Breaking: BII and Ghana Bank Forge $50M Alliance to Revolutionize African Trade Finance

Finance

2025-03-07 09:57:39Content

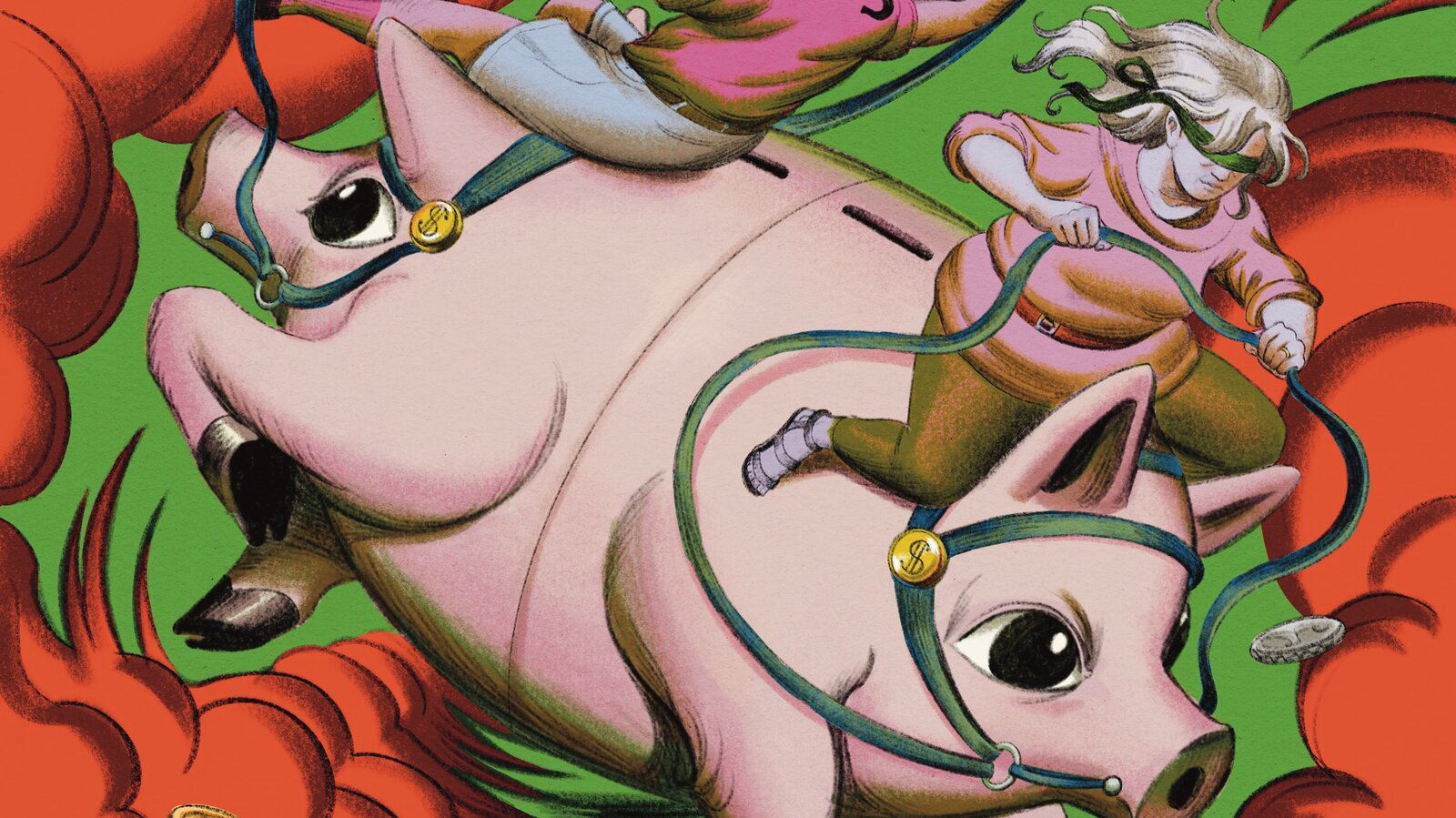

In a strategic move to strengthen economic collaboration, West African nations have forged a groundbreaking agreement aimed at enhancing foreign exchange liquidity across the region. This innovative partnership addresses a critical economic challenge by creating a more robust financial infrastructure that will facilitate smoother cross-border trade and economic interactions.

The initiative is particularly significant for its potential to streamline the import of essential goods, which are vital for the region's economic development and stability. By improving foreign exchange mechanisms, the agreement promises to reduce financial barriers and create a more dynamic, interconnected economic landscape for West African countries.

This collaborative effort underscores the region's commitment to economic resilience and mutual growth, positioning West African economies to better navigate global economic challenges and unlock new opportunities for trade and investment.

Economic Lifeline: West Africa's Strategic Financial Transformation Unveiled

In the dynamic landscape of global economic development, West African nations are pioneering innovative approaches to strengthen their financial ecosystems, addressing critical challenges of foreign exchange liquidity and sustainable economic growth through strategic international collaborations.Empowering Economies: A Breakthrough Financial Strategy Emerges

The Economic Context of West African Financial Dynamics

West Africa stands at a pivotal economic crossroads, confronting complex financial challenges that demand sophisticated and nuanced solutions. The region's economic infrastructure has long been characterized by structural vulnerabilities, particularly in foreign exchange management and international trade mechanisms. Traditional economic models have struggled to provide sustainable pathways for economic resilience, creating an urgent need for transformative financial strategies. Emerging economic research suggests that targeted interventions in foreign exchange liquidity can catalyze profound systemic improvements. By implementing strategic frameworks that enhance monetary flexibility, West African economies can unlock unprecedented opportunities for growth, investment attraction, and international economic integration.Foreign Exchange Liquidity: A Critical Economic Lever

Foreign exchange liquidity represents more than a technical financial concept; it embodies the fundamental capacity of economies to engage dynamically in global markets. For West African nations, this liquidity serves as a critical lifeline, enabling essential import capabilities, supporting international trade relationships, and providing economic stability in an increasingly interconnected global landscape. The intricate mechanisms of foreign exchange management require sophisticated approaches that balance national economic interests with international financial dynamics. Policymakers and financial experts are increasingly recognizing the need for innovative strategies that transcend traditional monetary frameworks.Strategic Implications for Regional Economic Development

The current financial agreement represents a watershed moment in West African economic policy, signaling a profound commitment to structural economic transformation. By prioritizing foreign exchange liquidity, participating nations are not merely addressing immediate financial challenges but laying foundational infrastructure for long-term economic resilience. This strategic approach encompasses multifaceted considerations, including trade optimization, investment attraction, and sustainable economic development. The potential ripple effects extend far beyond immediate monetary considerations, promising comprehensive socioeconomic regeneration across the region.Technological and Institutional Innovations

Technological advancements and institutional reforms are emerging as critical enablers of this economic transformation. Digital financial platforms, blockchain technologies, and sophisticated monetary management systems are providing unprecedented tools for economic coordination and liquidity management. Financial institutions are developing increasingly complex algorithmic models to predict, manage, and optimize foreign exchange dynamics. These technological interventions represent a quantum leap in economic management capabilities, offering West African nations sophisticated mechanisms for navigating complex global financial landscapes.Global Economic Positioning and Future Outlook

The current financial strategy positions West African economies at the forefront of innovative economic development. By demonstrating adaptability, strategic thinking, and commitment to progressive economic models, the region is challenging traditional narratives of economic vulnerability. International observers and economic analysts are closely monitoring these developments, recognizing the potential for transformative economic approaches that could serve as models for other emerging economic regions worldwide. The unfolding narrative represents not just a regional economic strategy but a potential blueprint for global economic resilience.RELATED NEWS

Finance

Carbon Cash and Prairie Secrets: How Montana's Grasslands Could Revolutionize Climate Finance

2025-04-17 21:33:15

Finance

Wall Street's Hot Tip: Why Cramer Says American Financial Group is Primed for Profit

2025-04-16 22:59:01

Finance

Earnings Surprise Brewing: Apollo Commercial Finance Set to Defy Wall Street Expectations

2025-04-16 16:10:12