Insider Confidence Soars: 3 European Startups Poised for Explosive 54% Earnings Surge

Companies

2025-04-23 05:35:30Content

European financial markets are experiencing a robust resurgence, signaling renewed investor confidence and economic optimism. The STOXX Europe 600 Index has surged impressively by 3.93%, with key markets like Italy's FTSE MIB and the UK's FTSE 100 demonstrating substantial gains.

This market rally is being driven by two significant developments: the European Central Bank's strategic rate cuts and President Trump's decision to postpone proposed tariff increases. These factors have collectively created a landscape of cautious yet promising economic potential.

Savvy investors are now turning their attention to growth-oriented companies characterized by high insider ownership. Such companies often represent a compelling investment opportunity, as significant insider stakes typically signal strong internal confidence and alignment with the organization's long-term vision.

The current market environment suggests that businesses with meaningful insider investment could be particularly well-positioned to capitalize on emerging economic trends. These companies not only demonstrate leadership's belief in their strategic direction but also potentially offer more stable and promising investment prospects.

As European markets continue to navigate complex economic terrain, investors are advised to carefully assess companies with robust insider commitment and clear growth strategies.

European Markets Surge: Insider Confidence and Economic Resilience Spark Investor Optimism

In the dynamic landscape of global financial markets, investors are witnessing a remarkable transformation as European economies demonstrate unexpected resilience and strategic adaptability. The current economic climate presents a fascinating narrative of recovery, innovation, and strategic repositioning that promises to reshape investment strategies and market perceptions.Navigating Uncertainty: The Breakthrough Moment for European Financial Markets

Market Dynamics and Institutional Momentum

The European financial ecosystem is experiencing a profound metamorphosis, characterized by unprecedented institutional interventions and strategic recalibrations. The European Central Bank's recent rate cut strategy represents a calculated maneuver designed to stimulate economic growth and restore investor confidence. By implementing nuanced monetary policies, financial institutions are creating a robust framework that encourages sustainable economic expansion. These strategic decisions are not merely technical adjustments but represent a comprehensive approach to economic revitalization. The ECB's interventions signal a deep understanding of the complex interconnections between monetary policy, market sentiment, and long-term economic sustainability.Geopolitical Influences and Market Sentiment

The complex interplay between geopolitical dynamics and financial markets has emerged as a critical factor in shaping investor perspectives. President Trump's decision to delay potential tariff implementations has created a momentary sense of relief and optimism among international investors. This geopolitical recalibration has profound implications for cross-border investment strategies. Investors are now reassessing risk profiles and exploring opportunities within a more nuanced and potentially less confrontational international trade environment. The reduction of immediate trade tensions provides a psychological boost to markets that have been operating under significant uncertainty.Growth Companies and Insider Ownership: A Strategic Investment Lens

The current market landscape presents a unique opportunity for investors to focus on growth companies characterized by substantial insider ownership. These organizations offer a compelling investment narrative, where leadership's financial commitment serves as a powerful indicator of potential success. Insider ownership represents more than a financial metric; it embodies a profound alignment between management's strategic vision and shareholder interests. Companies where executives maintain significant equity stakes tend to demonstrate enhanced accountability, long-term strategic planning, and a genuine commitment to sustainable growth.Index Performance and Economic Indicators

The remarkable performance of key European indices provides tangible evidence of the region's economic resilience. The STOXX Europe 600 Index's impressive 3.93% climb represents more than a statistical anomaly; it reflects a broader narrative of economic recovery and investor confidence. Specific national indices like Italy's FTSE MIB and the UK's FTSE 100 have demonstrated remarkable strength, suggesting that individual European economies are finding unique pathways to growth and stability. These performance metrics indicate a nuanced and diversified approach to economic recovery that transcends broad, generalized strategies.Future Outlook and Strategic Considerations

As the European financial landscape continues to evolve, investors must remain agile, informed, and strategically positioned. The current market conditions suggest a potential paradigm shift where traditional investment models are being reimagined and reconstructed. The convergence of monetary policy innovations, geopolitical recalibrations, and emerging market dynamics creates an environment of cautious optimism. Successful investors will be those who can navigate this complex terrain with sophistication, adaptability, and a forward-looking perspective.RELATED NEWS

Companies

The AI Revolution: How Businesses Are Reimagining Product Design for Intelligent Agents

2025-04-16 20:00:00

Companies

Breaking: PCL Clinches Spot on Fortune's Prestigious 'Best Workplaces' List

2025-04-02 19:24:58

Companies

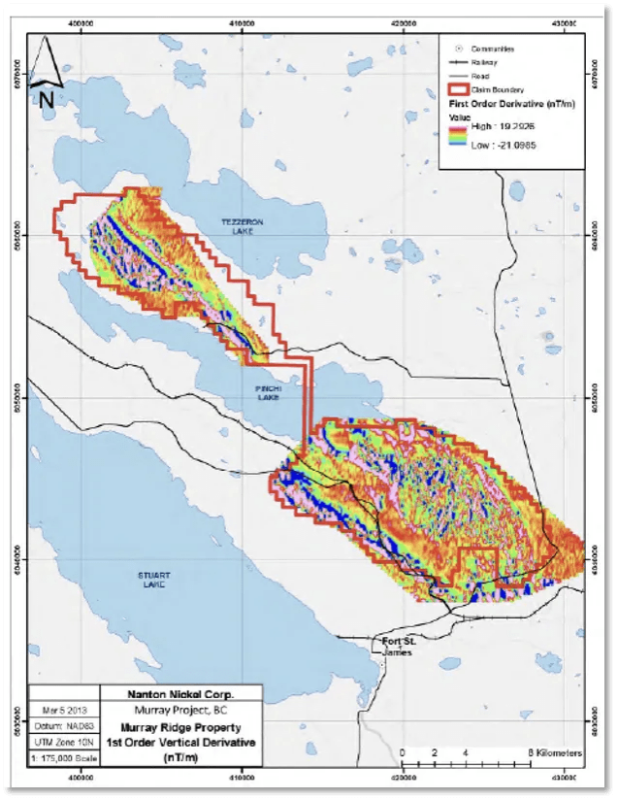

Strategic Split: Recharge Resources Unveils Twin Spin-Off Ventures in Copper and Nickel Exploration

2025-03-04 08:05:00