Transatlantic Tensions: US Trade Tariffs Spark European Business Hesitation

Companies

2025-04-25 05:05:32

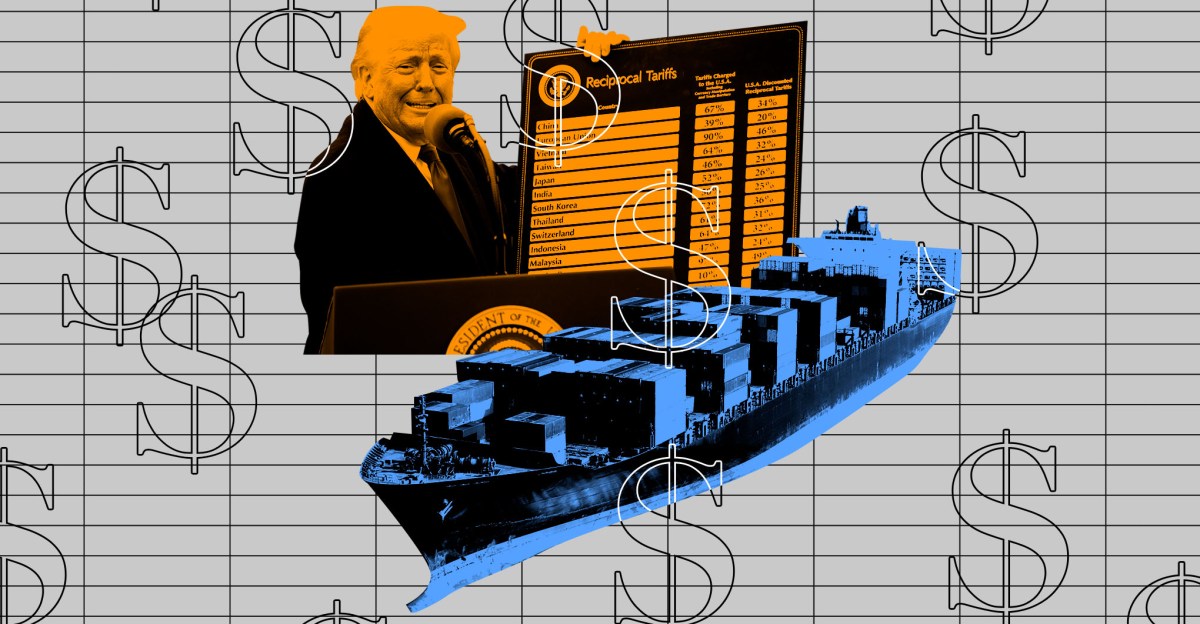

The unpredictable trade policies of U.S. President Donald Trump are casting a long shadow over European businesses, particularly smaller companies that are now hesitant to invest in the American market. The volatile tariff landscape has created significant uncertainty, making expansion into the United States a risky proposition for many international enterprises. As trade tensions continue to simmer, European companies are carefully reassessing their strategies, weighing the potential opportunities against the considerable challenges posed by the current economic climate. The erratic nature of Trump's trade approach has transformed what was once seen as a promising market into a minefield of potential financial risks. This growing reluctance highlights the broader impact of inconsistent trade policies on global business confidence. Smaller European firms, typically more vulnerable to economic fluctuations, are finding themselves particularly cautious about committing resources to U.S. market expansion. The uncertainty surrounding tariffs and trade negotiations has effectively created a chilling effect on international business relations. The situation serves as a stark reminder of how dramatically trade dynamics can shift in today's interconnected global economy, with political decisions having immediate and far-reaching consequences for businesses of all sizes. MORE...

Transatlantic Tensions: EU Firms Wary of US Market Amid Tariff Turbulence

Companies

2025-04-25 05:05:32

The Unpredictable Trade Landscape: How Trump's Tariff Tactics Are Reshaping Business Decisions In an era of economic uncertainty, U.S. President Donald Trump's volatile approach to international trade is sending ripples of concern through European business communities, particularly among smaller companies contemplating expansion into the American market. Trump's aggressive tariff strategy targets a wide range of products—from steel and cognac to automobiles and footwear—with the stated goal of encouraging foreign companies to invest directly in the United States, promising job creation and domestic manufacturing growth. Take Italy's EuroGroup Laminations as a prime example. Currently, the company enjoys tariff-free access to the U.S. automotive market, supplying critical components like rotors and stators to major manufacturers such as Ford and General Motors through its Mexican production facility, which fully complies with existing import regulations. However, the unpredictable nature of current trade policies is causing many international businesses to pause and reassess their strategic investments. The complex web of tariffs and potential retaliatory measures has transformed what was once a straightforward global marketplace into a challenging and often uncertain economic environment. As companies navigate this intricate landscape, the long-term implications of such protectionist policies remain a topic of intense speculation and concern among international business leaders. MORE...

Trade War Tremors: Corporate Leaders Sound Alarm on Tariff Fallout

Companies

2025-04-25 05:03:04

In a stark reflection of the current economic landscape, multiple companies are taking a cautious approach to their financial projections. Businesses across various sectors are either scaling back their profit expectations or completely suspending their forecasts, signaling deep uncertainty in the market. The wave of revised financial outlooks comes as companies grapple with complex economic challenges, including volatile market conditions, supply chain disruptions, and unpredictable consumer spending. Executives are choosing prudence over optimism, recognizing the need to provide more realistic assessments of their potential performance. This trend of financial conservatism highlights the broader economic pressures facing businesses today. By withdrawing or reducing profit forecasts, companies are sending a clear message about the unprecedented levels of economic unpredictability they are currently navigating. Investors and market analysts are closely watching these developments, understanding that such strategic adjustments are critical indicators of the current economic climate. The widespread nature of these forecast modifications suggests a broader economic hesitation that extends far beyond individual corporate strategies. MORE...

Tariff Tsunami: Boulder Businesses Brace for Economic Shockwaves

Companies

2025-04-25 03:52:00

Outdoor Industry Braces for Potential Economic Shockwave from Trump-Era Tariffs Leading voices in the outdoor recreation and equipment sector are sounding the alarm about proposed tariffs that could deliver a devastating blow to smaller brands and ultimately squeeze consumers' wallets. Industry experts warn that the potential new trade restrictions could fundamentally disrupt the delicate economic ecosystem of outdoor gear manufacturing and retail. Small to mid-sized outdoor equipment companies are particularly vulnerable, with many expressing serious concerns about their ability to absorb the additional financial burden. These tariffs threaten to dramatically increase production costs, potentially forcing some beloved brands to the brink of extinction or compelling them to significantly raise prices. Consumers can expect to see substantial price increases across camping, hiking, climbing, and other outdoor recreation equipment if these tariffs are implemented. The ripple effect could extend beyond pricing, potentially reducing product diversity and innovation as smaller manufacturers struggle to remain competitive. Industry leaders are calling for careful reconsideration of the proposed tariffs, emphasizing the potential long-term damage to a vibrant and dynamic sector that supports thousands of jobs and contributes significantly to the American economy. MORE...

Titans of Innovation: How Tech, Healthcare, and Energy Firms Are Reshaping the Americas' Business Landscape

Companies

2025-04-25 03:00:34

ABA Centers Soars to the Top: Financial Times Recognizes Rapid Growth and Innovation In an impressive display of entrepreneurial success, ABA Centers has clinched the top spot in the Financial Times' sixth annual ranking of the most dynamic and rapidly expanding companies in the region. The prestigious list, meticulously compiled in collaboration with Statista, highlights the organization's exceptional performance and remarkable growth trajectory. This achievement underscores ABA Centers' commitment to innovation, strategic development, and market leadership, setting a new benchmark for excellence in their industry. The ranking not only celebrates their current success but also signals the company's potential for continued expansion and influence in the competitive business landscape. MORE...

Trade War Tactics: How Consumer Brands Are Outsmarting Tariff Turbulence

Companies

2025-04-25 02:26:40

In the dynamic world of consumer packaged goods (CPG), companies are navigating complex supply chain challenges with strategic innovation and adaptability. As global markets continue to evolve, these businesses are proactively implementing sophisticated approaches to enhance operational efficiency and mitigate potential disruptions. Leading CPG organizations are embracing comprehensive strategies that focus on two critical areas: streamlining internal processes and diversifying their sourcing networks. By leveraging advanced technologies and data-driven insights, companies are transforming traditional supply chain models into more resilient and flexible systems. The current economic landscape demands agility and forward-thinking solutions. CPG companies are investing in robust sourcing strategies that reduce dependency on single suppliers and geographic regions. This approach not only minimizes risk but also creates opportunities for more competitive pricing and improved product quality. Technological innovations such as artificial intelligence, predictive analytics, and blockchain are enabling these organizations to gain unprecedented visibility into their supply chains. These tools help companies anticipate potential challenges, optimize inventory management, and make more informed strategic decisions. As the market continues to shift, successful CPG companies will be those that can quickly adapt, innovate, and maintain a customer-centric approach while building resilient and efficient supply chain ecosystems. MORE...

Dice, Dollars, and Diplomacy: Board Game Makers Take Trump to Court Over Tariff Battle

Companies

2025-04-25 02:18:25

A Growing Wave of Legal Challenges: Tariff Battles Heat Up in Court The landscape of international trade is currently witnessing an unprecedented surge of legal challenges as businesses and industries mount aggressive legal battles against controversial tariff policies. Across multiple sectors, companies are increasingly turning to the courts to challenge what they perceive as burdensome and economically damaging trade restrictions. These lawsuits represent more than just isolated legal disputes; they signal a broader pushback against trade policies that many argue are hindering economic growth and international commerce. From technology manufacturers to agricultural exporters, a diverse range of industries are joining forces to contest tariff regulations that they believe unfairly impact their bottom line. The legal challenges are not merely defensive maneuvers but strategic efforts to reshape trade dynamics. By bringing these cases to court, companies hope to not only seek financial relief but also establish precedents that could fundamentally alter how international trade regulations are implemented and enforced. As the number of lawsuits continues to multiply, the legal battlefield becomes increasingly complex, with potential far-reaching implications for global trade policies, economic relationships, and the intricate web of international commerce. MORE...

Behind the Scenes: How Individual Investors Are Quietly Dominating Strickland Metals' Ownership Landscape

Companies

2025-04-25 01:06:53

Key Insights: Decoding Strickland Metals' Investor Landscape A closer examination of Strickland Metals reveals a compelling ownership structure that provides critical insights into the company's strategic direction. The significant individual investor presence suggests that key decisions are not just made in boardrooms, but are deeply influenced by major shareholders who have a substantial financial stake in the company's success. These prominent individual investors bring more than just capital to the table. Their deep involvement implies a hands-on approach to governance, potentially driving strategic initiatives, operational improvements, and long-term value creation. Their substantial ownership stakes align their interests directly with the company's performance, creating a powerful motivation for making decisions that benefit both the organization and its shareholders. The concentration of ownership among key individuals indicates a focused and potentially more agile decision-making process. Unlike companies with widely dispersed shareholding, Strickland Metals appears to have a more concentrated power structure that could enable quicker strategic pivots and more targeted corporate strategies. Investors and market analysts should pay close attention to this ownership dynamic, as it could be a significant indicator of the company's future trajectory and potential for growth. MORE...

Dice, Dollars, and Defiance: Board Game Makers Challenge Trump's Tariff Tactics

Companies

2025-04-25 00:21:16

A coalition of board game companies has launched a legal challenge against the Trump administration, signaling a unique intersection of the gaming industry and federal policy. Stonemaier Games, XYZ Game Labs, Spielcraft Games, Rookie Mage, and Tinkerhouse Games have joined forces to file a lawsuit challenging recent administrative actions that potentially impact their business operations. The collaborative legal effort highlights the growing tension between creative industries and government regulations. These innovative game developers are taking a stand to protect their interests and challenge what they perceive as potentially restrictive policies that could hinder their ability to design, produce, and distribute board games in the current market landscape. While specific details of the lawsuit remain confidential, the united front presented by these gaming companies suggests a significant and principled approach to addressing their concerns with the administration's policies. MORE...

Regional Air Connectivity Heats Up: 5 Contenders Vie for Mid-Ohio Valley Airport Subsidies

Companies

2025-04-25 00:00:00

Regional Air Connectivity Expands: Mid-Ohio Valley Airport Seeks New Commercial Service Williamstown is poised for enhanced air travel opportunities as multiple airlines compete to provide federally subsidized commercial flights from the Mid-Ohio Valley Regional Airport. The latest proposals showcase an impressive range of aircraft options, with carriers bidding to operate planes ranging from compact 30-seat regional jets to larger 137-passenger aircraft. The proposed routes promise to connect travelers to major metropolitan destinations, including Charlotte, Raleigh, Atlanta, Chicago, and Washington, D.C. These potential new flight paths represent a significant boost in regional transportation infrastructure, offering local residents and businesses improved access to key economic and cultural centers. Detailed proposals for the Alternate Essential Air Service program are now publicly available on the federal Regulations.gov website, inviting community review and input. The competitive bidding process aims to select an airline that can provide reliable, affordable, and convenient air service to the Mid-Ohio Valley region. Aviation enthusiasts and local travelers alike are eagerly anticipating the outcome of these bids, which could dramatically transform air travel options for the community. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331