Market Pulse: Pound Sterling, Gold, and Oil Prices Spark Global Investor Attention

Finance

2025-02-17 09:30:20Content

The British pound is staging a remarkable comeback, climbing higher after experiencing its most impressive performance in 2023. Currency traders are buzzing with excitement as the sterling demonstrates renewed strength in the financial markets.

Following a turbulent period of economic uncertainty, the pound has shown resilience and momentum, signaling growing confidence among investors. Market analysts attribute this upward trajectory to a combination of factors, including improving economic indicators and shifting global monetary policies.

The currency's recent surge represents a significant turning point, marking its best weekly performance this year. Investors are closely watching the pound's movements, sensing potential opportunities in the currency markets.

Economic experts suggest that the pound's recovery could be a positive sign of stabilization in the UK's financial landscape. The momentum suggests a potential shift in market sentiment and renewed optimism about the British economy's prospects.

As global financial dynamics continue to evolve, the pound's current performance offers an intriguing glimpse into the potential economic recovery and investor sentiment in the United Kingdom.

Currency Dynamics: British Pound's Remarkable Surge in Global Markets

In the intricate landscape of international finance, currency markets continue to demonstrate remarkable volatility and resilience, with the British pound emerging as a standout performer in recent trading sessions. Investors and economic analysts are closely monitoring the pound's unexpected momentum, which signals potential shifts in global economic sentiment and monetary policy.Breaking Barriers: The Pound's Unprecedented Weekly Performance

Market Momentum and Economic Indicators

The British pound has experienced a transformative week, showcasing unprecedented strength against major global currencies. Sophisticated financial mechanisms and complex economic indicators have converged to create an extraordinary environment for currency trading. Macroeconomic factors, including international trade dynamics, central bank policies, and geopolitical developments, have collectively contributed to the pound's remarkable trajectory. Sophisticated investors are meticulously analyzing the underlying drivers of this exceptional performance. The intricate interplay between monetary policy, international investment flows, and broader economic indicators has created a nuanced landscape that demands comprehensive understanding and strategic interpretation.Global Economic Context and Currency Valuation

The pound's recent performance represents more than a mere statistical anomaly; it reflects deeper structural changes within the global financial ecosystem. International investors are recalibrating their perspectives, recognizing the potential for significant value appreciation in British financial markets. Economic analysts have identified multiple contributing factors to this extraordinary currency movement. Structural reforms, potential shifts in trade relationships, and evolving monetary policy frameworks have all played crucial roles in shaping the pound's current momentum. The complex web of international financial interactions continues to generate fascinating insights into currency valuation mechanisms.Investor Sentiment and Market Psychology

Psychological factors play an increasingly significant role in contemporary financial markets. The pound's recent performance has triggered a cascade of investor confidence, creating a self-reinforcing cycle of positive market sentiment. Institutional and retail investors alike are reassessing their strategic approaches in light of these unexpected market dynamics. The nuanced interplay between objective economic data and subjective market perception creates a fascinating narrative of financial evolution. Sophisticated market participants are continuously adapting their strategies, recognizing the fluid nature of global currency markets and the potential for rapid transformational shifts.Technical Analysis and Future Projections

Advanced computational models and sophisticated algorithmic trading platforms are providing unprecedented insights into potential future currency movements. Technical analysts are employing complex mathematical frameworks to decode the pound's recent performance and project potential future trajectories. While historical data provides valuable context, the most astute financial professionals understand the inherent unpredictability of currency markets. The pound's current momentum represents a compelling case study in the complex, dynamic nature of global financial systems.Broader Economic Implications

The pound's remarkable week extends far beyond immediate currency valuation. It represents a potential harbinger of broader economic transformations, signaling potential shifts in international trade dynamics, investment strategies, and monetary policy frameworks. Economists and financial strategists are carefully examining these developments, recognizing that currency movements are not isolated phenomena but integral components of a complex, interconnected global economic ecosystem.RELATED NEWS

Finance

Blazing Insights: How California's Wildfire Crisis Is Sparking Revolutionary Insurance Solutions

2025-03-01 15:58:52

Finance

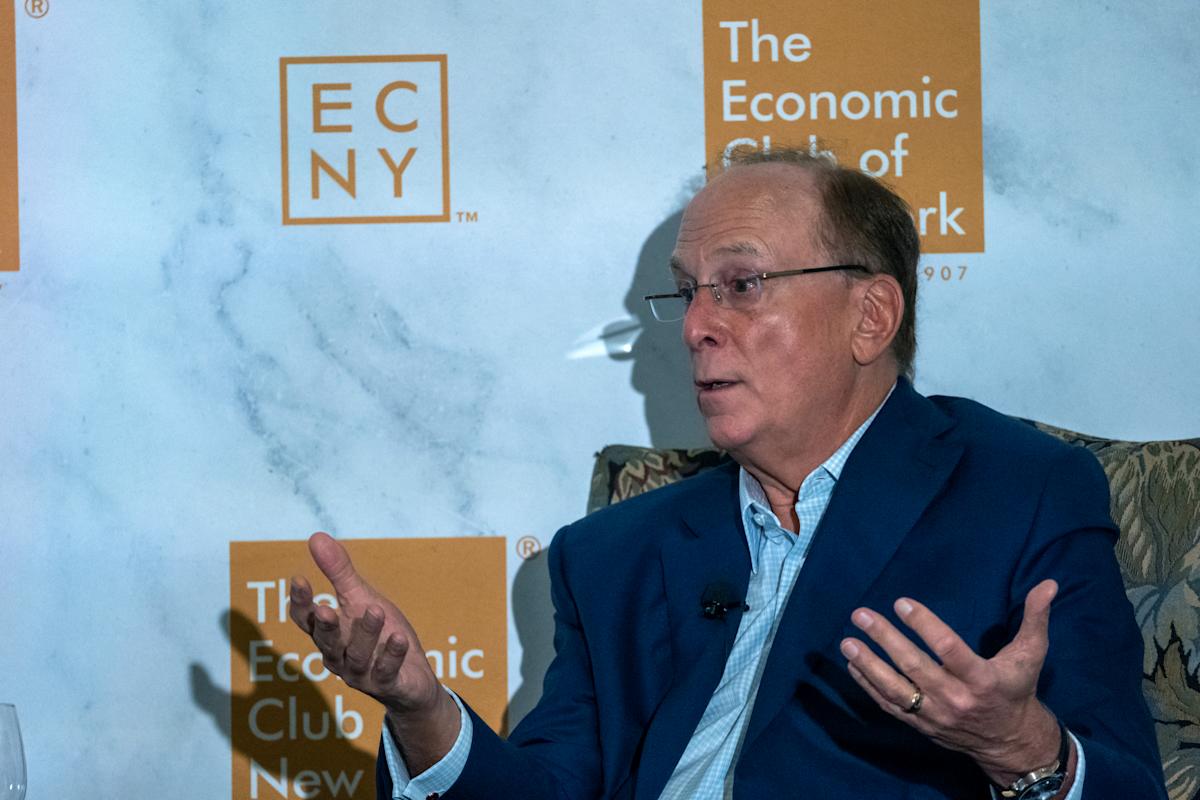

Corporate Pulse: CEOs Signal Economic Storm Brewing, BlackRock's Fink Reveals

2025-04-07 18:16:53