Tech Titans' Tumble: How Trump's First 100 Days Wiped $194 Billion from Billionaires' Fortunes

Business

2025-04-29 08:15:01Content

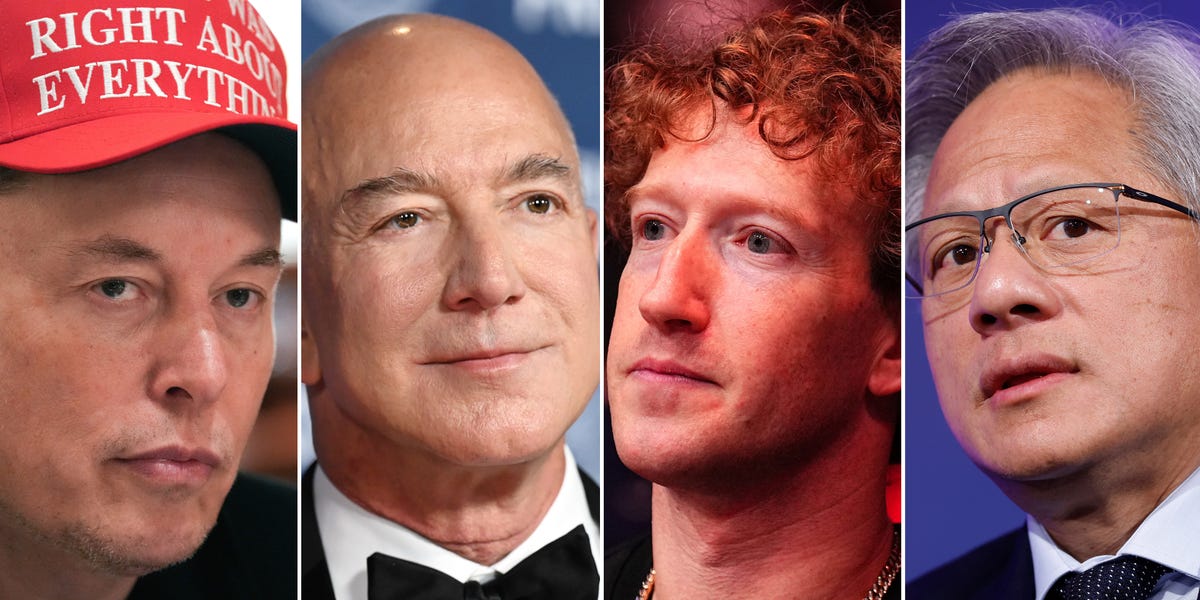

In a stunning financial rollercoaster, four of tech's most prominent billionaires—Elon Musk, Jeff Bezos, Mark Zuckerberg, and Jensen Huang—have experienced a dramatic collective wealth erosion of $194 billion since attending Donald Trump's presidential inauguration just 100 days ago.

These tech titans, who represent some of the most innovative companies in the world, have witnessed their net worth plummet amid market volatility, technological shifts, and broader economic uncertainties. Musk, the mercurial CEO of Tesla and SpaceX, has been particularly impacted by significant fluctuations in his company's stock prices and his high-profile Twitter acquisition.

Bezos, the Amazon founder, and Zuckerberg, Meta's (formerly Facebook) chief, have also seen substantial declines in their personal fortunes, reflecting broader challenges in the tech sector. Jensen Huang, NVIDIA's visionary leader, has not been immune to these financial pressures.

The staggering $194 billion loss underscores the volatile nature of wealth in the technology and innovation landscape, where fortunes can rise and fall with remarkable speed. It serves as a stark reminder that even the world's most successful entrepreneurs are not insulated from market dynamics and economic unpredictability.

Tech Titans' Wealth Rollercoaster: A $194 Billion Plunge in the Post-Inauguration Era

In the volatile landscape of technological innovation and entrepreneurial prowess, the financial trajectories of some of the world's most influential tech moguls have taken a dramatic turn. The period following a significant political event has unveiled a startling narrative of wealth transformation that challenges our understanding of economic resilience and market dynamics.Navigating Turbulent Financial Waters: When Tech Billionaires Face Unexpected Challenges

The Wealth Erosion Phenomenon

The financial landscape for tech luminaries has been nothing short of a seismic shift. Elon Musk, Jeff Bezos, Mark Zuckerberg, and Jensen Huang have experienced a collective wealth reduction that defies conventional economic expectations. This unprecedented decline of $194 billion represents more than just numerical data—it's a testament to the intricate and unpredictable nature of global markets and technological investments. The magnitude of this financial transformation goes beyond simple market fluctuations. Each of these tech titans has built empires that seemingly transcend traditional economic boundaries, yet they find themselves vulnerable to broader economic and political winds. The period following a significant political milestone has exposed the fragility of even the most robust technological fortunes.Individual Trajectories of Wealth Transformation

Diving deeper into individual narratives reveals a complex tapestry of financial challenges. Elon Musk, known for his audacious ventures in electric vehicles and space exploration, has witnessed substantial volatility in his net worth. Tesla's market performance and his controversial public persona have played significant roles in this financial rollercoaster. Jeff Bezos, the Amazon founder who revolutionized e-commerce, has not been immune to these market pressures. His wealth fluctuations reflect the intricate dance between technological innovation, market sentiment, and global economic conditions. The tech ecosystem continues to demonstrate its capacity for rapid and unexpected transformations.Market Dynamics and Technological Disruption

The $194 billion wealth reduction is more than a mere statistical anomaly. It represents a profound commentary on the interconnected nature of technology, politics, and global economics. Mark Zuckerberg's Meta (formerly Facebook) and Jensen Huang's NVIDIA have both experienced significant market challenges that contribute to this broader narrative. These tech leaders are not passive recipients of market forces but active participants in a complex economic ecosystem. Their ability to adapt, innovate, and pivot becomes crucial in navigating these turbulent financial waters. The reduction in wealth serves as a powerful reminder of the dynamic and often unpredictable nature of technological entrepreneurship.Broader Implications for Tech Entrepreneurship

The financial journey of these tech billionaires offers profound insights into the nature of wealth creation in the digital age. Their experiences underscore the importance of resilience, adaptability, and strategic thinking. The $194 billion decline is not a story of failure but a nuanced narrative of economic complexity. Each of these entrepreneurs has demonstrated an extraordinary capacity to rebuild, reinvent, and reimagine their economic strategies. Their collective experience serves as a powerful testament to the dynamic nature of technological innovation and entrepreneurial spirit in an increasingly complex global landscape.RELATED NEWS

Business

Love, Business, and Partnership: How Couples Are Redefining Entrepreneurship

2025-02-16 11:00:44

Business

Farewell to Flavor: Beloved Westborough Italian Eatery Serves Its Final Meal After 16-Year Culinary Journey

2025-03-01 09:46:34

Business

Local Prodigy Tops the Throne in Waste Management: Avon Lake's Unlikely Success Story

2025-02-19 13:40:44