Naturenergie Holding's Financial Forecast Stumbles: Annual Earnings Fall Short of Wall Street Predictions

Finance

2025-03-02 06:37:25Content

Naturenergie Holding Navigates Challenging Market Conditions in 2024 Financial Review

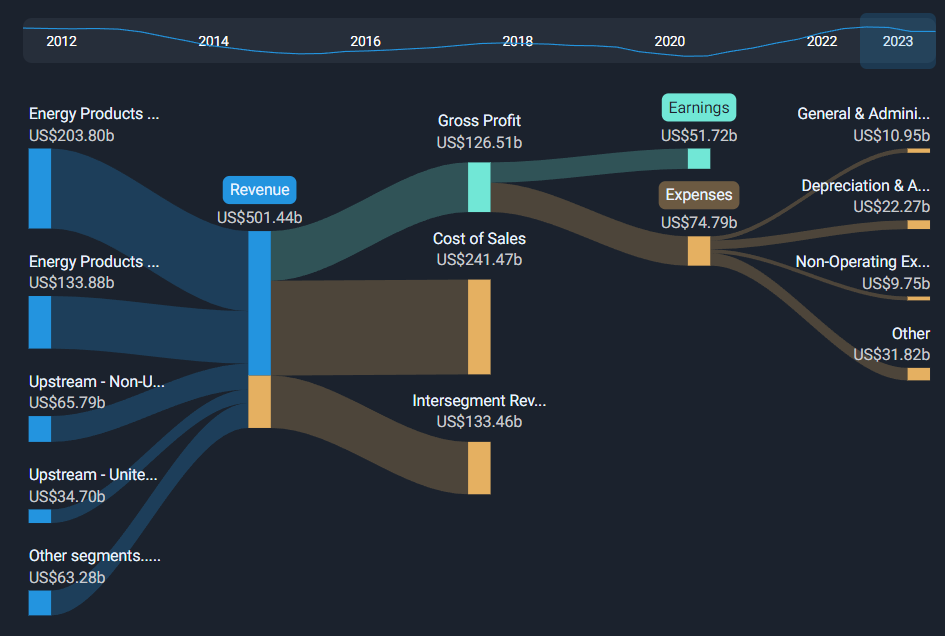

Naturenergie Holding (VTX:NEAG) has released its full-year financial results for 2024, revealing a resilient performance amid complex market dynamics. The company reported a consolidated revenue of €1.76 billion, reflecting an 11% decline compared to the previous fiscal year.

Key Financial Highlights

- Total Revenue: €1.76 billion

- Year-over-Year Change: -11%

- Market Context: Navigating economic headwinds and sector-wide challenges

Despite the revenue reduction, Naturenergie Holding remains committed to strategic optimization and maintaining operational efficiency. The company's leadership emphasized their focus on long-term sustainability and adaptive business strategies in response to the current economic landscape.

Investors and stakeholders are advised to review the comprehensive financial report for deeper insights into the company's performance and future outlook.

Navigating Turbulent Waters: Naturenergie Holding's Financial Odyssey in 2024

In the dynamic landscape of renewable energy, Naturenergie Holding emerges as a pivotal player wrestling with the complex challenges of market volatility and economic transformation. The company's financial performance for the full year 2024 reveals a nuanced narrative of resilience, strategic recalibration, and the ongoing pursuit of sustainable energy solutions in an increasingly competitive global environment.Powering Through Uncertainty: A Financial Journey of Adaptation and Innovation

Revenue Dynamics and Market Positioning

The financial trajectory of Naturenergie Holding in 2024 presents a compelling study of strategic adaptation. With revenues declining by 11% compared to the previous fiscal year, the company confronts a multifaceted challenge that extends far beyond mere numerical representations. This downturn is not simply a setback but a reflection of the intricate market dynamics reshaping the renewable energy sector. The decline in revenue signals a profound transformation occurring within the industry. Global economic pressures, shifting regulatory landscapes, and technological disruptions have created a complex ecosystem where traditional revenue models are being fundamentally reimagined. Naturenergie Holding's experience mirrors the broader challenges faced by renewable energy enterprises navigating an increasingly volatile market environment.Strategic Resilience and Technological Innovation

Despite the revenue contraction, Naturenergie Holding demonstrates remarkable strategic resilience. The company's approach transcends traditional reactive strategies, embracing a proactive model of technological innovation and market adaptation. By investing in cutting-edge renewable technologies and exploring novel market segments, the organization positions itself as a forward-thinking entity capable of transforming challenges into opportunities. The strategic pivot involves not just technological innovation but a holistic reimagining of business models. This includes exploring alternative revenue streams, enhancing operational efficiency, and developing more flexible and responsive organizational structures that can quickly adapt to changing market conditions.Economic and Regulatory Landscape

The renewable energy sector in 2024 operates within a complex web of economic and regulatory considerations. Naturenergie Holding's financial performance reflects the broader challenges of navigating increasingly sophisticated policy environments, international trade dynamics, and evolving sustainability standards. Government policies, carbon pricing mechanisms, and international climate agreements play a crucial role in shaping the operational landscape for renewable energy companies. Naturenergie Holding's ability to strategically respond to these multifaceted challenges demonstrates a sophisticated understanding of the intricate relationships between economic performance, technological innovation, and regulatory compliance.Future Outlook and Strategic Positioning

Looking forward, Naturenergie Holding appears poised to leverage its strategic insights and technological capabilities. The company's response to the 2024 financial challenges suggests a robust and adaptive approach that goes beyond mere survival, focusing instead on sustainable growth and market leadership. The organization's commitment to renewable energy technologies, combined with its ability to navigate complex market dynamics, positions it as a potential trendsetter in the evolving global energy landscape. By embracing innovation, maintaining financial discipline, and remaining responsive to market changes, Naturenergie Holding demonstrates the resilience required to thrive in an increasingly competitive and dynamic sector.RELATED NEWS

Market Pulse: Pound Sterling, Gold, and Oil Prices Spark Global Investor Attention

Digital Revolution: Russia's Financial Vision Reshapes BRICS Economic Landscape