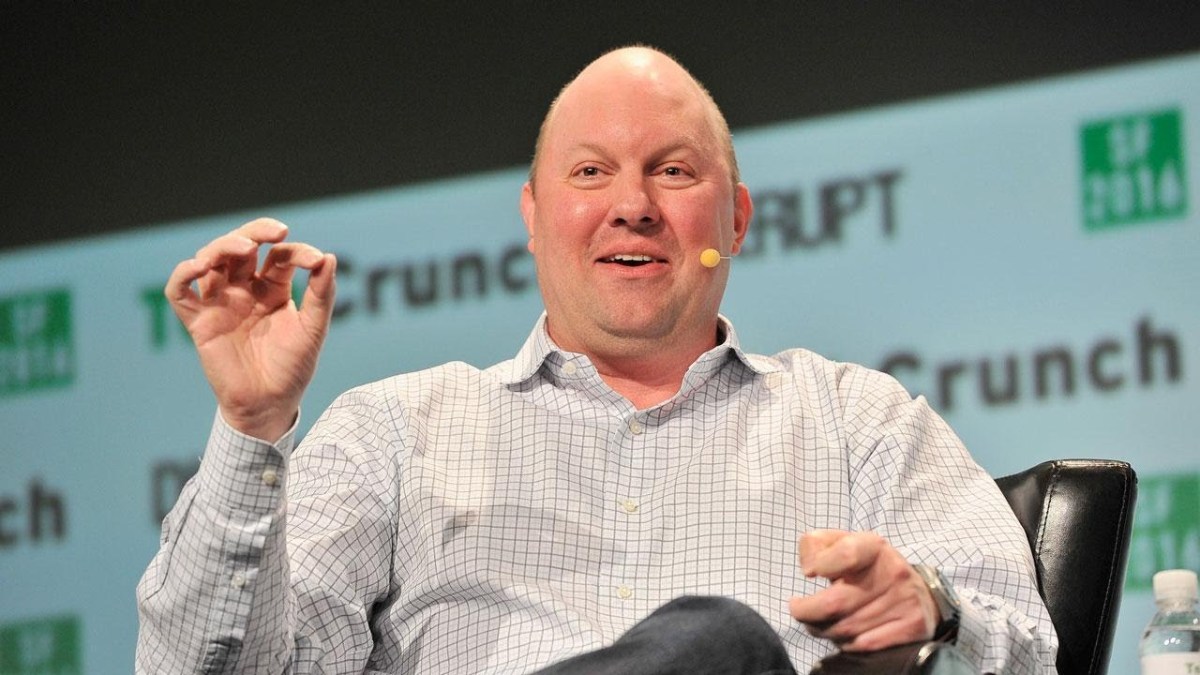

Silicon Valley's Venture Titan: How Marc Andreessen Aims to Build a Legacy Beyond Venture Capital

Companies

2025-02-15 17:00:00Content

The venture capital world has been buzzing with speculation about Andreessen Horowitz, the powerhouse investment firm managing an impressive $45 billion in assets. Industry insiders and tech enthusiasts are increasingly curious about the firm's long-term strategic vision and potential expansion plans. With its significant financial resources and track record of backing groundbreaking startups, Andreessen Horowitz continues to be a pivotal player in the technology investment landscape, sparking ongoing discussions about its future trajectory and ambitions.

Silicon Valley's Venture Capital Titans: Andreessen Horowitz's Strategic Evolution

In the dynamic landscape of technological investment, venture capital firms constantly navigate complex strategic transformations that challenge traditional industry paradigms. The emergence of innovative investment models has sparked intense speculation about the future trajectory of prominent venture capital institutions, particularly those with substantial financial resources and visionary leadership.Redefining Venture Capital's Boundaries: A Bold Strategic Frontier

The Metamorphosis of Investment Strategies

Andreessen Horowitz, a powerhouse managing an impressive $45 billion portfolio, represents a quintessential example of strategic reinvention in the venture capital ecosystem. The firm's approach transcends conventional investment methodologies, embracing a holistic perspective that integrates deep technological understanding with sophisticated financial engineering. By cultivating an ecosystem that nurtures entrepreneurial talent and technological innovation, the firm has positioned itself as a transformative force in Silicon Valley's investment landscape. The organization's strategic framework goes beyond mere capital allocation, focusing on creating comprehensive support structures that empower emerging technological ventures. Their unique model involves providing extensive operational expertise, strategic guidance, and network connections that significantly enhance portfolio companies' probability of success.Technological Convergence and Investment Philosophy

Modern venture capital firms like Andreessen Horowitz are increasingly recognizing the intricate interconnections between technological domains. Their investment strategy reflects a nuanced understanding that breakthrough innovations often emerge from interdisciplinary convergences rather than siloed technological developments. By maintaining a flexible and adaptive investment approach, the firm can rapidly identify and capitalize on emerging technological trends. This dynamic strategy allows them to navigate complex market landscapes, anticipating potential disruptions and positioning their investments at the forefront of technological evolution.Ecosystem Development and Strategic Partnerships

The firm's approach extends beyond traditional venture capital models by actively cultivating robust entrepreneurial ecosystems. Through strategic partnerships with academic institutions, research centers, and technological incubators, Andreessen Horowitz creates fertile ground for groundbreaking innovations. Their investment philosophy emphasizes long-term value creation, focusing not just on immediate financial returns but on nurturing sustainable technological advancements. This approach requires deep technological comprehension, sophisticated market analysis, and an unwavering commitment to supporting visionary entrepreneurs.Navigating Technological Complexity

In an era characterized by rapid technological transformation, venture capital firms must continuously adapt their strategies. Andreessen Horowitz exemplifies this adaptability by maintaining a sophisticated understanding of emerging technological domains, from artificial intelligence and blockchain to quantum computing and biotechnology. The firm's investment team comprises experts with diverse technological backgrounds, enabling them to conduct comprehensive assessments of potential investments. This multidisciplinary approach allows for nuanced evaluations that extend beyond traditional financial metrics, incorporating technological potential and scalability considerations.Future-Oriented Investment Paradigms

As technological landscapes continue to evolve at unprecedented rates, venture capital firms like Andreessen Horowitz are redefining investment paradigms. Their strategic approach represents a sophisticated model that integrates financial acumen, technological expertise, and visionary thinking. By challenging conventional investment frameworks and embracing a holistic, forward-looking perspective, the firm continues to shape the future of technological innovation and venture capital investment strategies.RELATED NEWS

Companies

Sky High Stakes: The 30 Powerhouse Jet Companies Reshaping Private Aviation in 2024

2025-02-22 05:06:20

Companies

Mortgage Mavens: Top Employers Revolutionizing Workplace Culture in 2025

2025-02-18 10:00:00