Money Matters: Why Linking Finances with Mom and Dad Could Be Your Smartest Move Yet

Finance

2025-02-17 11:00:00Content

Navigating Financial Care: A Compassionate Guide to Joint Bank Accounts for Seniors

As our loved ones age, managing their financial well-being becomes an increasingly important responsibility. Opening a joint bank account can be a thoughtful and practical solution for families seeking to provide financial support and oversight for elderly relatives.

A joint account offers more than just convenience—it's a powerful tool for maintaining financial transparency and ensuring the financial safety of aging family members. By sharing access to the account, you can help monitor spending, detect potential financial abuse, and provide timely assistance if needed.

Key benefits of establishing a joint account include:

• Real-time transaction tracking

• Immediate ability to help with bill payments

• Quick intervention if unusual spending patterns emerge

• Simplified financial management during challenging times

When considering a joint account, approach the conversation with sensitivity and respect. Discuss the benefits openly, emphasizing that this is about support and protection, not control. Ensure your loved one feels comfortable and maintains their sense of financial independence.

Remember, every family's situation is unique. Consulting with a financial advisor or elder care specialist can provide personalized guidance tailored to your specific circumstances.

Safeguarding Senior Finances: A Comprehensive Guide to Joint Account Management

In an era of increasing financial complexity and elder care challenges, families are seeking innovative strategies to protect their aging loved ones' financial well-being. The delicate balance between maintaining senior independence and ensuring financial security has become a critical concern for millions of families navigating the intricate landscape of elder financial management.Protect Your Loved Ones: Smart Financial Oversight Starts Here

Understanding the Importance of Financial Transparency

Navigating the financial landscape for elderly family members requires a nuanced approach that balances respect, protection, and transparency. Joint accounts emerge as a powerful tool for families seeking to provide financial oversight without compromising their loved ones' sense of autonomy. The complexity of elder financial management goes far beyond simple monitoring, involving intricate considerations of trust, privacy, and legal protection. Financial experts increasingly recognize the delicate nature of intervening in an older person's financial affairs. The psychological impact of financial intervention can be profound, potentially affecting the senior's sense of independence and self-worth. Careful communication and collaborative approach become paramount in establishing a joint account that serves both protective and respectful purposes.Legal and Emotional Considerations of Joint Account Management

The decision to open a joint account represents a multifaceted strategy that extends well beyond mere financial tracking. Legal experts emphasize the importance of comprehensive documentation and clear communication when establishing such financial arrangements. Seniors must be fully informed and comfortable with the proposed financial oversight, ensuring their dignity remains intact throughout the process. Potential risks associated with joint accounts require meticulous consideration. Family members must navigate complex emotional terrain, balancing the need for financial protection with the senior's desire for autonomy. Professional financial advisors recommend thorough discussions that address concerns, establish clear boundaries, and create a mutual understanding of the joint account's purpose.Technological Solutions in Elder Financial Management

Modern technology has revolutionized the approach to senior financial oversight. Advanced digital banking platforms now offer sophisticated monitoring tools that provide real-time insights without direct account access. These innovative solutions allow families to detect potential financial irregularities while maintaining the senior's sense of financial independence. Cybersecurity becomes a critical consideration in this digital age. Families must implement robust protection mechanisms to safeguard their loved ones from potential financial fraud. This involves not just technological solutions but also comprehensive education about digital financial safety for seniors.Psychological Impact of Financial Intervention

The emotional landscape of financial management for seniors is complex and nuanced. Psychological research suggests that maintaining a sense of control and dignity is crucial for elderly individuals. Joint accounts must be approached as a collaborative process, not a unilateral intervention. Families should prioritize open communication, treating the senior as an active participant in financial decision-making. This approach helps mitigate potential feelings of vulnerability or loss of autonomy. Professional counselors recommend regular, transparent discussions that validate the senior's experiences and perspectives.Alternative Strategies for Financial Protection

While joint accounts offer one approach to financial management, they are not the sole solution. Comprehensive elder financial protection may involve multiple strategies, including power of attorney, trust arrangements, and advanced financial planning. Each family must carefully evaluate their unique circumstances to develop the most appropriate approach. Financial professionals emphasize the importance of personalized solutions that adapt to individual needs. What works for one family may not be suitable for another, highlighting the need for flexible, compassionate financial management strategies that prioritize the senior's well-being and autonomy.RELATED NEWS

Finance

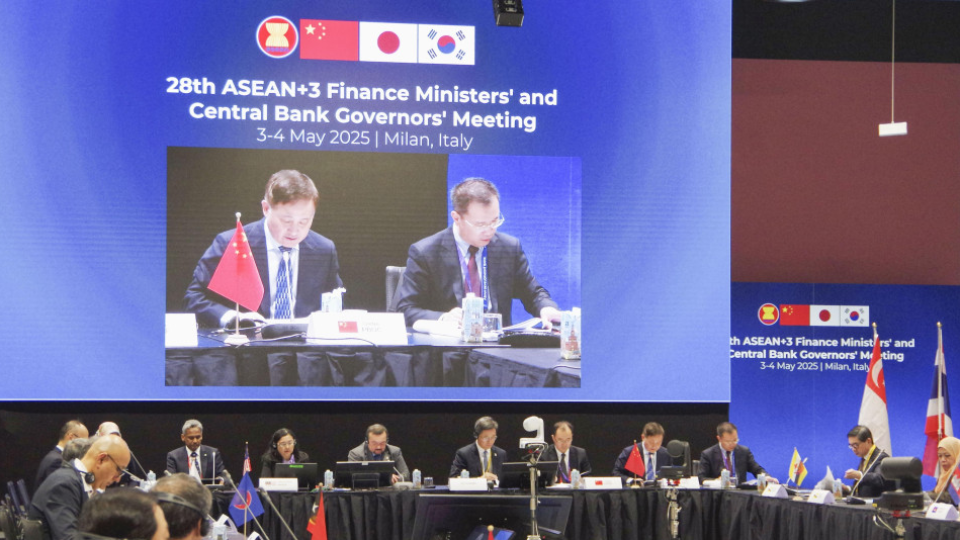

Trade Tensions Rise: ASEAN-Plus-3 Leaders Sound Alarm on Global Protectionist Threats

2025-05-05 10:36:33

Finance

Revolutionizing Equipment Finance: Leasepath Launches Game-Changing Workflow Portal

2025-03-26 08:00:00