Breaking: International Personal Finance Defies Odds with Surprise Earnings Triumph

Finance

2025-02-28 05:28:54Content

International Personal Finance Reveals Robust Financial Performance for 2024

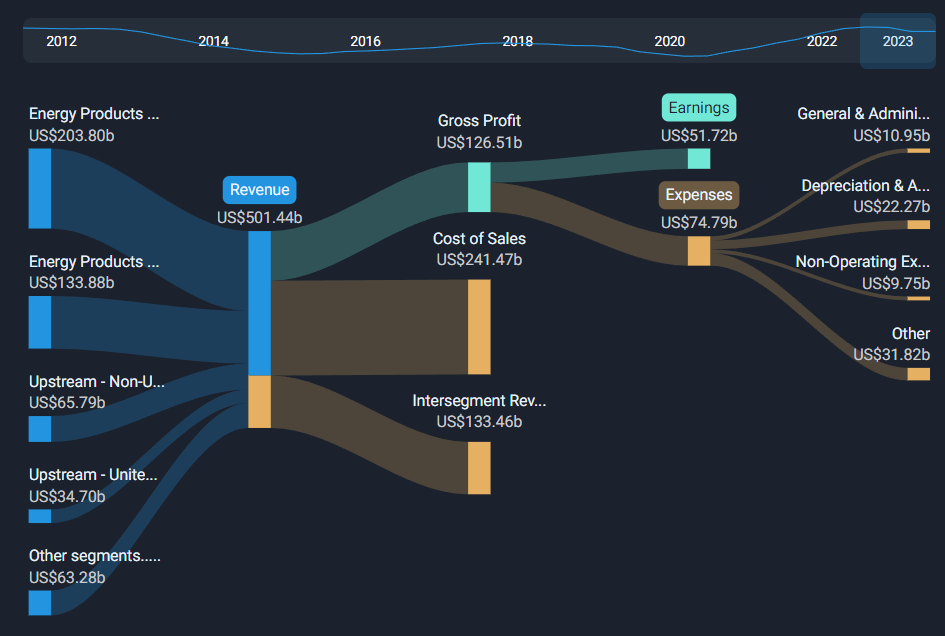

International Personal Finance (LON:IPF) has unveiled its full-year financial results for 2024, demonstrating resilience in a challenging economic landscape. Despite facing market headwinds, the company has maintained a strong financial position.

Key Financial Highlights

- Revenue: £726.3 million, representing a 5.4% decline from the previous year

- Strategic cost management initiatives implemented

- Continued focus on operational efficiency and market adaptation

The slight revenue reduction reflects the complex economic environment, but the company remains confident in its strategic approach and long-term growth potential. Management emphasized their commitment to navigating market challenges while preserving shareholder value.

Investors and analysts will be closely monitoring the company's future strategies and potential market recovery plans in the coming quarters.

Financial Fortunes: International Personal Finance's Rollercoaster Year Unveiled

In the dynamic world of financial services, International Personal Finance (IPF) stands as a testament to resilience and strategic adaptation, navigating through complex market landscapes with calculated precision and unwavering determination.Transforming Challenges into Opportunities: A Financial Odyssey Revealed

Market Dynamics and Strategic Positioning

International Personal Finance has demonstrated remarkable agility in confronting unprecedented economic challenges. The company's performance reflects a nuanced understanding of global financial ecosystems, where traditional lending models are continuously evolving. By leveraging sophisticated risk management strategies, IPF has maintained a robust financial framework despite experiencing revenue fluctuations. The organization's approach transcends mere numerical performance, embodying a holistic vision of financial services that prioritizes customer-centric solutions and innovative technological integration. Their ability to adapt swiftly to changing market conditions underscores a profound commitment to sustainable growth and operational excellence.Revenue Landscape and Operational Insights

Delving deeper into the financial narrative, IPF's revenue trajectory reveals a complex tapestry of challenges and opportunities. The reported decline of 5.4% in annual revenue represents more than a statistical metric—it signifies a strategic recalibration in response to volatile economic environments. This nuanced performance stems from multifaceted factors including regulatory shifts, technological disruptions, and evolving consumer financial behaviors. The company's leadership has demonstrated exceptional strategic acumen by maintaining operational efficiency while navigating these intricate market dynamics.Technological Innovation and Digital Transformation

In an era dominated by digital disruption, IPF has positioned itself at the forefront of technological innovation within financial services. Their commitment to digital transformation extends beyond superficial technological adoption, representing a fundamental reimagining of customer engagement and service delivery. By integrating advanced data analytics, artificial intelligence, and machine learning capabilities, the organization has created a sophisticated ecosystem that enhances risk assessment, personalizes customer experiences, and drives operational efficiency. This technological prowess enables IPF to differentiate itself in an increasingly competitive financial landscape.Risk Management and Regulatory Compliance

The financial services sector demands an unprecedented level of regulatory compliance and sophisticated risk management. IPF has distinguished itself by developing a comprehensive approach that balances innovation with stringent risk mitigation strategies. Their robust compliance framework not only meets regulatory requirements but anticipates potential future regulatory shifts. This proactive stance demonstrates a forward-thinking approach that protects stakeholder interests while creating sustainable competitive advantages.Future Outlook and Strategic Vision

Looking beyond immediate financial metrics, IPF's strategic vision encompasses a broader perspective of financial services evolution. The organization is not merely responding to market changes but actively shaping future industry paradigms. By investing in talent development, technological infrastructure, and customer-centric innovations, IPF is positioning itself as a transformative force in the financial services ecosystem. Their approach suggests a long-term commitment to creating value that extends beyond traditional financial performance measurements. The company's resilience, strategic vision, and commitment to innovation paint a compelling narrative of adaptation and growth in an increasingly complex global financial landscape.RELATED NEWS

Finance

Radian's Q1 2025 Earnings: Navigating Financial Horizons with Resilience

2025-04-30 20:30:00

Finance

Cosmic Crossroads: Gemini's Pivotal Day Unveiled - Career Shifts, Financial Whispers, and Romantic Revelations

2025-03-02 02:36:39

Finance

Maldives Unveils Ambitious $8.8B Financial Powerhouse with Qatari Royal Backing

2025-05-04 18:24:43