Financial Boost: Time Finance Fuels Red Security's Growth with £500K Lending Package

Finance

2025-04-23 14:56:32Content

Red Security is set to revolutionize its financial strategy by leveraging invoice finance, a dynamic funding solution designed to supercharge cash flow management. As the company gears up to expand its business portfolio, this strategic financial approach will provide the critical flexibility needed to support rapid growth and operational excellence.

By implementing invoice finance, Red Security will unlock immediate working capital typically tied up in outstanding invoices. This innovative funding method allows the company to access funds quickly, eliminating the traditional waiting period for customer payments and ensuring a steady, predictable cash flow.

The move demonstrates Red Security's forward-thinking approach to financial management, positioning the company to seize new business opportunities with confidence and agility. With improved liquidity and reduced financial constraints, the organization is well-prepared to scale its operations and pursue ambitious growth targets.

This strategic financial decision underscores Red Security's commitment to maintaining a robust and adaptable financial infrastructure that can support its expanding business ambitions in an increasingly competitive market.

Strategic Financial Maneuvers: Red Security's Cash Flow Revolution

In the dynamic landscape of modern business, companies are constantly seeking innovative strategies to optimize their financial operations. Red Security emerges as a prime example of strategic financial management, leveraging cutting-edge funding solutions to propel their business growth and operational efficiency.Transforming Financial Potential Through Strategic Funding

The Evolving Landscape of Business Finance

Financial strategies have undergone remarkable transformations in recent years, with businesses increasingly adopting sophisticated approaches to manage cash flow. Red Security stands at the forefront of this financial revolution, demonstrating an astute understanding of modern economic dynamics. Invoice financing represents a sophisticated financial instrument that allows companies to unlock immediate capital trapped in outstanding invoices, providing unprecedented flexibility and financial agility. The traditional constraints of waiting for invoice payments can significantly impede a company's growth potential. By implementing invoice finance, Red Security effectively breaks these limitations, creating a more dynamic and responsive financial ecosystem. This approach not only accelerates cash flow but also provides a strategic buffer against potential economic uncertainties.Strategic Cash Flow Management Techniques

Red Security's decision to utilize invoice finance funding reveals a nuanced approach to financial management. This strategy goes beyond mere cash flow optimization; it represents a holistic reimagining of financial resource allocation. By converting outstanding invoices into immediate working capital, the company can rapidly deploy resources toward critical business initiatives, expansion strategies, and operational investments. The implications of such a financial strategy extend far beyond immediate monetary gains. It signals a proactive approach to business growth, demonstrating the company's commitment to maintaining financial flexibility and resilience. Invoice financing allows Red Security to reduce dependency on traditional lending mechanisms, offering greater autonomy and strategic maneuverability.Technological Integration in Financial Operations

Modern financial strategies are increasingly intertwined with technological innovations. Red Security's approach to invoice financing likely involves sophisticated digital platforms that streamline the funding process, reduce administrative overhead, and provide real-time financial insights. These technological integrations enable more transparent, efficient, and data-driven financial decision-making. The convergence of financial technology with traditional funding mechanisms represents a significant shift in how businesses conceptualize and manage their economic resources. By embracing such advanced financial tools, Red Security positions itself as a forward-thinking organization capable of navigating complex economic landscapes with remarkable precision and adaptability.Long-term Strategic Implications

The decision to optimize cash flow management through invoice financing is not merely a tactical financial move but a strategic long-term investment. It reflects a comprehensive understanding of how financial flexibility can drive sustainable business growth. Red Security demonstrates that true financial success lies not just in accumulating resources but in creating dynamic, responsive financial ecosystems. This approach allows the company to maintain competitive momentum, quickly respond to market opportunities, and invest in critical areas of business development. By minimizing financial constraints and maximizing resource utilization, Red Security sets a compelling precedent for strategic financial management in contemporary business environments.RELATED NEWS

Finance

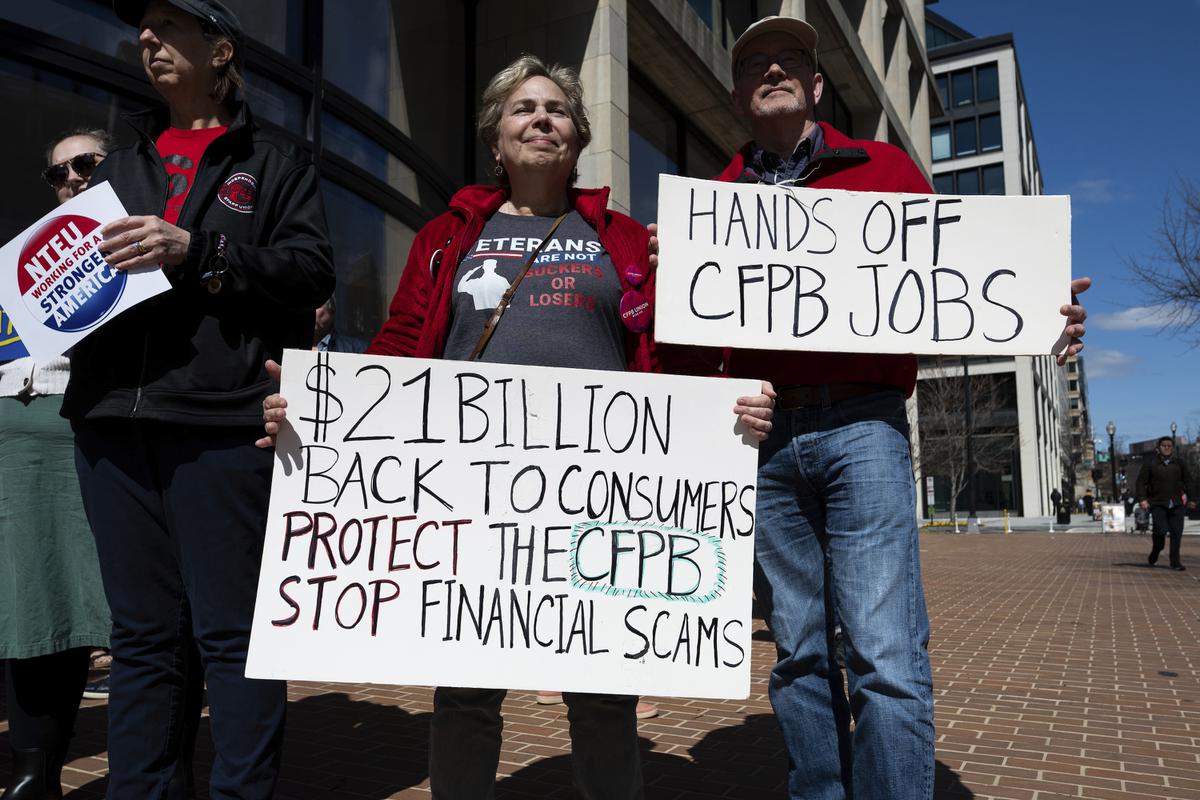

Financial Watchdog Under Siege: How CFPB's Brutal Budget Cut Could Shake Wall Street

2025-04-18 02:00:00

Finance

Automation Giant UiPath Stumbles: Federal Budget Cuts Trigger Dramatic Stock Plunge

2025-03-13 15:02:34