Money Stress Decoded: 5 Expert Strategies to Survive Economic Turbulence

Finance

2025-04-30 19:32:00Content

In today's unpredictable economic landscape, stock market turbulence and the looming threat of new tariffs can send shivers down any investor's spine. But don't panic—financial experts have strategies to help you weather these uncertain times with confidence.

We sat down with a certified financial planner to unpack the complexities of navigating market volatility and potential price increases. The key is staying calm, informed, and strategic about your financial decisions.

Understanding that market fluctuations are a natural part of economic cycles can help reduce anxiety. Instead of making impulsive decisions driven by fear, focus on maintaining a diversified investment portfolio and keeping a long-term perspective. Your financial advisor can help you assess your current strategy and make prudent adjustments that align with your personal financial goals.

Remember, turbulent markets also present unique opportunities for savvy investors. By staying educated, maintaining a balanced approach, and seeking professional guidance, you can transform financial uncertainty into a chance for strategic growth and financial resilience.

Navigating Financial Turbulence: A Comprehensive Guide to Protecting Your Wealth in Uncertain Markets

In an era of unprecedented economic complexity, investors find themselves navigating a treacherous financial landscape fraught with volatility, unexpected market shifts, and global economic uncertainties. The current economic environment demands not just passive observation, but active, strategic financial management that goes beyond traditional investment approaches.Mastering Your Financial Destiny in Unpredictable Economic Terrain

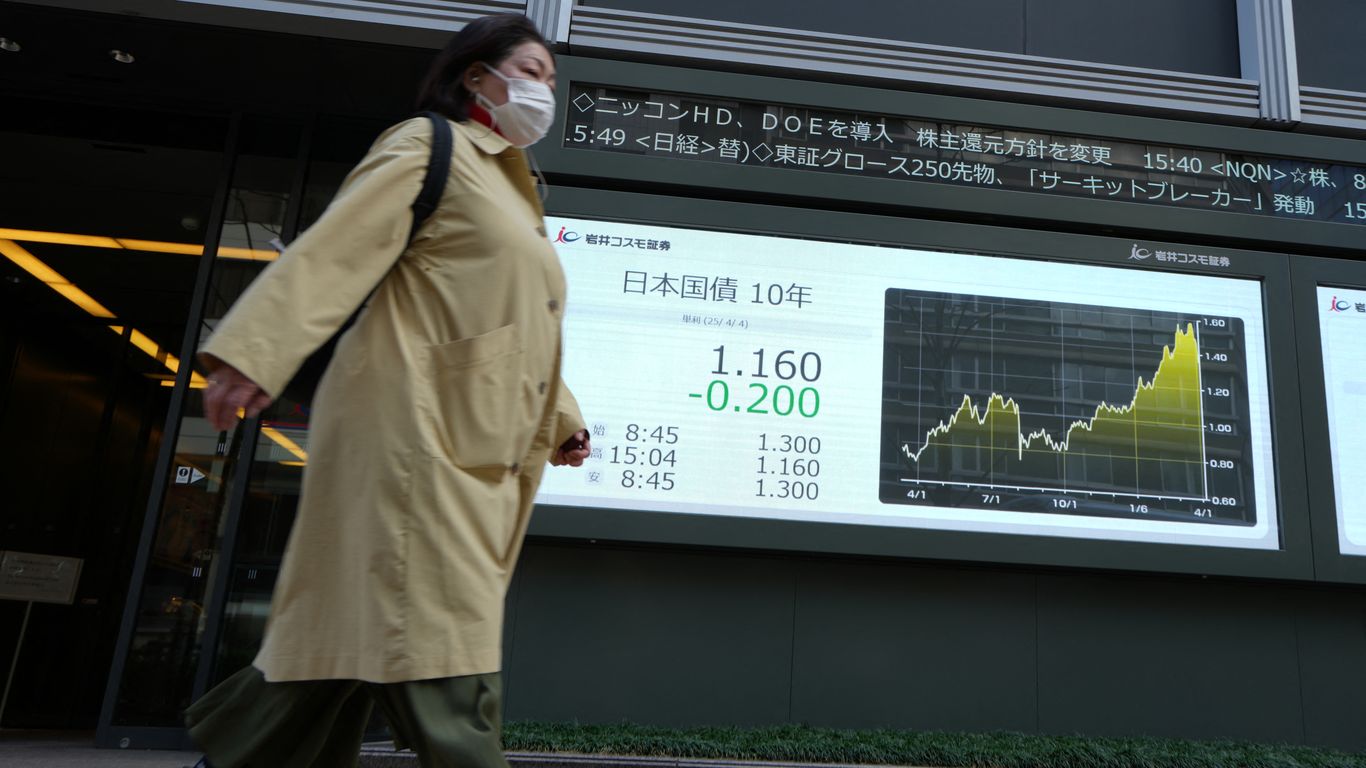

Understanding Market Volatility: The New Economic Paradigm

The contemporary financial ecosystem has transformed dramatically, rendering traditional investment strategies increasingly obsolete. Modern investors must develop a nuanced understanding of market dynamics that transcend simplistic economic models. Global economic interconnectedness means that geopolitical events, technological disruptions, and regulatory changes can instantaneously impact investment portfolios. Sophisticated investors recognize that volatility isn't merely a challenge but an opportunity for strategic repositioning. By cultivating financial adaptability, individuals can transform market uncertainties into potential wealth-generation mechanisms. This requires a holistic approach that integrates comprehensive market analysis, risk management, and proactive financial planning.Strategic Financial Planning in the Age of Uncertainty

Developing a robust financial strategy demands more than conventional wisdom. Today's investors must embrace a multifaceted approach that combines rigorous analytical frameworks with emotional intelligence. Certified financial planners emphasize the critical importance of diversification, not just across asset classes, but across geographical and sectoral boundaries. Risk mitigation becomes paramount in this complex economic landscape. Investors should consider implementing dynamic asset allocation strategies that can rapidly adapt to changing market conditions. This might involve leveraging sophisticated financial instruments, exploring alternative investment vehicles, and maintaining a flexible investment philosophy that can pivot quickly in response to emerging economic trends.Tariffs and Economic Policy: Navigating Regulatory Complexities

The implementation of new tariffs represents a significant potential disruptor in the global economic ecosystem. Savvy investors must develop a nuanced understanding of how these regulatory changes can impact various market segments. This requires continuous monitoring of international trade dynamics, understanding geopolitical tensions, and anticipating potential economic ripple effects. Proactive financial management in this context involves developing scenario-based investment strategies. By creating multiple contingency plans, investors can position themselves to capitalize on potential market inefficiencies while simultaneously protecting their financial interests against potential downside risks.Psychological Resilience in Financial Decision-Making

Beyond technical financial strategies, successful wealth management demands exceptional psychological fortitude. The ability to maintain emotional equilibrium during market turbulence distinguishes exceptional investors from average market participants. This requires developing a disciplined approach that separates emotional impulses from rational financial decision-making. Implementing structured decision-making frameworks, practicing mindful investing, and maintaining a long-term perspective can help investors navigate complex market environments. Continuous financial education, staying informed about global economic trends, and cultivating a growth mindset become essential components of successful wealth management.RELATED NEWS

Finance

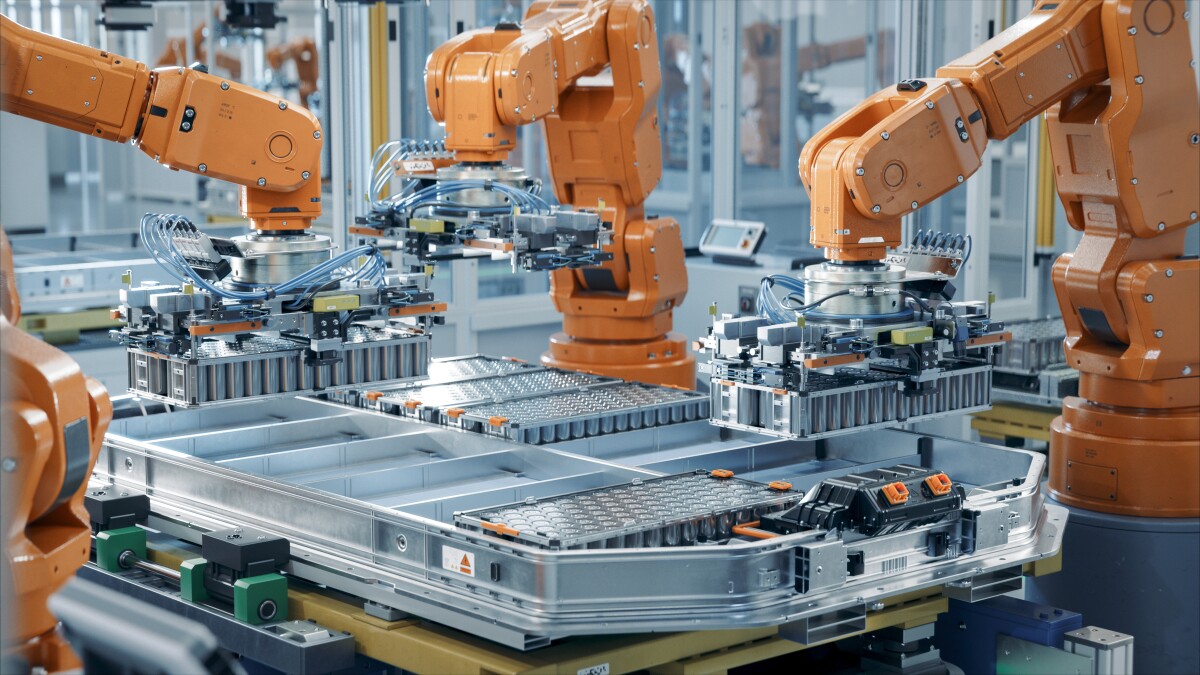

Reviving American Manufacturing: A Bold Blueprint for Industrial Renaissance

2025-03-13 14:00:00

Finance

Shield for Seniors: N.J. Unveils Digital Weapon Against Financial Predators

2025-03-27 14:55:08

Finance

Behind Bars and Battling: The Untold Story of Victor Selormey's Judicial Ordeal

2025-02-17 12:42:16