Breaking: ATD Finance and ATD Money Revolutionize Workplace Finance with Instant Salary Advances

Finance

2025-02-17 08:51:54Content

In a groundbreaking move to revolutionize employee financial wellness, ATD Finance has unveiled a strategic partnership with ATD Money, introducing an innovative instant salary advance solution for corporate professionals. This cutting-edge collaboration is designed to provide employees with rapid access to emergency funds, eliminating traditional bureaucratic hurdles and employer approvals.

The partnership represents a significant leap forward in financial accessibility, offering workers a seamless and fully digital platform to secure short-term loans. By streamlining the borrowing process, ATD Finance and ATD Money are empowering employees with greater financial flexibility and immediate support during unexpected monetary challenges.

Through this transformative initiative, corporate employees can now enjoy quick, hassle-free financial assistance without navigating complex approval processes or seeking direct intervention from their employers. The digital-first approach ensures convenience, speed, and discretion in addressing urgent financial needs.

Financial Revolution: Instant Salary Advances Redefine Employee Financial Empowerment

In the rapidly evolving landscape of financial technology, innovative solutions are transforming how employees access and manage their earnings. The emergence of digital platforms offering instant financial support represents a paradigm shift in traditional employment-related financial services, promising unprecedented flexibility and immediate financial relief for corporate professionals.Breaking Financial Barriers: The Future of Workplace Financial Solutions

Digital Financial Transformation

The contemporary corporate ecosystem is witnessing a remarkable metamorphosis in financial service delivery. Traditional banking models are being systematically disrupted by agile, technology-driven platforms that prioritize user convenience and immediate financial accessibility. These emerging solutions leverage sophisticated algorithms and seamless digital infrastructure to provide employees with unprecedented financial autonomy. Modern financial technology platforms are revolutionizing the way corporate professionals interact with their earnings. By eliminating bureaucratic intermediaries and leveraging advanced technological frameworks, these services create direct, instantaneous financial channels that empower employees with real-time monetary flexibility.Innovative Lending Mechanisms

Contemporary salary advance platforms represent a sophisticated approach to short-term financial management. Unlike conventional loan systems, these digital solutions offer rapid, transparent, and user-friendly financial assistance without requiring extensive documentation or prolonged approval processes. The underlying technological architecture enables these platforms to assess financial eligibility through advanced data analytics, machine learning algorithms, and comprehensive risk assessment models. This approach ensures rapid, secure, and personalized financial solutions tailored to individual employee profiles.Employee Financial Wellness Ecosystem

The emergence of instant salary advance services signifies a broader transformation in workplace financial wellness strategies. Organizations are increasingly recognizing the critical importance of providing employees with flexible financial tools that address immediate monetary requirements while maintaining professional dignity and financial integrity. These platforms go beyond mere transactional interactions, creating holistic financial ecosystems that prioritize employee well-being. By offering instant, hassle-free financial support, they contribute to reduced financial stress, enhanced job satisfaction, and improved overall workplace productivity.Technological Infrastructure and Security

Advanced digital platforms implementing salary advance services deploy cutting-edge cybersecurity protocols to ensure comprehensive data protection and transactional integrity. Sophisticated encryption technologies, multi-factor authentication, and real-time monitoring systems safeguard sensitive financial information. The integration of artificial intelligence and machine learning enables these platforms to continuously refine risk assessment mechanisms, ensuring sustainable and responsible lending practices that protect both employees and financial service providers.Economic and Social Implications

The proliferation of instant salary advance services represents more than a technological innovation—it signifies a fundamental reimagining of financial interactions within corporate environments. By democratizing access to immediate financial resources, these platforms contribute to broader economic inclusivity and individual financial empowerment. Such services challenge traditional financial paradigms, offering a glimpse into a future where technological innovation seamlessly addresses complex human financial needs, transcending conventional banking limitations and creating more responsive, adaptive financial ecosystems.RELATED NEWS

Finance

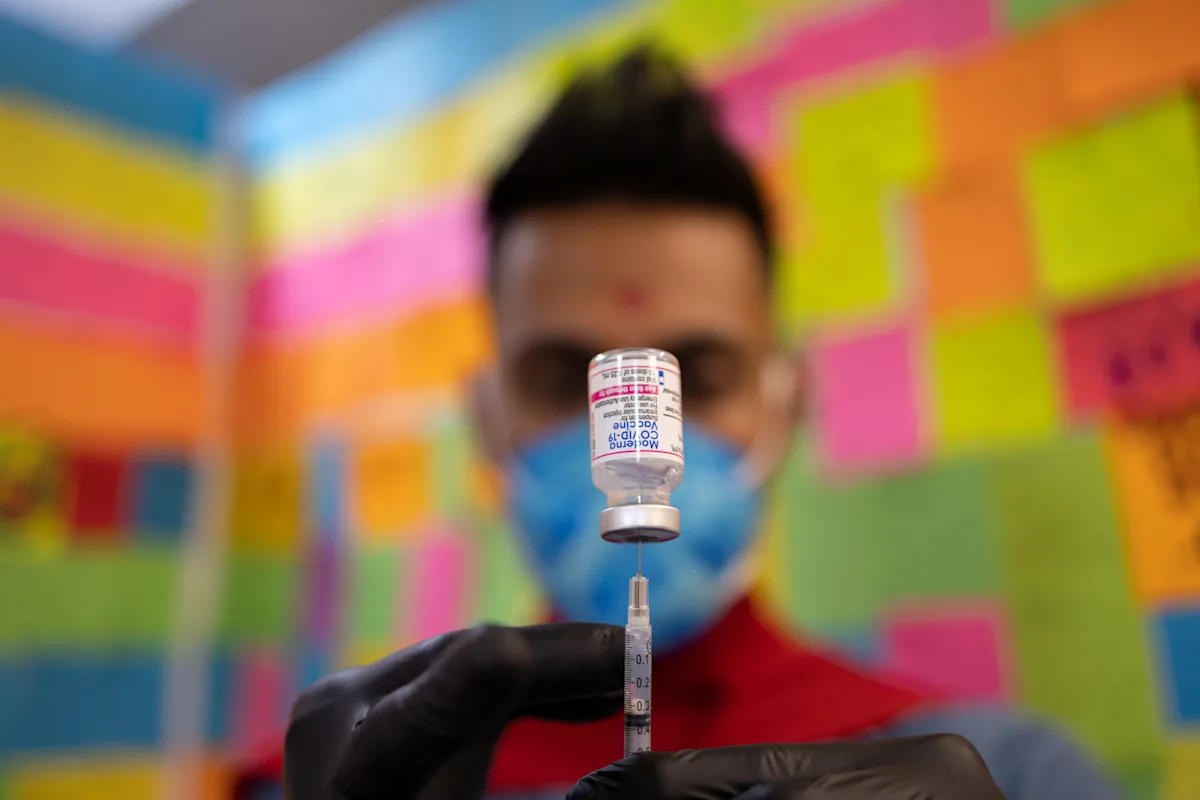

Biotech Shockwave: Top FDA Official's Sudden Exit Rattles Moderna's Market Momentum

2025-03-31 14:00:10

Finance

Banking's Secret Weapon: How Legacy Institutions Are Quietly Revolutionizing Financial Integration

2025-03-20 11:45:00