Wall Street Insider Reveals: The Shocking Truth Behind America's Financial Foundations

Finance

2025-04-24 15:30:53Content

April 23, 2025 – What was supposed to be a week of "Liberation Day" according to government officials turned into a pivotal moment in financial history. Instead of celebrating, the United States witnessed the dramatic end of its long-standing privileged status in the global investment landscape.

The week of April 2 marked a transformative shift, effectively stripping away the nation's once-unassailable economic reputation. Where the U.S. had previously been viewed as a unique and untouchable investment haven, it now found itself mirroring the economic vulnerabilities of countries like Italy – a stark and unsettling comparison for a nation accustomed to economic supremacy.

This watershed moment signaled more than just a financial transition; it represented a fundamental reshaping of global economic perceptions, challenging long-held assumptions about American economic exceptionalism and revealing the fragility of international financial standings.

The Twilight of American Financial Exceptionalism: A Seismic Shift in Global Investment Dynamics

In the intricate landscape of global finance, moments of profound transformation often arrive quietly, without fanfare, yet with consequences that reverberate through decades of economic paradigms. The week of April 2, 2025, emerged as one such pivotal moment, marking a watershed in the United States' long-standing financial narrative.When Global Perception Transforms Overnight

The Erosion of Investment Confidence

The United States has long been perceived as the golden standard of investment reliability, a beacon of economic stability that attracted global capital with an almost magnetic pull. However, recent geopolitical tensions, mounting national debt, and structural economic challenges have gradually chipped away at this pristine reputation. Investors, once viewing American markets as an unassailable fortress of financial security, now approach with heightened skepticism and calculated caution. Sophisticated international investors have begun recalibrating their portfolios, recognizing that the traditional narrative of American economic invincibility no longer holds absolute truth. The transformation is subtle yet profound, reminiscent of historical shifts that have reshaped global economic landscapes.Comparative Economic Vulnerability

The comparison to Italy is not merely metaphorical but represents a nuanced analysis of economic vulnerability. Just as Italy experienced periods of economic instability and reduced investor confidence, the United States now confronts similar challenges that threaten its long-standing financial supremacy. Structural economic weaknesses, including an increasingly polarized political environment, infrastructure challenges, and complex monetary policies, have contributed to this perception shift. International financial analysts are now scrutinizing American economic indicators with the same critical lens previously reserved for emerging markets.Global Capital Reallocation Strategies

Institutional investors are implementing sophisticated risk mitigation strategies, diversifying investments across multiple geographical regions. The traditional safe-haven status of U.S. Treasury bonds is being reevaluated, with emerging markets and alternative investment vehicles gaining increased attention. This reallocation is not a sudden exodus but a calculated, methodical approach to risk management. Hedge funds, sovereign wealth funds, and multinational corporations are developing more nuanced investment frameworks that transcend traditional geographical boundaries.Technological and Geopolitical Disruptions

The convergence of technological disruption and geopolitical complexity has accelerated this transformative process. Blockchain technologies, decentralized finance, and emerging economic powers are reshaping the global investment landscape, challenging traditional American financial hegemony. Cryptocurrency markets, renewable energy investments, and technology-driven economic models are providing alternative pathways for global capital, further eroding the United States' monopolistic investment appeal.Psychological and Strategic Implications

Beyond numerical metrics, this shift represents a profound psychological transformation in global investment consciousness. The narrative of American economic exceptionalism is being rewritten, not through dramatic collapse, but through a gradual, almost imperceptible recalibration of expectations. International investors are developing more nuanced, multi-dimensional perspectives that recognize the interconnected and dynamic nature of contemporary global economics. The United States is no longer viewed as an unassailable economic titan but as one significant player in a complex, multipolar financial ecosystem.RELATED NEWS

Finance

Wall Street's Regret: How Trump Supporters in Finance Are Changing Their Tune

2025-04-07 17:11:41

Finance

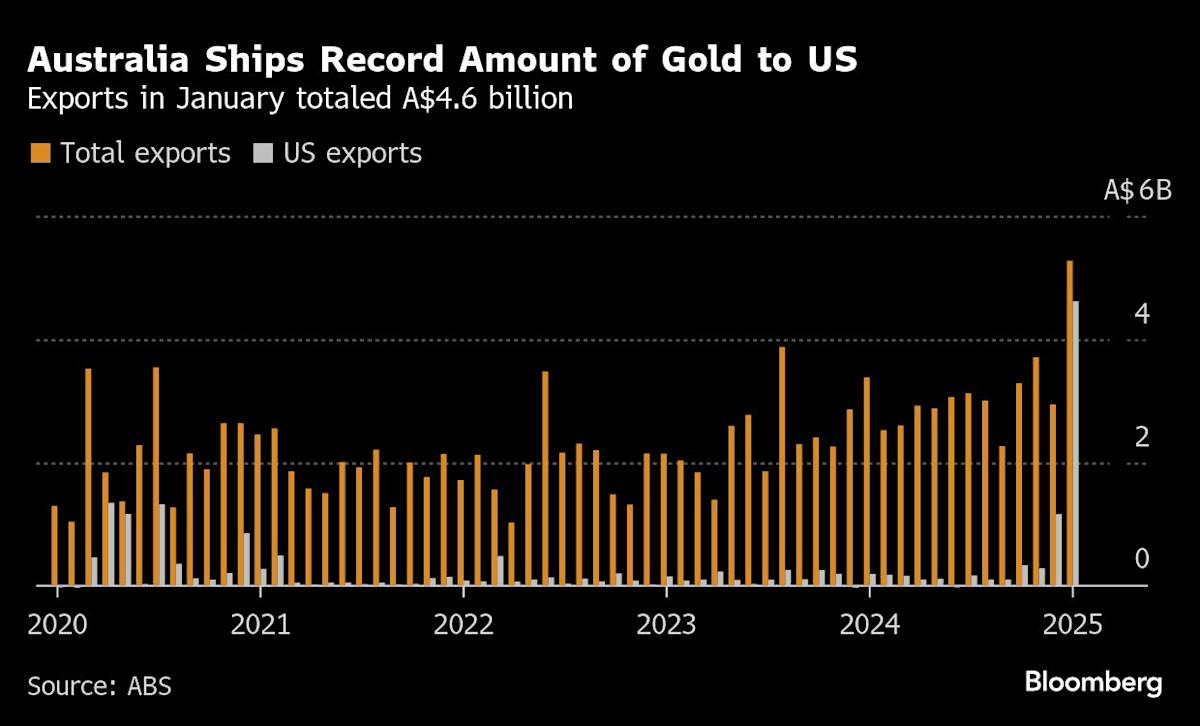

Gold Rush 2.0: Australia Floods US Markets with Unprecedented Precious Metal Shipment

2025-03-07 06:53:58