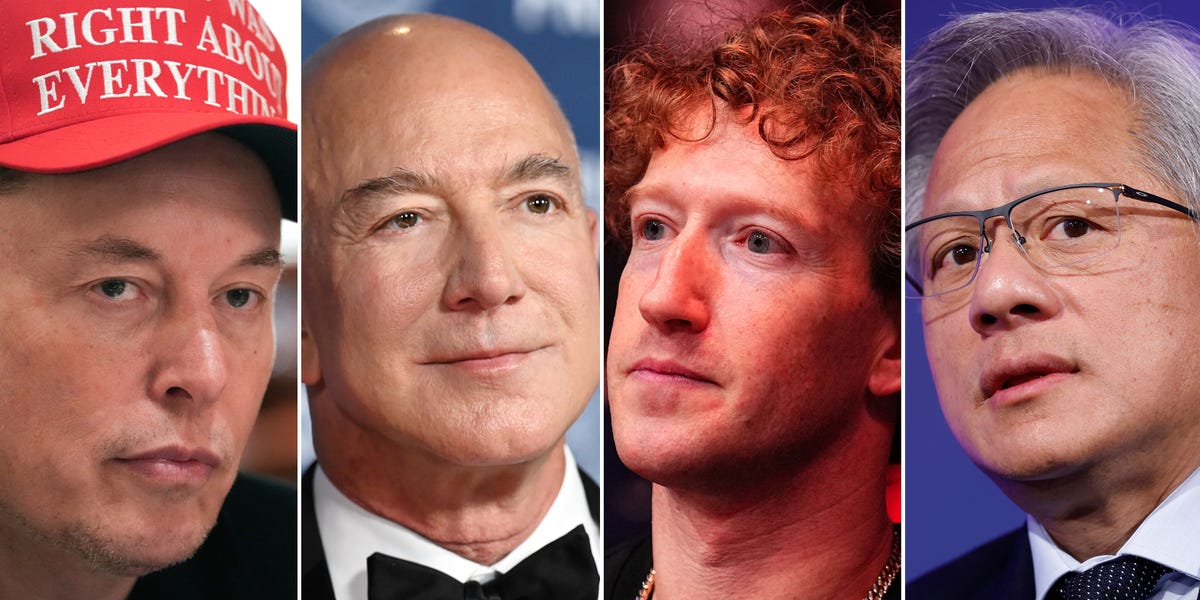

Tech Titans' Tumble: How Trump's First 100 Days Wiped $194 Billion from Billionaires' Fortunes

Business

2025-04-29 08:15:01

In a stunning financial rollercoaster, four of tech's most prominent billionaires—Elon Musk, Jeff Bezos, Mark Zuckerberg, and Jensen Huang—have experienced a dramatic collective wealth erosion of $194 billion since attending Donald Trump's presidential inauguration just 100 days ago. These tech titans, who represent some of the most innovative companies in the world, have witnessed their net worth plummet amid market volatility, technological shifts, and broader economic uncertainties. Musk, the mercurial CEO of Tesla and SpaceX, has been particularly impacted by significant fluctuations in his company's stock prices and his high-profile Twitter acquisition. Bezos, the Amazon founder, and Zuckerberg, Meta's (formerly Facebook) chief, have also seen substantial declines in their personal fortunes, reflecting broader challenges in the tech sector. Jensen Huang, NVIDIA's visionary leader, has not been immune to these financial pressures. The staggering $194 billion loss underscores the volatile nature of wealth in the technology and innovation landscape, where fortunes can rise and fall with remarkable speed. It serves as a stark reminder that even the world's most successful entrepreneurs are not insulated from market dynamics and economic unpredictability. MORE...

Economic Rollercoaster: Inside Trump's Unpredictable Second-Term Financial Landscape

Business

2025-04-29 08:00:02

As President Donald Trump reaches a significant milestone—his 100th day in office—Business Insider delved deep into the American public's perception of the nation's economic landscape. Our comprehensive analysis explores critical economic indicators, revealing how citizens are experiencing and interpreting the early stages of the Trump administration's economic policies. From stock market performance to inflation trends, and from trade tariffs to overall economic sentiment, Americans are closely watching the economic shifts under the new presidential leadership. This in-depth examination provides insights into the complex interplay between presidential actions and economic realities that are directly impacting everyday citizens. Our research highlights the nuanced perspectives of Americans as they assess the economic trajectory, offering a comprehensive snapshot of the national mood during this pivotal period of political and economic transition. MORE...

BP's Profit Plunge: Inside the Oil Giant's Uphill Battle for Recovery

Business

2025-04-29 06:36:14

In a strategic move to strengthen its financial position, a prominent FTSE 100 company is preparing to divest a substantial portfolio of assets, targeting between $3 billion and $4 billion in sales throughout the year. The ambitious divestment plan is primarily aimed at reducing the company's debt burden and streamlining its operational structure. By strategically selling off selected assets, the company hopes to improve its balance sheet, enhance financial flexibility, and create more value for shareholders. This proactive approach demonstrates the organization's commitment to financial prudence and long-term sustainability in an increasingly competitive business landscape. The planned asset sales represent a significant step towards optimizing the company's portfolio, potentially allowing for reinvestment in core business areas and future growth opportunities. Investors and market analysts will be closely watching the progress of this strategic financial restructuring. MORE...

Tariff Tsunami: Local Denton Business Caught in Economic Crossfire

Business

2025-04-29 06:30:00

In the heart of Denton, Texas, a small business called Bunch Bikes has been fighting an uphill battle against the economic challenges posed by international trade tensions. The Cato Institute recently highlighted the company's struggle, revealing how Trump-era tariffs have created significant obstacles for this innovative local enterprise. Bunch Bikes, known for its unique cargo bicycles designed for families and urban commuters, found itself caught in the crossfire of trade policies that have dramatically increased the cost of doing business. The company's founder has been vocal about the direct impact of these tariffs, which have forced them to make difficult financial decisions. The additional import taxes have substantially raised the cost of bicycle components, squeezing the company's already thin profit margins. What was once a promising small business model has been transformed into a challenging economic landscape, where every imported part becomes more expensive and less predictable. This story exemplifies the real-world consequences of trade policies on small American businesses. While international trade negotiations play out on a global stage, companies like Bunch Bikes bear the immediate and tangible burden of these economic maneuvers. Despite the challenges, the company continues to innovate and adapt, demonstrating the resilience that defines many small businesses in the United States. Their experience serves as a powerful reminder of how macro-level economic decisions can have profound micro-level impacts. MORE...

Sweet Setback: AB Foods Wrestles with Sugar Market Slump in Profit Squeeze

Business

2025-04-29 06:23:10

Associated British Foods (ABF) has experienced a challenging financial period, with adjusted operating profit dropping by 10%, primarily driven by significant losses in its sugar division. The British multinational conglomerate revealed the downturn in its latest financial report, highlighting the ongoing challenges facing its sugar business. The decline underscores the complex market dynamics and operational hurdles confronting ABF's diverse portfolio. While the sugar segment struggled, the company's performance reflects the broader economic pressures and competitive landscape in which global food and agricultural businesses are currently operating. Investors and market analysts will be closely monitoring the company's strategic responses to this profit reduction, particularly in terms of potential restructuring or optimization of the sugar business. The results signal a need for adaptive measures to restore profitability and maintain the company's competitive edge in the global marketplace. Despite the setback, ABF remains a significant player in the international food and retail sectors, with multiple business segments that could potentially offset the sugar division's current challenges. MORE...

Back to Base: The Corporate Comeback - Are You Prepared for the Office Resurrection?

Business

2025-04-29 05:30:00

The COVID-19 pandemic fundamentally transformed the way we work, leaving an indelible mark on the modern business landscape. While the days of widespread lockdowns and mandatory remote work might seem like a distant memory, the professional world has undergone a profound and lasting metamorphosis. What began as an emergency response to a global health crisis has evolved into a permanent shift in workplace dynamics. Companies that once viewed remote and hybrid work models with skepticism have now embraced flexible arrangements as a strategic advantage. Employees, having experienced the benefits of greater autonomy and work-life balance, are increasingly demanding more adaptable work environments. The pandemic accelerated digital transformation by years, compelling organizations to invest in robust technological infrastructure, collaboration tools, and virtual communication platforms. This technological leap has not only enabled seamless remote work but has also opened up new possibilities for global talent recruitment and cross-border collaboration. As businesses continue to navigate this new terrain, it's clear that the traditional 9-to-5 office model has been irrevocably changed. The future of work is now characterized by flexibility, digital connectivity, and a reimagined understanding of productivity and workplace engagement. MORE...

Signal Shakeup: Trump's Cryptic Commentary on Secure Messaging Sparks Digital Debate

Business

2025-04-29 05:02:14

In a candid and controversial statement, former President Donald Trump has expressed strong reservations about the popular encrypted messaging app Signal. "If you want the unvarnished truth," Trump declared, "I would honestly advise people to steer clear of Signal." The remarks come amid growing concerns about digital privacy and communication security. Trump's blunt warning suggests a deeper skepticism about the platform's reliability and potential vulnerabilities. While the specific reasons behind his recommendation remain unclear, the statement is likely to spark further discussion about communication technologies and their trustworthiness. As users become increasingly conscious of their digital footprint, Trump's comments add another layer of complexity to the ongoing debate about secure messaging platforms. Whether his advice will influence user behavior remains to be seen, but it certainly brings Signal into the spotlight of public discourse. MORE...

Culinary Confession: Jamie Oliver Reveals the Surprising Truth About Teaching Kids to Cook

Business

2025-04-29 04:36:39

In a candid 2018 interview, celebrity chef Jamie Oliver, famously known as the Naked Chef, revealed a surprisingly relaxed approach to his children's fast food choices. Despite his well-known advocacy for healthy eating, Oliver shared that he would not strictly forbid his kids from enjoying an occasional McDonald's meal if they genuinely wanted to. This refreshingly honest stance demonstrates his belief in balanced nutrition and allowing children some personal food freedom, while still maintaining overall healthy eating habits at home. MORE...

Research Funding Fight: Omaha Chamber Leads Nationwide Advocacy Charge

Business

2025-04-29 04:17:48

In a powerful show of support for scientific innovation, the Greater Omaha Chamber has united with over 50 chambers of commerce and business organizations nationwide to revive the Business for Federal Research Funding Coalition. This collaborative effort aims to champion the critical role of federal research funding in driving economic growth, technological advancement, and national competitiveness. By joining forces, these business leaders are sending a clear message about the importance of sustained investment in research and development across various sectors. The coalition represents a diverse network of business voices committed to highlighting how federal research funding fuels breakthrough discoveries, creates jobs, and strengthens America's global leadership in innovation. The relaunch signals a renewed commitment to advocating for policies that support robust federal research investments, recognizing that today's research funding translates into tomorrow's economic opportunities and technological breakthroughs. MORE...

End of an Era: Mount Pleasant's Beloved Dry Cleaning Landmark Prepares to Shut Down

Business

2025-04-29 01:45:58

A beloved local dry cleaning business is set to bid farewell to the Mount Pleasant community. Chris' Dry Cleaning and Shirt Service, a long-standing fixture on Coleman Boulevard, will soon close its doors, marking the end of an era for loyal customers and local residents. The family-owned business, which has been a trusted name in garment care for years, is preparing to shut down its operations. Owners Chris and [Name] have been integral to the community, providing quality cleaning services and building lasting relationships with their clientele. While the exact closure date remains unspecified, the impending shutdown represents a significant change for the neighborhood. Longtime patrons will undoubtedly feel the impact of losing this trusted local service that has been a staple of Coleman Boulevard for many years. As the business prepares to wind down its operations, residents are encouraged to take advantage of the remaining time to collect their garments and say goodbye to a cherished local establishment. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489