Market Jitters: Trade Tensions Rattle Wall Street as Futures Teeter on Tariff Tightrope

Finance

2025-04-16 23:11:26Content

Wall Street Braces for Uncertain Trading as Trade Tensions Simmer

U.S. stock futures hovered near neutral territory Wednesday morning, following a tumultuous trading session that laid bare growing investor anxieties about the potential economic fallout from escalating trade tensions. The previous day's market volatility served as a stark reminder of the mounting pressure created by President Trump's aggressive tariff strategies.

Investors remain on edge, carefully parsing every signal that might indicate the direction of international trade relations and their potential impact on corporate earnings and economic growth. The market's fragile sentiment reflects deep uncertainty about how ongoing trade disputes could reshape global economic dynamics.

As traders prepare for another potentially turbulent day, all eyes are focused on potential developments in the ongoing trade negotiations and their potential ripple effects across various market sectors. The delicate balance of international commerce hangs in the balance, with each new policy announcement capable of triggering significant market movements.

Market Tremors: Navigating the Economic Landscape Amid Trade Tensions

In the intricate world of global finance, where economic currents can shift with the subtlest of policy changes, investors find themselves navigating increasingly turbulent waters. The intersection of international trade relations and market dynamics presents a complex tableau of challenges and opportunities that demand nuanced understanding and strategic insight.Unraveling the Economic Ripple Effect of Trade Policy Decisions

The Geopolitical Chessboard of International Trade

The contemporary economic landscape resembles a sophisticated geopolitical chess match, where each strategic move carries profound implications for global markets. Trade policies, particularly those involving tariffs, function as powerful economic instruments that can dramatically reshape international commerce. These policy decisions are not merely bureaucratic exercises but intricate mechanisms that can trigger cascading economic consequences across multiple sectors and national boundaries. Sophisticated economic analysts recognize that tariff implementations represent more than simple protectionist measures. They are complex diplomatic tools that can simultaneously serve multiple strategic objectives, including protecting domestic industries, applying economic pressure on international competitors, and signaling geopolitical positioning. The intricate interplay between political decision-making and market responses creates a dynamic environment where investors must remain perpetually vigilant and adaptable.Market Sentiment and Investor Psychology

Financial markets are fundamentally driven by collective investor sentiment, which can oscillate dramatically in response to perceived economic uncertainties. When significant policy changes emerge, such as the implementation of expansive tariff frameworks, investors tend to exhibit heightened sensitivity and potentially reactive behavior. This psychological dimension transforms abstract policy decisions into tangible market movements, creating a feedback loop where perception and reality become increasingly intertwined. The volatility induced by trade policy announcements can manifest in multiple market indicators, including stock futures, currency exchange rates, and commodity pricing. Investors must develop sophisticated analytical frameworks that can rapidly interpret and contextualize these complex signals, distinguishing between short-term market fluctuations and fundamental economic shifts.Technological and Structural Market Transformations

Contemporary economic ecosystems are experiencing unprecedented technological disruption, which intersects dramatically with evolving trade dynamics. Advanced algorithmic trading systems, real-time global communication networks, and increasingly sophisticated financial instruments have fundamentally altered how markets process and respond to economic information. These technological developments create both opportunities and challenges for investors. While they enable more rapid and precise market responses, they simultaneously introduce new layers of complexity and potential systemic risks. The ability to quickly analyze and interpret complex economic signals has become a critical competitive advantage in the modern financial landscape.Strategic Resilience in Uncertain Economic Environments

Successful navigation of complex economic terrains requires a multifaceted approach that combines rigorous analytical capabilities with strategic flexibility. Investors and economic actors must develop robust risk management strategies that can accommodate rapid and potentially unpredictable market transformations. Diversification remains a fundamental principle, but its implementation has become increasingly sophisticated. Modern portfolio management involves not just geographic and sectoral diversification, but also consideration of technological trends, regulatory environments, and potential geopolitical disruptions. The most effective strategies will blend quantitative analysis with nuanced understanding of broader economic and political contexts.RELATED NEWS

Finance

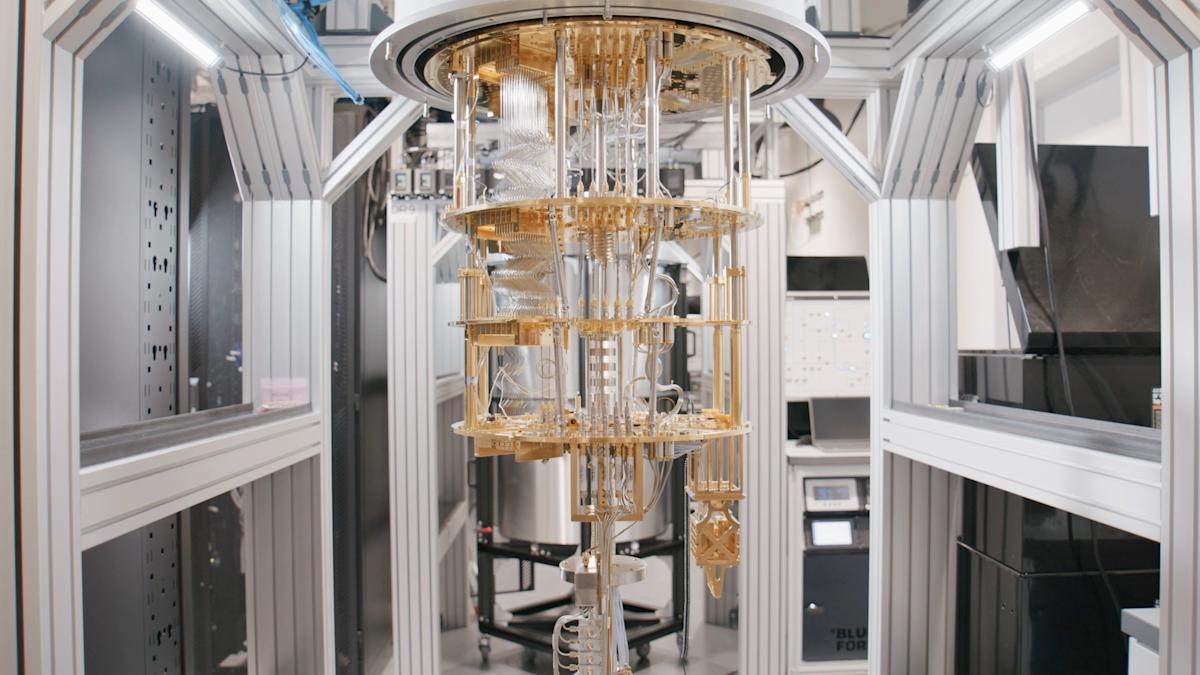

Quantum Leap: Amazon Races into Tech's Next Frontier with Groundbreaking Computing Chip

2025-02-27 11:00:25