Why Wall Street's Favorite Metric Just Got Benched: P/E Ratio Takes an Unexpected Timeout

Finance

2025-04-13 15:18:39Content

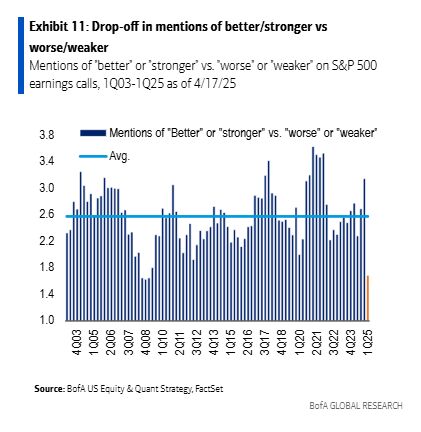

In the complex world of financial analysis, a critical insight is emerging: traditional earnings estimates might be painting an overly rosy picture. The assumption that tariffs negatively impact corporate earnings is widespread, yet current financial calculations may not be fully capturing this economic reality.

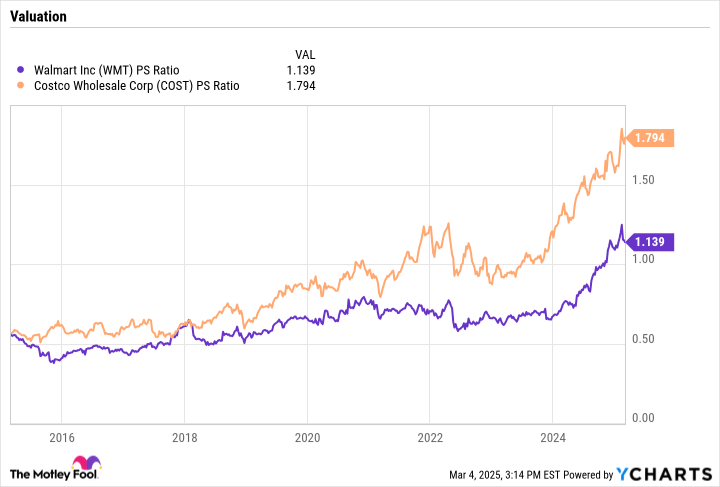

By clinging to outdated estimates that haven't fully integrated the potential drag from tariffs, analysts could be artificially inflating earnings projections. This means the "E" in price-to-earnings (P/E) ratios might be significantly distorted, potentially misleading investors about a company's true financial health.

The implications are profound. Investors relying on these potentially skewed estimates could be making decisions based on incomplete or inaccurate financial information. As global trade tensions continue to evolve, it's more crucial than ever to scrutinize the underlying assumptions in financial metrics and ensure they reflect the current economic landscape.

Unraveling the Economic Enigma: Tariffs, Earnings, and Market Dynamics

In the complex landscape of global economics, financial analysts and market experts continually grapple with the intricate relationships between trade policies, corporate performance, and economic indicators. The interplay of tariffs, earnings estimates, and market perceptions creates a multifaceted puzzle that demands careful examination and nuanced understanding.Decoding the Hidden Impacts of Trade Barriers on Corporate Financial Landscapes

The Distortion of Financial Metrics

The contemporary economic environment presents a sophisticated challenge for investors and financial strategists. Tariffs, traditionally viewed as potential disruptors of corporate earnings, introduce a layer of complexity that goes beyond simple numerical calculations. When trade barriers are implemented, they create ripple effects that extend far beyond immediate financial statements, potentially skewing traditional performance metrics. Financial analysts must navigate a labyrinth of economic indicators, recognizing that surface-level earnings estimates may not capture the full depth of economic transformations. The mechanism by which tariffs influence corporate performance is not linear but rather a complex ecosystem of interconnected economic variables.Earnings Estimation in a Volatile Global Market

Modern financial modeling requires a sophisticated approach to earnings estimation. Traditional methodologies often fail to account for the nuanced impacts of international trade policies. When tariffs are introduced, they create a cascading effect that can fundamentally alter corporate strategies, supply chain dynamics, and ultimately, financial performance. Sophisticated investors understand that earnings estimates are not static snapshots but dynamic representations of potential economic scenarios. The interaction between trade policies and corporate earnings represents a delicate dance of economic forces, where each movement can significantly impact financial projections.Strategic Implications for Corporate Decision-Making

Corporate leadership must develop adaptive strategies that can withstand the unpredictable nature of international trade policies. The ability to anticipate and respond to tariff-related challenges becomes a critical competitive advantage in today's global economic landscape. Successful organizations recognize that financial resilience requires more than traditional risk management. It demands a holistic approach that integrates economic forecasting, geopolitical analysis, and strategic flexibility. The most effective corporate strategies will be those that can rapidly recalibrate in response to changing trade environments.Technological Innovation and Economic Adaptation

The intersection of technological innovation and economic policy creates unprecedented opportunities for corporate transformation. Companies that can leverage advanced analytics, artificial intelligence, and predictive modeling will be better positioned to navigate the complex terrain of international trade. By developing sophisticated economic models that can rapidly integrate new information and adjust financial projections, organizations can transform potential challenges into strategic opportunities. The future of corporate financial management lies in the ability to create dynamic, responsive economic frameworks that can anticipate and mitigate potential disruptions.RELATED NEWS

Finance

Cosmic Crossroads: Capricorn's Strategic Breakthrough in Career, Love, and Wealth Revealed

2025-03-08 06:15:17

Finance

Regulatory Roadblocks: Why 3 Out of 4 Fintech Startups Are Crashing Before Takeoff

2025-04-06 15:00:00