Wall Street's Lifeline: How 1,600+ Financial Giants Raced to the Fed's Emergency Rescue

Finance

2025-03-12 20:35:51Content

Over 1,600 Banks Leverage Fed's Emergency Lending Program During Financial Turbulence

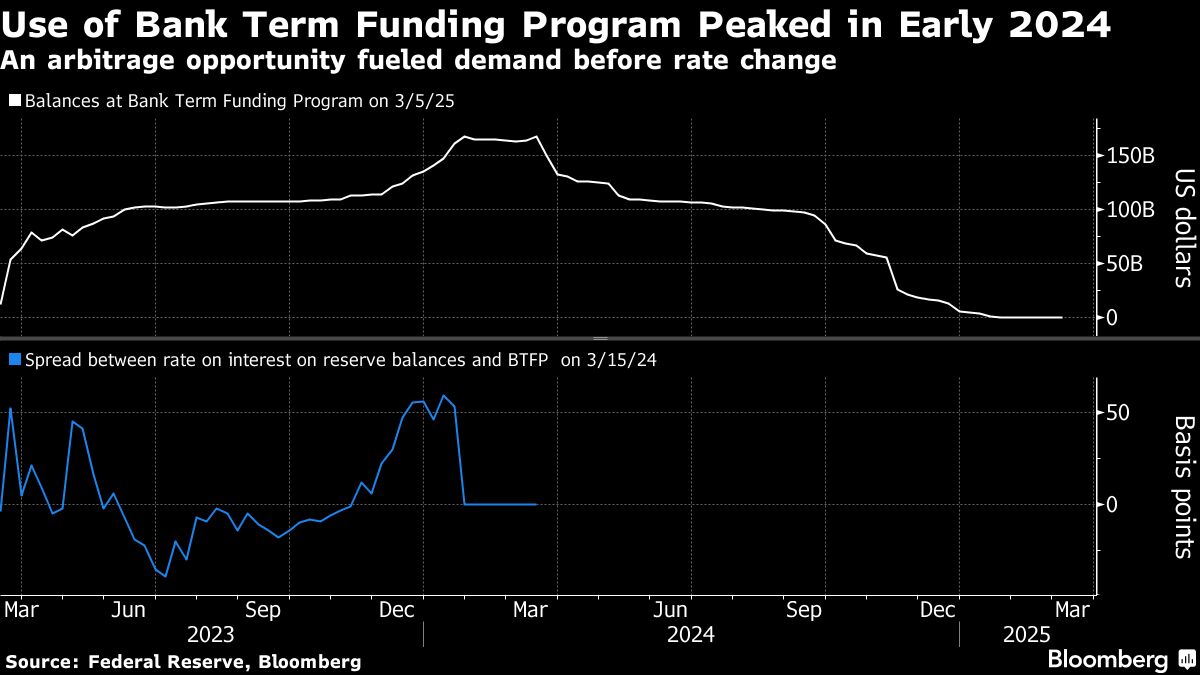

In a remarkable display of financial resilience, more than 1,600 banks and their affiliated subsidiaries have utilized the Federal Reserve's emergency lending initiative, which was strategically designed to provide critical support during the regional banking crisis that unfolded two years ago.

The extensive participation in this emergency lending program underscores the significant challenges faced by financial institutions and highlights the Federal Reserve's proactive approach to stabilizing the banking sector during uncertain economic times.

This unprecedented level of engagement demonstrates the widespread impact of the regional banking turmoil and the crucial role of the Fed's financial safety net in maintaining economic stability.

The lending program served as a lifeline for numerous banks, offering them much-needed liquidity and confidence during a period of heightened financial uncertainty.

Banking's Hidden Lifeline: How 1,600 Financial Institutions Survived the Economic Storm

In the tumultuous landscape of financial uncertainty, banks across the United States discovered an unexpected guardian angel in the Federal Reserve's emergency lending program. This critical financial mechanism emerged as a beacon of hope during a period of unprecedented regional banking challenges, offering a sophisticated safety net that prevented potential systemic collapse.When Financial Survival Hangs in the Balance: A Critical Intervention Strategy

The Unprecedented Scale of Financial Rescue

The Federal Reserve's emergency lending initiative represented more than a mere financial instrument; it was a comprehensive lifeline that transformed the banking ecosystem. By extending targeted support, the program demonstrated remarkable adaptability in confronting complex economic challenges. Financial institutions, ranging from regional banks to substantial subsidiaries, found themselves navigating treacherous economic waters, ultimately discovering stability through this strategic intervention. Remarkably, over 1,600 banking entities leveraged this critical support mechanism, revealing the profound depth of economic uncertainty pervading the financial sector. Each participating institution represented a unique narrative of resilience, strategically positioning themselves to weather potentially devastating economic turbulence.Decoding the Mechanics of Emergency Financial Support

The lending program's intricate design allowed banks to access crucial capital during moments of extreme vulnerability. Unlike traditional lending frameworks, this emergency strategy incorporated flexible parameters that recognized the nuanced challenges facing different financial institutions. By providing rapid, targeted financial support, the Federal Reserve effectively prevented potential domino effects that could have destabilized broader economic structures. Banking experts noted the program's unprecedented scope, highlighting how it transcended conventional rescue mechanisms. The support wasn't merely about preventing individual bank failures but maintaining overall economic ecosystem integrity.Strategic Implications for Future Economic Resilience

This extraordinary intervention signaled a profound shift in how financial regulators approach economic challenges. The Federal Reserve demonstrated an ability to rapidly deploy sophisticated financial tools, transforming potential crisis points into opportunities for institutional adaptation and growth. The program's success underscored the critical importance of proactive economic management. By creating a responsive, dynamic support framework, financial authorities could mitigate risks before they escalated into systemic threats. Each participating bank's experience contributed to a broader understanding of economic vulnerability and institutional resilience.Long-Term Transformative Impact

Beyond immediate financial stabilization, the emergency lending program catalyzed significant structural changes within the banking industry. Institutions were compelled to reassess their risk management strategies, operational frameworks, and long-term sustainability models. The Federal Reserve's intervention represented more than a temporary solution; it was a transformative moment that reshaped understanding of financial institutional support. Banks emerged not just surviving, but fundamentally reimagined, with enhanced capabilities to navigate future economic uncertainties.Lessons in Economic Adaptability

The narrative surrounding this emergency lending program transcends traditional financial discourse. It illuminates the complex, interconnected nature of modern economic systems, where rapid, intelligent intervention can prevent potential catastrophic failures. Financial leaders and policymakers will undoubtedly study this period as a critical case study in economic resilience, institutional support, and the delicate balance between regulatory oversight and market dynamics.RELATED NEWS

Retail Giant Hudson's Bay on the Brink: Financial Turmoil Sparks Liquidation Countdown

Financial Firms on Edge: CFPB's Uncertain Future Sparks Industry Tremors