Reviving American Manufacturing: A Bold Blueprint for Industrial Renaissance

Finance

2025-03-13 14:00:00Content

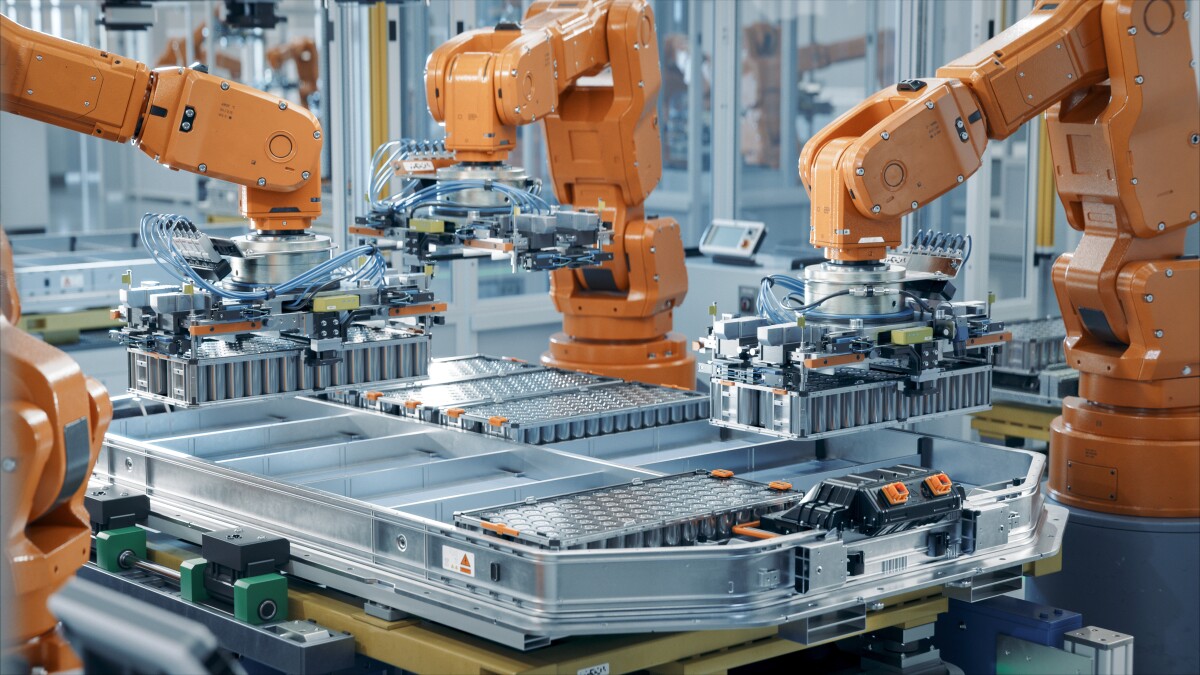

The Industrial Revolution's remarkable economic transformation was fueled by a sophisticated financial ecosystem that strategically combined equity investments, private debt instruments, and public sector funding. Today, the United States faces a critical challenge: maintaining its global economic leadership by reimagining how large-scale infrastructure projects are financed.

Just as innovative financial approaches drove unprecedented growth during the industrial era, modern economic competitiveness demands creative and flexible funding mechanisms. By embracing a dynamic blend of private and public capital, the nation can unlock new opportunities for infrastructure development, technological advancement, and sustainable economic expansion.

The key lies in developing more agile, collaborative financing models that can attract diverse investment sources, mitigate risks, and accelerate critical infrastructure projects. This approach will not only modernize critical national infrastructure but also position the United States at the forefront of global economic innovation.

Reimagining Infrastructure: The Financial Alchemy of National Development

In the complex landscape of economic transformation, nations stand at a critical crossroads where innovative financial strategies determine the trajectory of progress. The intricate dance of capital allocation, investment mechanisms, and strategic funding models has become the cornerstone of sustainable national development, challenging traditional approaches to infrastructure and economic growth.Unlocking America's Economic Potential Through Revolutionary Financing

The Evolving Paradigm of Capital Deployment

Modern economic landscapes demand unprecedented creativity in financial engineering. Traditional funding models are rapidly becoming obsolete, replaced by sophisticated hybrid approaches that blend public and private capital streams. The United States finds itself at a pivotal moment where strategic investment mechanisms can dramatically reshape economic infrastructure. Sophisticated investors and policymakers are increasingly recognizing that economic transformation requires more than conventional funding strategies. By integrating equity investments, private debt instruments, and targeted public sector interventions, nations can create robust economic ecosystems that drive sustainable growth and technological innovation.Navigating the Complex Terrain of Infrastructure Investment

Infrastructure development represents more than mere construction—it's a nuanced strategic endeavor requiring multifaceted financial approaches. Contemporary economic architects must design funding models that transcend traditional boundaries, creating flexible frameworks capable of adapting to rapidly changing technological and economic landscapes. The convergence of public and private capital represents a powerful mechanism for accelerating national development. By strategically aligning investment incentives, governments can unlock unprecedented potential, transforming infrastructure from a cost center into a dynamic economic catalyst that generates long-term value and competitive advantage.Technological Innovation and Financial Creativity

Emerging technologies are fundamentally reshaping investment paradigms. Artificial intelligence, blockchain, and advanced data analytics are providing unprecedented insights into infrastructure investment strategies, enabling more precise risk assessment and capital allocation. Financial institutions and government agencies are developing increasingly sophisticated models that leverage data-driven decision-making. These approaches allow for more granular understanding of potential investment opportunities, reducing uncertainty and creating more resilient economic development strategies.Global Competitiveness and Strategic Investment

In an increasingly interconnected global economy, nations must view infrastructure investment as a critical competitive strategy. The ability to rapidly deploy capital, embrace technological innovation, and create adaptive economic frameworks will determine future economic leadership. The United States stands at a crucial juncture where strategic financial innovation can redefine its global economic positioning. By developing more creative, flexible, and technologically integrated investment approaches, the nation can maintain its position as a global economic powerhouse.Sustainable Development Through Intelligent Financing

Sustainable economic growth requires a holistic approach that balances immediate infrastructure needs with long-term environmental and social considerations. Modern financing strategies must incorporate comprehensive evaluation metrics that extend beyond traditional financial returns. Innovative funding models are emerging that integrate environmental, social, and governance (ESG) principles directly into investment frameworks. These approaches recognize that true economic progress must simultaneously address infrastructure development, technological innovation, and broader societal challenges.The Future of Economic Transformation

As global economic dynamics continue to evolve, nations must develop increasingly sophisticated approaches to capital deployment. The most successful economies will be those capable of creating flexible, technology-enabled financial ecosystems that can rapidly adapt to emerging challenges and opportunities. The journey of economic transformation is ongoing, requiring continuous innovation, strategic thinking, and a willingness to challenge existing paradigms. By embracing creative financing strategies, nations can unlock unprecedented potential and shape a more dynamic, resilient economic future.RELATED NEWS

Finance

Unlock Financial Freedom: The $150 Hack That Transforms Your Spring Cleanup

2025-04-01 15:03:34