Companies

2025-04-17 23:26:13

Content

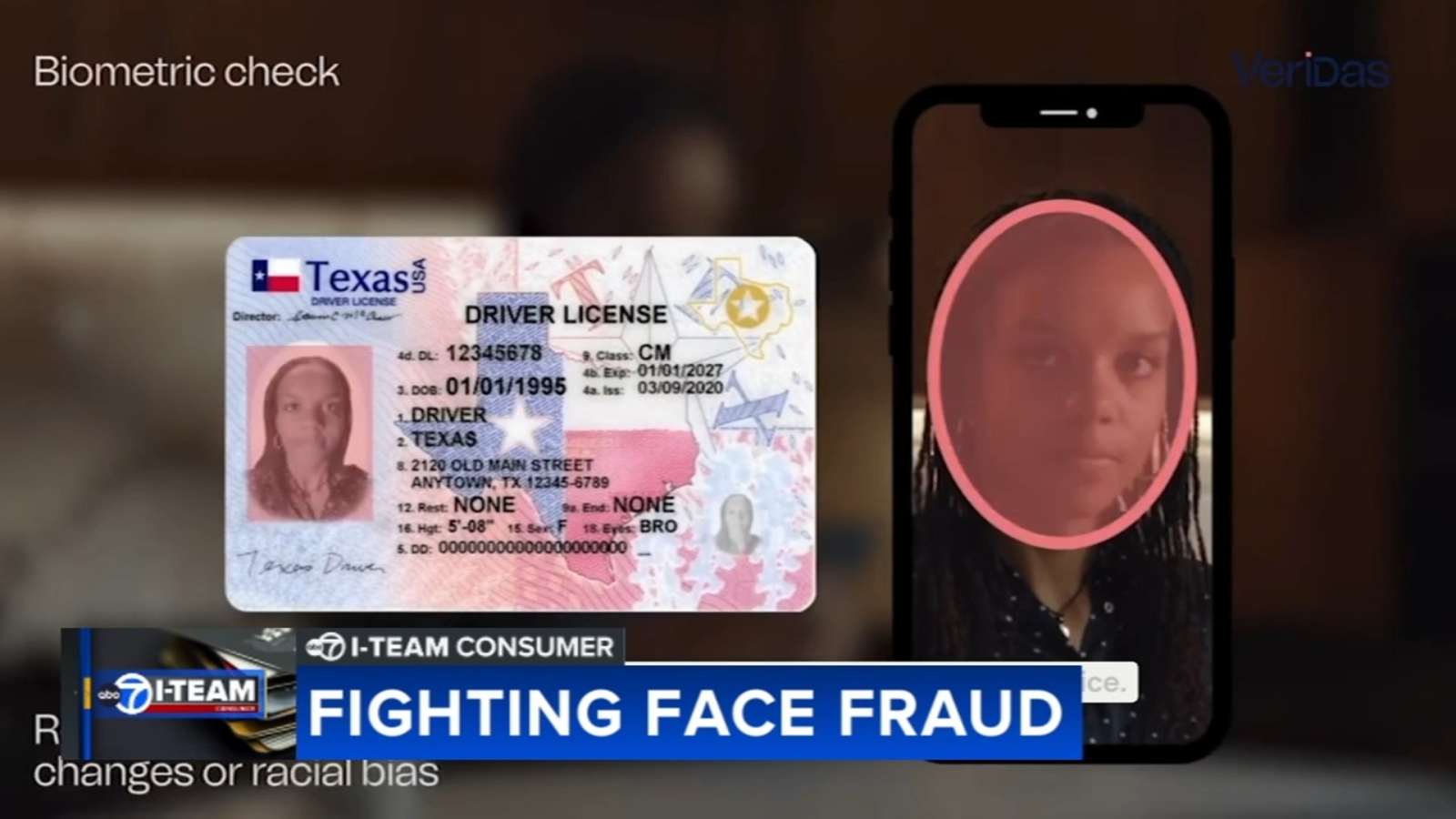

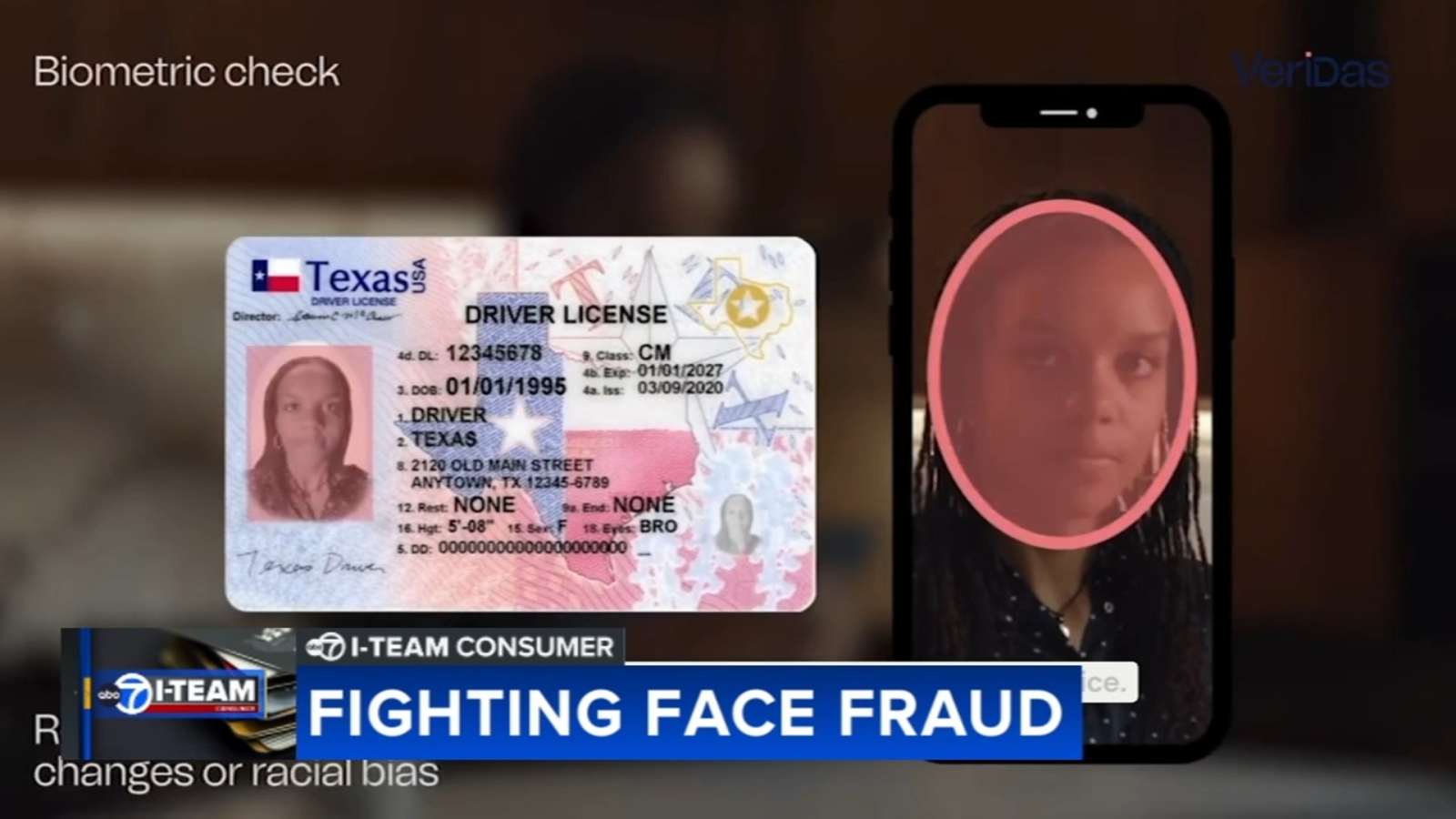

In a high-stakes battle against digital fraud, banks and utility companies are taking aggressive steps to combat sophisticated scammers who are using advanced facial recognition technology to create fake accounts and steal customer identities.

These cybercriminals are now employing cutting-edge artificial intelligence to generate hyper-realistic digital replicas of individuals' faces, allowing them to bypass traditional security measures. Financial institutions and service providers are rapidly developing innovative countermeasures to detect and prevent these increasingly complex identity theft schemes.

By implementing advanced biometric verification techniques, multi-factor authentication, and AI-powered fraud detection systems, these companies are working to stay one step ahead of criminals who seek to exploit digital identity vulnerabilities. The goal is to create robust security frameworks that can distinguish between genuine customer identities and sophisticated digital impersonations.

As technology evolves, so do the methods of protection, with ongoing investments in cybersecurity becoming a critical priority for businesses seeking to safeguard their customers' personal and financial information in an increasingly digital world.

Digital Identity Theft: The Alarming Rise of Facial Fraud in Financial Services

In an era of unprecedented technological advancement, financial institutions are facing a sophisticated and rapidly evolving threat that challenges the very foundations of digital security. The emergence of advanced facial manipulation technologies has created a perfect storm for cybercriminals seeking to exploit vulnerabilities in identity verification systems.

Unmasking the Digital Deception: How Scammers Are Stealing Your Face

The Technological Arms Race of Identity Verification

Modern financial institutions are engaged in a complex battle against increasingly sophisticated fraudsters who leverage cutting-edge artificial intelligence and machine learning technologies. These cybercriminals have developed intricate methods of generating hyper-realistic digital representations that can bypass traditional security protocols. Facial recognition systems, once considered the gold standard of identity verification, are now finding themselves vulnerable to unprecedented levels of technological manipulation.

The complexity of these attacks goes far beyond simple image replication. Advanced deep learning algorithms can now generate synthetic identities that possess remarkable levels of detail and authenticity. Banks and utility companies are discovering that traditional verification methods are becoming obsolete in the face of these technological innovations.

Biometric Vulnerability: Understanding the Mechanics of Facial Fraud

Cybersecurity experts have identified multiple vectors through which facial fraud can occur. Deepfake technologies, which use artificial intelligence to create convincing video and image manipulations, have become increasingly accessible to malicious actors. These technologies can generate digital representations so sophisticated that they can potentially fool even advanced facial recognition systems.

The implications of such technological capabilities are profound. Financial institutions are now required to develop multi-layered authentication processes that go beyond simple visual verification. This involves integrating advanced machine learning algorithms capable of detecting subtle inconsistencies that might indicate synthetic identity generation.

Defensive Strategies in the Digital Identity Landscape

Financial institutions are responding to these challenges by implementing increasingly complex verification protocols. These strategies include multi-factor authentication, behavioral biometric analysis, and real-time risk assessment algorithms. Machine learning models are being trained to recognize patterns of potential fraudulent activity, creating dynamic defense mechanisms that can adapt to emerging threats.

Collaboration between technology companies, financial institutions, and cybersecurity experts has become crucial in developing robust identity protection frameworks. The development of blockchain-based identity verification systems represents one promising avenue for creating more secure digital identity management.

The Human Element: Psychological Warfare in Digital Security

Beyond technological solutions, financial institutions are recognizing the critical importance of human awareness and education. Training customers to recognize potential fraud indicators and implementing comprehensive communication strategies have become essential components of modern digital security approaches.

Social engineering techniques remain a significant threat, with fraudsters often exploiting psychological vulnerabilities alongside technological innovations. Financial institutions are investing heavily in customer education programs designed to enhance digital literacy and promote proactive security practices.

Regulatory Landscape and Future Implications

Governments and regulatory bodies are increasingly developing comprehensive legislative frameworks to address the challenges of digital identity theft. These emerging regulations aim to establish standardized protocols for identity verification and impose significant penalties for institutions failing to implement adequate protective measures.

The ongoing evolution of facial fraud technologies suggests that this is not merely a temporary challenge but a fundamental transformation in how digital identities are conceived, verified, and protected. Financial institutions must remain agile, continuously adapting their technological and strategic approaches to stay ahead of emerging threats.