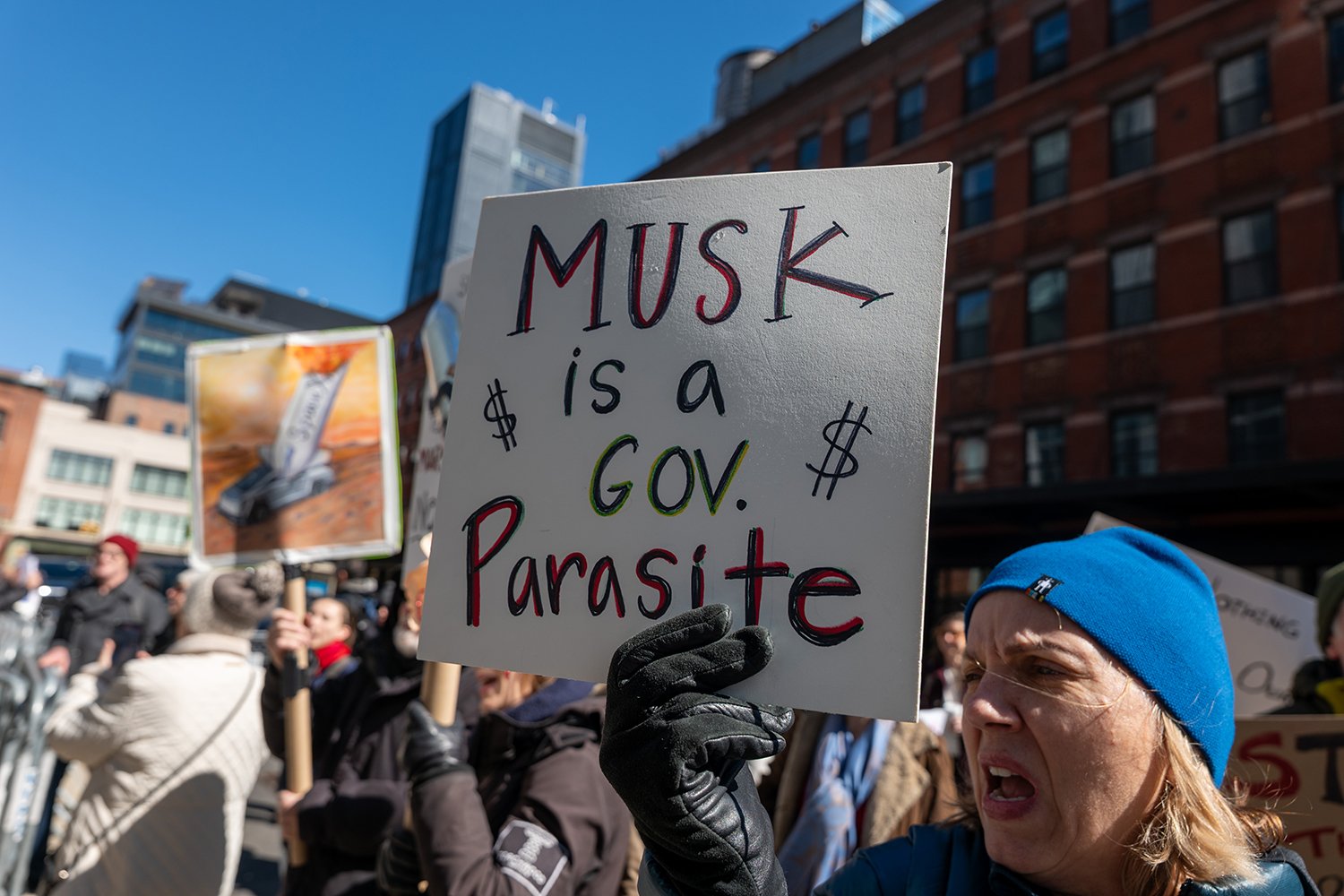

Silicon Valley Shakeup: Chinese Investors Quietly Acquire Shares in Musk's Empire

Companies

2025-03-09 14:53:23

In a strategic move to navigate the complex geopolitical landscape, Chinese investors are deploying innovative investment approaches through special-purpose vehicles. These carefully structured financial mechanisms are designed to circumvent potential scrutiny from US authorities and corporations, who remain cautious amid the current tensions between the two economic powerhouses. According to insider sources close to the investment community, these sophisticated investment strategies reflect a nuanced approach to cross-border capital deployment. By utilizing special-purpose vehicles, Chinese investors are effectively creating a buffer that allows them to pursue strategic investments while minimizing potential regulatory pushback. The current low point in US-China relations has prompted investors to become increasingly creative in their investment methodologies, seeking ways to maintain financial engagement without triggering diplomatic or regulatory complications. Asset managers and investors involved in these transactions are leveraging these specialized vehicles as a pragmatic solution to the challenging geopolitical environment. MORE...

Silicon Valley Shakeup: Chinese Investors Quietly Acquire Shares in Musk's Empire

Companies

2025-03-09 14:53:23

In a strategic move to navigate the complex geopolitical landscape, Chinese investors are deploying innovative investment approaches through special-purpose vehicles. These carefully structured financial mechanisms are designed to circumvent potential scrutiny from US authorities and corporations, who remain cautious amid the current tensions between the two economic powerhouses. According to insider sources close to the investment community, these sophisticated investment strategies reflect a nuanced approach to cross-border capital deployment. By utilizing special-purpose vehicles, Chinese investors are effectively creating a buffer that allows them to pursue strategic investments while minimizing potential regulatory pushback. The current low point in US-China relations has prompted investors to become increasingly creative in their investment methodologies, seeking ways to maintain financial engagement without triggering diplomatic or regulatory complications. Asset managers and investors involved in these transactions are leveraging these specialized vehicles as a pragmatic solution to the challenging geopolitical environment. MORE...

Silicon Valley Shakeup: Chinese Investors Quietly Acquire Shares in Musk's Empire

Companies

2025-03-09 14:53:23

In a strategic move to navigate the complex geopolitical landscape, Chinese investors are deploying innovative investment approaches through special-purpose vehicles. These carefully structured financial mechanisms are designed to circumvent potential scrutiny from US authorities and corporations, who remain cautious amid the current tensions between the two economic powerhouses. According to insider sources close to the investment community, these sophisticated investment strategies reflect a nuanced approach to cross-border capital deployment. By utilizing special-purpose vehicles, Chinese investors are effectively creating a buffer that allows them to pursue strategic investments while minimizing potential regulatory pushback. The current low point in US-China relations has prompted investors to become increasingly creative in their investment methodologies, seeking ways to maintain financial engagement without triggering diplomatic or regulatory complications. Asset managers and investors involved in these transactions are leveraging these specialized vehicles as a pragmatic solution to the challenging geopolitical environment. MORE...

Behind the Scenes: Chinese Investors Quietly Acquire Shares in Musk's Empire

Companies

2025-03-09 13:11:00

In a strategic maneuver to navigate the complex geopolitical landscape, Chinese investors are deploying innovative investment approaches that circumvent potential scrutiny. According to recent reports, these investors are utilizing special-purpose vehicles as a sophisticated method to channel capital while sidestepping potential resistance from U.S. authorities and corporations. The current tension-filled climate between the United States and China has prompted investors to adopt more nuanced investment strategies. By leveraging these specialized financial structures, Chinese investors are finding creative ways to maintain their international investment momentum, even as diplomatic relations remain strained. Asset managers and investors involved in these transactions reveal that the use of special-purpose vehicles represents a calculated response to the challenging bilateral environment. This approach allows for continued economic engagement while minimizing potential regulatory pushback and maintaining a low profile in an increasingly sensitive investment ecosystem. MORE...

Climate Culprits Revealed: Just 36 Corporations Responsible for Staggering Half of World's Carbon Footprint

Companies

2025-03-09 12:55:35

In a revealing snapshot of global carbon emissions, state-owned enterprises have emerged as the primary culprits of environmental pollution in 2023. A comprehensive analysis shows that a staggering 16 out of the top 20 carbon-emitting companies are government-controlled, highlighting the critical role of state-backed industries in the global climate crisis. These state-owned giants, spanning sectors like energy, manufacturing, and utilities, continue to dominate the emissions landscape, underscoring the urgent need for more aggressive environmental policies and sustainable practices. The data paints a stark picture of how government-controlled corporations are significantly contributing to global greenhouse gas emissions, despite increasing international pressure to reduce carbon footprints. The findings serve as a powerful reminder that meaningful climate action requires not just corporate responsibility, but also decisive governmental intervention and a fundamental reimagining of how state-owned enterprises approach environmental sustainability. As the world grapples with escalating climate challenges, these statistics provide a critical wake-up call for more comprehensive and immediate emissions reduction strategies. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331