Wall Street's Verdict: Unpacking Trump's Economic Rollercoaster

Finance

2025-03-05 11:00:53Content

Global financial markets experienced a sharp downturn on Tuesday as the escalating trade tensions between the United States and its international trading partners reached a critical point. President Trump's aggressive trade policies officially kicked into high gear, sending shockwaves through investor confidence and triggering widespread market sell-offs.

The intensifying trade war sparked significant uncertainty, with investors growing increasingly anxious about the potential economic consequences of mounting tariffs and retaliatory measures. Stock exchanges around the world reflected this unease, as key indices tumbled and traders scrambled to reassess their investment strategies in light of the rapidly changing geopolitical landscape.

Analysts warned that the escalating trade disputes could have far-reaching implications for global economic growth, potentially disrupting international supply chains and creating additional challenges for businesses already navigating a complex economic environment. The market's reaction underscored the growing concerns about the potential long-term impact of protectionist trade policies.

Global Financial Tremors: Unraveling the Economic Landscape Amid Trade Tensions

In the intricate world of international finance, where global markets dance to the rhythm of geopolitical tensions, a seismic shift is underway. The delicate balance of economic relationships is being tested, with far-reaching implications that extend beyond mere numbers and trading floors.When Economic Strategies Collide: A Watershed Moment in Global Trade

The Escalating Trade War Dynamics

The contemporary economic landscape is witnessing an unprecedented transformation, characterized by increasingly complex international trade negotiations. Geopolitical strategies are no longer confined to diplomatic channels but are now manifesting dramatically in financial markets. Sophisticated economic actors are navigating a terrain fraught with uncertainty, where traditional trade paradigms are being systematically dismantled and reconstructed. Governments and multinational corporations are engaged in a high-stakes chess match, with each strategic move sending ripples through global financial ecosystems. The intricate web of international commerce is being rewoven, challenging long-established economic assumptions and forcing market participants to rapidly adapt to emerging realities.Market Volatility and Investor Sentiment

Investor confidence is experiencing significant turbulence, reflecting the profound uncertainties surrounding current trade dynamics. Financial markets are demonstrating remarkable sensitivity to geopolitical developments, with even minor policy announcements capable of triggering substantial market movements. Sophisticated investors are recalibrating their strategies, implementing robust risk management protocols to mitigate potential economic disruptions. The traditional models of market prediction are being challenged, requiring a more nuanced and adaptive approach to understanding global economic interactions.Technological and Economic Interdependence

The current trade landscape reveals a complex interdependence between technological innovation and economic policy. Nations are increasingly recognizing that economic strategies are inextricably linked to technological capabilities, with trade negotiations now encompassing broader discussions about technological sovereignty and strategic economic positioning. Emerging technologies are playing a pivotal role in reshaping international trade dynamics, creating new avenues for economic collaboration and competition. The traditional boundaries between economic and technological domains are becoming increasingly blurred, presenting both unprecedented challenges and opportunities.Global Economic Resilience and Adaptation

Despite the current turbulence, global economic systems are demonstrating remarkable resilience. Businesses and governments are developing sophisticated strategies to navigate the complex trade environment, leveraging innovative approaches to maintain economic momentum. Adaptive economic policies are emerging as a critical component of national strategies, with countries developing more flexible and responsive economic frameworks. This approach allows for more dynamic engagement with the rapidly evolving global economic landscape, minimizing potential negative impacts while maximizing opportunities for growth and development.Long-term Implications and Strategic Considerations

The current trade tensions are not merely a temporary disruption but potentially represent a fundamental restructuring of global economic relationships. Economists and policy makers are closely analyzing these developments, recognizing that the current strategies will likely shape international economic interactions for years to come. Strategic foresight and proactive policy development are becoming increasingly crucial. Nations and corporations that can anticipate and effectively respond to these complex economic dynamics will be best positioned to thrive in the emerging global economic environment.RELATED NEWS

Finance

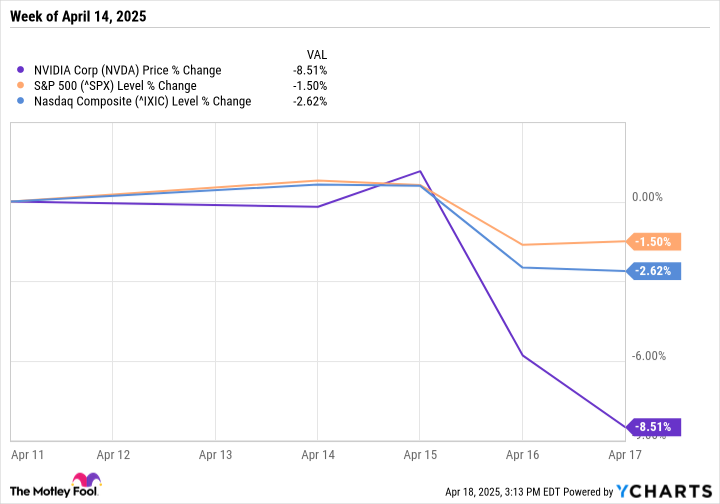

Nvidia's Market Rollercoaster: Inside the High-Stakes Trading Week of April 14-18

2025-04-20 19:00:00

Finance

Breaking: Local Lawmaker Tackles Postpartum Care and Campaign Transparency in Community Roundtable

2025-04-21 23:30:11

Finance

Time Finance Bullish on 2025: Strong Growth Signals Bright Fiscal Horizon

2025-02-28 14:53:22