Climate Cash Crunch: Insider Secrets to Supercharging Your Project Proposals

Finance

2025-04-10 12:00:00Content

tags.

Climate Finance Revolution: Transforming Sri Lanka's Sustainable Development Landscape

In the dynamic world of global climate action, nations are increasingly recognizing the critical importance of strategic financial mechanisms to combat environmental challenges. Sri Lanka stands at a pivotal moment, where innovative climate finance approaches can potentially reshape its economic and ecological future, offering hope and tangible solutions to complex environmental and developmental challenges.Empowering Sustainable Transformation Through Strategic Financial Interventions

The Strategic Imperative of Climate Finance

Climate finance represents a sophisticated and nuanced approach to addressing environmental sustainability beyond traditional funding models. In Sri Lanka's context, this strategy transcends mere monetary allocation, embodying a comprehensive framework for holistic national development. The intricate landscape of climate finance demands sophisticated understanding, integrating economic resilience, environmental protection, and social equity into a cohesive strategic vision. Financial institutions and governmental bodies are increasingly recognizing that climate finance is not just an environmental initiative but a fundamental economic restructuring mechanism. By strategically channeling resources into sustainable infrastructure, renewable energy projects, and climate-resilient agricultural systems, Sri Lanka can simultaneously address ecological challenges and stimulate economic growth.Innovative Funding Mechanisms and Technological Integration

The evolution of climate finance in Sri Lanka necessitates groundbreaking funding mechanisms that leverage cutting-edge technological platforms. Blockchain technologies, green bonds, and digital financial instruments are emerging as transformative tools in mobilizing and tracking climate-related investments. These innovative approaches provide unprecedented transparency, enabling precise monitoring of financial flows and ensuring accountability in sustainable development projects. Digital platforms are revolutionizing how climate finance is conceptualized, implemented, and evaluated. By creating sophisticated tracking systems, stakeholders can now assess the real-time impact of financial interventions, providing granular insights into the effectiveness of climate-related investments. This technological integration represents a paradigm shift in how nations approach environmental financing.Collaborative Ecosystem and International Partnerships

Successful climate finance implementation requires robust collaborative ecosystems that transcend traditional governmental boundaries. International partnerships, multilateral agreements, and cross-sector collaborations are becoming increasingly crucial in developing comprehensive climate finance strategies. Sri Lanka's approach must emphasize building strong networks with global financial institutions, research organizations, and climate action platforms. These collaborative frameworks enable knowledge exchange, technological transfer, and shared learning experiences. By fostering an environment of mutual cooperation, Sri Lanka can leverage global expertise while simultaneously developing localized solutions that address its unique environmental and economic challenges.Capacity Building and Human Capital Development

The true potential of climate finance lies not just in monetary resources but in developing human capital capable of driving sustainable transformation. Comprehensive training programs, educational initiatives, and skill development workshops are essential in creating a workforce equipped to design, implement, and manage climate-related financial strategies. Investing in human potential means cultivating a generation of professionals who understand the intricate connections between financial mechanisms, environmental sustainability, and socio-economic development. This approach ensures that climate finance becomes more than a theoretical concept, transforming into a practical, implementable strategy that can drive meaningful change.Risk Mitigation and Adaptive Strategies

Climate finance must inherently incorporate sophisticated risk mitigation strategies that anticipate and respond to dynamic environmental challenges. This requires developing adaptive financial frameworks capable of responding to unpredictable climate scenarios, technological disruptions, and evolving global economic landscapes. By creating flexible, resilient financial models, Sri Lanka can position itself as a forward-thinking nation capable of navigating complex environmental and economic uncertainties. These adaptive strategies involve continuous monitoring, predictive analysis, and agile response mechanisms that can quickly reallocate resources in response to emerging challenges.RELATED NEWS

Finance

Breaking: Europe's Defense Budget Dilemma - Can Funding Solve Security Challenges?

2025-02-21 08:55:06

Finance

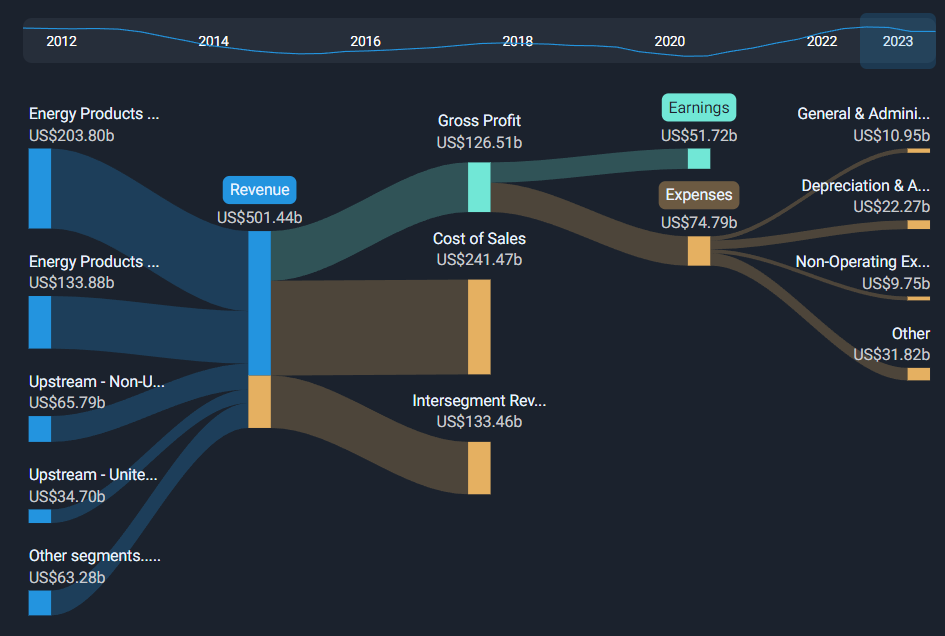

Ocean Vantage Holdings Surges: Earnings Per Share Doubles in Breakthrough 2024 Financial Year

2025-03-03 02:07:36