BP's Profit Plunge: Inside the Oil Giant's Uphill Battle for Recovery

Business

2025-04-29 06:36:14Content

In a strategic move to strengthen its financial position, a prominent FTSE 100 company is preparing to divest a substantial portfolio of assets, targeting between $3 billion and $4 billion in sales throughout the year. The ambitious divestment plan is primarily aimed at reducing the company's debt burden and streamlining its operational structure.

By strategically selling off selected assets, the company hopes to improve its balance sheet, enhance financial flexibility, and create more value for shareholders. This proactive approach demonstrates the organization's commitment to financial prudence and long-term sustainability in an increasingly competitive business landscape.

The planned asset sales represent a significant step towards optimizing the company's portfolio, potentially allowing for reinvestment in core business areas and future growth opportunities. Investors and market analysts will be closely watching the progress of this strategic financial restructuring.

Corporate Strategy Unveiled: Major FTSE 100 Group's Bold Asset Divestment Plan Signals Financial Transformation

In the dynamic landscape of corporate finance, strategic asset management has emerged as a critical lever for organizational resilience and growth. Companies increasingly recognize the importance of portfolio optimization, leveraging divestment strategies to streamline operations, reduce financial burdens, and unlock shareholder value in an increasingly competitive global marketplace.Navigating Financial Challenges: A Strategic Approach to Corporate Restructuring

Strategic Asset Rationalization: Understanding the Motivation

Corporate financial strategies are complex ecosystems requiring nuanced decision-making. The FTSE 100 group's ambitious plan to divest between $3 billion and $4 billion in assets represents a calculated approach to balance sheet management. By strategically identifying non-core or underperforming assets, organizations can redirect capital toward more promising investment opportunities, enhance operational efficiency, and demonstrate financial prudence to stakeholders. The decision to sell assets is rarely undertaken lightly. It involves comprehensive analysis of portfolio performance, market conditions, and long-term strategic objectives. Financial leaders must meticulously evaluate each potential divestment, considering factors such as market valuation, potential future growth, and alignment with the organization's core competencies.Financial Engineering and Debt Reduction Strategies

Debt reduction remains a paramount concern for corporate financial management. The proposed asset sales represent a sophisticated mechanism for deleveraging, allowing the organization to strengthen its financial foundation. By converting non-essential assets into liquid capital, the company can reduce its debt burden, improve credit ratings, and create financial flexibility for future investments. Modern corporate finance demands dynamic approaches to capital allocation. The FTSE 100 group's strategy exemplifies a proactive approach to financial management, demonstrating an ability to adapt to changing market conditions and optimize resource utilization.Market Implications and Investor Perspectives

Institutional investors and market analysts closely scrutinize such strategic moves. The planned asset divestment signals management's commitment to shareholder value creation and financial discipline. Such transparent strategies can potentially boost investor confidence, potentially leading to improved stock performance and enhanced market perception. The broader economic landscape plays a crucial role in these strategic decisions. Global economic uncertainties, sector-specific challenges, and evolving market dynamics all contribute to the complex calculus of corporate asset management. By proactively addressing financial challenges, the organization positions itself as a resilient and forward-thinking market participant.Operational Transformation and Strategic Realignment

Asset divestment is more than a financial transaction; it represents a holistic approach to organizational transformation. By carefully selecting assets for sale, companies can streamline operations, focus on core competencies, and create a more agile and responsive organizational structure. The process involves rigorous internal assessment, external market analysis, and strategic planning. Each potential asset sale undergoes extensive due diligence, ensuring that the divestment aligns with the organization's long-term vision and creates sustainable value.Future Outlook and Strategic Positioning

The FTSE 100 group's asset divestment strategy reflects a sophisticated approach to corporate financial management. By demonstrating adaptability, financial acumen, and strategic vision, the organization signals its commitment to continuous improvement and value creation. As global markets continue to evolve, such proactive strategies will become increasingly important. Companies that can effectively manage their asset portfolios, reduce financial complexity, and maintain strategic focus will be best positioned to thrive in an increasingly competitive business environment.RELATED NEWS

Business

Retail Revolt: How Trump's Trade War Is Forcing Brands Like Shein and Target to Hike Prices

2025-04-28 17:38:19

Business

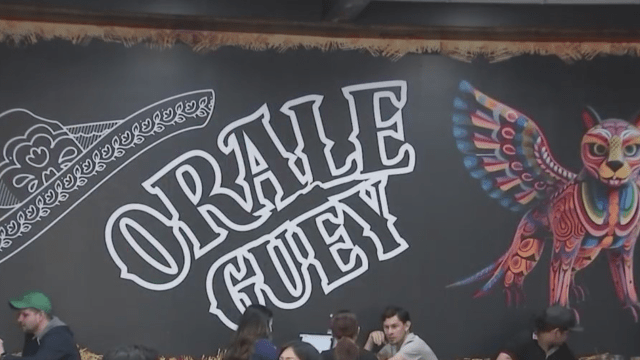

From TikTok Buzz to Booming Business: How One Columbus Eatery Went Viral Overnight

2025-03-16 03:30:00

Business

Business Leaders Converge: Dearborn County's Power Breakfast Set to Ignite Regional Growth

2025-03-10 16:19:25