Cruise Industry's Tax Dilemma: Navigating Fiscal Waves and Economic Ripples

Companies

2025-03-03 15:11:21Content

Navigating Choppy Waters: The Ongoing Taxation Debate for Cruise Operators

The cruise industry has long been sailing through turbulent discussions surrounding taxation, with policymakers and industry leaders locked in an ongoing debate about fair financial contributions. As these massive floating resorts continue to traverse global waters, the complex question of how to appropriately tax cruise lines remains a challenging and contentious issue.

The potential impact on cruise operators could be significant. Increased taxation might lead to higher ticket prices for passengers, potentially reducing the industry's competitiveness and attractiveness to travelers. Conversely, more structured tax policies could provide additional revenue for coastal communities and improve maritime infrastructure.

Cruise lines argue that their current tax structures already contribute substantially to local economies through port fees, employment, and tourism spending. However, critics contend that these massive vessels often exploit tax loopholes, paying disproportionately low rates compared to their substantial revenues.

As the debate continues, the cruise industry finds itself at a critical crossroads, balancing economic sustainability with fair fiscal responsibility. The ultimate resolution will likely require nuanced negotiations between industry stakeholders, government officials, and economic experts.

Navigating the Fiscal Waves: The Complex Taxation Landscape of Cruise Line Operations

In the intricate world of maritime commerce, cruise lines find themselves navigating treacherous financial waters, where taxation policies can dramatically reshape the industry's economic landscape. The ongoing debate surrounding the fiscal treatment of these floating resorts has sparked intense discussions among policymakers, economists, and industry stakeholders.Unraveling the Financial Currents Challenging Cruise Line Profitability

The Global Taxation Maze: Complexity and Challenges

Cruise operators exist in a uniquely complex regulatory environment that transcends traditional national boundaries. Unlike land-based businesses, these maritime enterprises operate across multiple jurisdictions, creating intricate tax scenarios that challenge conventional fiscal frameworks. International maritime laws, combined with varying national tax regulations, generate a labyrinthine system where financial compliance becomes an extraordinary challenge. The complexity stems from multiple factors, including vessel registration locations, passenger embarkation points, and the multinational nature of cruise line operations. Some companies strategically register vessels in countries with favorable tax structures, a practice that has drawn significant scrutiny from global tax authorities seeking to optimize revenue collection.Economic Impact and Industry Dynamics

Taxation policies directly influence the cruise industry's economic sustainability and operational strategies. Higher tax burdens could potentially translate into increased ticket prices, reduced route expansions, or diminished investment in fleet modernization. Conversely, strategic tax management might enable cruise lines to maintain competitive pricing and continue technological innovations. Economists argue that the current taxation model fails to adequately capture the true economic contribution of cruise lines. These floating cities generate substantial economic activity through tourism, employment, and ancillary services, yet their tax contributions remain a contentious issue.Regulatory Frameworks and International Perspectives

Different countries approach cruise line taxation with varying degrees of complexity and stringency. European Union nations tend to implement more rigorous regulatory frameworks, while some Caribbean and Southeast Asian countries offer more lenient tax environments to attract maritime businesses. The international maritime community continues to debate standardized taxation protocols. Proposals range from implementing uniform global tax rates to developing more nuanced, activity-based taxation models that reflect the unique operational characteristics of cruise enterprises.Technological Innovations and Future Taxation Strategies

Emerging technologies are reshaping how tax authorities track and assess maritime businesses. Advanced digital platforms, blockchain technologies, and sophisticated data analytics are enabling more transparent and efficient tax reporting mechanisms. Cruise lines are increasingly investing in technological solutions that provide real-time financial transparency, potentially mitigating complex tax challenges. These innovations could revolutionize how maritime businesses interact with global tax systems, creating more streamlined and predictable fiscal environments.Environmental Considerations and Tax Incentives

Environmental sustainability has become a critical factor in contemporary taxation discussions. Many governments are exploring tax incentive structures that reward cruise lines implementing green technologies and reducing carbon footprints. Progressive taxation models might offer financial benefits to companies demonstrating significant environmental commitments, thereby creating economic motivations for sustainable maritime practices. This approach represents a potential paradigm shift in how cruise line operations are fiscally evaluated.Strategic Adaptation and Future Outlook

Successful cruise lines will likely be those demonstrating exceptional adaptability in navigating increasingly complex taxation landscapes. Strategic financial planning, technological integration, and proactive engagement with regulatory frameworks will become paramount. The future of cruise line taxation remains fluid, with ongoing negotiations and evolving global economic dynamics continuously reshaping the industry's fiscal environment. Stakeholders must remain agile, anticipating potential regulatory changes and developing robust, flexible financial strategies.RELATED NEWS

Companies

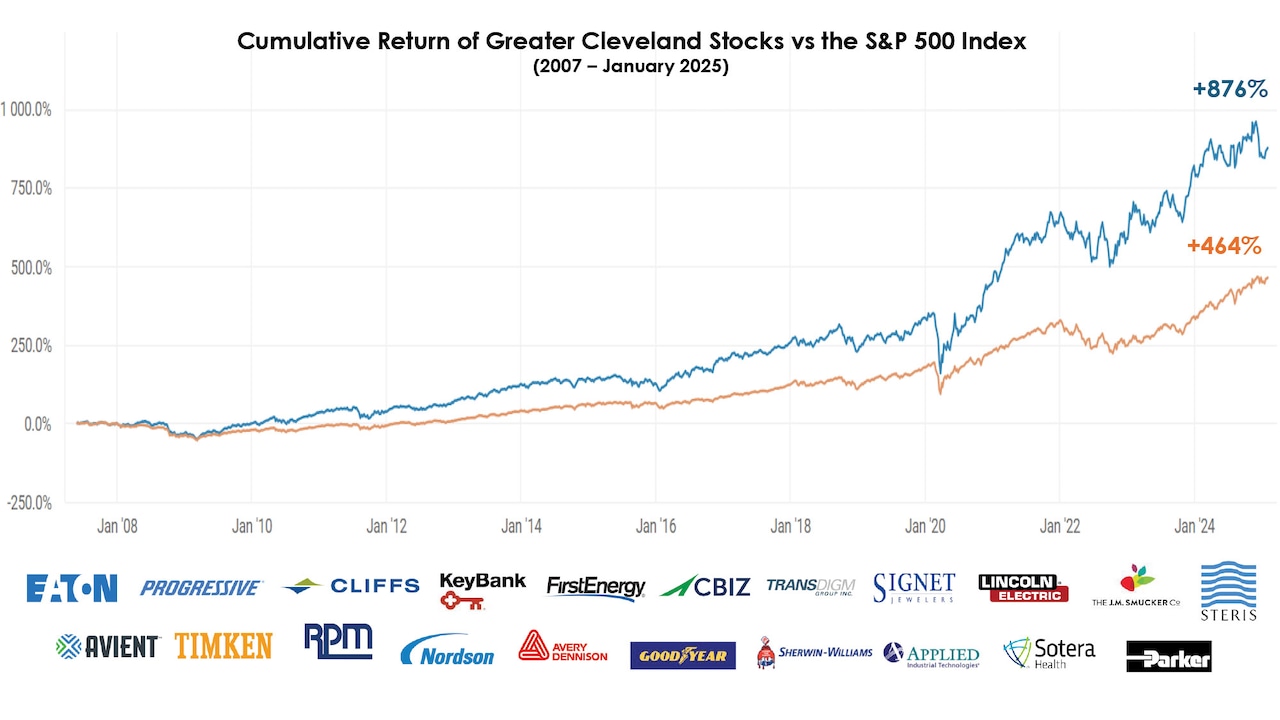

Local Powerhouse: Northeast Ohio Firms Outperform Wall Street's Gold Standard

2025-03-07 21:24:44

Companies

Defying the Odds: Corporate America's Diversity Commitment Stands Strong

2025-04-05 01:39:49