Western NC Entrepreneurs Rejoice: Governor Unveils Game-Changing Small Business Lifeline

Business

2025-04-29 17:40:32

In a bold move to support local businesses, North Carolina Governor Josh Stein has unveiled a comprehensive $55 million state infrastructure recovery program aimed at helping small businesses rebuild and recover in the aftermath of Hurricane Helene's devastating impact. The strategic grant initiative is designed to provide critical financial assistance to entrepreneurs and business owners who have been struggling to bounce back from the hurricane's destructive path. The new program represents a significant commitment from the state government to support local economic resilience, offering targeted grants that will help small businesses repair infrastructure damage, restore operations, and regain their economic footing. By providing these crucial funds, Governor Stein hopes to accelerate the recovery process and prevent long-term economic disruption in the communities most affected by the hurricane. Small business owners across North Carolina can now look forward to accessing much-needed financial support that will help them rebuild, recover, and continue serving their local communities in the wake of this natural disaster. MORE...

Navigating Economic Storms: Amazon's Jassy Reveals CEO Survival Strategy in Tariff Turbulence

Business

2025-04-29 17:21:55

In the midst of complex global trade dynamics, Amazon Web Services (AWS) CEO Andy Jassy offers a compelling strategic insight for business leaders: maintain unwavering focus on customer needs, regardless of economic uncertainties. Speaking candidly about navigating challenging market conditions, Jassy emphasized the critical importance of prioritizing customer value over short-term economic fluctuations. His advice serves as a beacon for executives grappling with unpredictable tariff landscapes and global economic shifts. By recommending that CEOs "stay focused" on delivering exceptional customer experiences, Jassy underscores a fundamental business principle: customer satisfaction remains the ultimate north star, even when external economic pressures create significant challenges. The guidance reflects AWS's own successful approach to business strategy, where customer-centric innovation has been a cornerstone of their remarkable growth. For business leaders, Jassy's message is clear: adapt, remain agile, and never lose sight of what truly matters - meeting and exceeding customer expectations. In an era of increasing economic complexity, this straightforward yet powerful advice could be the key to sustainable business success. MORE...

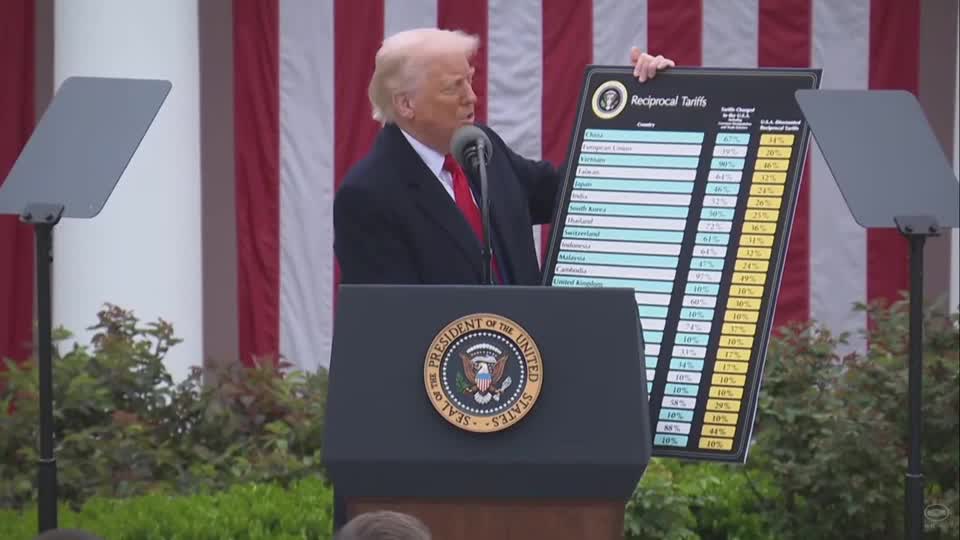

Tariff Tensions: Amazon's Price Tag Silence Sparks Political Firestorm

Business

2025-04-29 17:16:05

The mere possibility of Amazon potentially revealing tariff costs has reignited a passionate policy debate in the nation's capital, even without the company's explicit commitment to transparency. This potential disclosure has sparked intense discussions among policymakers, trade experts, and economic analysts about the broader implications of tariff pricing and consumer awareness. While Amazon has not definitively announced plans to display tariff expenses, the speculation alone has thrust the complex issue of trade costs into the spotlight. Washington insiders are closely watching how this potential move could influence consumer understanding of international trade dynamics and pricing structures. The prospect of such transparency has energized conversations about the true economic impact of trade policies and how they directly affect consumer spending. By potentially bringing hidden costs to the forefront, Amazon could be setting a precedent for corporate accountability and consumer education in an increasingly complex global marketplace. MORE...

Tariff Tug-of-War: Small Businesses Demand Economic Relief

Business

2025-04-29 17:10:17

In a candid discussion on Bloomberg Open Interest, Rebecca Minkoff, founder and chief creative officer of her eponymous fashion brand, shed light on the challenging economic landscape facing small business owners. Minkoff revealed that if she were to relocate her production to the United States, the cost of her products would immediately skyrocket, effectively doubling in price. The fashion entrepreneur's stark assessment highlights the complex economic realities of domestic manufacturing in today's global marketplace. Her comments underscore the significant financial pressures created by current tariff structures, which pose substantial challenges for small businesses trying to remain competitive while maintaining affordable pricing for consumers. Minkoff's insights provide a raw, unfiltered look into the intricate balance between production costs, international trade policies, and the survival strategies of independent brands in an increasingly complex global economy. MORE...

Breaking: Wall Street Insights - Key Business Developments on April 29th

Business

2025-04-29 16:47:23

General Motors Navigates Challenging Quarter with Resilience In a dynamic first quarter, General Motors experienced a dip in net income, primarily driven by softer sales in its truck and SUV segments. Despite the headwinds, the automotive giant remains committed to strategic adaptation and market responsiveness. Meanwhile, the automotive industry is closely watching potential trade developments, with indications that the Trump administration may implement measures to mitigate the impact of potential automotive tariffs. This proactive approach aims to protect domestic manufacturers and maintain market stability. In related corporate news, logistics leader UPS is preparing for significant organizational restructuring, announcing plans to eliminate approximately 20,000 jobs. This strategic workforce reduction reflects the company's efforts to optimize operational efficiency in a rapidly evolving business landscape. Beverage titan Coca-Cola remains cautiously optimistic, characterizing the current market environment as "manageable" despite experiencing a decline in net revenue. The company's strategic resilience continues to be a hallmark of its global brand positioning. On a positive note, Royal Caribbean is demonstrating strong market confidence by raising its financial forecast, signaling potential growth and optimism in the cruise industry's recovery and future prospects. MORE...

"Wisdom in Focus: What a 100-Year-Old Taught Me About Life Through My Camera Lens"

Business

2025-04-29 16:10:50

Steve Reeves, a seasoned photographer based in London, has discovered a profound shift in his perspective on professional success. Through meaningful connections with older individuals, he has learned to embrace a more relaxed approach to his career trajectory. No longer driven by the relentless pursuit of rapid milestones, Reeves now values the wisdom and insights gained from his diverse friendships. His interactions with experienced mentors and friends have taught him that professional growth is not solely about racing to achieve predetermined goals, but about cultivating rich experiences and deep understanding. This newfound philosophy has not only transformed his outlook on work but has also enriched his personal and creative life, allowing him to appreciate the journey rather than fixating on distant destinations. MORE...

White House Slams Amazon: Tech Giant Silences Tariff Cost Transparency Amid Heated Dispute

Business

2025-04-29 15:53:30

Amazon's stock took a tumble following a controversial report about its approach to tariff costs, which quickly drew sharp criticism from the White House. The tech giant swiftly moved to clarify the narrative and address the mounting concerns. The initial report suggested that Amazon was planning to pass on tariff expenses directly to consumers, a move that sparked immediate backlash from government officials. In response to the mounting pressure, the company quickly stepped in to provide additional context and nuance to the developing story. By offering a more detailed explanation, Amazon sought to mitigate potential damage to its reputation and reassure both consumers and government stakeholders. The incident highlights the delicate balance companies must maintain when navigating complex economic policies and public perception. As the situation unfolded, it became clear that communication and transparency would be key in resolving the misunderstanding and preventing further market volatility. The company's rapid response underscored its commitment to addressing potential misconceptions head-on. MORE...

Inferno Halts Traffic: Major Blaze Shuts Down Highway 321 in Gaston

Business

2025-04-29 15:01:00

In a developing situation, authorities report no injuries have been sustained thus far. Emergency responders are actively monitoring the scene, ensuring public safety remains the top priority. While details are still emerging, officials are working diligently to assess the full extent of the incident and provide timely updates to the community. Residents are advised to remain calm and stay informed through official communication channels. MORE...

Mastercard's Strategic Play: Powering Up Cross-Border Payments with Corpay Partnership

Business

2025-04-29 14:29:06

Mastercard Strengthens Global Payment Solutions with Strategic Corpay Investment In a significant move to enhance cross-border payment capabilities, Mastercard has acquired a 3% stake in Corpay's cross-border business, marking a strategic partnership that promises to revolutionize international financial transactions. The collaboration goes beyond a simple investment, with the two companies establishing exclusive agreements that are set to transform the landscape of global payment solutions. This strategic investment underscores Mastercard's commitment to expanding its reach in the cross-border payment market, leveraging Corpay's expertise and innovative technologies. By joining forces, the companies aim to create more seamless, efficient, and secure international payment experiences for businesses and consumers alike. The exclusive agreements between Mastercard and Corpay signal a powerful synergy that could potentially reshape how cross-border transactions are conducted, offering enhanced value and improved financial connectivity on a global scale. This partnership represents a forward-thinking approach to addressing the complex challenges of international payments in an increasingly interconnected world. MORE...

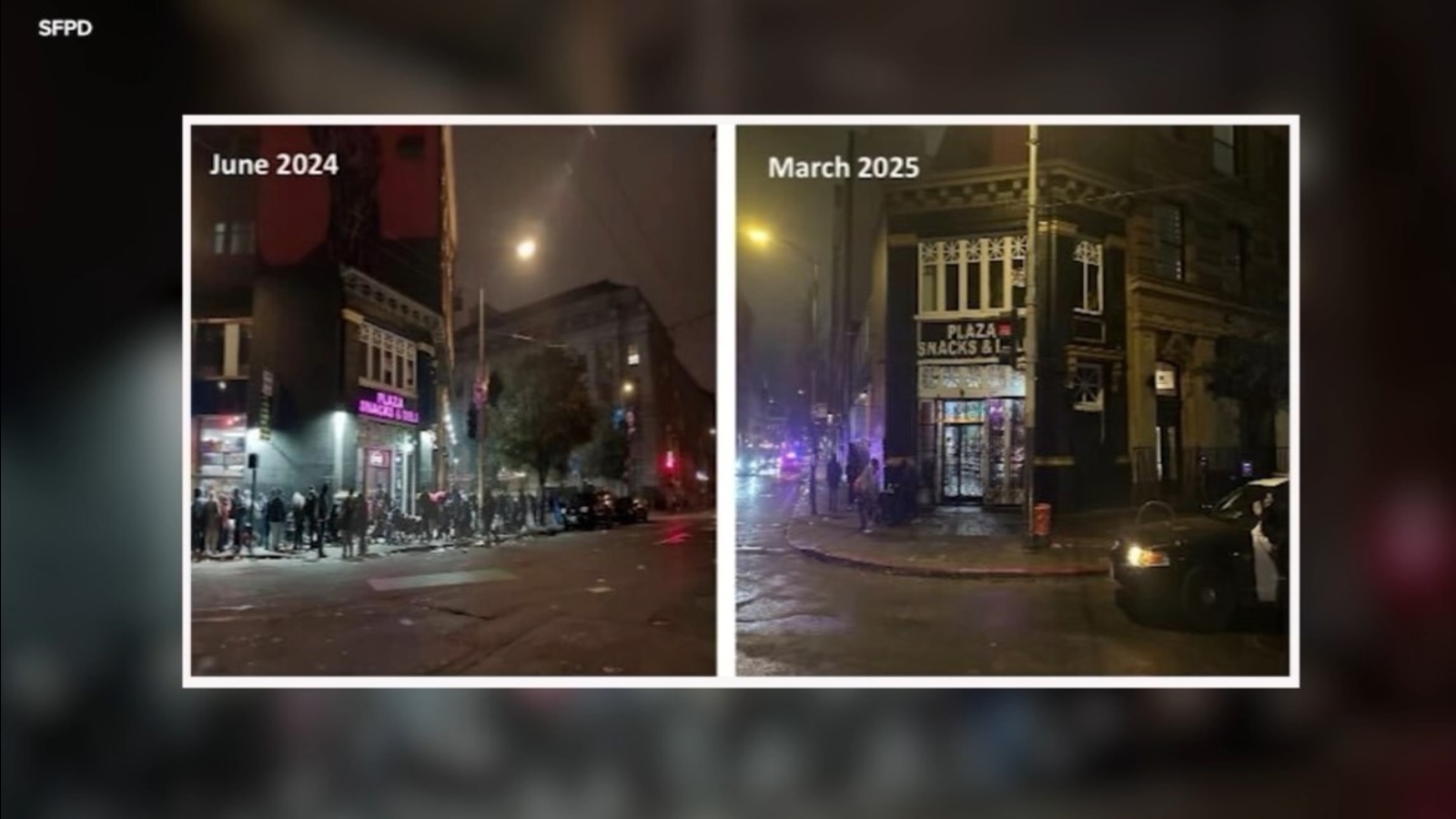

Nighttime Crackdown: Tenderloin Crime Plummets After Business Curfew, City Eyes Wider Rollout

Business

2025-04-29 14:23:30

San Francisco's Tenderloin neighborhood has found an innovative solution to late-night crime and safety concerns through a strategic curfew implemented last summer. The ordinance requires most businesses to shut down between midnight and 5 a.m., aiming to reduce nighttime criminal activity and improve neighborhood safety. Recent data from the San Francisco Police Department (SFPD) suggests the curfew has been remarkably effective. The positive results have caught the attention of city supervisors, who are now considering extending the program to further enhance community security. By limiting business operations during the early morning hours, the curfew has created a more controlled environment, potentially deterring potential criminal incidents and providing residents with a greater sense of peace and safety. The early success of this initiative demonstrates the city's commitment to proactive community-driven solutions for urban safety challenges. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489