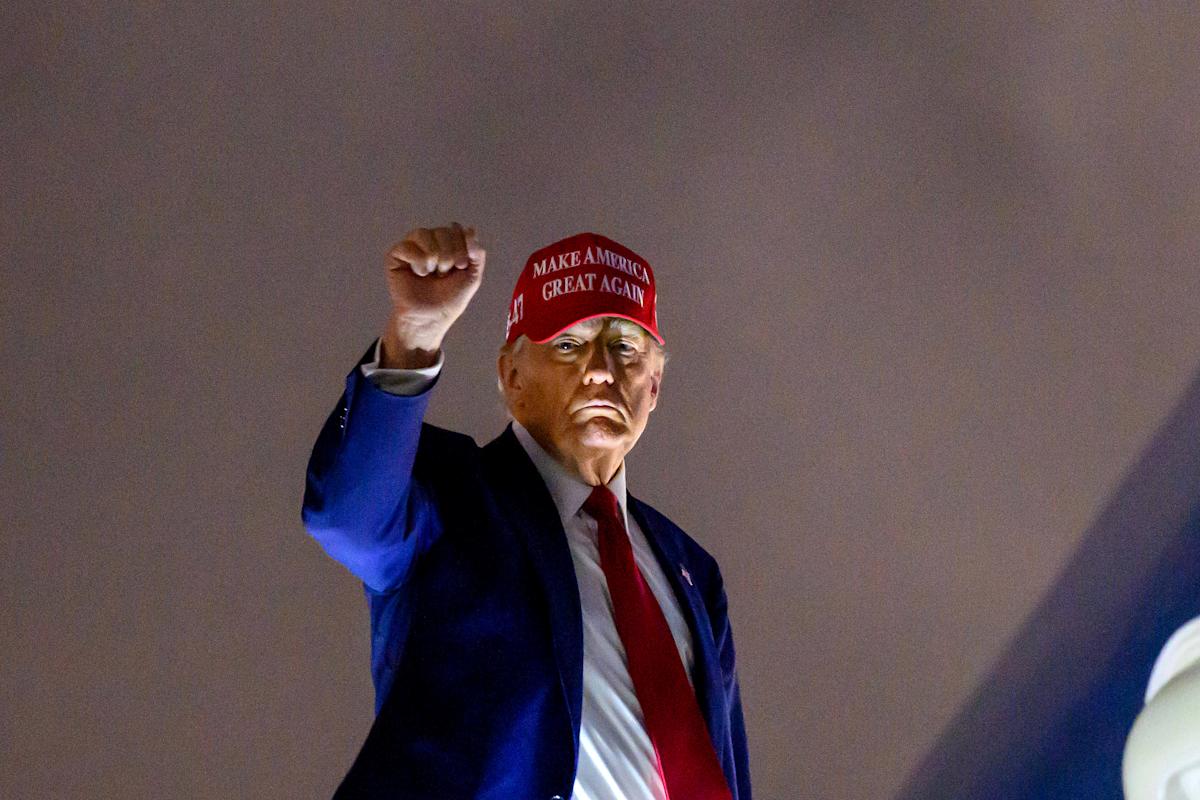

Endowment Under Siege: Harvard's Massive Wealth Faces Off Against Trump's Federal Funding Crackdown

Finance

2025-04-15 20:25:57Content

Harvard University's legendary financial resilience is being put to the ultimate test as it confronts an unexpected and high-stakes challenge from the Trump administration. The prestigious institution, known for its robust financial strategy and substantial endowment, now finds itself navigating treacherous political waters that threaten to shake its long-standing financial foundations.

With a balance sheet traditionally designed to absorb economic shocks and unexpected disruptions, Harvard is now facing a confrontation that goes beyond typical financial planning. The university's leadership must draw upon its deep strategic reserves and institutional wisdom to counter the mounting pressures from federal policy makers.

This unprecedented challenge represents more than just a financial dispute; it's a critical moment that will test Harvard's ability to maintain its independence, financial stability, and global reputation in an increasingly complex political landscape. The outcome could potentially set a precedent for how elite educational institutions manage their resources and autonomy in an era of heightened political scrutiny.

Harvard's Financial Fortress: Navigating Turbulent Political Waters

In the high-stakes world of academic finance, Harvard University stands as a beacon of institutional resilience, facing unprecedented challenges that test the very foundations of its economic strategy. The intersection of academic prestige and political complexity creates a narrative that goes far beyond traditional institutional management.When Institutional Wealth Meets Political Pressure

The Financial Anatomy of Harvard's Endowment

Harvard's endowment represents more than just a financial reservoir; it is a complex ecosystem of strategic investments, philanthropic commitments, and institutional survival mechanisms. The university's financial infrastructure has been meticulously constructed over decades, creating a robust shield against potential economic disruptions. Unlike typical institutional portfolios, Harvard's financial strategy incorporates sophisticated risk management techniques that anticipate and mitigate potential systemic challenges. The endowment's complexity extends beyond mere monetary accumulation. Each investment represents a carefully calculated decision, balancing long-term academic objectives with short-term financial stability. Sophisticated algorithms and expert financial strategists continuously analyze global economic trends, ensuring the university's financial health remains resilient and adaptable.Political Dynamics and Institutional Autonomy

The confrontation with the Trump administration represents a profound test of institutional autonomy and financial independence. Harvard's leadership must navigate a delicate balance between maintaining academic principles and managing potential political pressures. This challenge requires nuanced diplomatic skills, strategic communication, and an unwavering commitment to institutional integrity. The political landscape introduces unprecedented variables into Harvard's financial calculations. External interventions, policy shifts, and potential regulatory changes create a dynamic environment that demands constant vigilance and adaptive strategies. The university's response must be both principled and pragmatic, protecting its core academic mission while maintaining financial flexibility.Strategic Resilience in Uncertain Times

Harvard's approach to financial management transcends traditional institutional models. The endowment serves not just as a monetary reserve but as a strategic instrument of academic empowerment. By diversifying investments, maintaining transparent governance, and cultivating global partnerships, the university creates multiple layers of financial protection. The institution's leadership understands that resilience is not about avoiding challenges but effectively navigating them. Each potential disruption becomes an opportunity for strategic recalibration, demonstrating the university's ability to transform potential vulnerabilities into strengths. This adaptive capacity has been cultivated through decades of sophisticated financial planning and institutional wisdom.Broader Implications for Higher Education

Harvard's current financial and political navigation serves as a critical case study for academic institutions worldwide. The strategies employed, the challenges confronted, and the responses developed offer profound insights into institutional management in an increasingly complex global environment. The university's experience highlights the intricate relationship between academic institutions, financial systems, and political landscapes. It underscores the necessity of maintaining institutional autonomy while remaining responsive to broader societal and economic dynamics. Harvard's approach represents a sophisticated model of institutional resilience that extends far beyond traditional financial management paradigms.RELATED NEWS

Finance

Budget Unveiled: Columbia Council Dives Deep into Fiscal Year 2024 Financial Landscape

2025-03-16 11:00:00

Finance

Transatlantic Trade Tensions: Germany's Finance Chief Signals Diplomatic Hope Over U.S. Tariff Standoff

2025-04-24 17:11:06