Retail Trap: The Shocking Truth Behind 'Going Out of Business' Sales Scams

Business

2025-03-11 10:25:07Content

In the ever-evolving landscape of retail scams, opportunistic fraudsters are always on the lookout for vulnerable moments to exploit unsuspecting consumers. The recent announcement of Joann Fabrics declaring bankruptcy and preparing to close its stores nationwide has become fertile ground for potential scammers seeking to capitalize on consumer confusion and desperation.

When major retailers face financial challenges and announce store closures, it creates a perfect storm for deceptive practices. Scammers understand that consumers are emotionally charged during such transitions, making them more susceptible to fraudulent schemes disguised as incredible "going out of business" deals.

Consumers must remain vigilant and exercise caution when encountering seemingly too-good-to-be-true promotions during these challenging retail transitions. Verifying the authenticity of sales, checking official company communications, and being skeptical of unsolicited offers can help protect individuals from falling victim to sophisticated scam tactics.

As the retail landscape continues to shift, awareness and informed decision-making are crucial in safeguarding personal finances and preventing opportunistic criminals from taking advantage of vulnerable situations.

Retail Deception Unveiled: The Dark Side of Bankruptcy Sales and Consumer Vulnerability

In the ever-evolving landscape of retail commerce, consumers face increasingly sophisticated threats from opportunistic scammers who exploit vulnerable moments of business transitions. The recent bankruptcy announcement of Joann Fabrics has illuminated a critical issue that extends far beyond a single retail closure, revealing systemic risks that demand immediate consumer awareness and strategic vigilance.Unmasking the Predators: When Liquidation Becomes a Hunting Ground

The Anatomy of Retail Bankruptcy Scams

The complex ecosystem of retail bankruptcy creates a perfect storm for malicious actors seeking to exploit consumer trust. When established businesses like Joann Fabrics announce their impending closure, scammers meticulously craft elaborate schemes designed to manipulate emotional and financial vulnerabilities. These sophisticated fraudsters leverage psychological triggers, creating narratives that appear legitimate and compelling. Consumers experiencing the shock of a beloved retailer's closure become particularly susceptible to manipulative tactics. The emotional turbulence surrounding such announcements clouds judgment, making individuals more likely to engage with seemingly attractive offers that promise extraordinary value or exclusive access to liquidation sales.Digital Deception: Technological Mechanisms of Modern Fraud

Contemporary scam operations utilize advanced technological infrastructures that mimic authentic communication channels. Phishing emails, fabricated websites, and social media impersonation represent sophisticated tools enabling criminals to construct intricate fraudulent ecosystems designed to extract personal and financial information. These digital predators employ complex algorithmic techniques to generate convincing content that closely resembles official communications. By analyzing genuine corporate messaging patterns, they create near-perfect replicas that can deceive even technologically savvy consumers.Psychological Manipulation in Retail Closure Scenarios

The psychological landscape of retail bankruptcy creates unique emotional vulnerabilities that scammers strategically exploit. By understanding human cognitive biases, these malicious actors construct narratives that trigger fear, urgency, and a sense of potential loss, compelling victims to act irrationally. Cognitive dissonance plays a significant role in these manipulative scenarios. Consumers experiencing the potential loss of a familiar retail environment become more susceptible to alternative narratives that promise resolution or compensation, making them prime targets for sophisticated fraudulent schemes.Consumer Protection Strategies and Defensive Mechanisms

Protecting oneself against these intricate scams requires a multifaceted approach combining technological awareness, psychological resilience, and strategic information verification. Consumers must develop robust digital literacy skills, enabling them to critically evaluate communication sources and recognize potential fraudulent indicators. Implementing stringent verification protocols, maintaining healthy skepticism, and consulting official sources become paramount in navigating potentially deceptive environments. Financial institutions and consumer protection agencies increasingly recommend comprehensive digital security measures to mitigate emerging risks.Regulatory Landscape and Future Implications

The evolving complexity of retail bankruptcy scams necessitates continuous adaptation of regulatory frameworks. Government agencies and consumer protection organizations must develop increasingly sophisticated mechanisms to identify, track, and neutralize emerging fraudulent strategies. Technological advancements in artificial intelligence and machine learning present promising opportunities for developing more robust detection and prevention systems. These innovative approaches could revolutionize our ability to protect consumers from increasingly sophisticated scamming techniques.RELATED NEWS

Business

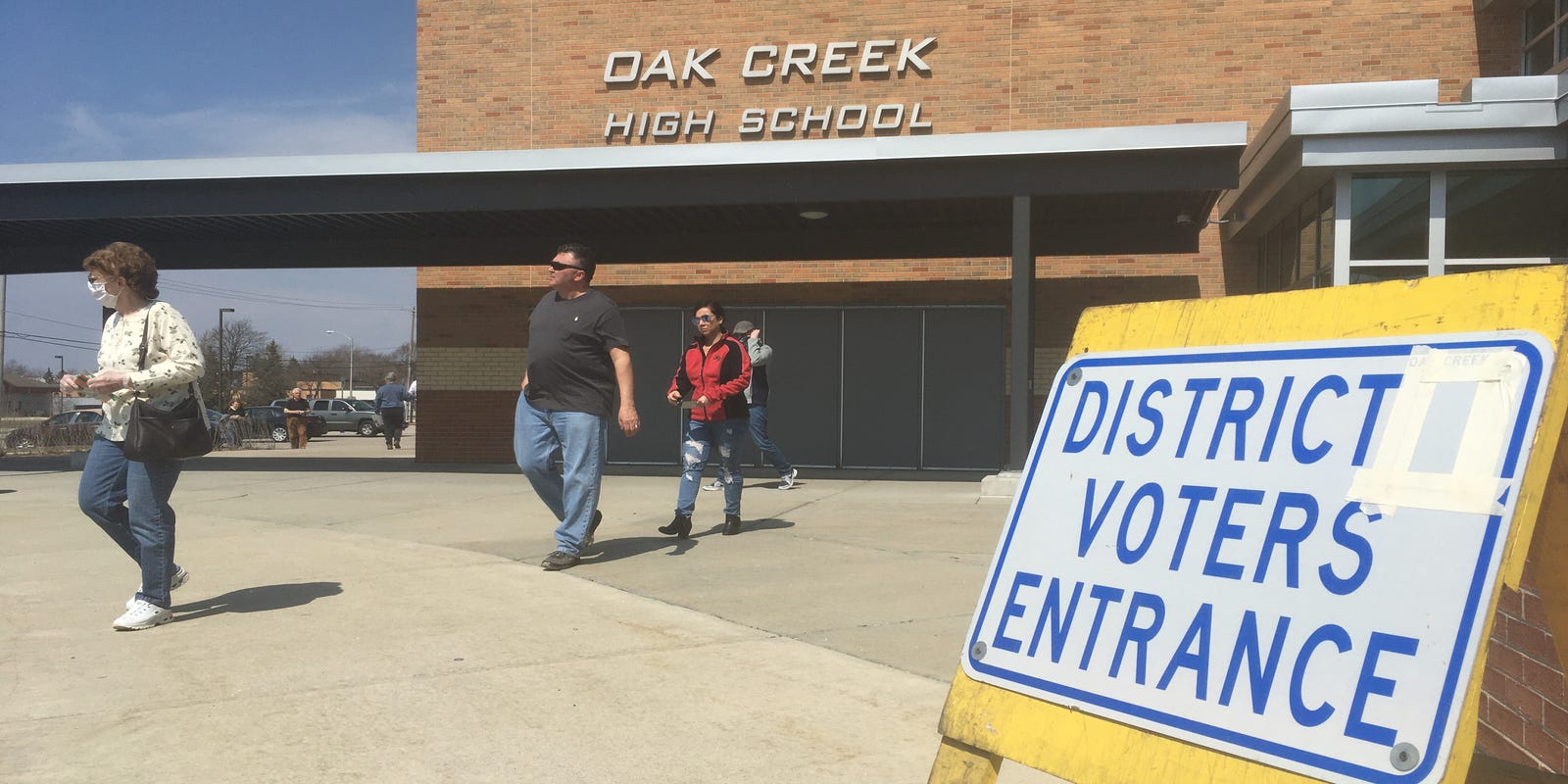

Business Battleground: Oak Creek District 1 Candidates Clash Over Economic Shifts

2025-03-12 10:03:35

Business

From Government Jobs to Shattered Dreams: Black Americans' Middle-Class Journey Unraveled

2025-03-29 08:15:01