Market Mayhem: Trump's Steel Tariff Twist Sends S&P 500 and Dow Tumbling

Finance

2025-03-11 15:40:22Content

Global Stock Markets Reel as Recession Fears Intensify

Investors are experiencing a turbulent week as stock markets worldwide continue to plummet, driven by mounting concerns about a potential economic downturn. The latest market selloff reflects growing anxiety among financial experts about the sustainability of current economic conditions.

Major financial indices have been experiencing significant declines, with investors rapidly shifting their portfolios in response to increasing recession signals. The dramatic market volatility stems from multiple economic pressures, including persistent inflation, tightening monetary policies, and geopolitical uncertainties.

Analysts are pointing to several key indicators that suggest a potential economic contraction. Central banks' aggressive interest rate hikes, designed to combat inflation, are creating additional pressure on corporate earnings and consumer spending. This delicate economic landscape is causing investors to reassess their investment strategies and seek safer financial havens.

Technology and growth stocks have been particularly hard hit, with many sectors experiencing sharp corrections. The widespread market uncertainty is prompting investors to adopt a more cautious approach, moving capital toward more stable and defensive investment options.

While market conditions remain challenging, financial experts advise maintaining a long-term perspective and avoiding panic-driven decision-making. The current economic landscape presents both risks and potential opportunities for strategic investors who can navigate the complex financial terrain.

Market Tremors: Navigating the Turbulent Landscape of Global Financial Uncertainty

In an era of unprecedented economic volatility, investors and financial experts find themselves at a critical crossroads, grappling with complex market dynamics that threaten to reshape the global economic landscape. The current financial environment presents a multifaceted challenge, demanding strategic insight and nuanced understanding of interconnected economic systems.Decoding the Economic Puzzle: When Recession Fears Shake Market Foundations

The Anatomy of Market Volatility

Financial markets are experiencing seismic shifts that challenge traditional economic paradigms. Sophisticated investors are witnessing unprecedented turbulence, characterized by rapid fluctuations and deep-seated uncertainty. The current economic climate represents more than a mere downturn; it's a fundamental restructuring of global financial architectures. Institutional investors are recalibrating their strategies, recognizing that conventional wisdom no longer provides reliable navigation through these treacherous economic waters. Complex algorithmic trading models are being rewritten, accounting for unprecedented levels of market unpredictability and systemic risk.Global Economic Interconnectedness and Systemic Risk

The contemporary financial ecosystem demonstrates remarkable complexity, where economic tremors in one region can instantaneously trigger cascading effects across international markets. Emerging economic powers are reshaping traditional market dynamics, introducing new variables that challenge established economic forecasting models. Geopolitical tensions, technological disruptions, and evolving regulatory landscapes contribute to an increasingly unpredictable economic environment. Institutional investors must now develop adaptive strategies that can rapidly respond to multidimensional challenges emerging from global economic interactions.Psychological Dimensions of Market Sentiment

Investor psychology plays a critical role in market movements, with collective sentiment often driving more significant fluctuations than fundamental economic indicators. The current market landscape is characterized by a delicate balance between rational analysis and emotional response. Fear and uncertainty create feedback loops that can amplify market volatility, transforming potential economic challenges into self-fulfilling prophecies. Sophisticated investors must develop emotional intelligence alongside traditional financial acumen to navigate these complex psychological terrains.Technological Disruption and Economic Transformation

Emerging technologies are fundamentally restructuring economic frameworks, introducing unprecedented levels of complexity and opportunity. Artificial intelligence, blockchain technologies, and advanced data analytics are redefining traditional investment strategies and market interactions. Financial institutions are investing heavily in technological infrastructure, recognizing that adaptive technological capabilities represent a critical competitive advantage in an increasingly dynamic economic landscape. The integration of machine learning and predictive analytics is transforming risk assessment and investment strategies.Strategic Resilience in Uncertain Times

Successful navigation of current market challenges requires a holistic approach that integrates sophisticated financial analysis, technological adaptability, and nuanced understanding of global economic ecosystems. Investors must develop multidimensional strategies that can withstand rapid and unpredictable market transformations. Diversification is no longer simply about spreading investments across different asset classes, but about developing flexible, adaptive investment frameworks that can rapidly recalibrate in response to emerging economic signals. The most successful investors will be those who can synthesize complex information and make strategic decisions with unprecedented speed and precision.RELATED NEWS

Finance

Market Mayhem Alert: Triple Witching Day Approaches - Investors Brace for Potential Chaos

2025-03-19 17:00:00

Finance

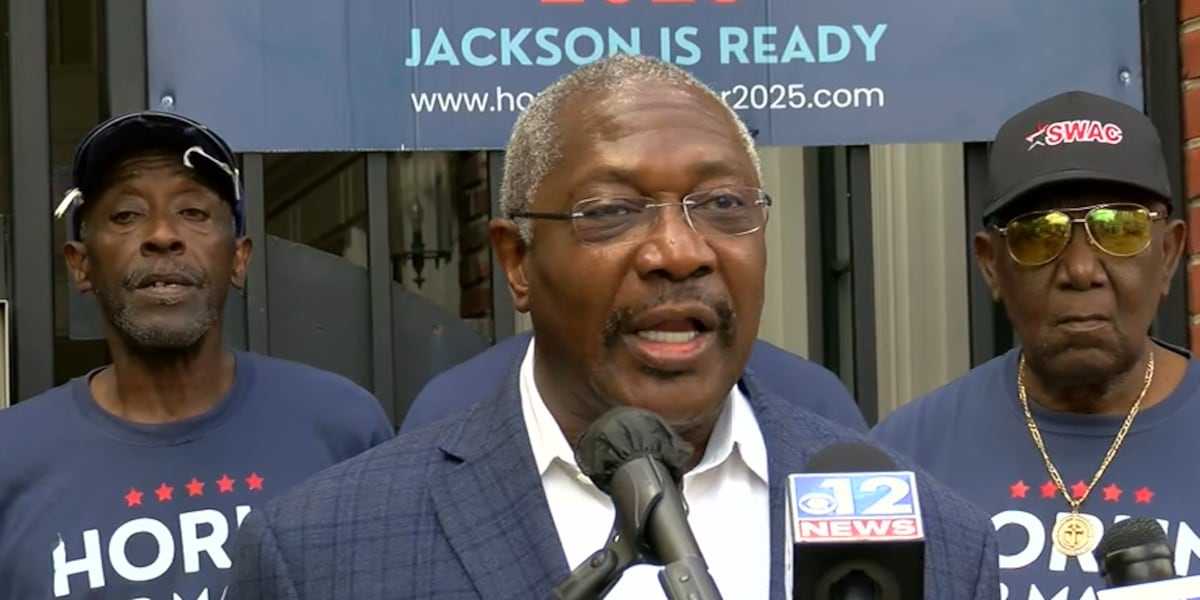

Campaign Cash Surge: Jackson Mayoral Hopeful Doubles Fundraising Before Critical Runoff

2025-04-16 20:35:47